Cigarette Taxes and Cigarette Smuggling by State, 2022

Key Findings

- Excessive taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

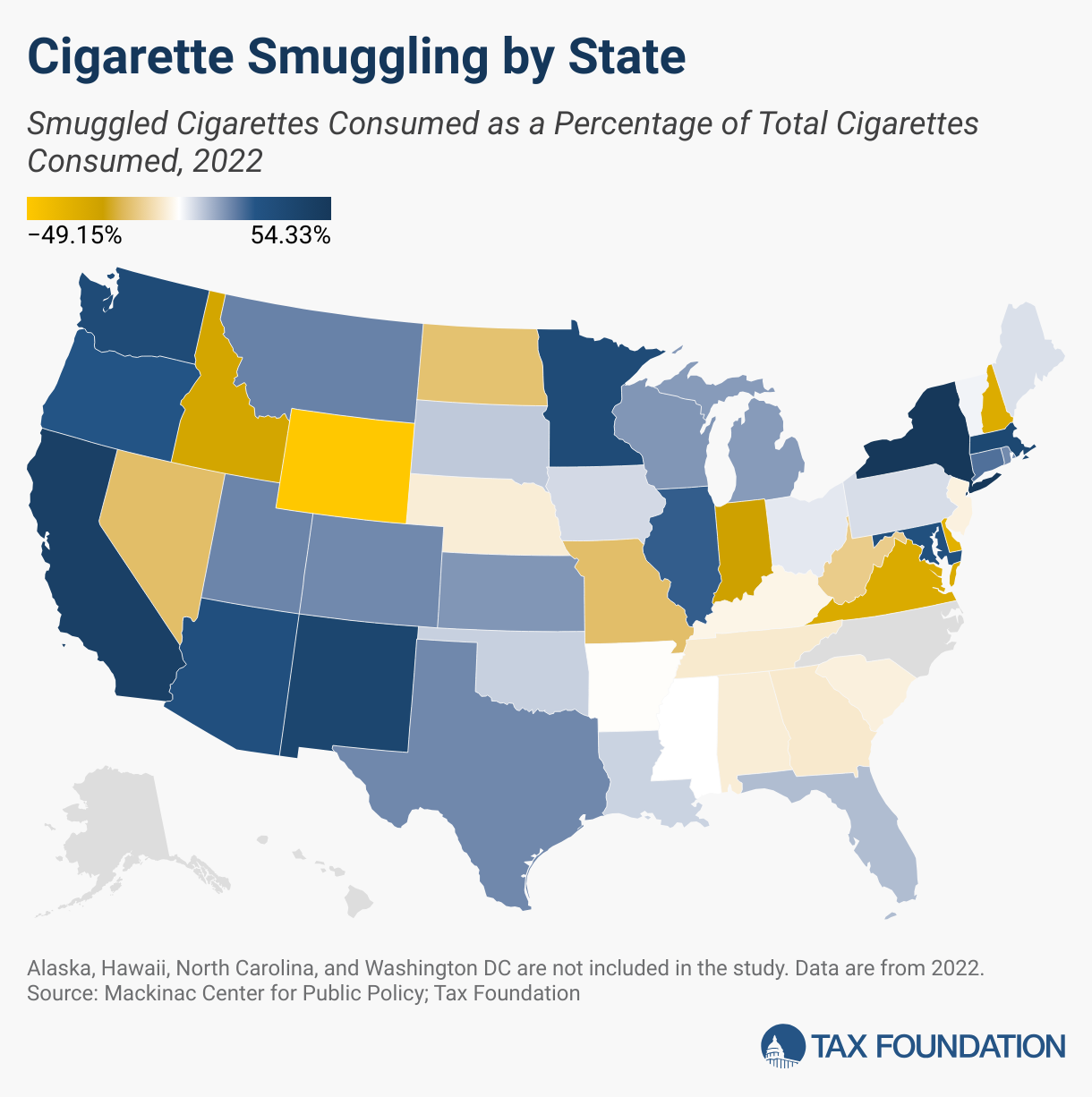

rates on cigarettes induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. - New York has the highest inbound smuggling activity, with an estimated 54.3 percent of cigarettes consumed in the state deriving from smuggled sources in 2022. New York is followed by California (46.7 percent), New Mexico (41.2 percent), Massachusetts (39.7 percent), and Washington (36.8 percent).

