How to Calculate and Make Estimated Tax Payments

Updated for tax year 2024.

If you’re like most taxpayers, you receive salary and wages from your employer and never have to worry about how to make estimated tax payments.

Even if you receive additional income on the side, such as interest and dividends, stock gains, or freelance income, the income tax withheld from wages usually covers your total income tax. If you earn more than just wages, you will need to increase your tax withholding. If you earn significant income and have little or no tax deducted from your wages, you may be required to make quarterly estimated payments to the Internal Revenue Service. Otherwise, you could owe interest and penalties when you file your tax return.

You may need to make quarterly payments if you have significant taxable income from any of the following sources:

Self-employment income (e.g., freelancer, independent contractor)

Small business owner income

- Investment income

- Unemployment benefits

- Retirement plan withdrawals

- Gambling income

- Don’t worry about estimated tax payments if you expect to owe only a small amount of tax. You should only pay quarterly estimated tax payments if you anticipate a tax bill of at least $1,000 when you file.

- Safe harbor amount

Even if you owe more than $1,000 when you file, you won’t pay the penalty if your total income tax withholding and timely estimated tax payments equal at least 90% of the tax shown on this year’s return or 100% of the tax shown on your previous year’s tax return.

This is called the “safe harbor amount.” The safe harbor provision is beneficial if your income fluctuates significantly, or you won’t know how much profit you’ll make for the year until you complete year-end calculations.

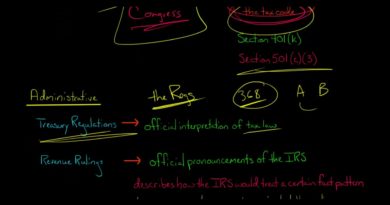

Calculating estimated payment amounts

If you need to make estimated tax payments, use TaxAct(r) to calculate those amounts. TaxAct can estimate your payment using a worksheet calculation, or your tax liability from the previous tax year. However, if you have significant income for this year, you may choose to make quarterly payments anyway, so you’re not faced with a massive bill at tax time.

Consider integrating a

tax calculator

seamlessly into your financial routine for effortless estimation of your tax obligations. TaxAct allows you to make accurate calculations based on your income, deductions and financial situation.

Note: Farmers and fishermen get special consideration for estimated tax payments. If two-thirds of your gross income is from farming or fishing, you only have to pay 66.6% of the current year’s estimated tax liability. Filing dates for federal quarterly estimated tax payments

Estimated tax payments are due every quarter. Tax deadlines do not fall evenly throughout the year. Due dates are usually on the 15th. Due DatePayment period

Jan. 1 – March 31

April 15, 2024

April 1 – May 31

| June 17, 2024 | June 1 – Aug. 31 |

|---|---|

| Sept. 16, 2024 | Sept. 1 – Dec. 31 |

| Jan. 152025 | And for 2025, the estimated quarterly tax payments are due on: |

| Payment period | Due date |

| Jan. 1 – March 31 | April 15, 2025 |

April 1 – May 31

| June 16, 2025 | June 1 – Aug. 31 |

|---|---|

| Sept. 15, 2025 | Sept. 1 – Dec. 31 |

| Jan. 15, 2026 | How to make quarterly estimated tax payments |

| There are several ways to make estimated tax payments: | Payment vouchers with TaxAct: |

| Our tax software can help you calculate your quarterly payments and print quarterly payment vouchers. Once printed, just mail the voucher and your check or money order to the IRS by each due date. | Electronic Funds Withdraw: |

Another easy way to make quarterly estimated tax payments is through Electronic Funds Withdraw. This method allows you to have quarterly payments automatically deducted from your account. Credit card and debit card payment:

You can pay with credit or debit cards online at irs.gov, as well as over the phone. Please note that using a credit or debit card will incur an additional convenience fee charged by your bank.

- Electronic Federal Tax Payment System: Another way to make quarterly estimated tax payments is through the Electronic Federal Tax Payment System (EFTPS), a free online payment system. If you want to use EFTPS, be sure to plan ahead — you can’t set it up or use it to pay your tax on the day your payment is due.

- Don’t forget to make estimated tax payments for your state taxes as well (if necessary).Tax Tip:

- If you have an overpayment on one year’s tax return, you can use it to get a head start on estimated tax payments for the following year. It’s as simple as applying all or a portion of your overpayment to the first quarter of your next year’s tax liability instead of receiving it as a refund.Strategies for making estimated tax payments easier

- The biggest hurdles to making estimated tax payments are:Remembering to make the payments.

Having the money on hand.

Don’t worry, though — there are some easy steps you can take to ensure you don’t miss payments and that you have enough cash to cover your estimated taxes.1. Set aside money as you earn it

.

As you receive income throughout the year, try to put aside an amount for taxes. You can put money aside for taxes every week or month if you have a separate account. You’ll be able to rest assured that your taxes are covered. Set up reminders for payment due dates

- .

- One of the easiest things you can do is mark the due dates for estimated tax payments on your calendar. Set up reminders in advance if you use a mobile phone calendar. You don’t want these dates to slip your mind if you pay quarterly tax. Recalculate what you owe every quarter

.

At least once a quarter, consider recalculating your estimated taxes for the year. You won’t be surprised by your tax liability when the year ends. For more info on this topic, check out our Guide to Adjusting Your Self-Employed Estimated Tax Payments.The bottom line

Estimated tax payments are a crucial part of managing your tax obligations if you earn significant income outside of regular wages. TaxAct can help you avoid penalties by staying on top of your due dates, accurately calculating payments, and using other resources. You can prepare for tax season by setting aside money, creating reminders and recalculating payments every quarter. You can stay on track with a little planning and avoid any surprises at tax time.