Carbon Tax Rankings: Matching Their Promise

Key Findings

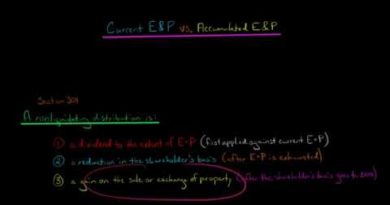

- Carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them.

es are a popular solution to climate change because they are an economically efficient way to price in negative externalities of greenhouse gas emissions. - In practice, carbon taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

es have been partial measures, either exempting certain sectors of the economy or offering substantially reduced rates for certain activities. - One way to judge the design and administration of carbon taxes is by measuring the ratio of actual revenue collected divided by potential revenue, known as a c-efficiency ratio. The resulting ratio illustrates how well the tax captures the theoretical tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

. - The Canadian territories of Northwest Territories and British Columbia, as well as Japan and Luxembourg, performed the best, with c-efficiency ratios around or above 0.6.

- The average c-efficiency ratio of the jurisdictions studied is 0.29, and the weighted average c-efficiency ratio is 0.24.

- Some countries employ multiple carbon pricing systems, often for different sectors of the economy, which explains some carbon taxes’ lower c-efficiency ratios.

- The high c-efficiency ratios of some high-income jurisdictions that rely heavily on carbon taxes show it is a viable policy tool for capturing its desired tax base.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Introduction

The carbon tax is often considered the ideal climate policy. However, existing carbon taxes do not match the ideal theoretical policy.[1] More than two dozen carbon taxes exist in the world today, and they vary widely in terms of design. Some cover only a limited share of emissions or feature reduced rates for different sectors. This study seeks to create a universal statistic to show how well a carbon tax compares to an idealized theoretical tax on greenhouse gas emissions.

Methodology and Issues

C-Efficiency Ratio: The Premise

This paper applies the concept of c-efficiency ratios, commonly used to evaluate value-added taxes (VATs), to carbon taxes. The ratio compares the extent to which a tax raises revenue equal to the total theoretical consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible.

base multiplied by the tax rate. If a tax was perfectly designed and enforced, the efficiency ratio should equal 1.[2] In practice, most taxes have enforcement challenges that create compliance gaps and deliberate design choices, such as exemptions, that create policy gaps. Together, the compliance and policy gaps reduce the c-efficiency ratio below 1.[3] While some divergence from a theoretical ideal is to be expected—no tax has a perfect compliance rate and certain aspects of total consumption are particularly difficult to measure—policymakers have significant control over policy gaps.

Applied to value-added taxes in 2018, the unweighted average efficiency ratio in the OECD was 0.56, meaning slightly more than half of potential VAT revenue was collected.[4] Across individual countries, efficiency ratios ranged from 0.35 at the low end to 0.75 at the high end.[5] While a revenue ratio of 1 is an unrealistic expectation, an average ratio of 0.56 suggests that VAT bases have significant room for improvement.

As carbon taxes are supposed to be broad taxes on all greenhouse gas emissions, the revenue generated should be emissions times the carbon tax rate. Calculating the efficiency ratio for a carbon tax, by dividing actual revenue by potential revenue, allows us to determine how well carbon taxes capture the potential greenhouse gas emissions. This paper considers all carbon taxes active for the entirety of 2022 according to the World Bank’s Carbon Pricing Dashboard with limited exceptions.[6]

What Drives the Ratio?

The carbon tax efficiency ratio has two components that lower it below 1: a compliance gap and a policy gap. The compliance gap reflects carbon tax revenue legally owed, but not remitted to the government levying the tax. Meanwhile, the policy gap reflects revenue not collected because some emissions are either exempted from tax or taxed at a reduced rate under the law.

Sector and Industry Exemptions or Reduced Rates

Carbon emissions are classified according to the sector from which emissions arise: power generation, industry, transportation, residential and commercial buildings, and agricultural and land use changes.[7]

Many existing carbon taxes exempt emissions from certain sectors or industries.[8] A few reasons motivate the exemptions or reduced rates: some sectors may be subject to a different emissions reduction policy, governments may fear that a carbon tax would make a domestic sector or industry uncompetitive, or political constraints might make only a partial carbon tax on some sectors viable.

The most common intersecting policy with carbon taxes in this report is the European Union’s Emissions Trading System, also known as the EU ETS. The ETS is a cap-and-trade system, where companies must pay for a fixed number of allowances for pollution (although some industries receive free allowances to preserve competitiveness). As of 2022, the EU ETS covered emissions from the power sector, certain emissions-intensive industrial activities, and intra-EU aviation, cumulatively covering roughly 40 percent of EU greenhouse gas emissions.[9] Many countries have designed their domestic carbon taxes to complement the EU ETS, excluding emissions that are subject to the EU-level policy. EU countries also often impose significant excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

es on various energy products.[10]

De Minimis Exemptions

At some margin, the cost of administering and complying with a tax becomes higher than the revenue collected. As a result, many taxes (not just carbon taxes) have de minimis exemptions designed to prevent certain small entities from incurring a large compliance burden just to remit a trivial sum to the government treasury.

We should expect some amount of emissions to be excluded from a carbon tax base for de minimis exemptions. However, according to most analyses, most carbon emissions are capturable in a carbon tax. When administered upstream, estimates from Gilbert Metcalf and Jeffrey Weisbach found that around 80 percent of carbon emissions in the United States could be taxed, while covering only 3,000 taxpayers, and that up to 90 percent of carbon emissions could be taxed with modest additional cost.[11]

A carbon tax is an excise tax, and most excise taxes have low administrative costs relative to the revenue collected, as relatively few taxpayers pay it directly.[12] So, while reasonable de minimis exemptions would keep an ideal carbon tax efficiency ratio shy of 1, they should not be a primary driver of a low c-efficiency ratio.

