Congressional Tax Package Considerations | Tax Foundation

Presented by:

Erica York

Tom Gannon

The Tax Foundation is hosting a Talking Tax Reform webinar to discuss potential policies that could constitute a tax package from Congress.

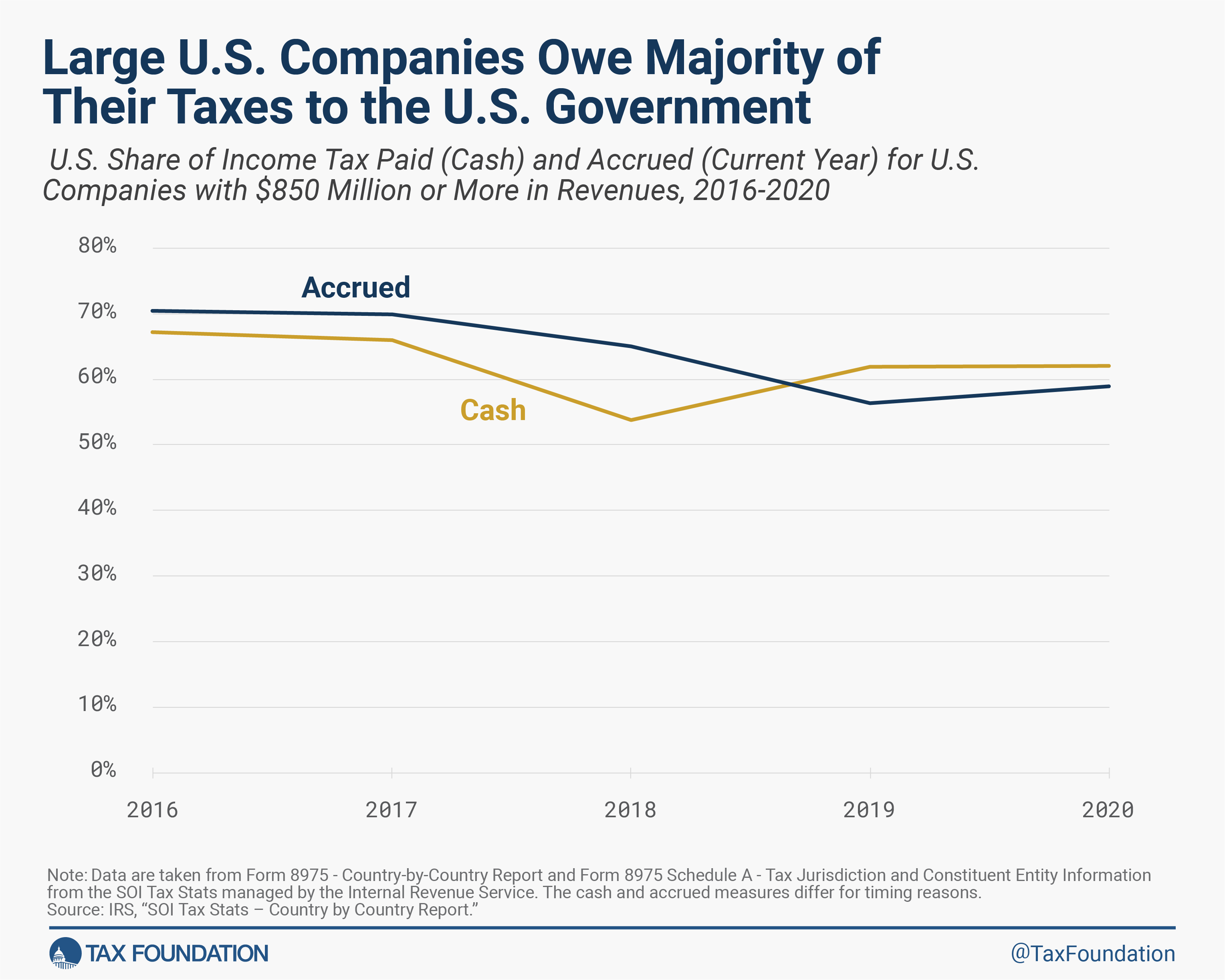

With the expiration of major provisions in the Tax Cuts and Jobs Act (TCJA) looming, the upcoming debate is colored by policies that already expired or will expire in the next few years. Policymakers have focused the bulk of their attention on the child tax credit, state and local tax deduction, and TCJA business-related provisions as potential items that could be included in a tax legislative package.

Further, the Republican-led House Ways and Means Committee debated legislation to expand the standard deduction, among other changes, that could serve as a bargaining chip in future negotiations.

Our experts will explain the policy implications and consider the impacts on taxpayers of various provisions. We’ll also explore the options for a potential legislative package that could coalesce in the coming months. Our panel of experts will be moderated by Will McBride, Vice President of Federal Tax Policy & Stephen J. Entin Fellow in Economics at the Tax Foundation. Panelists include:

- Erica York, Senior Economist and Research Manager, Tax Foundation

- Tom Gannon, Chief Government Relations Officer, H&R Block

Register Here

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe