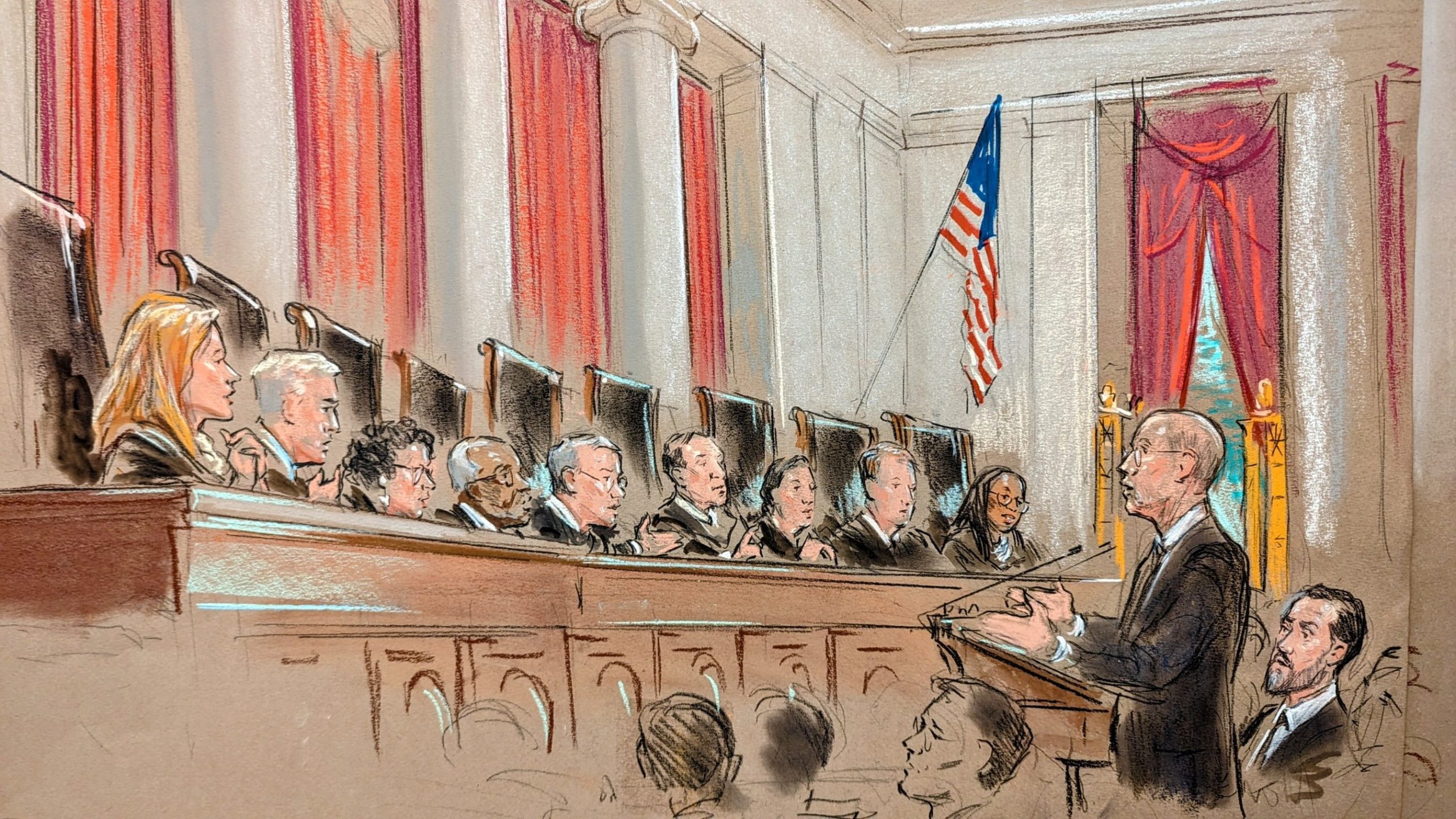

Dewberry Oral Arguments Focuses on Discretion in Crafting Profits Award under Just Sum Provision

“What you have here is not the idea

and are identical… It’s the opposite. It’s a recognition that they are separate entities and that only one of them drove and created the gain.” – Elbert Lin, Counsel for Dewberry Engineers

Today, the U.S. Supreme Court heard oral arguments in Dewberry Group, Inc. v. Dewberry Engineers Inc., which asks the Court to determine whether an award of defendant’s profits for trademark infringement under the Lanham Act can include profits from legally separate non-party corporate affiliates. The day’s questions centered on whether the $43,000,000 profits award affirmed in the Fourth Circuit was allowed under the just-sum provision of 15 U.S.C. The Supreme Court granted Group’s petition for a writ of certiorari in June to determine whether the profits award could be supported without resorting to corporate veil piercing principles. This June, the Supreme Court granted Group’s petition for writ of certiorari to determine whether the profits award could be supported without resorting to corporate veil piercing principles.[the Petitioner and the affiliates]Dewberry Group: Court Shouldn’t Fix Tactical Errors in Liability Theories

