Guide

01 Not We In this guide, we’ll go over everything you need to know about Form 1099-PATR, including why you received it, what it means, and how to report it, if necessary.

At a glance:

Form 1099-PATR reports patronage dividends and other distributions paid to co-op members.

- Patronage dividends are rebates paid by the co-op to members who made purchases.

- While individuals generally do not owe taxes on patronage dividends, businesses may need to report these payments as income.

- What is a 1099-PATR form?

Receiving IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives, means you received at least $10 in patronage dividends and other distributions from a cooperative during the previous year. However, you can also receive this tax form if a cooperative withheld federal income tax from you under the Internal Revenue Service (IRS) backup withholding rules.

To better understand why you received a 1099-PATR form, let’s first define some key terms:

Cooperative:

- Cooperatives, also known as co-ops, are similar to businesses, but they are owned by their members. Co Co Other examples include credit unions, retail operations, etc.Patronage dividend:

- Co-ops often refund their members by giving them a distribution of the co-op’s profits called patronage dividends. Patron Patron Patron Co The Patron Businesses may owe income tax on patronage dividends that exceed the value of their business purchases.Backup withholding:

- Backup withholding happens when the co-op withholds federal income tax on your payments. Backup Usually, this only happens when you do not provide the co-op with your taxpayer identification number (TIN), give the wrong TIN, or fail to certify you are not subject to backup withholding on Form W-9.Now that we know the basics let’s take a closer look at how to use your Form 1099-PATR and how to tell if you owe taxes on the distributions you received.

Form 1099-PATR example

Here’s an example of what a 1099-PATR form looks like:

On Form 1099-PATR, you’ll find the payer’s contact information and taxpayer identification number (TIN). You’ll also see your own contact info, including your TIN (often your Social Security number) and sometimes your account number.

The boxes on the right of the form provide details about the amount you were paid:

Patronage dividends:

- Box 1 shows the amount of patronage dividends paid in cash, qualified written notices of allocation, and other property allowable as a deduction under Section 1382(b)(1).Nonpatronage distributions:

- Box 2 is for specific farmers’ cooperatives that don’t have to pay tax. This box reports your share of the total cash payments, qualified written notices of allocation, and other kinds of payments from this specific kind of co-op.Per-unit retain allocations:

- If you sold products through the co-op, Box 3 details payments you received based on the volume or value of those products.Federal income tax withheld:

- If you were subject to backup withholding, the amount withheld by the co-op is in Box 4.Redeemed nonqualified notices:

- A co-op may issue nonqualified written notices of allocation for distributions that didn’t qualify for a deduction by the co-op when first issued. The For a list of which trades or businesses the IRS considers SSTBs, check out the Instructions for Form 8995-A (page 2) on irs.gov.Additional boxes detail qualified payments and federal tax credits, such as investment credits (Box 10), work opportunity credit (Box 11), and other credits and deductions that may apply (Box 12).

Box 13 will be checked if the payer is a specified cooperative defined in Section 199A(g)(4)(A).

Instructions for Form 1099-PATR

Once you have your Form 1099-PATR in hand, here’s what you need to do:

Review your form carefully:

Cross-check all the amounts listed on your 1099-PATR with your own records. If something looks off, contact the issuer for clarification.

- Determine taxability: Depending on what’s in the boxes, parts of your payment may be taxable, and some may not be. TaxAct(r) can help you determine how to report your patronage dividends and other distributions, if necessary, by asking you step-by-step questions about your income during the e-filing process.

- Report your income: If you received taxable distributions from a co-op, it’s time to report it. Tax Tax It all depends on how the co-op paid you and what the payments were for:

- Individual co-op members who purchased personal items for themselves or their families generally do not owe taxes on patronage dividends they received.

Business co-op members

who received patronage dividends on purchases made for business purposes may owe taxes on any payments exceeding the adjusted value of capital assets or depreciable property they purchased for business purposes. Don Don’t just ignore it — errors can lead to headaches later.

Do I need to attach Form 1099-PATR to my tax return?

