Guide to Tax Form 1099 – LS

If you have received a 1099-LS form in your mailbox this tax year, let’s look at why it arrived and what to do with it when filing your taxes. You may receive Form 1099 LS

or

Reportable life insurance sale if you transfer or sell your life insurance contract. Due to the current 1099 LS requirements, the buyer is required to report the transaction to the Internal Revenue Service. The IRS is interested in the sale of a policy because it may have tax implications. After the sale, the life settlement company sends you Form 1099-LS to document the transaction.

- Viatical settlement (terminal illness sale):

- You are diagnosed with a terminal illness and sell your life insurance policy to a viatical settlement provider in exchange for a cash payment. The provider sends you Form 1099-LS to report the transaction.

Transferring a policy:

You are a business owner with a key person life insurance policy (meaning the business owns the policy). You decide to transfer the policy and cash it out to your business partner. The taxation of life insurance settlementsNote: 1099 forms are merely information returns. Cashing out a policy does not automatically mean that you owe taxes. This form will contain information about your cost basis and the settlement amount. You can use this form along with your 1099-LS to figure out if the policy sale resulted in a taxable gain.Here are the possible scenarios you could be looking at:

No tax owed:

If the amount you received does not exceed your tax basis (for instance, the total amount of premiums you paid over time), it is not taxable.

- Ordinary income: If the amount you received does exceed your basis, the extra amount — up to the policy’s cash surrender value — is taxed as ordinary income.

- Capital gains: Any remaining proceeds are taxed as capital gains.

- Capital loss: If you sell the policy for less than your basis, you have a capital loss. Losses can be used to lower your taxable income.

Tax Tip:

The IRS has a useful calculator to help you determine whether life insurance proceeds are taxable.

Example of Form 1099-LS

Here’s a 1099-LS form example. Your TIN is often your Social Security number. Your TIN is often your Social Security number.

- The acquirer’s information: This is the entity that bought your policy — you’ll see their TIN and contact info on the form as well.

- Policy details: Information about the life insurance policy, including the policy number.

- Amount paid to payment recipient (

- Box 1): This is the amount the buyer paid for the policy.

Date of sale (Box 2): The date the buyer bought the policy from you.

Instructions for Form 1099-LS

Now that you’ve got your 1099-LS form in hand, it’s time to figure out what to do with it. Here’s what you need to do:

Review the information

- : Double-check that all details on the form are correct and contact the issuer if you notice any discrepancies.Determine

- if you have a taxable event: The 1099-LS form details the sale of a life insurance policy, which could have tax implications (but not always). If the proceeds need to be reported, TaxAct(r) can help you do so when you e-file with us.

- Consult a tax professional: If this all sounds a bit too complex, don’t hesitate to consult a tax expert or use tax preparation software like TaxAct, which can guide you through the reporting process step-by-step.

- FAQs about Form 1099-LSHow do you report 1099-LS transactions?You’ll report the proceeds from your 1099-LS form on your income tax return in one of two ways. Taxable proceeds must be reported in the “Other income” section of Form 10. TaxAct can assist you with both methods. The buyer (acquirer), sends you Forms 1099-LS in order to report the sale of life insurance. The life insurance company that issued the policy will send you (the seller) Form 1099SB. On Form 1099-SB, you’ll find information about your investment in the life insurance contract and the settlement amount (what you sold the policy for), which you can use to determine if the life insurance sale has tax implications.When is the due date for 1099-LS forms?

- The IRS requires acquirers to send out Form 1099-LS to filers by Jan. 31, meaning you should see it in your mailbox by mid-February. TaxAct can help you finish the marathon of filing taxes. Here’s how you can file your 1099-LS form with TaxAct:To report ordinary income:

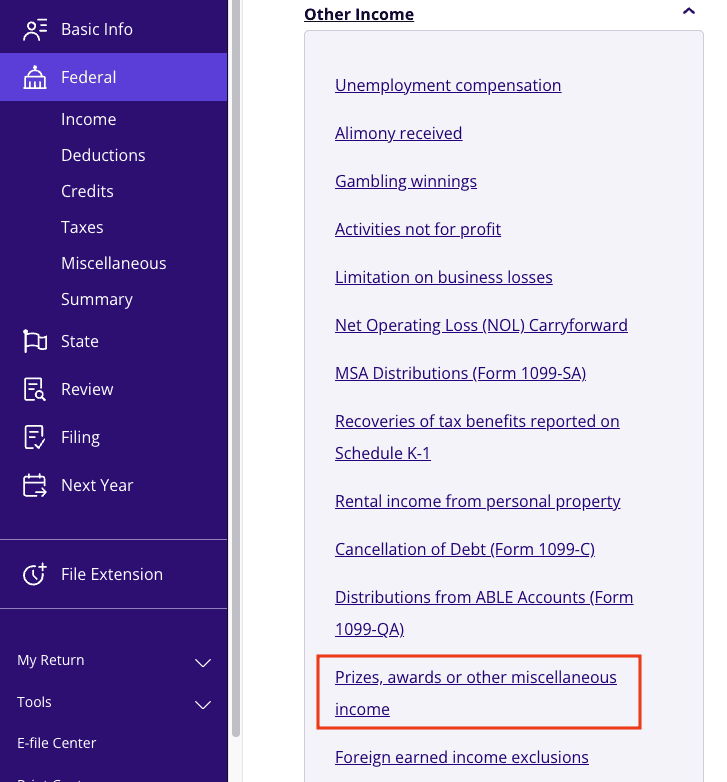

Click

Federal

- in the left navigation.On the

- Federal Quick Q&A Topics screen, click Other Income

- to expand the category.Click

Prizes, awards or other miscellaneous income

as shown below.

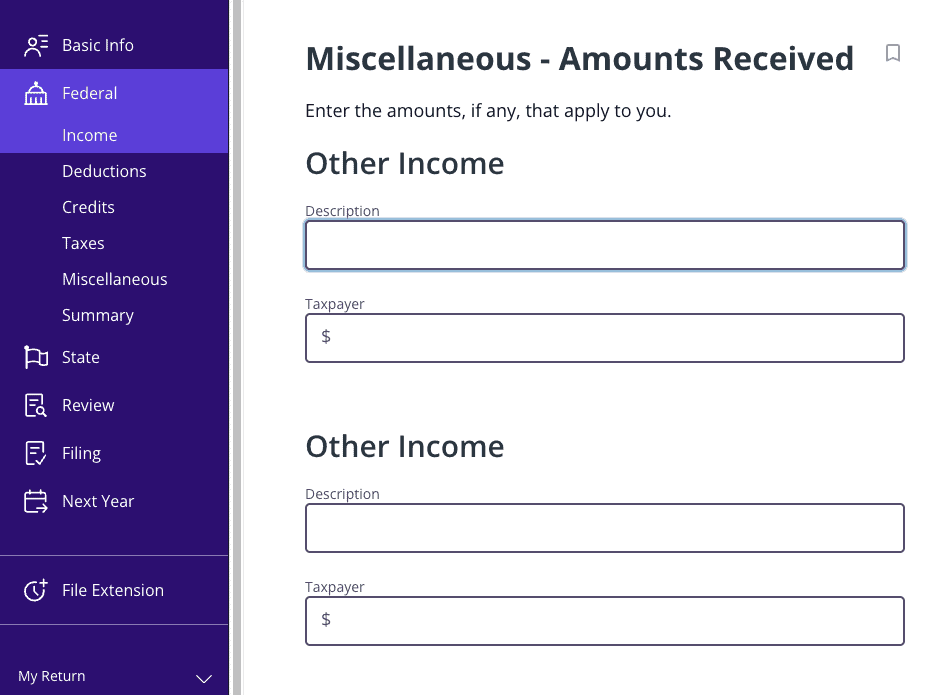

4. Enter the amount and description in one of the two

Other Income

lines as shown below.

To report capital gains:

Click

Federal

in the left navigation.

On the

- Federal Quick Q&A Topics screen, click Investment Income

- to expand the category.Click Gain or loss on the sale of investments to expand the category.Click

- Capital gain or loss (Form 1099-B) as shown below.5. Proceed to enter the transaction details. Tax Tip:

If you held the policy for more than one year, then it is a long-term profit. If you held the policy for less than a year, it is a short-term capital gain. By understanding this form, what it contains, and how to properly report it on your tax return, you can avoid unnecessary anxiety and ensure that you are in good standing with IRS. And remember, TaxAct is here to make the tax filing process as smooth as possible.This article is for informational purposes only and not legal or financial advice.All TaxAct offers, products and services are subject to applicable terms and conditions.