Acknowledging that equity allows a court to look past the defendant’s own financial accounting to understand the true economic reality of a situation, Thomas Hungar, Counsel for Group, argued that principles of equity encompassed by Section 1117(a)’s just sum provision only entitle Dewberry Engineers (“Engineers”) to profits actually owned by Group. Group, as a service provider, was not entitled to collect rents from its affiliates. The profits award could only be justified under the expressly stated equity principles of corporate veil-piercing or alternate ego. Justice Jackson noted that Group’s financial arrangement precluded normal profits recovery under Lanham Act. He argued that this was the type of situation in which equity should ensure that a legal breach has a remedy. Hungar opined that this would essentially fix the tactical error made by Engineers by not pursuing profits under equitable considerations or secondary liability.

Hungar also pushed back on the below market rate profits calculation theory advanced by the U.S. Solicitor General. Hungar argued that profits disgorged can only be based upon actual profits and not potential profits. He also noted that no findings were made in the record to show that Group charged its affiliates below market rates. Hungar added that the horizontal management structure at issue was common in the real estate industry and that the profits calculation included profits attributable to non-infringing services.

U.S. Solicitor General: Profits Analysis Should Look to Arm’s Length Negotiations

While Nicholas Crown, representing the U.S. Crown, representing the U.S. Solicitor General, acknowledged that the Fourth Circuit’s profits award was not consistent with corporate separateness principles. However, he argued that lower courts should calculate profits to address Group’s attempts at concealing economic reality, without crossing corporate separateness lines. Given the closely held nature of Group’s affiliates, Crown argued that the court’s profits inquiry should ask what the defendant would charge unaffiliated entities for the same services through arm’s length negotiations.

Crown raised several issues with the application of veil piercing principles to the circumstances of this case, including the lack of evidence of direct infringement by Group’s affiliates. Responding to Justice Samuel Alito’s concerns on the open-ended nature of this theory, Crown pointed out that Supreme Court cases relied upon in Group’s petition, including City of Elizabeth v. Pavement Co. (1878) and Rubber Co. v. Goodyear (1870), provided principles for dealing with profits awards where courts have to look beyond a defendant’s own accounting to assess economic realities.

Dewberry Engineers: Unchallenged Evidentiary Findings Provide Basis for Just Sum

Although the Fourth Circuit could have conducted a more express analysis, Elbert Lin, counsel for Engineers, argued that the just sum provision of Section 1117(a) provided lower courts with the discretion to rely on the revenues of Group’s affiliates as evidence of Group’s true financial gain. Justice Clarence Thomas asked why Engineers didn’t sue the affiliate entities, to which Lin responded that Engineers acted on property ownership representations made on Group’s website.

Pointing to the evidentiary record, Lin noted the lower court’s unchallenged findings that Group alone drove and created the revenues that were then put on the affiliate’s books at Group’s direction. Justice Amy Coney Barrett stated that by articulating an attribution theory not directly addressed by the Fourth Circuit, the Court was “wading in uncertainty”. Lin conceded that the Court could rule by vacating and remanding to give lower courts a chance for further explanation.

However, to the extent that there was any uncertainty over the portion of profits not attributable to infringement, Lin contended that it was the burden of petitioner Group to disentangle costs and other money to which Engineers was not entitled once Engineers made its prima facie showing of infringement. Lin added that the district court made unchallenged factual findings that the affiliates generated no value, that Group controlled the allocation of the revenues and that Group’s revenues were recorded on the books of the property-owning affiliates.

“So what you have is not the idea that

are indistinguishable… It’s to the contrary. It’s a recognition of the fact that they are separate and that only one created and drove the gain.” – Lin

Hungar received a period of time to respond, noting that service providers who generate corporate profits aren’t the legal owners of these profits. Hungar pointed out that the Court reached the same conclusion in the context of taxation in 2005’s Commissioner of Internal Revenue V. Banks. He insisted that the only theories argued at the Fourth Circuit involved disregard of the corporate form, and that Engineers other arguments were not properly raised in briefing before the Court as required by Rule 15 such that the Court should reverse the Fourth Circuit without remand.

Commenting on the case today, Evan Everist of Dorsey & Whitney predicted the Court will either remand or reverse. Everist predicted that the procedural argument would result in either a remand or an outright reversal. “The biggest issue is how far the Court will go to explain the limits of the ‘just-sums’ provision to lower courts in cases such as this.”

Steve Brachmann graduated from the University at Buffalo School of Law in May 2022, earning his Juris Doctor. He served as the president of the Intellectual