Countdown to the Unified Patent Court, Part IV: Financials

“UPC infringement proceedings will be far more expensive and will entail a far higher cost risk than national European infringement proceedings. But this mark-up is justified in light of the territorial scope and economic impact of a UPC decision.”

The Unified Patent Court (UPC) is only a fortnight away; it will go live on June 1, 2023. No doubt, the UPC will become a game changer requiring diligent planning and preparation. In order to faciliate such preparation, we have been providing a series of articles that will deal with the most important aspects of the UPC. Whereas Part 1 focused on the designated UPC judges, Part 2 on the timelines and Part 3 on the remedies that are available at the UPC, this Part 4 will address the financial aspects of UPC infringement proceedings.

Outset: “Value of the Action”

It is fair to assume that the amount of the court fees, the attorney fees, the security for costs and the enforcement security will all play the chief role in determining the financial dimension of UPC infringement proceedings. It is noteworthy that all of these aspects are interrelated with and interdependent on one another. The crux of this interrelationship / interdependency is the so called “value of the action”, since:

a high “value of the action”

- triggers higher court fees (and also a high claim for recoverable representation fees);

- causes higher amounts for the security for costs and the enforcement security;

- likely paves the way for higher damage awards.

Conversely, a low “value of the action”

- triggers low court fees (and also a low claim for recoverable representation fees);

- causes lower amounts for the security for costs and the enforcement security;

- may prejudice higher damage awards.

But how is the “value of the action” determined? In theory, it should reflect the “objective economic interest” in bringing the action. For national German patent litigation, it is fair to state that such value determination is often based on rough estimates that are provided by the plaintiff for strategic reasons, rather than a transparent calculation model of the “objective economic interest” in bringing the action. Apparently, UPC proceedings intend to follow a different path. The UPC Administrative Committee proposes a calculation model which is in general based on an “appropriate license fee”. The valuation should relate to the estimated values for the remedies sought, hence primarily injunctive relief for the future (until the end of lifetime of the patent) and past damages.

This calculation model for the “appropriate license fee”means multiplying:

- the known existing turnover of the defendant, or if not known or not yet existent, the market share the defendant has taken and/or may reasonably be assumed to take

- with the royalty rate based upon the existing royalty rate for the same invention charged by the plaintiff or the generally accepted industry rate for the type of the invention or a royalty rate determined by the Court after hearing the parties.

It goes without saying that this calculation model can lead to (very) high values, in particular if Unitary Patents are asserted, where the turnover with the accused products in 17 EU States needs to be taken into account for calculating the appropriate license fee.

However, if the parties agree on a valuation, the Court shall in principle adopt this proposal for determining the value of the action. Thus, the ball is first in the court of the plaintiff who is requested to provide a first indication on the value of the action in the complaint (see Rule 13.1 (p)). As mentioned above, and as will be further detailed below, such indication should not be given without due care in light of the potential ramifications. There is a very important strategic call to be made prior to kicking off any UPC infringement action.

