FinCEN BOIR Compliance: Powered by BOI-Labs

Law 4 Small Business (L4SB) is proud to announce that it has partnered up with BOI-Labs.com to deliver the most powerful and comprehensive set of tools for Beneficial Ownership Information reporting (BOIR) compliance.

Starting on January 1st, 2024, all new companies formed are required to report their Beneficial Ownership Information (BOI) within 90-days of formation, unless a company meets one or more narrow exemptions to the requirements to report. By January 1st, 2025, all pre-existing companies formed prior to 1/1/2024, are required to report their BOI (again, unless they meet an exemption).

Even more annoying, every “reporting company” (that’s what FinCEN calls companies you are required to submit a BOIR), has only 30 days to submit an updated report, when something changes about the company or its Beneficial Owners. This means, if a Beneficial Owner gets married, moves his or her primary residence, or his or her ID expires — the reporting company has just 30-days to update its BOIR.

L4SB shall make BOI-Labs’ sophisticated tools available to its clients, so L4SB clients will be able to quickly, easily and most importantly, accurately determine:

- Is the company is a “reporting company” according to FinCEN and must therefore report its BOI?

- Who are its Beneficial Owners that must submit information for the BOIR?

These questions aren’t as easy to answer as you may think, as it depends on how the company is setup, how its taxed, and how its ownership is structured. Simple setups that are “legally proper” are going to be the easy cases. Harder are those companies setup by non-lawyers or the cheap Internet companies who issue template Operating Agreements, Bylaws and Shareholder Agreements, especially if those companies aren’t setup as “legally proper” entities.

What would be an example of a company that is not setup properly? Companies that claim to have (for example, this is not a complete list):

- Owners with zero ownership interest

- Companies taxed as S-Corps with multiple classes of ownership

- Companies taxed as S-Corps, violating the S-Corp entity status rules (i.e. with foreign ownership, more than 100 owners, etc)

- Companies who issue shares, but keep track of ownership by percentage

- Companies taxed as S-Corps or Partnerships, but not issuing K-1’s to its owners

- Companies setup as Double LLC’s (See The Florida Double LLC is Double Trouble)

Even for entities that are setup legally and properly, the analysis on who is a Beneficial Owner can be difficult to determine, especially if you have non-individual owners, such as trusts, companies or other types of entities. Or, if you have “future ownership” interests, such as options or convertible promissory notes. Furthermore, Beneficial Owners aren’t just direct or indirect owners — they can be individuals with substantial control.

Unfortunately, there is a significant financial (and criminal) penalty for getting this wrong. Therefore, L4SB strongly recommends every business owner consult with their attorney, or use the BOI-Powered system for BOI compliance. It’s free, anonymous, and takes 3-5 or 5-10 minutes, depending on the question you’re asking. Want to speak with an attorney? L4SB has trained, licensed attorneys available for 30-minute BOI consults available now.

All L4SB clients will have free access to BOI-Labs.com tools, and will be able to rely on L4SB for quick, easy and accurate assessments, as well as ongoing BOIR compliance maintenance.

Law 4 Small Business (L4SB). A Slingshot company.

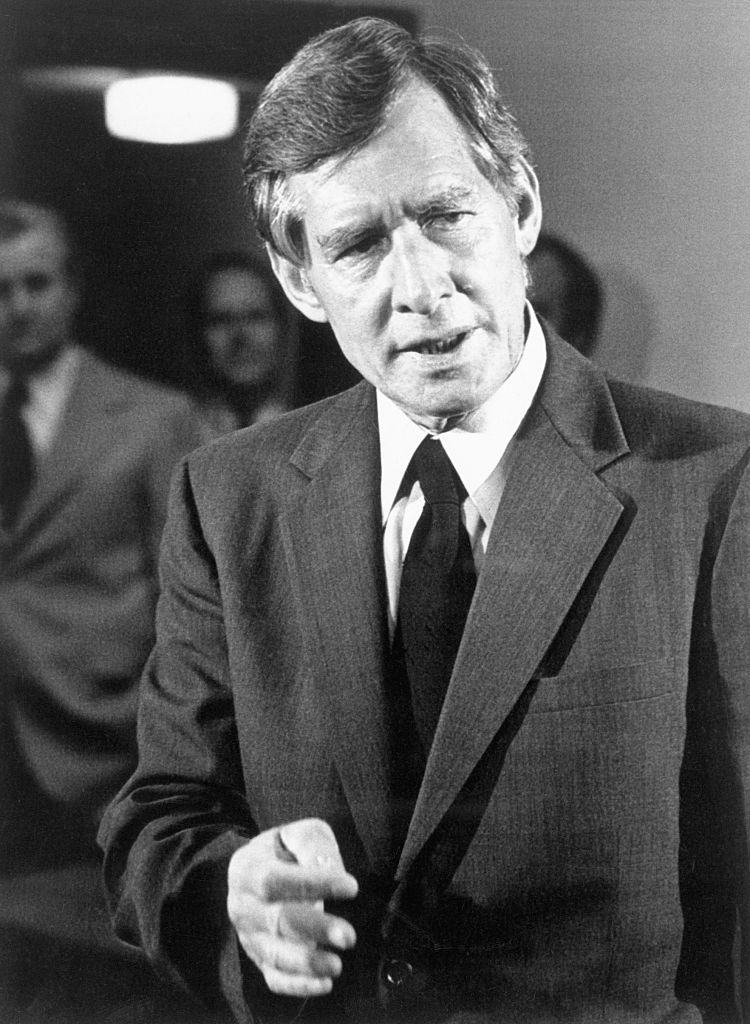

Author: Larry Donahue

Larry Donahue is a managing member of the firm, with 30-years of experience as an attorney with a focus on Internet law, intellectual property, corporate law, and contracts. Larry leads the firm’s Internet sales efforts. He is licensed in the states of Illinois and New Mexico, as well as at the United States Patent and Trademark Office (USPTO).