How will the Trump Tariffs impact the US economy?

President-elect Trump has promised to impose steep new taxes on trade, including a 10-20 percent tariff on all imports, at least a 60 percent tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers which increase prices, reduce the amount of goods and services available to US businesses and consumers and place an economic burden on foreign suppliers.

At least a dozen estimates on Trump’s proposed tariffs show they will have a harmful effect on the American economy, supporting the standard view among economists that tariffs reduce trade and distort production, leading to lower standards of living. At least 12 estimates of Trump’s proposed tariffs indicate that they will have a negative effect on the American Economy, supporting the standard opinion among economists, that tariffs reduce the trade and distort the production, leading lower standards of living.

is a tax on imported goods that is applied at the border by a person or business in the US when they purchase a product from abroad. Tariffs increase the cost of imported goods, which encourages consumers to switch to locally produced goods. They also give domestic producers more room to raise their prices. Tariffs are redistributive, taking income from some and giving it to protected businesses. For this reason, tariffs are redistributive, taking income from some and giving it to protected businesses.

While the protected businesses may grow because of the tariff, they are not low-cost producers. Tariffs lead to less efficient production and, in the long run, lower incomes. The standard analysis of tariffs dates back to Adam Smith, and classical economists who advocated keeping tariffs low (tariffs were the primary source of revenue for the government at the time).The discussion has its nuances such as the impact of tariffs on price levels. Tariffs can have a short-term inflationary effect or cause a downturn in the economy, depending on the Federal Reserve’s actions to ease policy and accommodate tax increases. (We will discuss these questions in an upcoming analysis). But no matter whether the short-term adjustment involves inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck will cover less goods, bills, and services. It is sometimes called a “hidden” tax, as it makes taxpayers less wealthy due to increased costs and “bracket-creep”, while increasing government spending power.

or temporarily heightened unemployment, the long-run adjustment to tariffs involves lower incomes and production.