Noncompliance

A carbon tax would include some level of noncompliance. While few studies exist on the range of noncompliance rates for carbon taxes, other studies provide enough context to determine a reasonable range. In aggregate, the United States collects roughly 85 percent of taxes legally owed voluntarily, and 87 percent of taxes owed once considering late payments and enforcement collections.[13] This translates to a gross tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the Internal Revenue Service (IRS) (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net tax gap was around 1 billion.

of 15 percent and a net tax gap of 13 percent in the United States. When looking at excise taxes in the United States, the tax gap is much lower on a rate basis. The U.S. federal government collected an average of $95 billion in excise taxes between 2014 and 2016, and the average excise tax gap was under $0.5 billion, translating to a tax gap rate below 1 percent.[14]

Meanwhile, in Europe, the compliance gap for value-added taxes is roughly 9.1 percent of expected VAT revenue.[15] For our purposes, determining the carbon tax compliance gap is unnecessary.

Challenges to Finding the Right Carbon Tax Base

While it may seem straightforward to determine the proper carbon tax base, a series of challenges complicate the effort, including how to account for intersecting policies, the selection of greenhouse gases, and the question of border adjustments.

Intersecting Policies

Some countries have multiple carbon pricing policies. For example, many European countries have national-level carbon taxes, while also being subject to the EU’s Emissions Trading System. As a result, many countries exempt sectors already subject to the other policies. In other cases, countries have sector-specific excise taxes on, for example, motor fuel or electricity use. Such excise taxes are not based on carbon emissions but may be partially aimed at targeting social costs related to carbon emissions. Furthermore, countries may choose more direct government involvement through either regulation or subsidy as a solution in some sectors.

Situations like these create a problem for measuring a carbon tax efficiency ratio. Consider a country that has a carbon tax of $40 per ton and participates in the EU ETS. The ETS covers emissions from electricity generation, among other sectors. In 2021, the ETS’s average price was roughly $65 per ton. If the country includes electricity generation in the carbon tax base, the resulting carbon emissions would face a combined tax of $105 per ton. That would be an excessive tax burden relative to emissions that don’t also face the ETS, so it would make sense to exclude the electricity generation sector from the carbon tax.

We have chosen to look at carbon taxes in isolation, instead of attempting to universalize other carbon pricing schemes or indirect, partial carbon taxes like motor fuel excise taxes. The primary argument for our approach is simplicity: with intersecting carbon pricing schemes we would need to consider exclusions where one carbon price applies and another does not, as well as duplications where both carbon prices apply. Furthermore, having multiple carbon pricing policies is not ideal: part of the appeal of the carbon tax is that it is universal, and relying on multiple policies which (usually) have different carbon prices runs contrary to that premise. The qualitative section of the paper, in which we explore each individual carbon tax at a country level, can provide additional context on whether a poor ranking is influenced by the existence of other carbon pricing or excise taxes.

The c-efficiency ratio is a useful statistic for evaluating how well a carbon tax covers emissions in a jurisdiction. It is not a cumulative assessment of how all of a jurisdiction’s environmental tax policies cover emissions. There may be better or worse explanations for a low c-efficiency ratio. It would be ideal if all emissions in a region were subject to one uniform carbon tax. However, excluding a sector from a carbon tax because it is already subject to a different carbon pricing system is more justifiable than excluding a sector without any existing carbon price.

“Carbon” Emissions versus Greenhouse Gases

Carbon dioxide emissions (or carbon emissions, in shorthand) are usually the focus of climate policy, with carbon emissions often used interchangeably with greenhouse gas emissions. However, carbon dioxide is not the only greenhouse gas of note. Methane and nitrous oxide also contribute to climate change in the same channels that carbon dioxide does.[16] While the volumes of methane and nitrous oxide are quite low, they are more powerful than CO2 in terms of their impact on the climate on a per-volume basis, so greenhouse gas emissions are often measured in CO2 equivalents. In 2021, CO2 was responsible for nearly 80 percent of gross U.S. greenhouse gas emissions as measured in CO2 equivalents, while methane was responsible for 11.5 percent of emissions, nitrous oxide for 6.2 percent, and a handful of fluorinated gases for the remaining 3 percent.[17]

Ideally, a “carbon” tax would cover all greenhouse gas emissions, with rates scaling to the impact of the gas on climate change. In practice, some gases pose administrative challenges.[18] Large shares of nitrous oxide and methane emissions in the United States come from agricultural activities and are difficult to measure.[19] In some cases, a country’s emissions profile may skew towards non-energy, non-CO2 emissions. As a result, the country may exclude a larger share of emissions (and thus receive a worse c-efficiency ratio) thanks to its more administratively challenging emissions profile.

Nonetheless, we include all greenhouse gas emissions, rather than just CO2, as the idealized tax base. We will note unusual emissions profiles in the country-level discussion.

Production versus Consumption and Foreign Markets

An ideal carbon tax would be based on consumption, rather than production. A carbon tax based on the production of emissions creates a disadvantage for domestic industry. In the domestic market, a domestic firm must pay taxes on their emissions, while imported goods from foreign manufacturers would go untaxed. Conversely, in foreign markets, the domestic exporter still owes the carbon tax, and the foreign manufacturer is still untaxed.[20]

The imbalance can be solved by moving to a consumption base. Under a consumption-based carbon tax, the carbon content of imports is taxed, while the carbon content of exports is exempted. As a result, the domestic market is neutral between domestic and foreign producers (because both would owe the carbon tax), as is the foreign market (because neither would owe the carbon tax).[21]

Introducing a border adjustment poses several challenges, most acutely measuring the carbon content of imported goods.[22] While it is possible to overcome the challenges, most carbon taxes follow a production base rather than a consumption base. As a result, we will use production emissions, even though ideally a carbon tax would be based on emissions from consumption.