- Wyoming has the highest level of net outbound smuggling at 49.2 percent of consumption. The next highest levels of outbound smuggling are in Delaware (34.4 percent), New Hampshire (31.4 percent), Virginia (30.4 percent), and Idaho (27.0 percent).

- From 2021 to 2022, no major cigarette tax changes occurred, and, subsequently, we observed no significant smuggling rate changes in 2022.

- States that experienced net inbound smuggling in 2022 lost more than $5 billion of potential tax revenue.

- States that have experienced net inbound smuggling since 2007 have forgone revenues totaling more than $79 billion over that period.

- Flavor bans have been imposed in Massachusetts and California. Following the imposition of a flavor ban, smuggling skyrocketed.

- Policymakers interested in increasing tax rates should recognize the unintended consequences of high taxation rates. Criminal distribution networks are well-established and illicit trade will grow as tax rates rise.

Tobacco Tax Differentials Incentivize Smuggling

Higher tax rates incentivize smuggling. As tax rates increase, consumers and suppliers search for ways around these costs. In cigarette markets, consumers tend to shop across borders where the tax rates are lower and dealers develop black and gray markets to sell illegally to consumers, paying little or no tax at all. Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

Each year, in partnership with scholars at the Mackinac Center for Public Policy, we estimate cigarette smuggling rates for each US state and the District of Columbia.[1] The most recent report uses 2022 data and finds a strong positive relationship between cigarette smuggling and tax rates across the country. The data also demonstrate that when states increase their cigarette taxes, smuggling rates increase, both in the form of increased purchases in neighboring states and through illicit international channels.

Nationwide, New York continues to have the greatest rate of cigarette smuggling, with smuggled cigarettes accounting for 54.3 percent of total cigarette consumption in the state. New York also had one of the highest state cigarette taxes ($4.35 per pack in the period considered here, increased to $5.35 per pack in 2023), not counting the additional local New York City cigarette tax ($1.50 per pack) and a minimum price markup.

Beyond the revenue lost from smuggled packs, states must use resources to address their black-market problems. A 2020 New York seizure of 6,267 cartons of cigarettes required a long-term investigation, including court-authorized search warrants, wiretaps, grand jury subpoenas, and other investigative tools.[2]

A Wellesley Island Station Anti-Smuggling Unit, with the help of US Border Patrol agents, seized more than 1 million cigarettes (worth more than $300,000) in April 2024.[3] A 2023 New York City raid seized more than 1,800 cartons of cigarettes and $155,000 in cash.[4] But even when successful, policing smuggling is costly and only prohibits a drop of water in the East River of smuggling activity. The 2023 seizure of 18,000 cigarette packs represents 0.007 percent of estimated annual smuggling activity in the state.

Massachusetts has established a dedicated Multi-Agency Illegal Tobacco Task Force, which seized a record-high 18,483 packs of cigarettes in 2022.[5] This, too, falls dramatically short of the more than 67 million packs smuggled into the state–amounting to 0.027 percent of illegal cigarettes. The scope of the task force also extends to other types of tobacco and vapor devices on a budget of more than $1 million in 2022.

These are just two examples of the ways states and municipalities have spent millions to combat cigarette smuggling. Recent policy responses include greater law enforcement activity on interstate roads,[6] differential tax rates near low-tax jurisdictions,[7] banning common carrier delivery of cigarettes,[8] and cracking down on tribal reservations that sell tax-free cigarettes.[9] However, the underlying problem persists. High cigarette taxes act similarly to a “price prohibition” on the legal product in many US states, incentivizing smuggling and illicit activity.[10]

After New York, the highest rate of smuggling occurs in California (46.7 percent of consumption smuggled), New Mexico (41.2 percent), Massachusetts (39.7 percent), and Washington (36.8 percent). Of the states for which the authors had data, the highest rates of outbound smuggling (least amount of net inbound smuggling) occur in Wyoming (49.2 percent outbound smuggling), Delaware (34.4 percent), New Hampshire (31.4 percent), and Virginia (30.4 percent).

