House GOP Tax Plan Would Temporarily Cut Taxes For All Income Groups

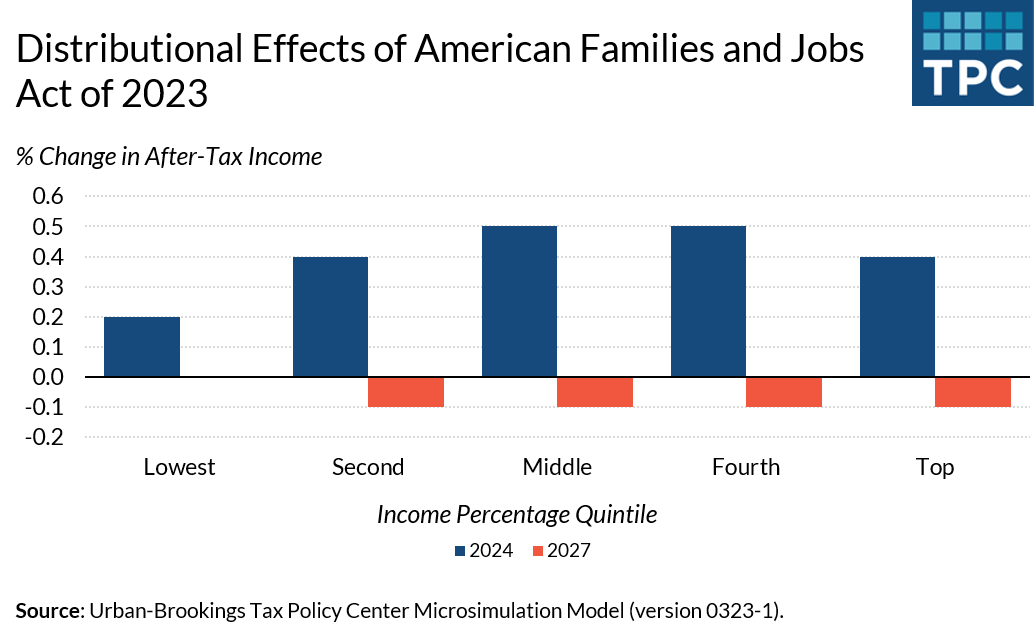

House Republican plans to temporarily raise the standard deduction and restore more generous business tax deductions would result in modest tax cuts for most households in 2024, according to a new Tax Policy Center analysis. However, after some of the largest cuts expire, most households would face a small tax hike due to the proposed repeal of clean energy tax breaks.

Overall, after-tax income for all households would increase by 0.4 percent ($380) on average in 2024. Households with annual incomes between $75,000 and $200,000 would see slightly larger benefits on average, with those filers seeing a gain of 0.5 percent in after-tax income. However, households earning below $30,000 would see an average gain of 0.2 percent or less in after-tax income.

Because of the temporary nature of many of the tax cuts, after-tax income would drop, on average, by 0.1 percent in nearly all income groups by 2027. The exception would be the lowest-income households, who would experience hardly any change in their after-tax income.

What’s in the Bill

The American Families and Jobs Act, which passed the House Ways & Means Committee last week, would increase the standard deduction by $2,000 for individuals and $4,000 for couples in 2024 and 2025, as my colleague Elaine Maag analyzed here.

It would also restore the ability of companies to deduct the cost of capital investments and research and development (R&D) immediately instead of over multiple years and it would loosen the cap on net interest deductions that businesses can claim. These changes would apply retroactively but expire at the start of 2026.

The legislative package includes other tax breaks for businesses that the Joint Committee on Taxation most recently estimated would cost about $80 billion over the next decade, as well as adjustments to Opportunity Zone tax rules to encourage more investment in rural jurisdictions. It would also repeal more stringent reporting requirements put in place for income earned by gig workers.

The proposed tax cuts are temporary, but the plan’s claw back of clean energy tax breaks—enacted in last year’s Inflation Reduction Act (IRA)—would be permanent. Most notably, the proposal would repeal the renewable energy production tax credit and investment tax credit, while replacing the IRA’s enhanced electric vehicles tax credit with the less generous version under prior law.

The TCJA Elephant in the Room

If some of the proposed business tax deductions sound familiar, it’s because they were put in place by the 2017 Tax Cuts and Jobs Act (TCJA) and were part of last year’s discussions about restoring the more generous 2021 child tax credit.

The TCJA allowed businesses to immediately deduct capital investments (full expensing). But, forced to comply with Senate budget reconciliation rules to bypass the filibuster, the TCJA’s backers made that provision temporary; starting this year, full expensing is phasing down before expiring entirely after 2026.

Because of those same budget restrictions, the TCJA included two unpopular business tax hikes. Expenses eligible for the R&D deduction now must be claimed over a period of several years rather than the year the costs are incurred. And the cap on business interest deductions meant to pay for the cost of full expensing became even more restrictive at the beginning of 2022.

The Republican plan would reverse all three provisions, but only through 2025.

Why would GOP policymakers want to set up another cliff for these business tax breaks after 2025? That’s the same year the TCJA individual income tax provisions are set to expire. President Joe Biden has signaled a willingness to extend the TCJA individual income tax breaks for taxpayers making below $400,000 if offsets are included, and some congressional Democrats support restoring the R&D deduction.

A grand bargain of some kind seems feasible in 2025, though the negotiations won’t be easy.

Technical Notes

TPC’s analysis of the House Republican tax plan also contains estimates of the number of households in each income group who would receive either a tax cut or a tax increase under the proposal. TPC was unable to include all provisions of the proposals in these breakdowns due to data limitations. Most notably, this breakdown does not reflect the proposed change to the electric vehicle tax credit, nor does it include changes to certain small business tax deductions or the proposed expansion of the Opportunity Zones tax break.

Because of the size of the EV tax credit change, it’s likely that a small portion of households would see tax hikes in 2024. The footnotes to TPC tables provide technical details identifying any provisions excluded from our analysis.