Enabling company growth and tax planning with AI

Discover how AI can drive growth by enabling advisory services, optimizing workflows, and saving time, as outlined in the Future of Professionals report

Jump to:

AI presents no shortage of opportunities. In a way, tax and accounting professionals can attain their goals with artificial intelligence. For accounting professionals, there is a shift in the industry to providing more advisory services to clients. AI can help facilitate this transition through multiple internal and external efficiencies. As tax professionals incorporate more AI into their tax planning workflows, they will be able to bring more services in-house. This will change how human resources are managed, how time is allocated, how work is performed, and how communications are managed. With leaner teams and more efficient and accurate analysis capabilities, tax professionals are positioned to capitalize on growth opportunities both in profitability and in client acquisition and retention.

The Future of Professionals report highlights many of these growth opportunities and the strategies that need to be implemented to accelerate and optimize AI adoption for growth and innovation.

Enabling the growth opportunity

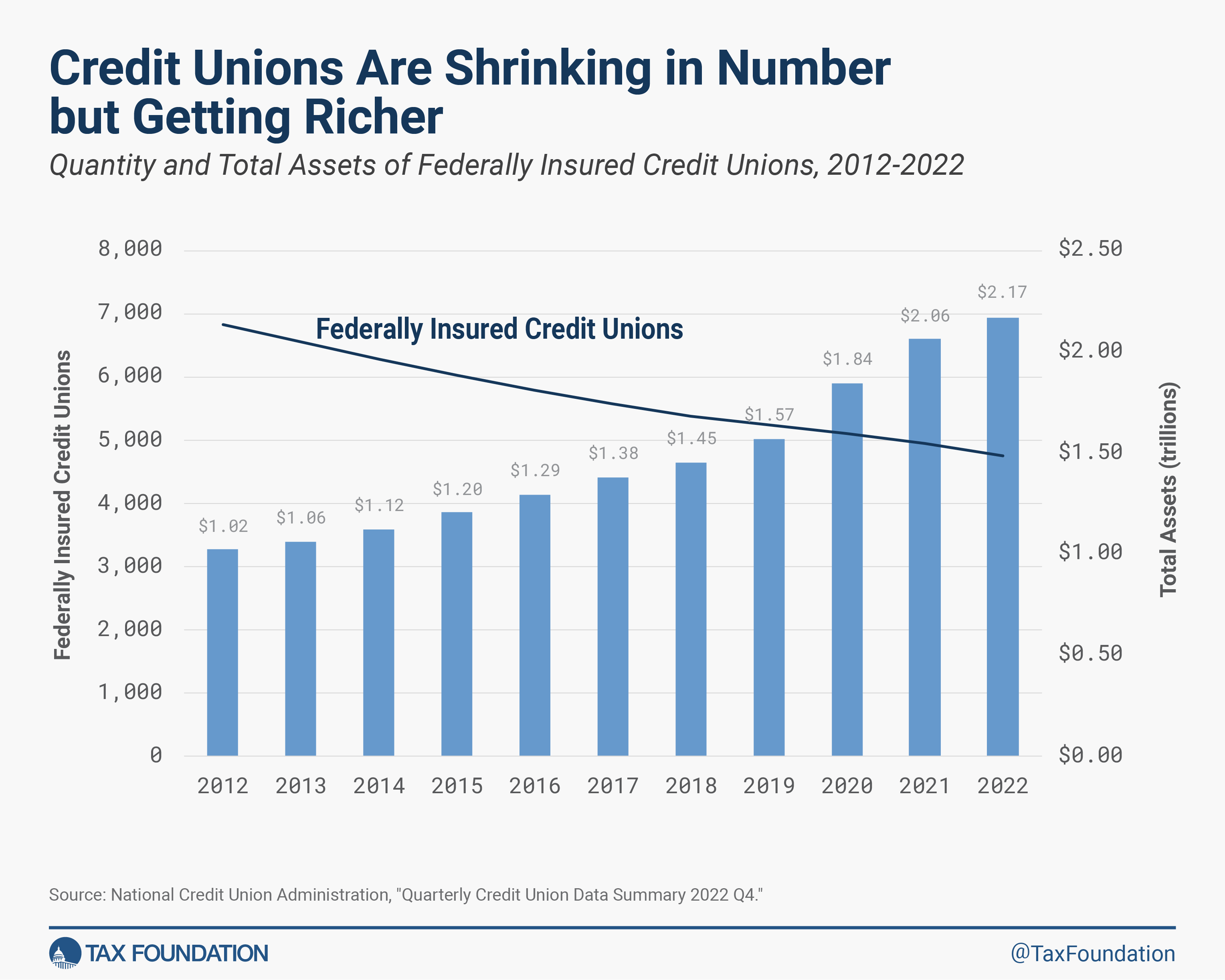

The survey revealed an optimistic outlook on the implementation of AI in achieving growth, particularly in the ability to reduce friction in moving to more value-based advisory services and pricing models. The analytical capability of AI allows for a detailed review of current clients highlighting the most profitable niches for strategic planning purposes.