No, you don’t have to attach Form 1099-PATR to your tax return, but you do need to report any taxable income from the form when you file your taxes.

- How to report Form 1099-PATR with TaxActTaxAct makes it easy to file Form 1099-PATR in our user-friendly tax preparation software — just follow the detailed instructions and screenshots below.

- Where to report 1099-PATRYou’ll typically report amounts from Boxes 1, 2, 3, and 5 from Form 1099-PATR on either Schedule C (Profit or Loss from Business), Schedule F (Profit or Loss from Farming), or Form 4835 (Farm Rental Income and Expenses), depending on how you earned the income.

To report Form 1099-PATR on Schedule C:

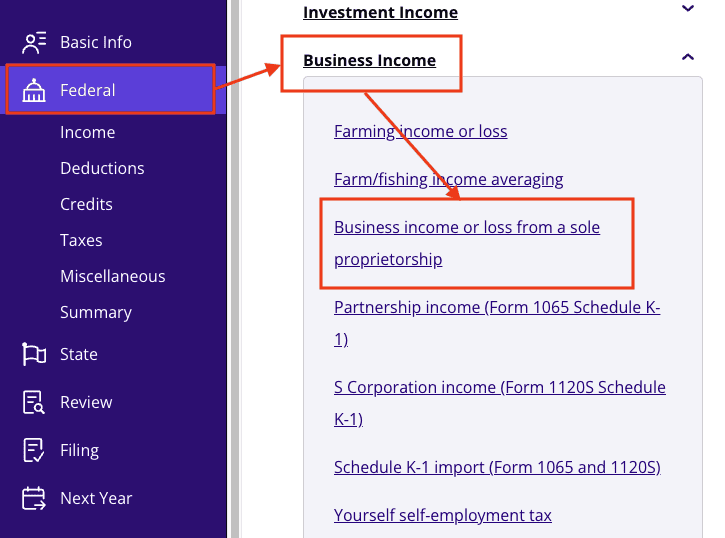

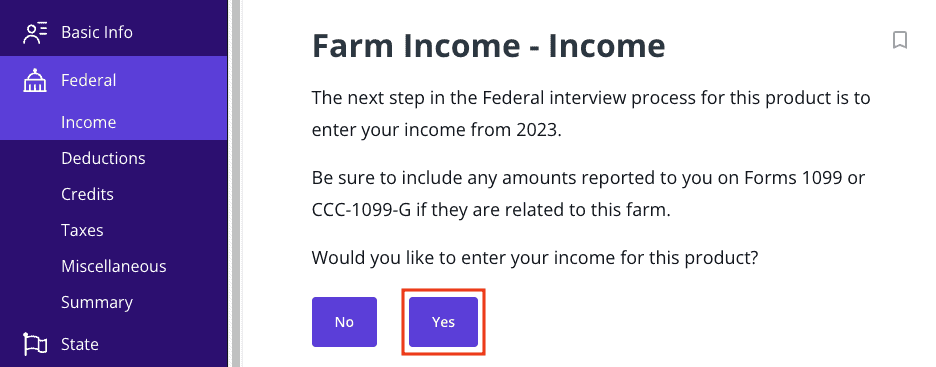

From within your TaxAct return (

Online

or Desktop), click

Federal.

(On smaller devices, click in the top left corner of your screen, then click

Federal

).

