Fixing The IRS Will Require Much More Than Hiring Additional Staff

As usual, the politicians are missing the point: Success or failure of the IRS’s ambitious plan to spend $80 billion in new money won’t be measured by how many new staff it hires. Rather it will depend largely on the agency’s ability to hire the right people, upgrade and modernize its technology, and change its hidebound culture, management, and business practices.

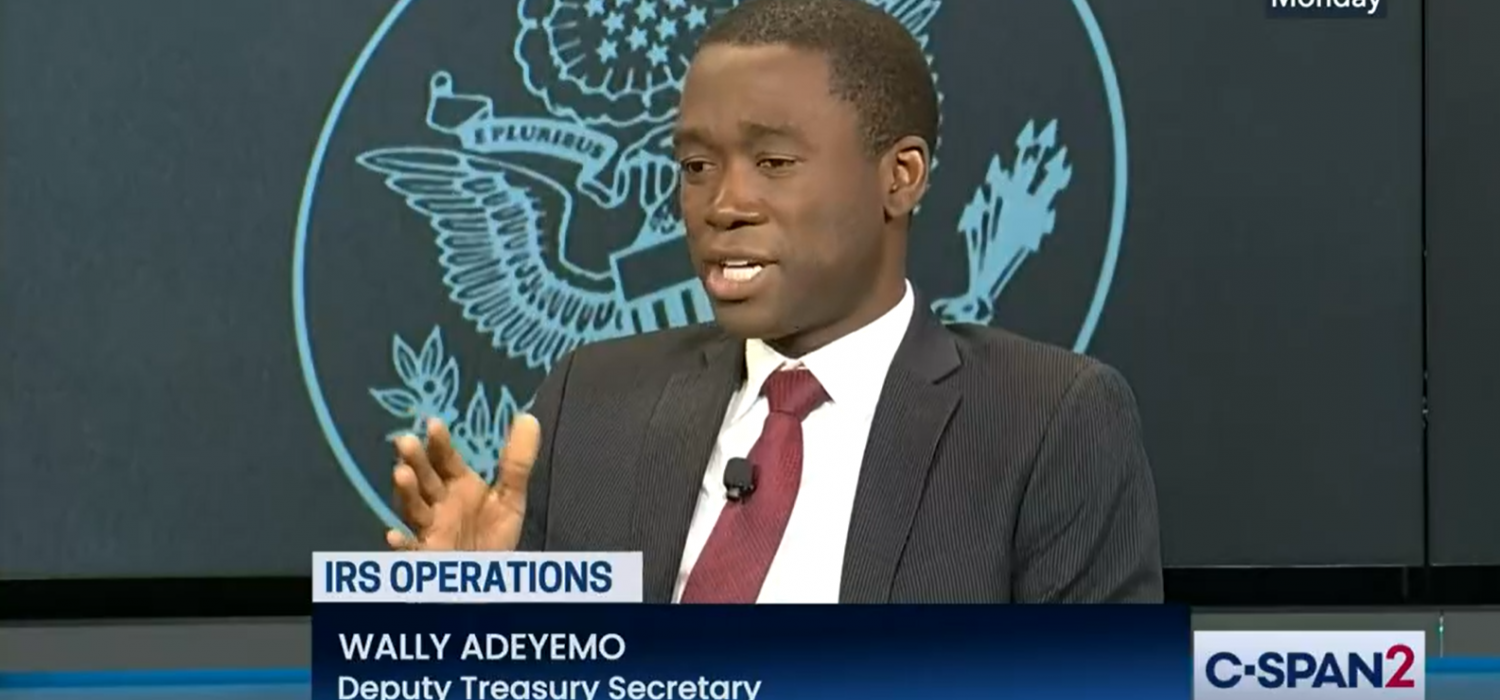

At TPC ‘s annual Donald C. Lubick Symposium this week, a broad range of experts, including Deputy Treasury Secretary Wally Adeyemo, former IRS Commissioner Charles Rossotti, former IRS Taxpayer Advocate Nina Olson, former senior Treasury official Natasha Sarin, and others broadly agreed: It will take much more than just increasing the IRS headcount to improve taxpayer experience and reduce non-compliance.

That’s not to say the IRS doesn’t need more staff. It does. Desperately. But the agency never will solve its many problems just by hiring more humans.

Staff, But More

Its need for updated technology is well-documented. Rossotti, who started and ran a business systems company before leading the IRS, believes the agency can make progress by installing new systems even before it completely replaces its decades-old core taxpayer database.

The agency also needs a cultural makeover. Much of its middle management is highly resistant to change, its rank-and-file staff morale is low, and its union/management relations are poor.

Olson said the IRS needs to think of itself primarily as an agency that supports taxpayers rather than mostly an enforcer of the law. These days, the IRS talks about “customer service.” Taxpayers, of course, are not customers. But more importantly, much of what the agency does sends very different signals, from its incomprehensible notices to taxpayers to its continued self-harm by effectively forcing many filers to communicate by paper.

How Tech Can Help

In any successful organization, appropriate technology is a key to making workers more productive.

Here’s one simple example: The IRS closed examinations of about 540,000 returns from 2018. In about 70,000 of them, or roughly one out of every eight, the IRS found no errors. Imagine if the agency could effectively use machine learning to better identify problem returns before it wastes staff on these “no change” audits.

Better computer-assisted triage could make it possible for humans to focus on true errors or fraud in a more cost-effective way. Tech also can help confused taxpayers avoid simple mistakes when they file and allow the IRS to communicate electronically, which can reduce agency resources now dedicated to reviewing tons of paper.

The IRS still will need more people to fulfill its promise of increasing audit rates for high-income households and corporations. And it will need more data scientists and computer geeks to build and maintain those new systems. But it may need fewer staff wielding red pens flyspecking paper returns by hand.

Pols Arguing Head Counts

To its credit, the agency’s spending plan barely mentions head counts. Rather it rightly focuses on the twin goals of improving service and reducing fraud. And it lays out scores of process changes to get there.

But you’d never know it from listening to the political debate, which appears to be occurring in some parallel universe.

This started when the Biden Treasury projected the agency could hire 87,000 new staff if Congress gave it the money it wanted. That number was almost certainly inflated. And, worse, it became a political gift to Republicans.

They, predictably, turned the number into a caricature. First, 87,000 new employees became 87,000 revenue agents (notwithstanding that the vast majority of new staff will be answering the phone and processing returns).

In his first speech to the House, newly elected Speaker Kevin McCarthy (R-CA) vowed “our very first bill will repeal the funding for 87,000 new IRS agents.” Though most of those 87,000 new agents were non-existent, House Republicans voted to repeal their funding anyway.

But the hyperbole didn’t end there. Some in the GOP turned those 87,000 phantom new revenue agents into a spectral army of armed officers battering down the doors of innocent, unsuspecting taxpayers.

Democrats rose to the bait and responded that more staff was good because it would target fat cat tax cheats.

If the agency is to meet its ambitious modernization goals, it will need new kinds of workers. But mostly it will have to change the way it thinks about all the ways it interacts with taxpayers. Without that profound change in culture, all the new staff in the world won’t help the IRS achieve its very ambitious goals.

The authors of the strategic plan seem to know that. If only the politicians could catch up.