How to Fill out Form 1120-S: Income & Deductions

If you’re an S corp owner, understanding how to fill out a 1120-S tax form accurately can help you avoid unnecessary headaches and make the most of your tax situation. If you’re an S corp owner, understanding how to fill out an 1120-S tax form accurately can help you avoid unnecessary headaches and make the most of your tax situation.

Whether it’s your first time filing this form or you just need a refresher, we’re here to guide you through Form 1120-S and how to complete it correctly. Breaking down each section, we’ll look at common tax deductions, examples, and tips to help you avoid tax filing mistakes.

What is IRS Form 1120-S?

Form 1120-S is the U.S. Income Tax Return for S Corporations. This is an informational document which lets the Internal Revenue Service know how much your business earned and how much you owe in taxes. S corporations are not taxed at corporate level, unlike C corporations. This means that profits (and losses), go directly to the individual shareholder (owner), and they report these on their own tax returns. S corporations avoid double taxation, which is a problem with C corporations. This form is different because S corporations do not pay corporate income tax. Instead, it focuses on the information that passes to shareholders. Below is an example of how Form 1120S looks (page 1):

This document consists of several sections and schedules which are combined to report business activity to IRS. You’ll need to fill out information about your business income, tax deductions, capital gains, losses, and more.

How to fill out Form 1120-S instructions

Filling out Form 1120-S might seem daunting, but we’re here to help break it down section by section. Before you begin, it might help to look at our 1120-S tax preparation checklist to ensure you have all the necessary documents.

Here’s what you’ll find on the form:

Basic information

At the top of Form 1120-S, you’ll need to fill in basic details about your business, including:

Name and address

: Your corporation’s legal name and mailing address.

Employer identification number (EIN)

: This is the number assigned to your business by the IRS. You can find your EIN on old tax returns.

- Date of incorporation: When your business was legally formed.

- S election effective date: When your S corp election status became effective, often at the start of the year.

- Business activity code: You can find a list of business activity codes on page 52 of the IRS website instructions.

- Total assets: Your total assets at the end of the year as determined by your bookkeeping method. Enter 0 if you have no assets. )

- IncomeThis section reports the corporation’s total income:

- Gross receipts or sales: List total sales from all business operations before returns, allowances, or discounts. Line 1c will reflect your balance after subtracting your returns and allowances.

Cost of goods sold (COGS)

: Include direct costs related to making your product, such as raw materials and labor.

- Gross profit: Subtract COGS from line 1c.

- Net gain (or loss): Report gains or losses from Form 4797, Sales of Business Property.

- Other income (loss): Any other losses not included on lines 1a through 4. For example, recoveries of certain bad debts deducted in prior years or taxable income from insurance proceeds.

- Correctly categorizing each income source here helps ensure your corporate tax return accurately reflects all your business’s revenue.Deductions

- Here’s where you list expenses that directly reduce taxable income. Each deduction is specific, so make sure you understand them to maximize your eligible deductions:Compensation of officers

Example

: If your corporation’s officer earns a salary, that salary is deductible.

Tip

: Officer salaries and distributions need to be reasonable. The IRS closely examines this to ensure officers aren’t underpaid to avoid payroll taxes.

- Salaries and wages Example

- : Total employee wages, excluding officers, like administrative staff salaries.Tip

: Make sure to properly categorize officer and employee wages separately, as only non-officer wages go here.

- Repairs and maintenance Example

- : Costs to fix production machinery or repaint the office.Tip

: Only routine maintenance and repairs that don’t add to the property’s value should be included here. Any major improvements need to be depreciated or amortized (spread out over years).

- Bad debts Example

- : If a customer defaults on a $5,000 invoice, you can deduct it as a bad debt.Tip

: Only deduct debts directly related to business sales or services; personal debts don’t qualify here.

- Rents Example

- : Rent payments for your business location or equipment rentals.Tip

: Only include rents paid on business property for business use. For instance, you wouldn’t include rent for a property a shareholder uses personally.

- Taxes and licenses Examples

- : Business licenses, property taxes, or payroll taxes.Tip

: Include taxes directly related to your business but exclude federal income tax payments or taxes for rental activities.

- Interest Example

- : Interest on a business loan or line of credit.Tip

: Make sure loans and interest are in the company’s name; personal loans aren’t deductible, even if used for business purposes.

- Depreciation Example

- : Depreciation on office furniture or production equipment.Tip

: Use IRS Pub 946 to determine the depreciation schedule for each asset.

- Advertising Example

- : Costs for social media ads or a new billboard.Tip

: Track every advertising dollar, as these deductions can add up quickly.

- Pension, profit-sharing, etc., plansExample

- : Contributions to retirement plans set up for employees, such as 401(k) plans.Tip

: These contributions are a great way to reduce taxable income while benefiting employees.

- Employee benefit programs:

- Example: Costs related to employee benefits like health insurance, life insurance, and other perks.

Tip: Don’t deduct amounts that are part of a pension or profit-sharing plan already reported elsewhere on the return.