Click the

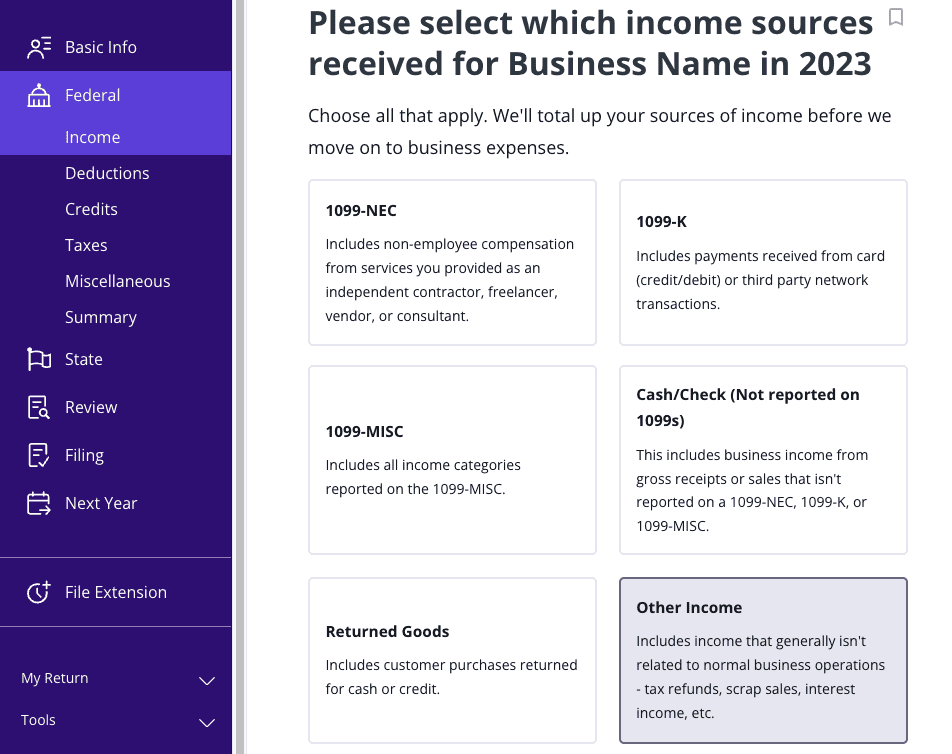

- Business Income dropdown, then click Business income or loss from a sole proprietorship, as shown below:3. Click (Desktop program: click Review instead of

- Edit).4. Continue the interview process until you reach the screen below, then click Other Income.

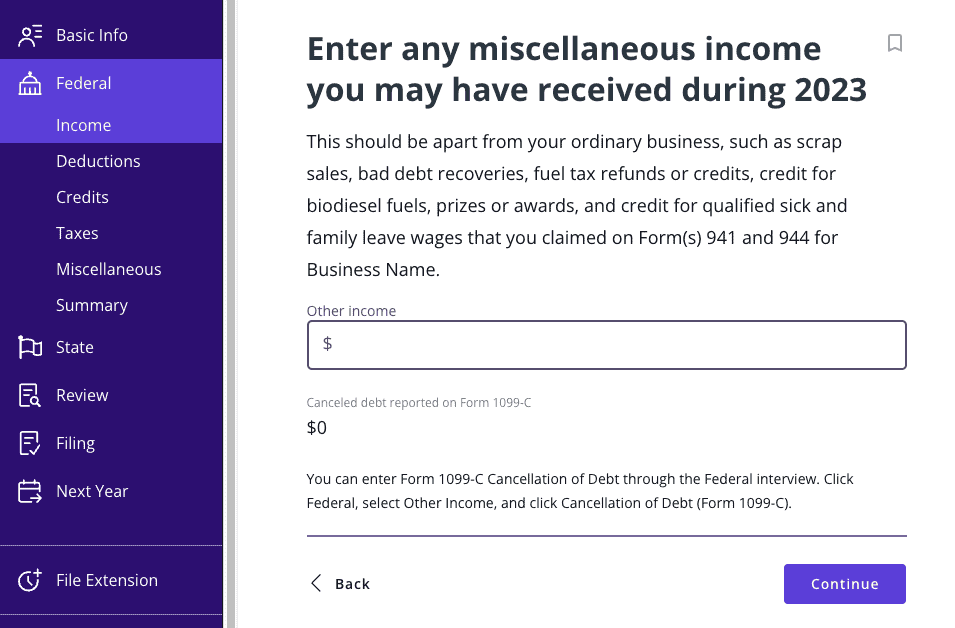

5. On the next screen shown below, click the field below Other income and type the Form 1099-PATR amount:To report Form 1099-PATR on Schedule F:From within your TaxAct return (Online or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click