No major tax rate changes occurred during this period. Subsequently, we observed no significant changes to the rankings from last year’s report.

A primary driver of the amount of cigarette smuggling is the relative magnitude of that state’s excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

compared to the rate imposed by surrounding states or foreign countries. A sizable literature of peer-reviewed academic studies supports these observations.[11] A 2017 study published in Public Finance Review provides the academic theory and estimates for how tax rates affect smuggling, highlighting that easily transportable goods (e.g., cigarettes) will be attractive cross-border shopping items.[12] A 2018 study published in the same journal supported those findings by examining littered packs of cigarettes across 132 communities in 38 states, finding that 21 percent of packs did not have proper local stamps.[13]

Smuggling comes in different forms. “Casual” smuggling occurs when smaller quantities of cigarettes are purchased in one area and then transported for personal consumption. “Commercial” smuggling is a large-scale criminal activity that can involve counterfeit state tax stamps, counterfeit versions of legitimate brands, and moving prohibited products.[14] The Mackinac Center provides several anecdotes of smuggling activity over the many editions of its report, including a prison guard caught smuggling cigarettes into prisons, a Maryland police officer running illicit cigarettes while on duty, and a Virginia man hiring a contract killer over a cigarette smuggling dispute.[15]

Cigarette Smuggling Costs State Governments Billions of Dollars Each Year

The inbound flow of cigarettes not appropriately taxed by California and New York cost each state roughly $1.3 and $1 billion, respectively, each year in lost revenue. The net combined effect of cigarette smuggling is a revenue loss of more than $4.7 billion per year.

The states that gain the most from cross-border shoppers and smugglers are Indiana–a net revenue gain of more than $68 million each year–and Virginia–a net revenue gain of $51.9 million per year. New Hampshire and Delaware each see annual tax gains from net exporting of cigarettes of more than $26 million.

Over time, these revenues compound. In our first historical analysis, we examine the cumulative effects of data spanning from 2007 to 2022.

New York experienced the largest loss, having forgone $21.1 billion over this period. The next largest sums of forgone revenue have been from California ($12.7 billion), Texas ($7.2 billion), and Washington ($4.3 billion).

In all, 15 states have missed out on more than $1 billion of tax revenue due to cigarette smuggling. The combined revenue loss from net inbound cigarette smuggling across all states since 2007 totals $79.4 billion. Some of this business has been driven to consistently low-tax states, giving them extra revenue from cigarettes bought but not consumed there. New Hampshire has gained the most with an extra $955 million in revenue, followed by Indiana ($787 million), Virginia ($511 million), and Delaware ($356 million).

International Smuggling and Counterfeiting Hurt Americans

Smuggling that occurs within the borders of the United States is mostly a zero-sum activity from a cost perspective. Smugglers may even facilitate an increase in total economic activity by decreasing the market tax burden, albeit at a high social cost.

A smuggler who legally purchases cigarettes in a low-tax area, such as Missouri, and then sells the cigarettes in a high-tax area, like California, still pays tax and buys American-produced goods. The tax gain for Missouri is less than the tax loss for California and consumption may decrease more slowly due to the lower effective (tax-reduced) price for California smokers, but all the gains from trade stay within the country.

But some criminals avoid the legal market altogether. Rather than pay market prices and lower taxes on American-made cigarettes, certain criminals produce counterfeit cigarettes with the look and feel of legitimate American brands and sell them with counterfeit tax stamps, paying no tax whatsoever. In 2020, three men were arrested in Texas for transporting internationally produced illicit cigarettes. They admitted intentions to smuggle over 400 million cigarettes.[16]

Many counterfeit cigarettes in the US are smuggled from China. [17] Estimates put Chinese counterfeit production as high as 400 billion cigarettes per year to meet international demand.[18] Because of the enormous volume of product that ships into US ports from China, it may be easier and lower cost to smuggle Chinese cigarettes into California markets through US ports than to try to capitalize on tax arbitrage by transporting products across the continental US.

