Gas Taxes in Europe | 2023 Fuel Tax Rates: Gas & Diesel

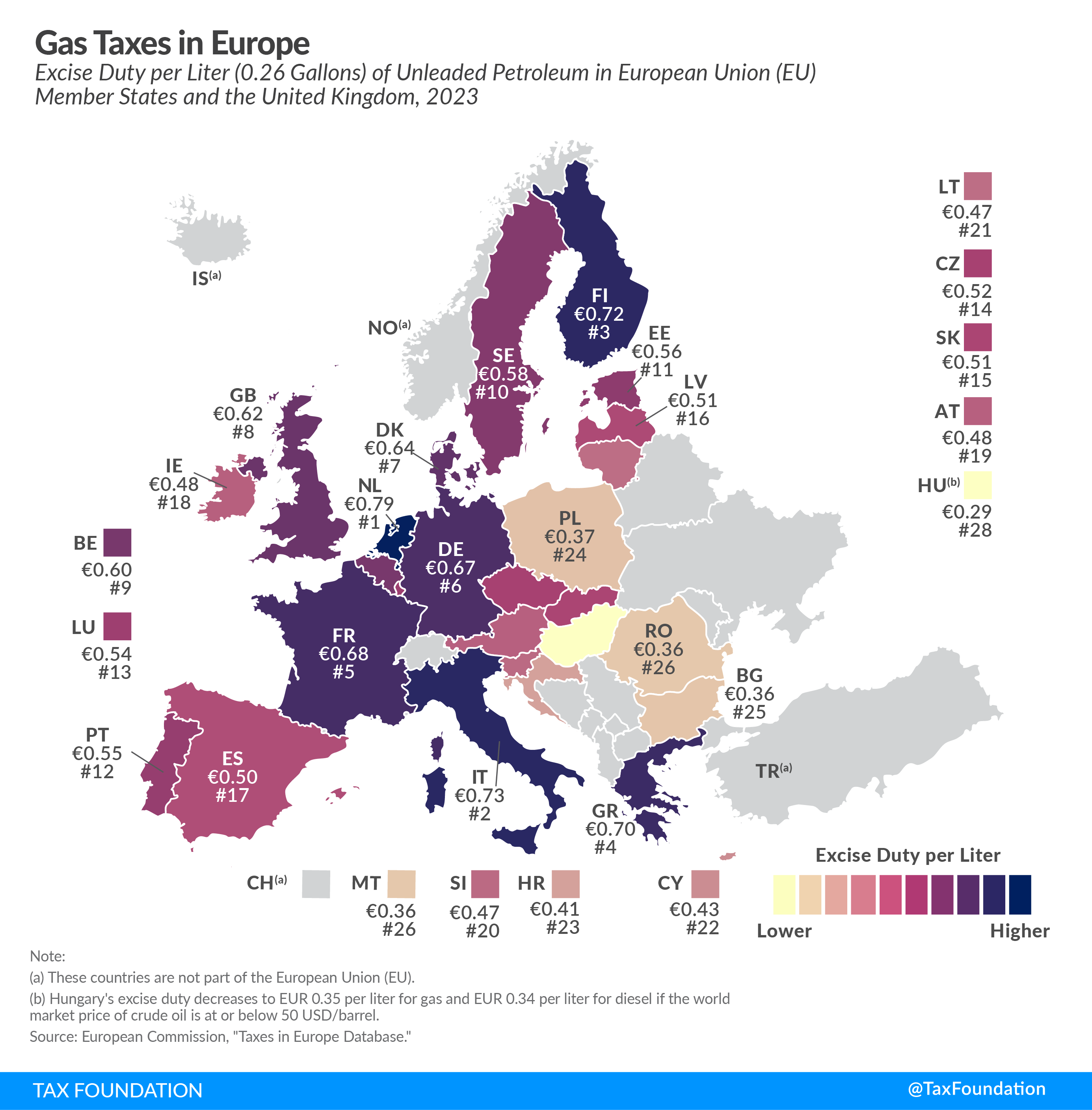

In response to a year of extreme energy price increases in 2022, many European countries offered partial relief through temporary fuel tax reductions. In 2023, European gas and diesel taxes have mostly returned to the rates in place before the Russia-Ukraine war. The European Union (EU) requires Member States to levy a minimum excise duty of €0.36 per liter ($1.55 per gallon) on petrol (gasoline).

Today’s map shows that only Bulgaria, Hungary, Romania, Malta, and Poland stick to the minimum rate, while all other EU countries levy higher excise duties on gas. The lowest gas tax is in Hungary, at €0.29 per liter ($1.21 per gallon), as the Hungarian rate is set in its domestic currency, the forint, resulting in an average rate slightly below the EU minimum after exchange rate fluctuations. The next lowest rates after exchange rates are Bulgaria, Malta, and Romania, each at €0.36 per liter ($1.48 per gallon).

The Netherlands has the highest gas tax in the EU, at €0.79 per liter ($3.25 per gallon). Italy applies the second-highest rate at €0.73 per liter ($3.00 per gallon), followed by Finland at €0.72 per liter ($2.98 per gallon).

Roughly 30 percent of new passenger vehicles in the EU are diesel vehicles. Therefore, many European consumers face excise duties on diesel instead of gas. The EU sets a slightly lower minimum excise duty of €0.33 per liter ($1.36 per gallon) on diesel.