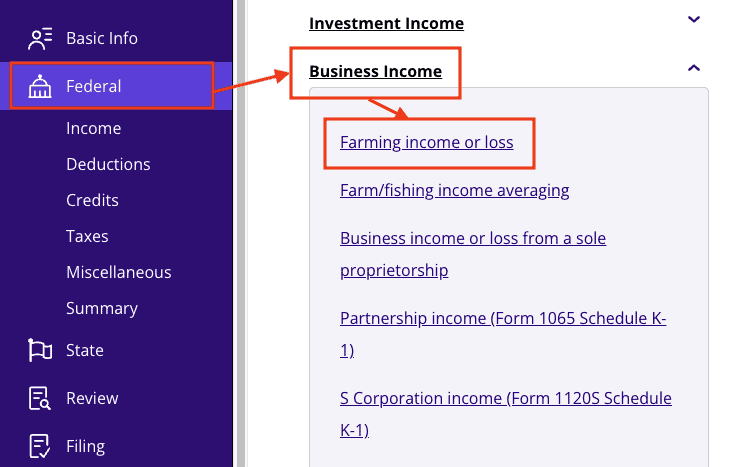

Federal).Click the

Business Income dropdown, then click Farming income or loss

, as shown below:

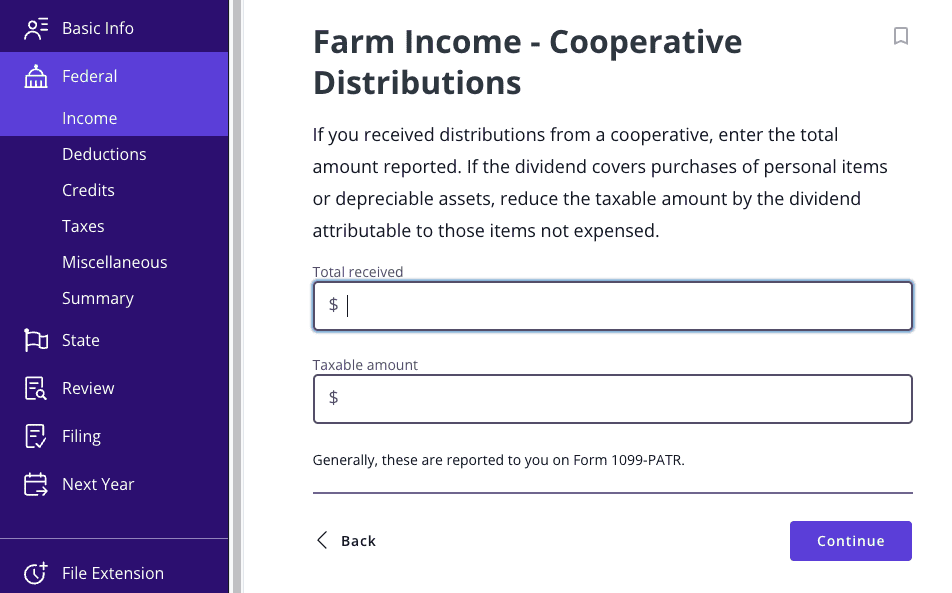

- 3. Click + Add Schedule F to create a new copy of the form or click Edit to edit a form already created (desktop program: click Review instead of

- Edit).4. Enter On the screen titled Farm Income – Cooperative Distributions, enter the Form 1099-PATR amounts as shown below:

To report Form 1099-PATR on Form 4835 for farm rental income:From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).Click the

Rent or Royalty Income dropdown, then click Farm rental for crop shares as shown below:3. Click (Desktop program: click

Review instead of Edit

).

- 4. Click On the screen titled Farm Rental – Cooperative Distributions, enter the Form 1099-PATR amounts as shown below:The bottom lineIf you received patronage dividends or other cooperative payments last year, Form 1099-PATR reports those payments to you and the IRS. Understanding You Tax Follow