As tax professionals consider moving to more specialized services to demonstrate expertise, AI can help identify where they should focus their energies and attention based on capabilities and profitability. In-house teams will move from cost centers to growth enablers by zeroing in and developing key areas of expertise as the foundation of expanding into advisory services. By using predictive analytics and customer segmentation, in-house teams can use lead scoring, qualification, and competitor analysis to identify areas of growth both in terms of specific types of clients or specializations worth pursuing but also use AI-generated competitive analysis for exploring new markets.

Future of Professionals ReportHow AI is the Catalyst for Transforming Every Aspect of Work

|

Tax planning with AI

How AI can drive operational improvements

Artificial intelligence is reshaping every aspect of tax and accounting work, which for the professional is saving the most valuable resource: time. AI adoption promises to give professionals time back from tasks that can be automated so they can focus on more valuable and strategic ones. Routine tasks such as tax compliance, reporting, calculations, analysis, and planning which take up hours can be done in minutes, even seconds. This frees up time for deeper analysis, broader insights, and more opportunities for tax professionals to deliver better advice and more services to their clients.

“In reviewing a return, I often spend a substantial amount of time… trying to figure out the best way to handle a client’s taxes to reduce overall taxes in the next five years and not just the current year,” one tax professional said. “AI will greatly assist in saving time in determining the best way to handle certain large deductions and income streams by showing the future tax results.”

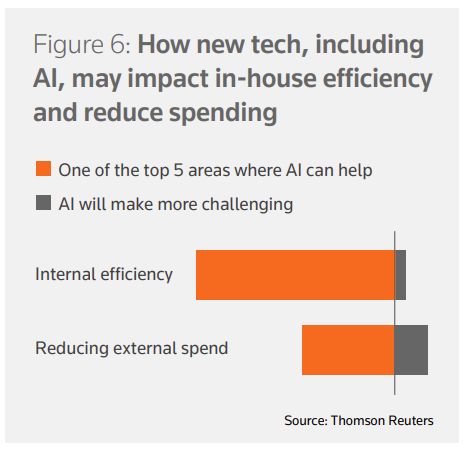

The centralization and consistency of AI outputs offer a level field on which teams, even those working remotely, can collaborate more effectively on creating a more agile and responsive work environment. More work will be able to be done in-house, reducing the need for outsourcing or external resources. Beyond client work, these efficiencies can also be realized in administrative work, finance, HR, and IT.

Achieving operational gains and improving the firm-client value exchange

AI can also relieve schedules by offering access for clients to common questions, and queries and offer recommendations based on standard data. The natural language processing eliminates the need for translation to layman’s terms. Professionals will be able to take a more proactive approach to client management by scheduling client touchpoints throughout the year and using AI to assist in the preparation of documents and reports for review as needed.

Clients will appreciate increased responsiveness and access to information and advice. Tax professionals may find they can take on more profitable work as a result of the increased value of their consultative services, specializations, and availability.

Reshaping talent, skills, and recruitment through the AI revolution

Despite the fear many feel of AI making their jobs redundant, the survey found that 64% of professionals said they see a rise in the appreciation of their professional skills while only 36% were concerned their skills would no longer be relevant or required.

With these opinions and AI use on the rise, internal teams will need to be trained and up-skilled, or additional talent in other areas such as structured data will need to be added, to set your accounting firm up for success. The report revealed that almost 90% of professionals anticipate basic mandatory AI training in the next five years.

Fortunately, AI can help automate this training as well, reducing the dependence on other staff members to take time away from their daily work to train junior staff or help colleagues learn new roles.

Thomson Reuters has led the way in research and assisting firms in implementing into their processes for decades. The Future of Professionals report offers insights for tax professionals on how they can develop their growth strategies in the new age of AI.