The Court Fees

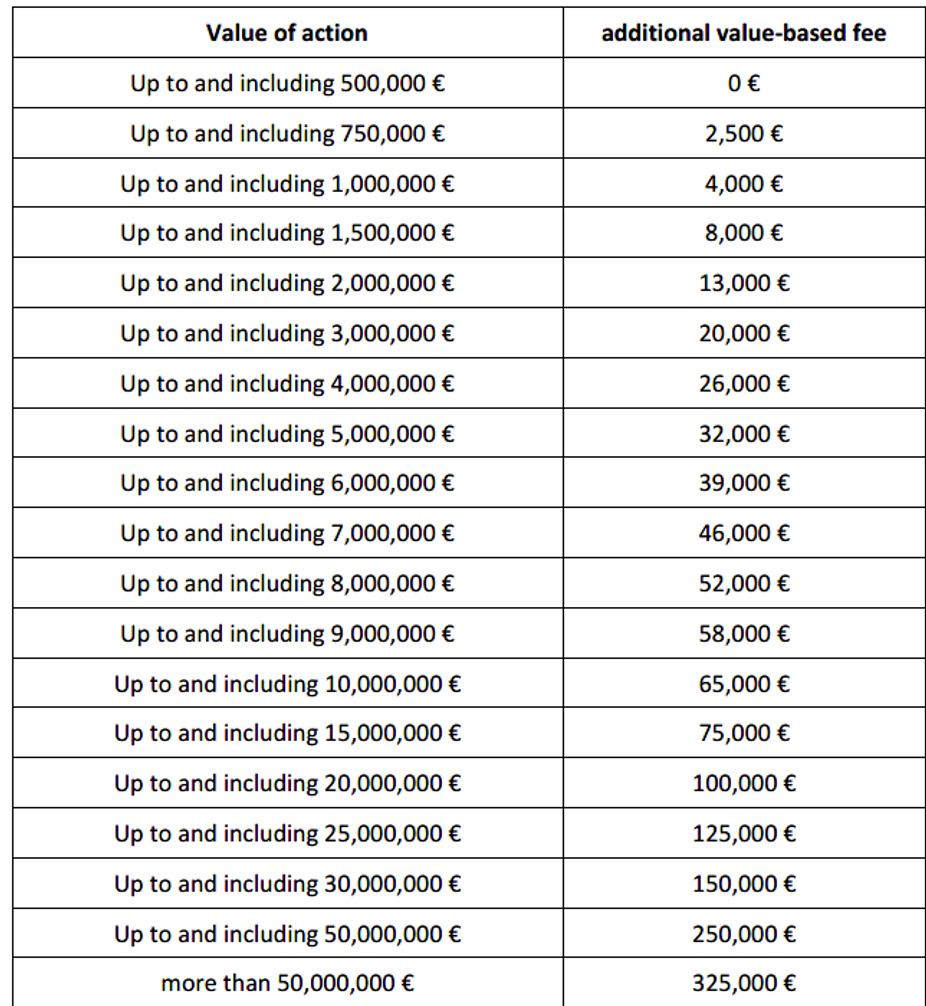

The court fees for a UPC infringement action also depend on the value of the action. If the value of the action is below EUR 500,000, there is only a very affordable fixed court fee of EUR 11,000. However, if the value of the action is above EUR 500,000 then an additional so called “value-based fee” becomes due, in addition to the fixed fee. The amounts of the value-based fee are as follows:

In a nutshell, a simple logic applies: the higher the value of the action, the higher the value-based court fee. As can be derived from the above table, the amounts of such value-based fee can be a significant six-digit figure if the value of the action exceeds 20 million EUR. The court fees must be paid by the plaintiff at the beginning of the proceedings, whereby the due fees are based on the plaintiff’s estimation of the value of the action. In case the Court later on in the proceedings (i.e., in the interim conference) after having discussed the issue with the parties, determines that the “true” value of the action is higher than indicated by the plaintiff in the statement of complaint, it will set a deadline for the plaintiff to pay the missing share of the value-based fee. It will be very interesting to see how the various divisions of the UPC will determine the “value of the action”. The choice of venue will certainly also depend on this point.

Attorney Fees (Including Recoverable Representation Fees)

Even though court fees may be substantial for high profile cases, still, the main cost factor for any UPC budget are attorney fees. The UPC provides for a “loser pays system” so the fees for one’s own attorneys and for reimbursing the adverse party’s representation fees in case the infringement proceedings are lost must be factored into the cost equation.