Data Sources, Methodology, and Challenges

We obtain data on carbon tax rates and actual revenue collected from the World Bank’s Carbon Pricing Dashboard on carbon taxes around the world, including both taxes applied nationally and taxes applied subnationally.[23] Greenhouse gas emissions data come from EDGAR, except in the case of the Canadian provinces, where we used values from the World Bank that come from Canadian provinces’ greenhouse gas emissions inventory reports.[24]

We calculate the c-efficiency ratio by dividing actual carbon tax revenue collected by the primary tax rate multiplied by the jurisdiction’s emissions. We adjust nominal price and revenue estimates with exchange rates as of March 31, 2023, per the World Bank’s database.[25]

For each country, we used revenue and rate data from 2022. Official estimates of 2022 greenhouse gas emissions were not yet available when we conducted the analysis, so we used emissions data from 2021. While the differing years may introduce some error in our estimates, national emissions levels rarely change substantially year-to-year. As a result, the error introduced is likely small. In the cases of Spain, France, and Ukraine, the World Bank data set does not include 2022 revenue figures; instead, we used 2021 revenue and 2021 tax rates.

Another possible source of mismeasurement is midyear changes in carbon tax rates. With the exception of the calculations solely using data from 2021, the c-efficiency ratio calculations use rates as of April 1, 2022.[26] The underlying assumption is that the period that rate is in place matches up with the time period the actual 2022 revenue was collected. Midyear changes in the carbon tax rate could lead to an overestimate or underestimate of the tax’s efficiency. If a carbon tax is raised midyear, then the estimated efficiency ratio will be an underestimate; if the tax is reduced midyear, the estimated efficiency ratio will be an overestimate.[27] We have noted the jurisdictions in which such an issue could be present.

2022 Carbon Tax C-Efficiency Ratios

The c-efficiency ratios range from a low of 0.01 in Spain to a high of 0.73 in the Northwest Territories of Canada. The average of all countries studied was 0.29. The weighted average c-efficiency ratio (calculated by adding up all revenue collected and dividing by the sum of each country’s potential revenue, so effectively weighted by country emissions) was 0.24.

The majority of countries have additional carbon price policies often designed to complement the carbon tax, and therefore limit their carbon tax to specific sectors to avoid double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

. Many of the taxes with the lowest c-efficiency ratios have further limited aims. Spain’s carbon tax, for instance, is solely focused on f-gases (a handful of marginal greenhouse gases containing fluorine, such as hydrofluorocarbons [HFCs], which combine for just over 2 percent of global greenhouse gas emissions), so while it qualifies to be included in the study, it was not intended to be an all-encompassing policy.[28] The South African carbon tax, meanwhile, is still in a transitional period, where most emissions are subject to dramatically lower rates than the headline rate.

In the table on each country’s page, we present revenue and rate data for each country in terms of U.S. dollars, adjusted using exchange rates as of March 31, 2023. However, in the text, we often discuss past tax rates or planned future tax rates in terms of local currency. This is to avoid misleading situations where, thanks to fluctuating exchange rates, a carbon tax in a country may have fallen over time when converted to dollars, but in local currency terms rose.

Conclusion

The unweighted and weighted average c-efficiency ratios of 0.29 and 0.24 do not inspire much confidence in carbon taxes living up to their promised benefits. But understanding that most countries with carbon taxes also employ cap-and-trade systems, the lower scores for many European countries look less discouraging.

Meanwhile, the results underscore some similarities between VATs and carbon taxes internationally. Both types of taxes have strong theoretical cases. Most international examples of both fall short of the optimal theoretical case, but nonetheless contribute to their respective goals. While VATs may not perfectly match the theoretical arguments that they tax all consumption equally, in practice, existing VATs are still less economically harmful means of generating revenue than income taxes.[29] Similarly, while carbon taxes might not perfectly match the theoretical ideal case, they can incentivize reductions in emissions and raise revenue used to reduce other taxes.[30]

The performance of the major high-income jurisdictions that exclusively or near-exclusively rely on a carbon tax for pricing carbon suggests a carbon tax-only approach is feasible. British Columbia and Japan both feature carbon taxes with higher c-efficiency ratios than most value-added taxes in the EU.

At the same time, a low c-efficiency score relative to other comparable countries suggests policymakers have significant room for improving the design of their respective carbon taxes to accurately and equally price emissions. And in an ideal world, countries would move towards a single carbon price, instead of relying on separate policies for different economic sectors.

Carbon Taxes by Country or Region

Argentina

Argentina introduced a carbon tax in 2018. The tax replaced existing excise taxes on motor fuel, including gas and diesel taxes, and a separate tax on imported fuel. Meanwhile, fuels such as coal and petroleum coke were subject to an initially lower carbon tax rate per ton that was intended to increase incrementally over time.[31] Updates intended to bring the rates on different fuels closer to parity were scheduled to begin in the second half of 2021 and continue through 2022, but were postponed until April 2023.[32]

A narrow scope is the major driver of the Argentine carbon tax’s low score. Notably, the tax does not include non-CO2 greenhouse gas emissions, and Argentina’s large agricultural sector is responsible for roughly a third of the country’s greenhouse gas emissions, mostly due to emissions of methane and nitrous oxide.[33] Additionally, the carbon tax exempts CO2 emissions from natural gas, which provides almost half of the country’s energy generation.[34] Beyond the significant exemptions, the tax also featured lower rates for mineral coal and petroleum coke in 2022.

British Columbia

Established in 2008, British Columbia’s carbon tax is often considered one of the best examples of the policy.[35] The tax was introduced at a low rate of CAD 10 per ton in 2008, before steadily increasing by CAD 5 per ton until reaching CAD 30 per ton by 2012.[36] The tax is applied to almost all CO2 emissions, and the tax revenue has been used to reduce marginal corporate and individual tax rates and provide transfer payments to lower-income households.[37] In 2016, British Columbia also introduced a narrow ETS targeted at emissions from newly constructed liquefied natural gas (LNG) facilities.[38]

The high c-efficiency ratio of British Columbia’s carbon tax means the tax lives up to its reputation for being well-designed and broad. The main drivers of its high rating are the broad base and uniform tax rate. The tax’s exemptions are quite narrow, such as for emissions from fuel used for some travel outside of British Columbia, emissions from agriculture, and fugitive methane emissions from oil and gas production.[39] The tax also features an incentive program for some industrial firms to reinvest some amount of their carbon tax liability into cleaner operations, although this program counted as grants, rather than tax reductions, so they do not hurt the c-efficiency ratio.[40] The British Columbian carbon tax remains one of the best examples of a well-designed carbon tax.