- Energy efficient commercial buildings deduction (attach Form 7205)Example

- : Installing energy-efficient windows or doors.Tip

: Attach Form 7205 to claim this deduction and support the energy-efficient improvements.

- Other deductions Examples

- : Amortization, utilities, legal fees for business contracts, insurance premiums, or employee training.Tip

: Include expenses not covered elsewhere (like Schedule K), but avoid personal expenses; keep them strictly business-related.

- Tax and PaymentsExcess net passive income and LIFO recapture

- : These taxes can apply if your S corp was previously a C corp.Estimated tax payments

: Include any estimated tax payments made during the year.

- Tax due or refund: If your corporation underpaid, line 26 will show the tax liability. Any overpayments on line 27 will be refunded.

- Schedule B: Other InformationSchedule B includes additional details about the S corporation, such as your accounting method (cash or accrual). It will also gather information about your business activity by asking Yes/No questions about ownership changes, restricted stock shares, canceled or forgiven shareholder debt, digital assets received or sold, and more.

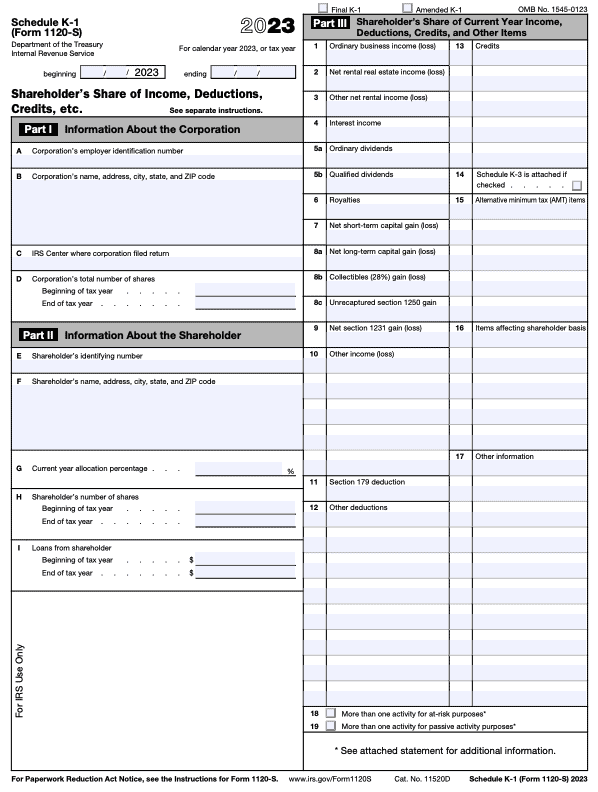

- Schedule K: Shareholder’s Pro Rata Share ItemsSchedule K reports the pro rata share of income, deductions, tax credits, and other items that flow through to the shareholders. Each item listed on Schedule K will also be reported individually on each shareholder’s Schedule K-1, pictured below:

Schedule K helps provide a complete picture of each owner’s financial benefits or responsibilities. This ensures that each shareholder’s share is accurately reported on their personal tax returns for individual tax purposes.

Schedules L, M-1, and M-2

Schedule L

: This balance sheet shows your business’s financial position at the beginning and end of the year.

Schedule M-1

: Reconciles the corporation’s financial records with the income reported on Form 1120-S.

- Schedule M-2: Reflects retained earnings and changes in equity.

- These schedules help ensure consistency between your accounting books and your tax return.FAQs about Form 1120-S

- What is the due date for filing Form 1120-S?The due date for filing Form 1120-S is typically the 15th day of the third month following the end of the tax year. The form is due March 15 for most S corporations that use a calendar year. This extension gives you six additional months to file Form 1120-S, moving the deadline to Sept. 15 for calendar-year S corps. This extension gives you six additional months to file Form 1120-S, moving the deadline to Sept. 15 for calendar-year S corps.

Can I e-file Form 1120-S?

Yes, you can e-file Form 1120-S — TaxAct(r) can help you file this form if you choose us as your tax preparer.

What happens if I miss the filing due date?

If you miss the due date, you may owe penalties, particularly if your corporation owes federal income tax. Filing as soon as possible is the best course of action to minimize penalties.

What are Schedule M-1 and Schedule M-2?

Schedule M-1 reconciles your book income with your taxable income, while Schedule M-2 deals with the accumulated adjustments account and retained earnings.

How to file Form 1120-S with TaxAct

Filing Form 1120-S doesn’t need to be overly complicated. TaxAct is here to help you every step of your way. Here’s how to get started:

Create a TaxAct account.

Select S Corporations Form 1120-S from the available options as shown below:

3. Follow the instructions step-by-step. We will ask you for basic information about your company, then any special filings you have made (for instance, if you’re an LLC that is taxed as an S corp). The K-1 Wizard will help you fill in information for each shareholder, as shown below. After that, we’ll walk you through the Federal Q&A, which covers income, deductions, and additional information.