Dutch

01 They Authorities are increasingly taking the view that the size of an undertaking’s revenue does not necessarily reflect that undertaking’s effect on competition.

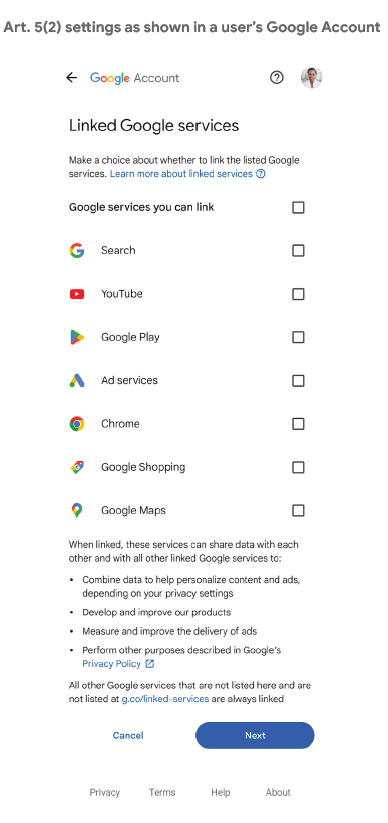

Some examples include online platforms offering zero-price services to consumers with a view to generating revenues at a later stage, or pharmaceutical companies developing vaccines with future value in pipeline blockbuster jabs. These Authorities Some legislatures have even changed the law to that effect by introducing powers for their competition authorities to call in below-threshold mergers.

No call-in power at EU level after loss of Illumina case

In 2021, the European Commission tried to be creative by establishing a call-in system for below-threshold mergers based on the existing referral system of Article 22 EU Merger Regulation (EUMR) in the Illumina/GRAIL case (see our initial analysis

here). After The The ECJ added that only the EU legislature can review these thresholds or establish a safeguarding mechanism for the Commission to scrutinise transactions. Increasing national call-in powers and widening existing powers As the EU legislature has not yet changed the EUMR, the Commission has to rely on the call-in powers of national competition authorities in member states, who can refer a case to the Commission based on Article 22 EUMR. The Despite the Commission’s unconditional approval in the first phase of its merger control procedure, Nvidia has

challenged

the Commission’s decision to accept the Article 22 referral. N Gate As The Italian competition authority even

admitted to interpreting this rule broadly to enable it to widen its jurisdiction as far as possible. National This possibility was confirmed by the ECJ in its Towercast

judgment. For the Belgian Competition Authority, the opening of two separate proceedings under Article 101 TFEU in the

Dossche Mills/Ceres case and under Article 102 TFEU in the Proximus/EDPnet case even led to the parties abandoning their planned acquisition; it proved to be a successful preventive measure. Situation in the NetherlandsDevelopments in the Netherlands mirror those in the EU. While the Netherlands Authority for Consumers and Markets (ACM) was part of the coalition of willing authorities referring the Illumina/GRAIL case to the Commission under Article 22 EUMR, it changed its position after the Commission losing the case at the ECJ. A The In The The 01 The The In This means that the ACM is left only with the assessment under Article 102 TFEU in cases like this.

In response to the ECJ’s Towercast judgment, a bill allowing the ACM to review below-threshold mergers under the Dutch prohibition of abuse of dominance is now pending in parliament.

Buy-and-build-strategyThe ACM is taking a more critical stance towards a buy-and-build strategy under its merger control mandate. The It It In this advance notice, the parties to the transaction concerned must report other recent transactions, even if these were not notified before.The first case subject to the ACM’s critical approach to buy-and-build strategies was the Foresco case, where the ACM’s

decision set out its criteria for assessing the competitive risks of a buy-and-build strategy. The This is novel and quite controversial, as a merger control investigation should generally be limited to the effects of the notified transaction.Some of the criteria will remain the same, as the ACM continues to assess if by making the acquisition the buyer acquires a dominant position or strengthens its dominant position. As a new element in its assessment of buy-and-build strategies, the ACM will analyse whether:sufficiently concrete future acquisitions identified in the buy-and-build strategy will allow the buyer to obtain a dominant position; andprevious below-threshold acquisitions have led to higher prices, taking into account the effects of those previous acquisitions that have not yet fully materialised due to their recent conclusion.

The practical implications for transactions that are part of a buy-and-build strategy are that

more time is needed to obtain approval (the Foresco case shows that the ACM took its time and even referred the case to a second phase); and

the ACM may request internal strategic documents on past or future potential acquisitions to ensure a comprehensive investigation.

Ultimately, the ACM unconditionally cleared the Foresco transaction. The In that event, it will impose the following obligations on the undertakings involved in the concentration:a) Notification: an obligation to notify the concentration to the ACM (by the regular form CO); and

b) Standstill obligation

: a prohibition on implementing the concentration unless the transaction had already been completed before the ACM decided to call in the merger (so either during the initial RFI period, or even before). When the standstill obligation is breached, a gun-jumping fine may be imposed.

Timing of call-in procedure and standstill obligation

The ACM can send an RFI within four weeks of the following dates, whichever comes first:When one of the undertakings involved in the merger publicly announces the intended merger;When the ACM becomes aware of the intention to implement the concentration (for example, parties can voluntarily disclose the concentration to the ACM);

Six months after the agreement implementing the concentration enters into force.

- After receiving all necessary information, the ACM must decide within four weeks whether to call in the concentration, although it can still stop the clock by requesting additional information or documents. The The Planning They They do this by opening antitrust proceedings with the possible threat of heavy fines, which has proven to be an effective way of blocking mergers.

- When an above-the-threshold buy-and-build merger triggers a notification, the ACM has demonstrated its willingness to use its review to consider all past and future below-threshold mergers in the buy-and-build strategy.

Finally, the introduction of call-in powers continues to make the landscape for below-threshold mergers even more opaque. The introduction of call-in powers has made the landscape for below-threshold mergers even more opaque.