Canada

Canada’s federal carbon tax (also known as the federal fuel charge) is a national-level backstop for carbon pricing in Canada’s provinces. When the policy was introduced in 2019, the minimal rate was set at CAD 20 and increased by CAD 10 until reaching CAD 50 per ton in 2022.[41] It was increased by another CAD 15 in 2023. The tax applies in cases where a province’s carbon pricing policy does not meet the stringency requirements of the federal government. The federal fuel charge is not the only national-level carbon pricing backstop, as Canada also has a national-level cap-and-trade system for major emitters.

The national-level Canadian carbon tax performs poorly under the c-efficiency ratio because emissions in several provinces are excluded from the tax base, as they have their own provincial-level carbon taxes. In 2022, the federal fuel charge applied in Alberta, Saskatchewan, Manitoba, Ontario, Yukon, and Nunavut. Meanwhile, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Quebec, British Columbia, and Northwest Territories were excluded from the tax thanks to provincial policies fulfilling the federal requirements.[42]

In addition to excluding most provinces, the Canadian national carbon tax is complementary to the federal national cap-and-trade system, known as the output-based pricing system (OBPS), which covers industrial facilities with more than 50 kilotons of emissions.[43] The patchwork nature of the Canadian approach to carbon pricing explains how the federal carbon tax, when considered in isolation, has a low c-efficiency ratio.

Chile’s carbon tax system was passed in 2014 as part of a broader tax reform and went into effect in 2017.[44] The system includes an annual tax on emissions from fixed sources, targeting CO2 emissions from boilers and turbines with a thermal power of 50MW or more, ultimately covering 93 facilities as of 2018.[45] The initial aim of the carbon tax was to help Chile achieve its climate mitigation goal of reducing carbon emissions by 20 percent by 2020 compared to 2007 levels. Another tax reform passed in 2020 included reforms to the tax base scheduled to take effect at the beginning of 2023.[46] The Chilean carbon tax has two components: a conventional carbon tax and a fee on local particulate pollution.[47]

As of 2022, Chile’s carbon tax c-efficiency ratio is roughly middle-of-the-pack. The power sector is the largest source of emissions in Chile, but the de minimis threshold of facilities producing over 50 MW suggests at least some non-coverage. More importantly, though, the tax largely does not cover transportation emissions, which are substantial, and it does not cover some non-CO2 GHG emissions, like methane, predominantly found in the agricultural sector.[48] Reforms taking effect at the beginning of 2023, which expanded the tax base by lowering the de minimis threshold to facilities with over 25,000 tons of CO2 and those that release over 100 tons of particulate matter, should improve Chile’s carbon tax efficiency rating going forward.[49]

Enacted in 2017, the Colombian carbon tax operates as a levy on the carbon content within liquid and gaseous fossil fuels, encompassing various petroleum derivatives used as motor fuel, in stationary power generation, or in heating.[50] It excludes solid fuels like coal, and it only includes natural gas when the gas is used in refineries or the petrochemical sector. A tax reform signed in late 2022 expanded the carbon tax’s base to coal, slowly phasing in a carbon tax on coal from 25 percent of the carbon tax rate in 2025 to 100 percent by 2027.[51] The reform also included an annual inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

adjustment to the carbon tax rate.[52]

Colombia’s carbon tax has a relatively low c-efficiency ratio. On paper, one might think the main driver of the gap is the exclusion for coal. While this exclusion is a poor policy choice, coal does not play a particularly important role in Colombia’s energy mix.[53] Instead, the likely explanation is the tax only includes emissions from fuels, ignoring the emissions from agricultural processes, which constitute more than a third of the country’s emissions as of 2019.[54] Additionally, the wide availability of carbon offsets that allow companies to legally avoid paying the carbon tax through investment in some net-carbon-negative project (typically some form of reforestation) may also play a role.[55]

Denmark introduced a carbon tax on energy from carbon-intensive sources in 1992 as part of a larger environmental package that also included energy taxes, a sulfur tax, and green subsidies.[56] The tax covers carbon emissions from gasoline and petroleum coke and captures mainly emissions from the buildings and transport sectors. In 2022, the tax was levied at a rate of DKK 180 per ton; by 2030, Denmark plans to raise the rate to DKK 750 per ton for companies outside of the EU ETS, to DKK 375 per ton for companies in the EU ETS, and to DKK 125 for emissions from certain types of industrial processes[57]

Denmark’s carbon tax covers a large share of its emissions, which explains its relatively high rank. Most operators subject to the EU ETS are exempted, but Denmark allows some overlap in the electricity sector and central heating.[58] An exemption for natural gas and a reduced rate for gasoline have a negative impact on Denmark’s rank. The latter tends to be politically justified with reference to high excise taxes on transport fuels. The use of carbon tax reimbursements for emission reductions relative to historical fuel use under “competitiveness considerations” decreases Denmark’s rank.[59]

Estonia first introduced a small carbon tax in 2000, focused on thermal energy producers with capacity over 50 MW. A reform introduced in 2006 applied the tax to all thermal energy producers.[60] This tax overlaps with the EU’s Emissions Trading System. The tax rate has grown steadily, from EUR 0.32 per ton to EUR 2 per ton. It is also worth noting that Estonia has numerous other environmental charges, such as a high excise tax on motor fuel, which combine to raise significant revenue.[61]

The Estonian carbon tax’s low c-efficiency ratio can be predominantly explained by both narrow scope and substantial targeted exemptions. While electricity and heat generation account for almost half of Estonia’s greenhouse gas emissions, biofuels (which are responsible for a large share of heat production) are exempt.[62] Other energy producers can also gain exemptions from the tax if they invest in retrofitting.[63] Beyond exemptions within the ostensibly covered power sector, the tax ignores emissions from other sectors like transportation.[64]