There are real social costs associated with the smuggling of properly manufactured cigarettes, but they pale in comparison to the dangers posed by this counterfeit market. Internationally smuggled and counterfeit cigarettes are dangerous products as they do not live up to the quality control standards imposed on legitimate brand cigarettes. Researchers have found that counterfeit cigarettes can have as much as seven times the lead of authentic brands and close to three times as much thallium, a toxic heavy metal.[19] Other sources report finding insect eggs, dead flies, mold, and human feces in counterfeit cigarettes.[20]

During the prohibition of alcohol in the United States during the 1920s, increased enforcement failed to significantly decrease the prevalence of bootlegging because the profit margins were so large and the distribution networks sophisticated. The same is true for today’s cigarette smugglers.

Global illicit trade in tobacco is a growing problem, but it’s considered low-risk, high-reward. Incentives matter. Billions of dollars are made each year through smuggling. To make matters worse, smuggling operations involve corruption, money laundering, and terrorism.[21] According to the Financial Action Task Force (FATF), “Large-scale organized smuggling likely accounts for the vast majority of cigarettes smuggled globally.”[22] These operations hurt governments, who lose out on revenue; consumers, because the products often don’t adhere to health standards; legal businesses, which cannot compete with illicit products; and the general respect of the law.

Taxes Are Not the Only Policy That Encourages Smuggling

We can learn from cigarette taxes how other policies involving tobacco and nicotine products may affect consumer and producer behavior.

Flavor bans are perhaps the biggest policy issue involving tobacco and nicotine products over the past decade. In 2023, the FDA sent a final set of rules to the White House Office of Management and Budget for final review that would prohibit the sale of flavored tobacco products, including menthol cigarettes.[23] After a thorough review of the topic, the White House decided to postpone any federal policy related to a prohibition. Flavor bans are a major issue for US states, however.

The first state to implement a statewide menthol flavor ban was Massachusetts. Its menthol flavor ban took effect in June 2020. In the 12 months following implementation, sales in the Bay State declined by almost 24 percent compared to the 12 months preceding the ban. Through the end of 2021, sales were down more than 25 percent compared to sales from 2019. This decline translates to $135 million less in cigarette tax revenue for Massachusetts (not including lost revenue from sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

and smokeless tobacco sales).

Importantly, these sales did not disappear; most of the transactions merely moved to neighboring states or to illicit markets. Throughout most of the US and all the New England states, cigarette sales have constantly declined since the 1960s. It was telling when sales of cigarettes in New Hampshire increased by 22 percent and sales in Rhode Island increased by 18 percent in the 12 months following the Massachusetts menthol ban. Sales in New Hampshire and Rhode Island remain roughly 10 percent higher in 2021 than in 2019 thanks to cross-border Massachusetts shoppers and smugglers.

Smuggling skyrocketed in Massachusetts. In 2019, prior to the flavor ban, Massachusetts had a net inbound smuggling rate of 19.9 percent, the 12th-highest in the country. The nearly 38 million packs smuggled into the state cost the state more than $133 million per year in forgone revenue.

A full year after the ban in 2021, smuggling in Massachusetts is up to 37.6 percent, the fourth-highest rate in the country. The 64 million packs smuggled into the state now cost the state $224 million in forgone revenue each year.

California was the second state to ban flavored cigarettes in December 2022. Prior to the ban, menthol cigarettes made up about 24.5 percent of legal sales in the state. In the months after, from December 2022 to September 2023, total tax-paid cigarette sales dropped about 15 percent from the same period the previous year. Unlike Massachusetts, however, sales have not moved across the border to neighboring states.

California is different from Massachusetts in several ways that would make interstate shopping less likely. California shares a land border with Mexico, the bulk of California’s population is several hundred miles from a neighboring US state, and California has some of the busiest international ports in the world. The likelihood of international smuggling is substantially greater and more difficult to track.

To evaluate the consumption choices of Californians after the menthol ban, market research firm WSPM Group conducted a discarded cigarette pack auditA tax audit is when the Internal Revenue Service (IRS) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return.

.[24] WSPM collected 15,000 discarded cigarette packs from public trash containers across 10 major California cities in May and June of 2023. Details on each pack were then recorded and categorized, including the cigarette brand, whether the pack contained menthol, if the pack originated domestically or abroad, and details on the tax stamp (if any was present).

