Cryptocurrency tax calculator

At a glance:

- The IRS treats cryptocurrency as property for tax purposes.

- Holding cryptocurrencies for less than a year may result in short-term capital gains tax, while holding for over a year may incur long-term capital gains tax.

- Your tax filing status and taxable income will determine your tax bracket and the tax rate on crypto profits.

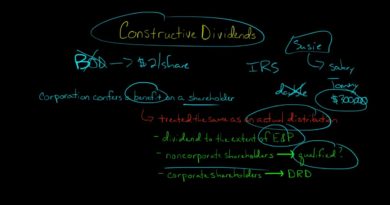

How is Bitcoin taxed?

If you are a U.S. resident who invested in Bitcoin or other cryptocurrencies in 2024, you might receive a tax document from the trading platform or cryptocurrency exchange you use and may need to pay taxes.

While there is currently very little guidance on the taxation of cryptocurrency such as bitcoin, one thing is clearly defined. The Internal Revenue Service (IRS), for tax purposes, views cryptocurrency as a property. The IRS has provided guidance that defines cryptocurrency, such as Bitcoin and Ethereum, as virtual currencies. This guidance is open to interpretation, but the main things that most people should consider are:

How much time have you held Bitcoin or other cryptocurrencies between purchase and sale?

- If held for less than one year, any profits may be subject to short-term capital gains taxes. If held for longer than a year, any profit may be liable for long-term capital gains tax.What is your tax filing status and taxable income?

- This will determine your tax bracket and the tax rate on any Bitcoin profits.What is your state tax rate?

- This will determine how much you may owe in state taxes.Bitcoin Tax Calculator instructions

Part 1: Enter your personal details

Step 1: Select the tax year you would like to calculate your estimated taxes.

Step 2: Select your tax filing status.

Step 3: Enter your taxable income excluding any profit from Bitcoin sales. This is usually the same as your adjusted gross income (AGI).

Step four: Enter the tax rate of your state.

Part two: For each Bitcoin purchase within a year

Step one: Enter the purchase price and date.

Step 2: Enter the sale date and sale price.

Step 3: Enter any profit from Bitcoin sales. The purchase date can be any time up to Dec. 31 of the tax year selected.

Step 2: Enter the sale date and sale price. Make sure the sale date is within the tax year selected.

Step 3: Repeat for all Bitcoin or cryptocurrency sales within the tax year selected.

Bitcoin Tax Calculator

Example of a Bitcoin tax situation

This example calculates estimated taxes for the 2024 tax year for a person (Jake) who made two sales. All values are in USD.

Jake’s tax and finance details

2024 Taxable income – $98,000

2024 Filing Status – Single

2024 State tax rate – 5%

Transaction #1 (short-term gain)

- On Feb. 1, 2024, Jake sold Bitcoin for a total of $10,000. This Bitcoin was purchased on June 1st, 2023 for $5,000. The $5,000 profit is taxed at the short-term capital gain rates because it was held less than a calendar year. Based on Jake’s filing status and income, the taxes are calculated as follows:

- The first $2,525 in profit is taxed at the 22% federal tax rate.

- The remaining $2,475 is taxed at the 24% federal tax rate.

The entire $5,000 is taxed at the 5% state tax rate.

$2,525 x 22% ($000) + $2,475 x 24% ($00) = $1,149.50 federal taxes owed on short-term capital gains

$5,000 x 5% = $250 state taxes$1,149.50 + $250 = $1,399.50 total tax liability

for transaction #1

Transaction #2 (long-term gain)

- On Mach 1, 2024, Jake sells more Bitcoin for a total of $10,000. This Bitcoin was purchased for $3,000 on Feb. 1, 2017. The taxes are calculated as follows:

- The entire $7,000 is taxed at the 15% long-term capital gain rate.

The entire $7,000 is taxed at the 5% state tax bracket.

$7,000 x 15% = $1,050 federal taxes owed on long-term gains

$7,000 x 5% = $350 state taxes owed$1,050 + $350 = $1,400

total tax liability for transaction #2

1010101010101010101010101010101010101010101010101010101

10101010101010101010 The taxes are calculated as follows:The entire $7,000 is taxed at the 15% long-term capital gains tax rate.The entire $7,000 is taxed at the 5% state tax bracket.$7,000 x 15% = $1,050 federal taxes owed on long-term capital gains

$7,000 x 5% = $350 state taxes owed

$1,050 + $350 = $1,400 total tax liability for transaction #2

Total taxes owed

Since both long-term and short-term capital gains are positive, the total taxes Jake owes are calculated as follows:

$1,149.50 federal short term capital gains + $1,050 federal long term capital gains + $600 state taxes owed = 01001010$2,799.5001001010 01001010total taxes owed01001010The bottom line01001010Leveraging a tax calculator simplifies the complex task of estimating Bitcoin taxes, offering insight into potential liabilities and supporting strategic financial planning for cryptocurrency investors. The tax calculator can also be used to calculate taxes based on income and investment portfolios.