Finland was the first country in the world to introduce a carbon tax, doing so in 1990. However, the tax was low initially.[65] Reforms in 1997, 2007, and 2011 significantly raised the tax while adjusting Finland’s excise tax on energy at the same time, and the carbon tax rate has been continually ratcheted up since then, amounting to EUR 76 in 2022.[66] Finland’s carbon tax is part of the country’s overall excise tax on liquid fuels.[67]

Finland’s above-average c-efficiency ratio can be credited to its broad scope, which includes the taxation of two main sources: heating and motor oil. Electricity and heat generation is the largest emissions sector in Finland, and while electricity (covered by the EU Emissions Trading System) is exempt from the carbon tax, heat generation is not. Emissions from combined heat and power plants are covered, but at a lower rate. Meanwhile, the transportation sector is the second-largest sector in terms of emissions, and it is fully taxed.[68] The tax excludes non-CO2 emissions, which primarily come from sectors such as agriculture, as well as emissions from industrial processes and peat.[69]

France

France introduced a carbon tax in 2014. The rate was set at EUR 7 per ton in 2014 and rose to EUR 44.6 per ton by 2018. That year, President Emmanuel Macron had planned to increase the tax further to around EUR 86 per ton by 2022, but political backlash as a part of the “Yellow Vest” movement led the French government to keep the carbon tax rate around EUR 44.[70] Despite the setback, the French carbon tax is still around the EU average.[71]

The French carbon tax performs well on the c-efficiency ratio thanks to its coverage of petrol, diesel, heating oil, and natural gas.[72] The transport sector is responsible for around 30 percent of France’s greenhouse gas emissions, and the tax covers most of those emissions, with some exemptions and reduced rates for commercial aviation, freight transport, and shipping.[73] The tax also captures emissions from heating oil in the buildings sector, which are more significant than emissions from the electricity sector, as France’s electricity sector is heavily reliant on nuclear power, with natural gas, oil, and coal combining for less than 10 percent of electricity production in 2021.[74]

Two main factors reduce France’s c-efficiency ratio. The carbon tax base is complementary with the EU ETS, so emissions subject to the ETS are not subject to the carbon tax. The tax is also limited to CO2, excluding methane, nitrous oxide, and HFCs. That is notable in France, as methane and nitrous oxide emissions from the agricultural sector alone make up a significant share of the country’s overall GHGs.[75]

Iceland introduced a carbon tax in 2010 in the aftermath of the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years.

and global financial crisis, as the small nation faced a significant revenue shortfall.[76] When the tax was introduced, the rate was set at around EUR 7 per ton of emissions, and it has slowly increased to around EUR 30 per ton in 2021.[77] The country has further raised its carbon tax along with inflation, most recently to EUR 35.40 as of January 1, 2023.[78]

Iceland’s carbon tax has a comparatively high efficiency ratio. The primary driver of the high ratio is coverage of the transportation sector, with road transportation making up over a quarter of overall emissions.[79] Iceland also taxes non-CO2 emissions, such as F-gases, albeit at a lower rate (at least on a CO2-equivalent basis).[80] A few factors reduce Iceland’s c-efficiency ratio, most notably the exclusion of aviation, which makes up a large share of the nation’s emissions.[81] Iceland also excludes emissions subject to the EU ETS from the carbon tax, and while Iceland has almost entirely decarbonized its power sector, emissions from industry (much of which are subject to the ETS) are still significant.[82]

Ireland introduced a carbon tax in 2010 in the aftermath of the global financial crisis, as the banking-heavy economy experienced major tax revenue shortfalls.[83] The tax is structured as several separate taxes on emissions: the Solid Fuel Carbon Tax, the Mineral Oil Tax, and the Natural Gas Carbon Tax.[84] Ireland raised the carbon tax rate in May 2022, from EUR 33.65 per ton to EUR 41 per ton, on non-motor fuel emissions (motor fuel emissions were already taxed at EUR 41 per ton).[85] In September 2022, Ireland raised the carbon tax again to EUR 48.5 per ton, which took place immediately for motor fuel but was delayed until May 2023 for heating fuels.[86]

Ireland’s carbon tax is focused on emissions from road transportation and commercial and residential buildings and exempts emissions from electricity production and industrial processes, both of which are largely covered by the EU ETS.[87] This is a relatively common carbon tax base for European countries designing carbon taxes to complement the EU ETS. However, Ireland performs worse on the c-efficiency ratio relative to those other states thanks to its emissions profile: its largest sector in terms of emissions is agriculture, and gases like methane and nitrous oxide primarily produced by the agricultural sector are not covered by the tax.[88]

Japan

Japan introduced a carbon tax in 2012.[89] While the tax rate has moved slightly, it has remained low at 289 JPY per ton.[90] In addition to the national-level carbon tax, the cities of Tokyo and Saitama Prefecture both employ cap-and-trade emissions schemes, covering 20 percent and 17 percent of localized greenhouse gas emissions.[91] In April 2023, Japan introduced a new set of carbon pricing initiatives. In 2023 and 2024, a voluntary emissions trading system will begin, entering full-scale operation in 2027, along with a new, more substantial carbon tax.[92]

While Japan’s carbon tax is low, and thus has not had a large impact on emissions, it is well-designed. Despite some exemptions for specific kinds of emissions within major sectors—e.g., fuel used in large-scale transportation such as passenger and cargo ships, railways, and aviation, and fuel used as inputs in industrial processes—the tax still covers a substantial share of emissions in all major sectors.[93] The Japanese power generation sector is emissions-intensive, particularly after nuclear facilities were taken offline following the Fukushima incident in 2011 and are only now slowly being brought back online.[94] The Japanese carbon tax excludes non-CO2 greenhouse gasses like methane or nitrous oxide, but they come predominantly from agriculture, responsible for only a small share of Japan’s overall greenhouse gas emissions.[95]