The data show that Californians are still smoking menthol cigarettes after the ban. Within the sample, 14.1 percent of packs were menthol and another 7.0 percent of the packs included a form of menthol work-around. In total, 21.1 percent of the discarded packs were menthol-style cigarettes. A mere 3-percentage-point drop in menthol market share should immediately raise questions as to whether the menthol ban is having any significant effects on consumption.

Foreign and illicit market share spiked. Non-US packs comprised 27.6 percent of the sample, compared to an estimated foreign market share of only 17 percent previously. These packs were found in high quantities in all cities studied. Over half of these packs, 14.2 percent of the entire sample, were duty-free cigarettes designated for export, but which somehow made their way back into California cities.

In electronic cigarette and vaping markets, the FDA finally authorized the first flavored products (all menthol-flavored) for sale in 2024. As the data from cigarettes clearly show, the risk of creating a new black market or fueling an existing one through prohibition regimes, with operators clearly willing and able to supply nicotine products to consumers, is significant.

A consequence of FDA inaction is that flavored tobacco products, often produced abroad by companies that the FDA cannot regulate, have flooded US markets. Paired with high profit margins for retailers and little to no enforcement of product sales in the industry, unauthorized flavored products can be found in almost every vaping store nationwide. Even with ramped up of enforcement efforts–like the Federal Multi-Agency Task Force combining the efforts of the FDA, DOJ, ATF, US Marshals, Postal Inspection Service, and FTC to counter illegal vapes–the experiences from cigarettes and Prohibition-era alcohol indicate that the underlying problems will likely remain.

The same California study also gathered data on discarded e-vapor products in California in 2023. The data show that 97.9 percent (4,434 of 4,529 products) of discarded vapor products were flavored, unauthorized for sale in the United States. Similar audits in 2024 found 99.1 percent of discarded vapes in New York City were flavored and 99.6 percent of discarded vapes in Washington, DC, were flavored. Nearly all the illicit products were imported from Chinese operators.

Legal markets suffer as untaxed and unregulated products have significant competitive advantages over highly taxed and regulated legal products. In addition to the dangers illicit markets create for consumers, illegal markets harm the large number of small business owners operating vape shops, convenience stores, and gas stations around the country.

Policymakers should consider the unintended consequences as they set rates and regulatory regimes for all tobacco and nicotine products.

Cigarette Smuggling by State

Smuggled Cigarettes Consumed as a Percentage of Total Cigarettes Consumed, 2022

Source: Mackinac Center for Public Policy; Tax Foundation

Note: Alaska, Hawaii, North Carolina, and the District of Columbia are not included in the study.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

[1] Michael Lafaive and Todd Nesbit, “Cigarette Taxes & Smuggling,” Mackinac Center for Public Policy, June 2023,

[2] “Cigarette Smuggler Pays More Than $1.3 Million to New York State After Pleading Guilty to Grand Larceny,” Office of Queens District Attorney Melinda Katz, Oct. 7, 2020,

[3] U.S. Customs and Border Protection, “U.S. Border Patrol Agents and Jefferson County Sheriff’s Deputies Seized More Than $300,000 in Smuggled Tobacco Products,” Apr. 24, 2024,

[4]”Five Arrested in Major Contraband Cigarette and Cigar Trafficking Case,” New York State Department of Taxation and Finance, Apr. 27, 2023,

[5] Commonwealth of Massachusetts, Annual Report of Multi-Agency Illegal Tobacco Task Force, Feb. 28, 2024,

[6] Gary Fields, “States Go to War on Cigarette Smuggling,” The Wall Street Journal, Jul. 20, 2009,

[7] Mark Robyn, “Border Zone Cigarette Taxation: Arkansas’s Novel Solution to the Border Shopping Problem,” Tax Foundation, Apr. 9, 2009, http:// taxfoundation.org/article/border-zone-cigarette-taxation-arkansass-novel-solution-border-shopping-problem.

[8] Curtis S. Dubay, “UPS Decision Unlikely to Stop Cigarette Smuggling,” Tax Foundation, Oct. 25, 2005, ups-decision-unlikely-stop-cigarette-smuggling/.

