Excise Duties on Electricity in Europe, 2024

In 1999, the European Union introduced a harmonised excise duty on electricity use. The rationales at the time were to raise revenue for the Member States and encourage the frugal use of electricity in light of climate goals.

Today, there are more targeted environmental policies directed at the reduction of carbon emissions. Since 2005, the European Union’s Emissions Trading System (EU ETS) caps the number of allowed greenhouse gas emissions, including those from electricity production. Additional taxes levied on covered activities do not change the number of permitted emissions, but simply shift them towards less-valuable uses outside of the ETS emissions base, introducing distortive double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

without associated environmental benefit.

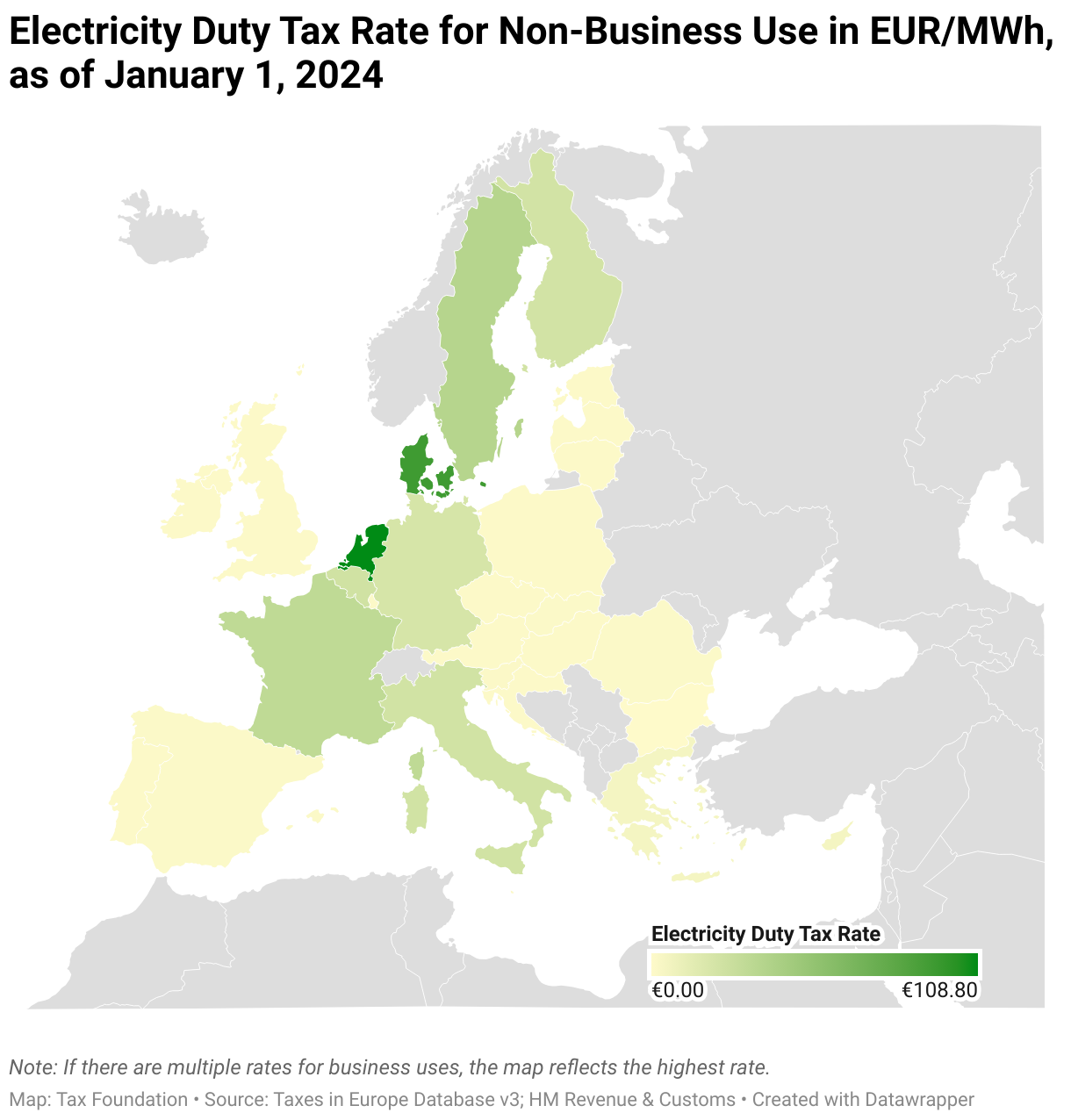

Nonetheless, the European Union’s Energy Tax Directive still requires Member States to impose an electricity duty at minimum rates of EUR 0.5 per MWh for business use and EUR 1 for non-business use, with many Member States imposing far higher rates.

For business uses, EU Member States and the UK charge an excise duty of EUR 7.1 per MWh of electricity on average. Belgium, Croatia, Luxembourg, and Sweden only impose the required minimum rate of EUR 0.5 per MWh. The Netherlands charges the highest top rate at EUR 108.8 per MWh, distantly followed by France (EUR 25.69) and Germany (EUR 15.67).

Excise duty rates for non-business use tend to be higher, with an average rate of EUR 14.4 per MWh. Bulgaria does not impose an electricity excise duty on non-business use until 2025, using a temporary exemption. Hungary (EUR 0.84) and the United Kingdom (EUR 0.91) both impose excise duty rates slightly below the required EU minimum rate, enabled by exchange rate fluctuations and the UK’s exit from the European Union. Six countries—Austria, Estonia, Ireland, Portugal, Croatia, and Luxembourg—impose the required minimum rate of EUR 1 per MWh on non-business use. The Netherlands charges the highest non-business rate (EUR 108.8), followed by Denmark (EUR 93.73) and Sweden (EUR 36.95).

Despite harmonizing regulation through the EU Energy Directive, there is considerable heterogeneity in the rate structures and tax bases that Member States use to impose an electricity duty. Some countries apply regressive rate structures, with rates decreasing with businesses’ electricity usage, favouring larger energy-intensive companies. Sectoral exemptions are common as well: many countries exempt electricity usage in sectors such as agriculture and public transport or electricity generated from renewable energy sources.

One useful metric to capture the extent of how simply and efficiently countries structure their electricity excise duty is the c-efficiency ratio, which is the ratio of actual revenue and hypothetical revenue if the top taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

rate were applied uniformly to the entire consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible.

base. This metric is commonly used to measure the efficiency of value-added tax collection but can in principle also be applied to other consumption taxes. In 2022, EU Member States captured less than half of their base. The Czech Republic, Estonia, and Malta captured their entire electricity consumption base. In contrast, the Netherlands (0 percent) has the most narrow base due to negative revenues in that year, followed by Ireland (11.4 percent), Lithuania (14.3 percent), and Hungary (17.4 percent) all capturing less than 20 percent of electricity consumption.

Since the electricity sector is already subject to more efficient and targeted policies to generate revenue from consumption under most Member States’ VAT systems or capture carbon emissions under the EU ETS, there is no economic justification to apply a separate excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on electricity. Sectoral or source-based exemptions and rate differentials introduce additional economic distortions and complexity to the tax code. Member States should therefore seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share