Latvia has implemented a comprehensive approach to address emissions, employing energy and carbon taxes and participating in the EU ETS. Introduced as part of the Natural Resources Tax Law in 2004, the carbon tax complements the EU ETS, focused on emissions in the power and industry sectors not covered by the EU-level policy.[96] In 2017, the government increased the carbon and energy tax rates to EUR 4.5 per ton of CO2.[97] The rate has been steadily increased, to EUR 9 per ton in 2020 and to EUR 15 per ton by the beginning of 2022 (where the rate stands today).[98]

Latvia’s low c-efficiency ratio is unsurprising, given that the carbon tax is merely designed to fill the gaps in the ETS base in the industrial and power sectors. In addition to excluding ETS industrial and power sector emissions, the tax excludes industrial and power sector emissions from peat and biomass.[99] Furthermore, most of Latvia’s GHG emissions do not come from industry and power generation. Road transportation and agriculture account for a much larger share of emissions, and the carbon tax does not touch those sectors.[100]

Liechtenstein

The Liechtenstein carbon tax was implemented in 2008 in line with a bilateral treaty that requires the adoption of Swiss federal legislation on environmental taxes.[101] Both countries levy the highest tax rate on carbon in Europe. The tax applies to carbon emissions from fossil fuel combustion in mainly the industry, power, buildings, and transport sectors. Liechtenstein also joined the EU ETS in 2021 and refunds carbon tax paid on fuel use already covered by the EU ETS or used merely in industrial processes. The resulting revenues are earmarked partially for environmental policy projects and partially for employer-side pension contributions.[102] The government allows for full or partial tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s.

s in exchange for emission reduction commitments or carbon offsets out to 2024.[103]

Liechtenstein’s carbon tax has a broad scope but ends up with a below-average c-efficiency ratio. The country’s rank is reduced by full or partial tax refunds to selected businesses in exchange for commitments to emission reductions or using carbon offsets. Partial refunds to heat generation plants not covered by the EU ETS but meeting minimum environmental standards also reduce the c-efficiency ratio of Liechtenstein’s carbon tax.[104]

Luxembourg

Luxembourg’s carbon tax (passed in 2019 and implemented in 2021) applies to CO2 emissions from fossil fuels used for transportation and heating. Emissions already covered by the EU ETS, as well as fuels used in industrial processes, are eligible for a tax refund.[105] In addition to its carbon tax and the EU ETS, Luxembourg also levies separate fuel excise taxes.[106] Imposition of the tax was accompanied by increased social support for low-income earners and some revenues are earmarked for a climate and energy fund. The basic rate gradually increased by 50 percent between 2021 and 2023. There is an increased rate for diesel which may be related to concerns over local pollution due to higher NO2 intensity.[107]

Luxembourg’s carbon tax has the second-best c-efficiency ratio of 0.7, due to its broad coverage of emissions. The reluctance to use exemptions or selective incentives in its design mirrors the country’s approach to broad-based value-added taxes.[108] Despite its high rank, Luxembourg’s carbon tax base does not overlap with the EU ETS, managing to avoid distortive double taxation.

Luxembourg’s national carbon tax is able to achieve a high c-efficiency score while also exempting emissions subject to the EU ETS because of its emissions profile. Industrial and power generation operations covered by the ETS produce a small share of the country’s carbon emissions. Similarly, the tax only includes CO2 emissions, excluding methane and nitrous oxide (both of which primarily come from the agricultural sector), but cumulatively these non-CO2 emissions make up under 10 percent of the national total as of 2019.[109] On the other hand, transport emissions (which are subject to the carbon tax) constitute a majority of Luxembourg’s total emissions.[110]

Mexico introduced a carbon tax in 2014. Since then, several Mexican provinces have implemented carbon taxes of their own, but we do not consider them here.[111] Mexico’s carbon tax is notable for being the first introduced in a major oil-producing emerging economy.[112] Additionally, Mexico introduced an ETS at the beginning of 2023.[113]

Several reasons lead to Mexico’s carbon tax’s low c-efficiency ratio. For one, the tax is only on CO2 emissions produced by fossil fuel activity in excess of emissions produced by natural gas, and natural gas emissions are entirely exempted.[114] Given that natural gas is the source of more than half of Mexico’s electricity generation, the exemption creates a significant hole in the tax base.[115] Mexico further narrowed its carbon tax base in March 2022, when the country suspended the tax on gasoline and diesel fuel (while also adding direct fiscal subsidies for fuel purchases).[116] The tax excludes non-CO2 emissions like methane and nitrous oxide, both of which largely come from the agricultural sector.[117]

New Brunswick

The Canadian province of New Brunswick first implemented a carbon tax in 2020 in response to the Canadian federal government’s carbon pricing backstop system, under which Canadian provinces without sufficient carbon pricing mechanisms are subject to federal taxes or cap-and-trade systems. Like several other provinces, it cut its gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

when the carbon tax was first introduced. As the Canadian federal system’s requirements were going to tighten in 2023, New Brunswick initially planned to update its carbon tax to remain in compliance.[118] However, in February 2023, New Brunswick announced that it would accept the federal backstop and ended the province’s carbon tax starting on July 1, 2023.[119] New Brunswick’s ETS program continues.

The New Brunswick carbon tax included several exemptions, including for the use of several fossil fuels for heating. The tax also exempts large emitters, particularly in electricity generation and petroleum refining, which are subject to New Brunswick’s ETS.[120] Approximately 30 percent of the province’s electricity generated comes from fossil fuel sources, and emissions from the electricity sector account for just under a quarter of the province’s total.[121] Nonetheless, the tax’s coverage of the transportation sector is enough to put it near the middle of the ranking.