Most EU countries levy a lower excise duty on diesel than gas. Both the United Kingdom, which is no longer a part of the EU, and Belgium levy the same rate on the two fuel types, while only Slovenia taxes diesel at a higher rate than unleaded gasoline. In the EU, the average excise duty on gas is €0.53 per liter ($2.19 per gallon), and the average excise duty on diesel is €0.43 per liter ($1.76 per gallon).

The United Kingdom levies the highest excise duty on diesel, at €0.62 per liter ($2.55 per gallon), followed by Italy (€0.62 per liter or $2.54 per gallon) and Belgium (€0.60 per liter or $2.47 per gallon).

The countries with the lowest excise duties on diesel are Hungary, at €0.28 per liter ($1.16 per gallon), again below the minimum rate due to the exchange rate, followed by Malta, Bulgaria, and Poland, which charge duties of €0.33 per liter ($1.36 per gallon).

All EU countries also levy a value-added tax (VAT) on gas and diesel. The excise amounts shown in the map relate only to excise taxes and do not include the VAT, which is charged on the sales value of gas and diesel.

Taxes on gas and diesel continue to be pressing public policy throughout Europe. These taxes are both highly visible and paid by a larger number of Europeans. As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

| Gas Tax | Diesel Tax | |||||

|---|---|---|---|---|---|---|

| Per Liter in EUR | Per Gallon in USD | Rank | Per Liter in EUR | Per Gallon in USD | Rank | |

| Austria (AT) | € 0.48 | $1.98 | 19 | € 0.40 | $1.63 | 16 |

| Belgium (BE) | € 0.60 | $2.47 | 9 | € 0.60 | $2.47 | 3 |

| Bulgaria (BG) | € 0.36 | $1.49 | 25 | € 0.33 | $1.36 | 25 |

| Croatia (HR) | € 0.41 | $1.67 | 23 | € 0.35 | $1.45 | 22 |

| Cyprus (CY) | € 0.43 | $1.77 | 22 | € 0.40 | $1.65 | 15 |

| Czech Republic (CZ) | € 0.52 | $2.15 | 14 | € 0.34 | $1.42 | 23 |

| Denmark (DK) | € 0.64 | $2.62 | 7 | € 0.44 | $1.82 | 9 |

| Estonia (EE) | € 0.56 | $2.32 | 11 | € 0.37 | $1.53 | 19 |

| Finland (FI) | € 0.72 | $2.98 | 3 | € 0.53 | $2.20 | 5 |

| France (FR) | € 0.68 | $2.81 | 5 | € 0.59 | $2.44 | 4 |

| Germany (DE) | € 0.67 | $2.76 | 6 | € 0.49 | $2.02 | 8 |

| Greece (GR) | € 0.70 | $2.88 | 4 | € 0.41 | $1.69 | 14 |

| Hungary (HU)** | € 0.29 | $1.21 | 28 | € 0.28 | $1.16 | 28 |

| Ireland (IE) | € 0.48 | $1.99 | 18 | € 0.43 | $1.75 | 10 |

| Italy (IT) | € 0.73 | $3.00 | 2 | € 0.62 | $2.54 | 2 |

| Latvia (LV) | € 0.51 | $2.09 | 16 | € 0.41 | $1.70 | 12 |

| Lithuania (LT) | € 0.47 | $1.92 | 21 | € 0.37 | $1.53 | 19 |

| Luxembourg (LU) | € 0.54 | $2.21 | 13 | € 0.41 | $1.70 | 13 |

| Malta (MT) | € 0.36 | $1.48 | 26 | € 0.33 | $1.36 | 26 |

| Netherlands (NL) | € 0.79 | $3.25 | 1 | € 0.52 | $2.12 | 6 |

| Poland (PL) | € 0.37 | $1.51 | 24 | € 0.33 | $1.37 | 24 |

| Portugal (PT) | € 0.55 | $2.27 | 12 | € 0.42 | $1.74 | 11 |

| Romania (RO) | € 0.36 | $1.48 | 26 | € 0.33 | $1.36 | 26 |

| Slovakia (SK) | € 0.51 | $2.11 | 15 | € 0.37 | $1.51 | 21 |

| Slovenia (SI) | € 0.47 | $1.94 | 20 | € 0.51 | $2.10 | 7 |

| Spain (ES) | € 0.50 | $2.07 | 17 | € 0.38 | $1.56 | 17 |

| Sweden (SE) | € 0.58 | $2.39 | 10 | € 0.38 | $1.54 | 18 |

| United Kingdom (GB) | € 0.62 | $2.55 | 8 | € 0.62 | $2.55 | 1 |

| Average | € 0.53 | $2.19 | € 0.43 | $1.76 | ||

| Minimum Rate | € 0.36 | $1.48 | € 0.33 | $1.36 | ||

|

Notes: The excise duties apply to petroleum and diesel with a sulphur content of < 10 mg/kg, RON 95 (gas) and bioethanol content; if applicable, they include carbon taxes and surcharges. The excise duties were converted into USD using the July 2023 USD-EUR exchange rate (0.92) Source: European Commission, “Taxes in Europe Database,” and HM Revenue and Customs, “UK Trade Tariff: excise duties, reliefs, drawbacks, and allowances,” |

||||||