Dividend Tax Rates in Europe | Dividend Income Tax Data

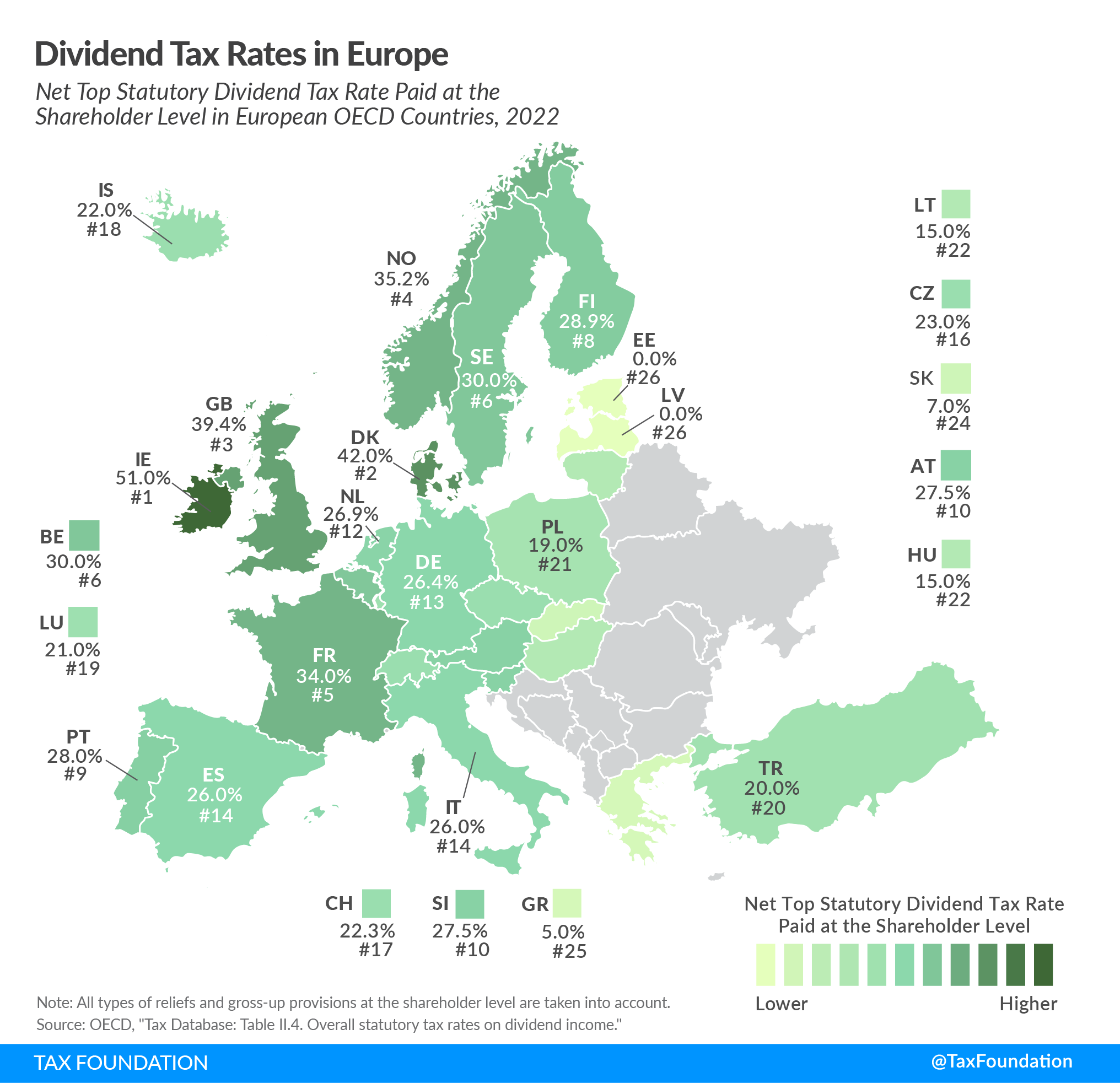

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains. Today’s map shows how dividend income is taxed across European OECD countries.

A dividend is a payment made to a corporation’s shareholders from corporate after-tax profits. In most countries, such dividend payments are subject to dividend tax. The dividend tax rates shown in the accompanying map reflect the top personal dividend tax rate, after accounting for all imputations, credits, or offsets.

Ireland has the highest top dividend tax rate among European OECD countries at 51 percent. Denmark and the United Kingdom follow, at 42 percent and 39.4 percent, respectively.

Estonia and Latvia are the only European countries covered that do not levy a tax on dividend income. This is due to their cash-flow-based corporate tax system. Instead of levying a dividend tax, Estonia and Latvia impose a corporate income tax of 20 percent when a business distributes its profits to shareholders.

Of the countries that do levy a dividend tax, Greece has the lowest tax rate at 5 percent, followed by Slovakia at 7 percent.

European OECD countries levy an average top dividend tax rate of 24 percent.

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains. Some countries, however, have integrated their taxation of corporate and dividend/capital gains income to eliminate such double taxation.

Dividend Tax Rates in Europe| Net Top Statutory Dividend Tax Rate Paid at the Shareholder Level in European OECD Countries, 2022 | ||

|---|---|---|

| European OECD Country | Net Top Statutory Dividend Tax Rate Paid at the Shareholder Level | Ranking |

| Austria | 27.5% | 10 |

| Belgium | 30.0% | 6 |

| Czech Republic | 23.0% | 16 |

| Denmark | 42.0% | 2 |

| Estonia | 0.0% | 26 |

| Finland | 28.9% | 8 |

| France | 34.0% | 5 |

| Germany | 26.4% | 13 |

| Greece | 5.0% | 25 |

| Hungary | 15.0% | 22 |

| Iceland | 22.0% | 18 |

| Ireland | 51.0% | 1 |

| Italy | 26.0% | 14 |

| Latvia | 0.0% | 26 |

| Lithuania | 15.0% | 22 |

| Luxembourg | 21.0% | 19 |

| Netherlands | 26.9% | 12 |

| Norway | 35.2% | 4 |

| Poland | 19.0% | 21 |

| Portugal | 28.0% | 9 |

| Slovak Republic | 7.0% | 24 |

| Slovenia | 27.5% | 10 |

| Spain | 26.0% | 14 |

| Sweden | 30.0% | 6 |

| Switzerland | 22.3% | 17 |

| Turkey | 20.0% | 20 |

| United Kingdom | 39.4% | 3 |

|

Note: All types of reliefs and gross-up provisions at the shareholder level are taken into account. Source: OECD, “Tax Database: Table II.4. Overall statutory tax rates on dividend income.” |

||