Newfoundland and Labrador

The Canadian province of Newfoundland and Labrador introduced a carbon tax in 2019 in response to the Canadian federal government’s carbon pricing backstop system, under which Canadian provinces without sufficient carbon pricing mechanisms are subject to federal taxes or cap-and-trade systems.[122] As of July 2023, the provincial carbon tax has been superseded by the federal carbon tax.[123] However, the province’s ETS continues to meet federal standards.[124]

The main factor that reduced Newfoundland and Labrador’s efficiency score is a narrow scope, as large industrial and power sector emitters subject to the province’s ETS system were exempt from the carbon tax.[125] A substantial portion of the province’s emissions come from upstream oil and gas production.[126] The carbon tax predominantly covered the transportation sector and some of the building sector. The taxation of home heating oil was a major point of dispute between the provincial government of Newfoundland and Labrador and the Canadian federal government, as the Newfoundland and Labrador tax excluded it.[127] The Newfoundland and Labrador carbon tax also exempted the agricultural sector, some marine transport, and methane emissions in the oil and gas sector.[128]

Northwest Territories

The Canadian territory of Northwest Territories introduced a carbon tax in 2019 in response to the Canadian federal government’s carbon pricing backstop system, under which Canadian provinces or territories without sufficient carbon pricing mechanisms are subject to federal taxes or cap-and-trade systems.[129] Northwest Territories is sparsely populated (with a population under 50,000 spread over an area roughly twice the size of Texas), and extremely cold. These geographic factors make the taxation of transport fuel and heating fuel particularly salient.[130]

The Northwest Territories tops the rankings, although that is partly due to how revenues are counted. Part of the reason why the tax performs so well under the c-efficiency ratio is that instead of having tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

s for some activities (most notably heating oil), the tax featured partial or 100 percent direct rebates for taxes paid. Economically, this is equivalent to an exemption—the money being returned to the taxpayer on a one-for-one basis means that the relative price of the greenhouse gas emissions has not changed.[131] However, the policy is counted as revenue recycling, rather than an exemption. The tax also has a few small, direct exemptions, including for aviation fuel and fuel sold to native band governments.[132] It also does not include non-CO2 emissions, which account for under 10 percent of the province’s total emissions.[133] If the 100 percent rebates were counted as exemptions, the tax’s c-efficiency rating would fall to the middle of the pack.

Since April 2023, many of the rebates, such as the full rebate for home heating oil, have been replaced with increased general assistance payments.[134] General assistance payments are better than direct rebates for taxes paid because general assistance payments preserve the relative price effects of a carbon tax. Thanks to these changes, the Northwest Territories’ carbon tax should preserve its high ranking going forward—and without the asterisk.

Norway introduced a carbon tax in 1991.[135] Since the tax was introduced, the rate has been increased substantially, and exemptions have been slowly peeled back. In practice, the Norwegian carbon tax is broken up into several different components (all based on greenhouse gas emissions): a CO2 tax on mineral products (which includes mineral oil, petrol, gas, natural gas, and liquid petroleum gas), a CO2 tax on emissions from offshore petroleum operations, a CO2 tax on emissions from waste incineration, and a tax on hydrofluorocarbons and perfluorocarbons (PFC)s.[136] In 2021, the Norwegian government proposed steadily raising the carbon tax to up to NOK 2,000 by 2030—more than doubling the current rate.[137] In 2022, the tax rate was NOK 766 per ton.[138]

Norway’s carbon tax covers a large share of Norway’s emissions, including non-CO2 greenhouse gases such as methane and HFCs. However, most operators subject to the EU ETS are exempted, and the tax features reduced rates on certain activities such as waste incineration.[139] Both factors reduce Norway’s c-efficiency ratio. The tax treatment of offshore drilling operations also reduces the Norwegian carbon tax’s c-efficiency ratio, perhaps unfairly. Emissions from offshore drilling are subject to the EU ETS and the carbon tax, although the carbon tax is levied at a slightly reduced rate. The combination of the EU ETS and the (reduced) carbon tax for offshore drilling has produced some of the highest total tax rates on any carbon emissions anywhere in the world, but on the whole, this reduces the c-efficiency ratio because the ratio considers the carbon tax in isolation.[140]

Poland’s carbon tax was one of the world’s earliest, although it receives much less attention than the other carbon taxes introduced in the early 1990s. Part of the reason Poland’s carbon tax is often forgotten in the discussion of early carbon taxes is that it was, and has rarely been, described as a carbon tax. Instead, it is referred to as a national emissions fee.[141] Poland has a series of fees that cover several forms of environmental pollution, fees that in some cases predate democratization.[142] While not billed as carbon taxes, the emissions-related fees do qualify, as the fees are levied according to emission volume, rather than on the value of goods sold. The emissions fees are just a few of the country’s long list of pollution and resource fees.[143]

The Polish emissions fees only cover greenhouse gases not subject to the EU ETS, and given that the ETS-covered power sector is responsible for almost 50 percent of Poland’s greenhouse gas emissions, the fees have a narrow scope.[144] The fee also includes a de minimis exemption for taxpayers who would owe less than PLN 800 (or roughly USD 200), which further shrinks the base slightly.[145] The national emissions fee has a strange anomaly that inflates the c-efficiency ratio in a way that does not necessarily reflect better tax design. The Polish emissions fee actually taxes some non-CO2 greenhouse gas emissions at a higher rate on a CO2-equivalent basis than the regular carbon tax rate.[146] Given that the c-efficiency ratio uses the tax rate on CO2 to calculate potential tax revenue, the higher rate on non-CO2 emissions raises more revenue than one would expect, thus boosting the ratio.

