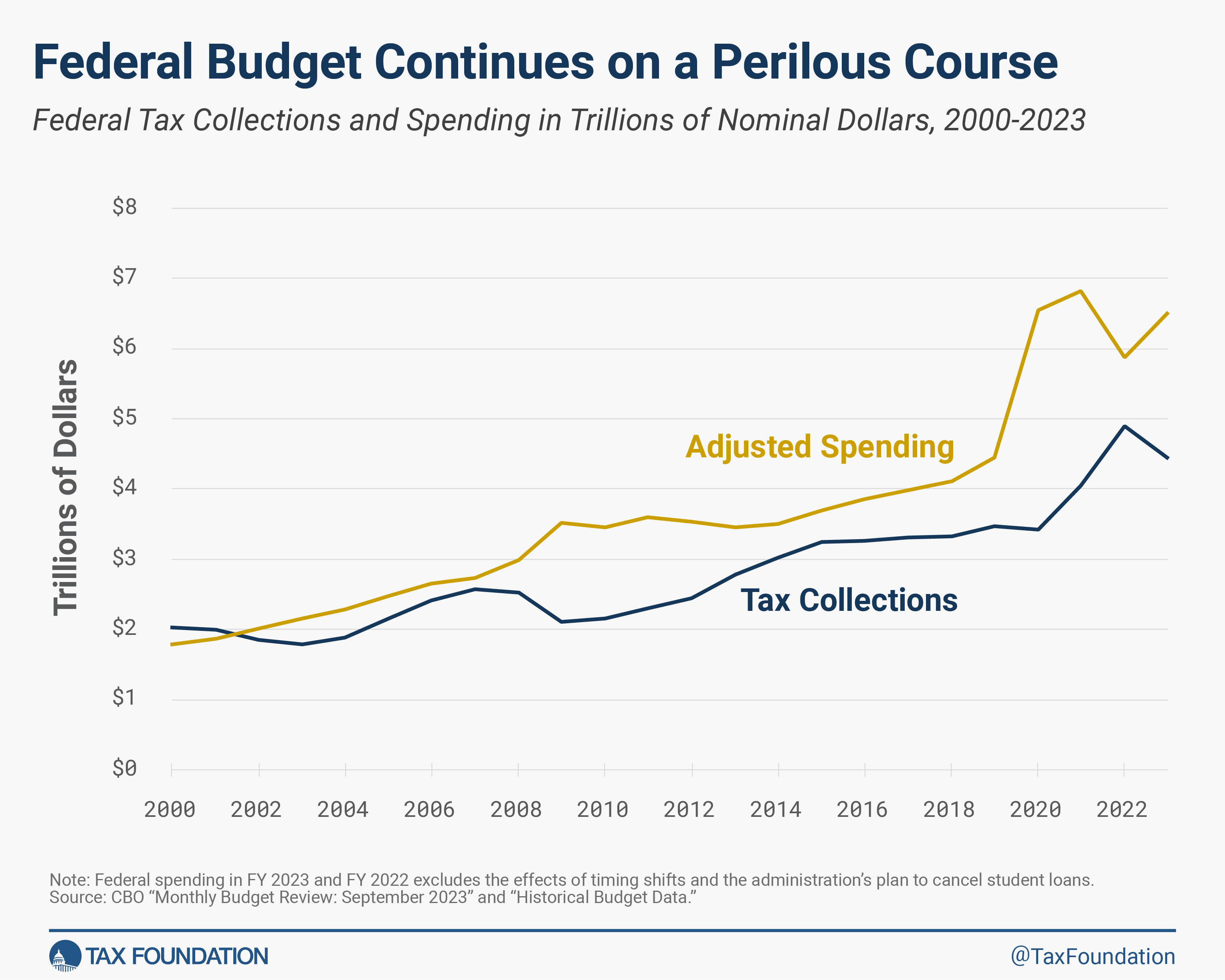

Federal Budget Deficit Grew to $2 Trillion in FY 2023

Outside of the pandemic years, this year’s federal deficit is the highest in U.S. history. Preliminary figures from the Congressional Budget Office (CBO)The Congressional Budget Office (CBO) provides nonpartisan analysis to the U.S. Congress on federal economic and budgetary matters.

for fiscal year (FY) 2023 indicate the federal deficit grew to about $2 trillion, nearly $1.1 trillion larger than the prior year after excluding the effects of the administration’s student debt cancellation plan that the Supreme Court struck down in June. Only 2020 and 2021 saw larger deficits, at $3.1 trillion and $2.8 trillion, respectively.

Social Security payments increased 11 percent, from $1.2 trillion in FY 2022 to $1.3 trillion in FY 2023, while Medicare payments increased 18 percent, from $751 billion to $846 billion, and Medicaid payments increased 4 percent, from $592 billion to $616 billion. Interest payments on the debt increased 33 percent, from $534 billion in FY 2022 to $711 billion in FY 2023. Defense spending grew 7 percent, from $727 billion to $774 billion. If this rate of increase continues, interest on the debt will overtake spending on defense next year.

TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

collections totaled $4.4 trillion in FY 2023, down $455 billion, or 9 percent, from last year’s record haul of $4.9 trillion. The largest decline was for individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

es, which fell $456 billion, or 17 percent, to $2.2 trillion, apparently due in large part to a drop in capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

revenue as the stock and housing markets deflated. CBO also points to “higher-than-anticipated claims” of the Employee Retention Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

, a pandemic-era program that spawned a cottage industry until the IRS halted new claims last month due to rampant fraud. Individual income tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s.

s were $129 billion higher this year than last, a 52 percent increase.

In contrast, payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue.

es grew 9 percent to $1.6 trillion in FY 2023, reflecting growth in wages and jobs.

Corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

es were roughly flat, falling $5 billion, or 1 percent, to $420 billion, despite the introduction of the new minimum tax on book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax.

and the stock buyback tax, both part of the Inflation Reduction Act (IRA) enacted last year. The Joint Committee on Taxation (JCT)The Joint Committee on Taxation (JCT) is a nonpartisan congressional committee in the United States that assists both the House and Senate with tax legislation. The JCT is chaired, on a rotation, by the Chair of the Senate Finance Committee and the Chairman of the House Ways and Means Committee.

predicted the new taxes would raise about $40 billion in FY 2023, but implementation challenges led the IRS to delay enforcement until further guidance is released. The IRA also provided 22 green energy tax credits, some of which may be claimed by corporations, and JCT’s most recent estimates indicate the credits would reduce tax revenue (from both corporations and individuals) by about $15 billion in FY 2023.

Other receipts dropped $124 billion, or 35 percent, to $232 billion in FY 2023. The drop primarily reflects a near-zeroing out of remittances from the Federal Reserve (from $107 billion in FY 2022 to less than $1 billion in FY 2023), as higher interest rates caused the central bank’s interest expense to offset its income (the Federal Reserve pays interest to banks and other institutions on their reserve balances). Customs duties also fell $20 billion due to a reduction in imports.

In sum, the federal budget continues on a perilous course. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent, and the deficit has more than doubled to $2 trillion. Annual deficits are headed towards $3 trillion over the next few years and interest expense is set to consume a growing share of the federal budget. Already this fiscal year, interest expense reached 16 percent of all revenue collected, the highest level since 1996. The bond market is signaling that interest expense could go much higher, leading to an unprecedented cost of servicing the debt. Now would be a good time for our political leaders to present a coherent plan for dealing with the debt problem before it becomes an urgent crisis.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share