Divestments: A Way for Buyers to Finance M&A Deals?

The Art of M&A® / Financing and Refinancing

An excerpt from The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux

Can a buyer always finance all or part of a transaction through partial divestments or spin-offs?

Not necessarily.

This is possible only when the business acquired consists of separate components or has excess real estate or other assets. The buyer must balance financial and operational considerations; there should always be a good business reason for the divestment.

Consider selling off those portions of the business that are separable from the part that is most desirable. As indicated earlier, not all businesses generate the cash flow or have the stability necessary for highly leveraged transactions, yet many cash-rich buyers are available for such businesses.

A solid domestic smokestack (industrial) business with valuable assets, itself highly suitable for leveraged financing, may have a subsidiary with foreign manufacturing and distribution operations, a separate retail division, and a large timberland holding—all candidates for divestiture. The foreign operations are accessible to a whole new set of possible buyers, the retail division could function better as part of another company’s nationwide chain, and the timberland does not generate cash flow.

Many buyout transactions are undertaken in order to divest assets at a profit. These transactions are better called restructurings or breakups.

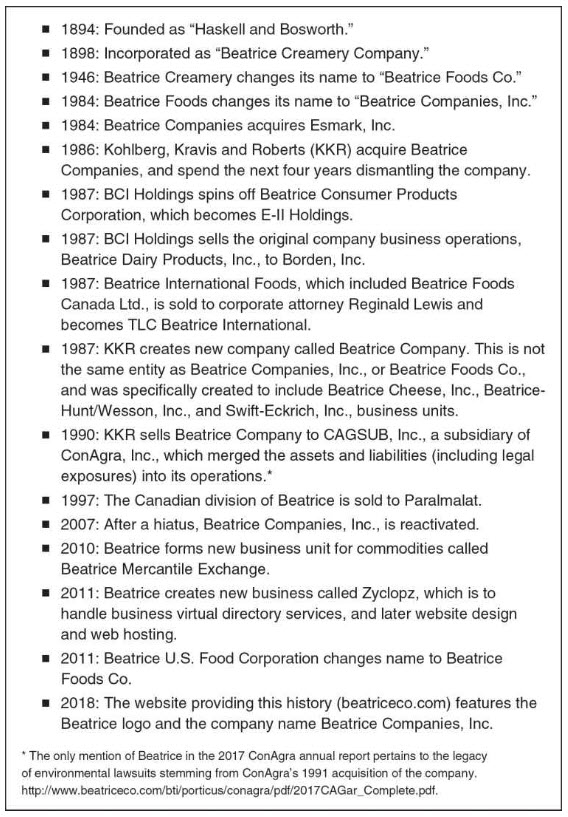

For example, the acquisition of Beatrice Foods by KKR at the height of the LBO boom of the 1980s resulted in the disbanding of its senior management and the sale of most of its assets to ConAgra.

In 2007, the brand revived in a new company operating under the Beatrice name. 35 Meanwhile, the Canadian division of Beatrice, which was not a part of the KKR buyout, remained intact, growing through acquisition until getting acquired by Parmalat, S.A., in 1997, surviving as a division of Parmalat to this day. 36

The divergent paths of the two Beatrices (in the United States and in Canada) illustrate the range of strategic and financing options available to acquirers—much as studies of twins can help us understand heredity versus environment. (See Exhibit 4-1.)

Exhibit 4-1 The LBO of Beatrice and Its Aftermath

Source: A history of the company appears at http:// www.beatriceco.com/ about_investor/.

There is a question of timing here; it is not advisable to start beating the bushes for a purchaser of a company’s division or subsidiary without a signed contract for the purchase of the company as a whole.

On signing an agreement, however, looking for division buyers is perfectly appropriate. Indeed, it is not uncommon to have an escrow closing of the divestiture in advance of the closing to minimize the risk of last-minute holdups.

Even if the deal does not close simultaneously with the main acquisition, the presence of the divestiture agreement of such presold assets may make possible a bridge loan to be taken out at the closing.

_________________________________________________________________________

Lajoux, Alexandra Reed with Capital Expert Services. The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide. United States of America: McGraw Hill, 2019. Pp. 222-224. Print.