[9] Joseph Bishop-Henchman, “New York Governor Signs Law to Tax Cigarettes Sold on Tribal Lands,” Tax Foundation, Dec. 16, 2008, blog/new-york-governor-signs-law-tax-cigarettes-sold-tribal-lands.

[10] Michael LaFaive, “Prohibition by price: Cigarette taxes and unintended consequences,” In For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century, edited by Adam Hoffer and Todd Nesbit (2018).

[11] Michael F. Lovenheim, “How Far to the Border? : The Extent and Impact of Cross-Border Casual Cigarette Smuggling,” National Tax Journal 61:1 (March 2008), R. Morris Coats, “A Note on Estimating Cross-Border Effects of State Cigarette Taxes,” National Tax Journal 48:4 (December 1995): 573-584, ntj-v48n04p573-84-note-estimating-cross-border.pdf?v=%CE%B1&r=35923133871196367; Mark Stehr, “Cigarette tax avoidance and evasion,” Journal of Health Economics 24:2 (March 2005): 277-297,

[12] Adam J. Hoffer and Donald J. Lacombe, “Excise tax setting in a dynamic space-time framework,” Public Finance Review 45:5 (2017): 628-646.

[13] Shu Wang, David Merriman, and Frank Chaloupka, “Relative Tax Rates, Proximity, and Cigarette Tax Noncompliance: Evidence from a National Sample of Littered Cigarette Packs,” Public Finance Review 47:2 (March 2019): 276-311.

[14] Scott Drenkard, “Tobacco Taxation and Unintended Consequences: U.S. Senate Hearing on Tobacco Taxes Owed, Avoided, and Evaded,” Tax Foundation, Jul. 29, 2014, tobacco-taxation-and-unintended-consequences-us-senate-hearing-tobacco-taxes-owed-avoided-and-evaded/.

[15] Michael Lafaive and Todd Nesbit, “Cigarette Taxes & Smuggling,” Mackinac Center for Public Policy, June 2022,

[16] St. John Barned-Smith and Gabrielle Banks, “Inside the lucrative smuggling operation that sees millions of Chinese cigarettes pass through Texas,” Houston Chronicle, Jul. 1, 2021,

[17] Adam Hoffer, “Taxes and Illicit Trade,” Tax Foundation, Aug. 10, 2023. blog/illicit-trade-taxes-counterfeit-cigarettes/#:~:text=July%2025%2C%202023.-,Tax,each%20with%20different%20policy%20implications.

[18] Te-Ping Chen, “China’s Marlboro Country,” Center for Public Integrity, Jun. 29, 2009, php?option=com_content&view=article&id=9:chinas-marlboro-country&catid=3:stories&Itemid=22.

[19] R.S. Pappas et al., “Cadmium, Lead, and Thallium in Smoke Particulate from Counterfeit Cigarettes Compared to Authentic US Brands,” Food and Chemical Toxicology 45:2 (Aug. 30, 2006): 202-209.

[20] International Chamber of Commerce, Commercial Crime Services, “Counterfeit Cigarettes Contain Disturbing Toxic Substances,” php/360-counterfeit-cigarettes-contain-disturbing-toxic-substances.

[21]Al Qaeda has made millions of dollars selling counterfeit cigarettes. See

Francesca Astorri, “EXCLUSIVE: How extremists smuggled $1 billion in cigarettes to finance terror,” AlArabiya News, May 20, 2020, DOS, DOJ, DOT, DOHS, DOHHS, “The Global Illicit Trade in Tobacco: A Threat to National Security,” December 2015,

[22] The Financial Action Task Force (FATF), “FATF Report: Illicit Tobacco Trade,” Jun. 2012, 9, Illicit%20Tobacco%20Trade.pdf.

[23] U.S. Food and Drug Administration, “FDA Proposes Rules Prohibiting Menthol Cigarettes and Flavored Cigars to Prevent Youth Initiation, Significantly Reduce Tobacco-Related Disease and Death,” Apr. 28, 2022,

[24] “WSPM Group Empty Packs Survey USA_CA Q2 2023,” August 2023,

Share this article