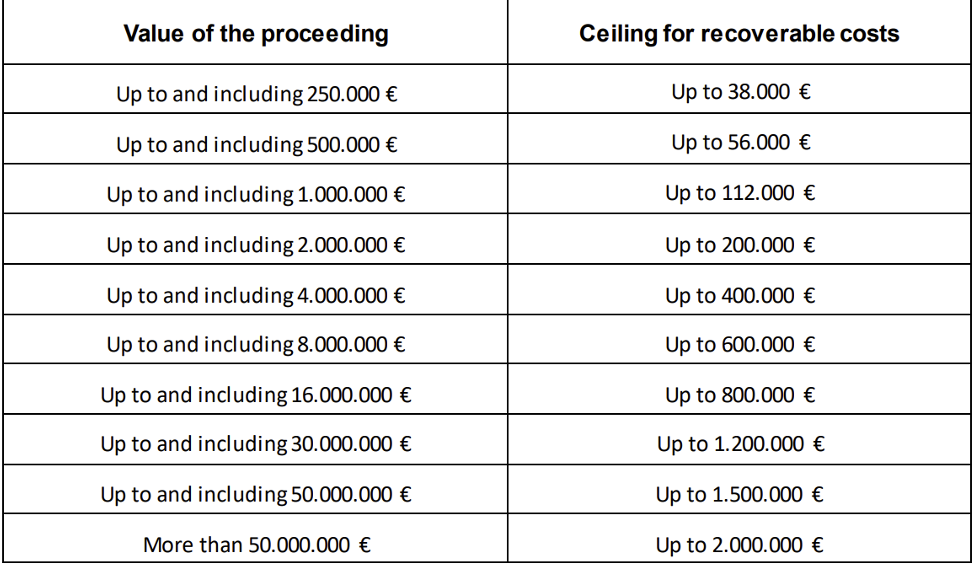

The UPC provides for ceilings of recoverable costs, which limit the cost risk. These absolute caps are detailed below.

In a nutshell, these caps are very attractive for the prevailing party if compared to the current cost reimbursement schemes in continental European patent litigation.

Security for Costs

Another cost factor that must be on the radar screen before bringing a UPC infringement action is the “security for costs”. This security applies to both plaintiff and defendant, and irrespective of where the parties are domiciled. Thus, EU plaintiffs/defendants are also addressees of such security. Pursuant to Rule 158.1, at any time during the proceedings, following a reasoned request by one party, the Court may order the other party to provide, within a specified time period, adequate security for the legal costs and other expenses incurred and/or to be incurred by the requesting party, which the other party may be liable to bear. Thus, the Court enjoys discretion whether to impose such security on either of the parties or not. The main factor will likely be whether the party “is good for the money”. Thus, this rule might play out in the favor of the blue chips. Where the Court decides to order such security, it shall decide whether it is appropriate to order the security by deposit or bank guarantee. Thus, we can anticipate a bond practice, which is already known from national patent litigation.

Enforcement of First Instance Decisions (Security)

If the plaintiff is successful in first instance proceedings, the Court may subject any order or measure to a security to be given by the successful party to the unsuccessful party (cf. Rule 118.8). Thus, the Court enjoys discretion “if” and “in which amount” a security needs to be provided. It will be interesting to see how the divisions of the Court will exercise such discretion, as different cultures exist in this regard in the UPC Member States. In Germany, the higher the value of the action, the higher the amount of the security. Likely, UPC plaintiffs will request very specific orders – e.g. injunction for a specific class of accused products, against a specific defendant, in a specific UPC Member State – in order to limit the amounts of the securities that need to be rendered.

The enforcement security is determined by the Court in accordance with Rule 352. Pursuant to this rule, the security may be provided through the standard means of deposit/bank guarantee, or “otherwise”. Thus, it’s up to the creativity of the prevailing plaintiffs to come up with other forms of securities that might be cheaper and easier to arrange than bank guarantees or deposits. Likely cross-undertakings for damages will be offered, but it is unclear whether they will be accepted by the Court as an adequate security.

Worth the Price

UPC infringement proceedings will be far more expensive and will entail a far higher cost risk than national European infringement proceedings. But this mark-up is justified in light of the territorial scope and economic impact of a UPC decision. On the flip side, the successful plaintiff can recover a much higher share of the attorney fees as compared to national European infringement proceedings.

Image Source: Deposit Photos

Image ID: 76007985

Author: jpgon