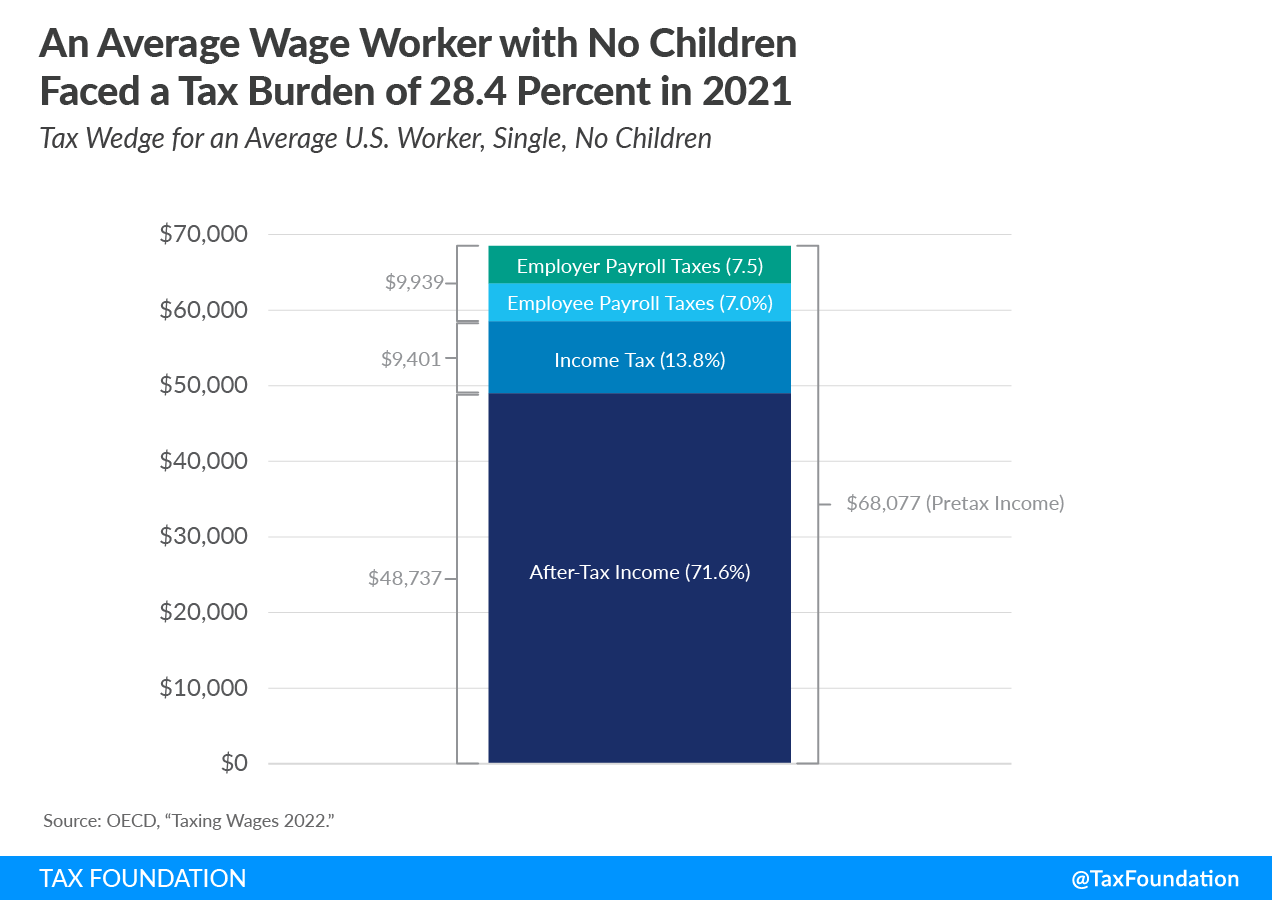

Over the long run, tariffs shrink the size of the economy by reducing work and investment. Tariffs raise the relative price of imported and protected products, and after paying these higher prices, people are left with less money to spend elsewhere. Tariffs reduce the value of income after tax by reducing what people can spend. The reduction in after-tax income reduces the incentive to work which, in turn reduces capital investment and hours worked. Fewer hours worked and a smaller capital stock result in a permanently lower level of output and income.Additionally, tariffs lead to dynamic inefficiencies, which reduce productivity. Tariffs create a protected domestic marketplace, which reduces the competitive pressures that would otherwise force firms to innovate. Protected firms do not need to continually improve processes or meet consumer demands. Instead, they can relax and enjoy higher profits. Past (and ongoing) episodes of protection, both anecdotally and empirically, reveal that protected firms tend to use their higher profits to lobby for more and longer protection, rather than for increased research and development or capital expenditure.Tariffs may also lead to inefficiencies through political favoritism and uncertainty. A new analysis of Trump’s first term tariffs revealed that firms that donated to Republican candidates were more inclined to receive tariff exemptions. The uncertainty surrounding trade and tariff policies can reduce incomes and chill investment. Twelve macroeconomic estimates have used different approaches to analyze Trump’s proposed tax hikes. These range from estimating the decline in aggregate demand as a result of the tax increases to using various trade model to our work at Tax Foundation, estimating the effect of the tax increase to labor. All studies find that Trump’s tariffs will have a negative effect on the United States. When foreign governments tax US exports, this reduces the amount of US products that are sold abroad, further reducing incomes and reducing output. Most private forecasts of US-imposed duties model the impact of retaliation ranging from tit for tat to more focused responses. Warwick McKibbin and others have provided estimates. The Peterson Institution for International Economics suggests that retaliation may more than double the economic loss from US-imposed duties.

Many studies included estimates of Trump’s economic effects during his first term, which ranged from a reduction of real output of 0.2 to 0.7 percent. The economic literature also reports similar effects on US output, ranging from -0.17 to -0.50 per cent. International trade economists have scathingly reviewed the assumptions that were used to create this estimate. They explain how researchers manipulated trade models, against all economic evidence, in order to produce positive results. The reviewers described the effort as “intentionally misleading” with “key assumptions”. . .

absolutely no support in the economic literature.”

President-elect Trump may want to impose tariffs to encourage investment and work, but his strategy will backfire. Tariffs will certainly create benefits for protected industries, but those benefits come at the expense of consumers and other industries throughout the economy.

Stay informed on the tax policies impacting you.[that find]Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe to our Newsletter