Portugal implemented a carbon tax in 2015, as an addition to its existing petroleum and energy products tax.[147] Portugal’s carbon tax rate is based on average ETS prices over the preceding two years.[148] Scheduled tax increases for 2022 were postponed until 2023. In 2023, Portugal added a flat EUR 2 tax on international air and sea travelers to provide additional coverage of the emissions from international aviation and shipping. While this particular tax is referred to as a carbon tax, it is not directly based on the emissions content of travel activity.[149]

Portugal’s carbon tax performs relatively well on the c-efficiency ratio due to its broad tax base. The tax primarily applies to the building and transportation sectors, the latter being the largest emitting sector in Portugal.[150] Meanwhile, Portugal partly includes sectors covered by the ETS. Initially, the tax excluded ETS sectors like electricity generation, but starting in 2018, coal-fired electricity generation facilities were partially subject to the carbon tax as well as the ETS, and the carbon tax began to partially apply to natural gas electricity facilities in 2020.[151] By 2021, coal had been fully phased out in Portugal’s electricity mix.[152] However, the tax excludes non-CO2 emissions, and given that methane and nitrous oxide combine for roughly one-quarter of the nation’s total as of 2019, that significantly reduces the country’s c-efficiency ratio.[153]

Prince Edward Island

The Canadian province of Prince Edward Island introduced a carbon tax in 2019 in response to the Canadian federal government’s carbon pricing backstop system, under which Canadian provinces without sufficient carbon pricing mechanisms are subject to federal taxes or cap-and-trade systems. At the time, the province also cut its gas tax, dampening the total tax increase.[154] As of July 1, 2023, the Canadian federal government now applies the federal backstop tax to the province.[155]

While the Prince Edward Island policy did not meet the Canadian federal government minimum standards, it still performed well under the c-efficiency ratio. The tax’s primary strength was its coverage of the transportation sector, a sector that accounts for almost half of the province’s overall emissions.[156] However, exemptions for home heating oil and propane along with the insufficiently high rate and the simultaneous reductions of the gas tax rate, drove the federal government to impose the federal backstop.[157] Another factor that reduced the provincial tax’s overall high c-efficiency ratio is that it exempted agricultural emissions (both CO2 emissions from fossil fuels and non-CO2 greenhouse gas emissions), which constitute a substantial share of emissions.[158]

Singapore

Singapore introduced a carbon tax in 2019 at a rate of SGD 5 per ton. Starting in 2024, the city-state will raise the rate from SGD 5 to SGD 25 per ton, and in 2026, it will further raise the rate to SGD 45 per ton, with additional increases planned in 2028 and beyond.[159] The tax has a high de minimis threshold of 25,000 metric tons of CO2 emissions per year and a small number of taxpayers, approximately 50, exceed the threshold. [160] The tax covers industrial and power emissions (including many non-CO2 GHG emissions), while excluding transportation emissions.[161]

Singapore’s high efficiency ratio, even with a relatively high de minimis exemption threshold, shows how an upstream carbon tax can cover a large share of emissions in a jurisdiction. Excluding the transportation sector does not have a substantially negative impact on the tax’s efficiency ratio, as transportation emissions are a small part of the nation’s emissions.[162] In the future, the elevated carbon tax will include some carbon offset credits, which will reduce the c-efficiency ratio, but the credits will be limited to offset just 5 percent of carbon tax liability.[163]

South Africa

In June 2019, South Africa became the first African country to introduce a carbon tax. The carbon tax is aimed at large businesses across economic sectors, including industry, power, and transportation.[164] The first phase of the tax (currently in law) is transitional, with substantial consideration for reducing the impact on low-income households and trade-exposed industries. Originally, the transitional phase was supposed to last until the end of 2022, but the 2022 budget extended the first phase of the policy until the end of 2025.[165]

On paper, South Africa’s carbon tax seems well-designed, with around 80 percent of emissions included in the tax base.[166] That fact makes the country’s low c-efficiency ratio puzzling. However, the South African carbon tax’s system of tax-free allowances explains its low performance. Under the allowances, between 60 and 75 percent of emissions in certain sectors end up effectively untaxed, with some additional exemptions making up to 95 percent of sector emissions untaxed.[167] Once the transitional period is over, and certain exemptions phase out, the carbon tax’s c-efficiency ratio should improve.

Spain

Spain introduced a tax on fluorinated gas emissions in 2014.[168] In 2022, the Spanish government revised the tax’s administration, making manufacturers, importers, and other intermediate firms, as opposed to final retail sellers, responsible for remitting the tax.[169] The reform eliminates some small exemptions, while also introducing some small new ones. However, due to revenue data limitations for 2022, we consider rate and revenue data for 2021.

The Spanish tax provides limited coverage of greenhouse gas, as it does not cover CO2, methane, or nitrous oxide, so it understandably performs poorly under the c-efficiency ratio. In addition to the narrow scope of the tax, another factor further reducing revenue (and thus the tax’s c-efficiency ratio) is noncompliance within the already narrow tax base. Enforcement challenges led to significant administrative reforms in 2022.[170] The EU ETS covers Spanish CO2 emissions from power generation and some industry, but CO2 emissions from the transportation sector (the largest sector in terms of greenhouse gas emissions in Spain) are not covered, and ordinary fuel taxes in Spain are also relatively low.[171]

Sweden’s carbon tax is one of the oldest in the world. Introduced in 1991, the carbon tax has steadily increased from SEK 250 per ton of CO2 in 1991 to SEK 1,300 in 2023.[172] The tax rate rose substantially in the early 2000s, from SEK 300 per ton in 2000 to SEK 900 by 2004.[173] The policy was originally introduced in a broader tax reform package that reduced Sweden’s relatively high corporate and personal income tax rates.[174] In addition to a carbon tax, Sweden has several targeted environmental and energy-related excise taxes and participates in the EU ETS.[175]

Sweden’s middle-of-the-pack c-efficiency ratio can be explained primarily by a limited scope. The largest factor is that the Swedish carbon tax does not include non-CO2 greenhouse gasses, which account for roughly 37 percent of Sweden’s CO2-equivalent greenhouse gas emissions.[176] The tax also exempts industrial emissions and emissions from electricity production, which are subject to the EU ETS.[177] However, the tax effectively covers most of the transportation sector (the Swedish economy’s largest sector in terms of emissions), with the exception of emissions from rail and shipping.[178] In the transportation sector, the tax has reduced emissions.[179]

Switzerland levies the highest tax rate on carbon emissions in Europe, at EUR 120.16 per ton (CHF 120 per ton).[180] The Swiss carbon tax was introduced in 2008 at a tenth of the current rate. The tax applies to CO2 emissions from fossil fuels used to generate heat, light, or electricity. In addition to its carbon tax, Switzerland operates its own ETS, which has been closely linked to the EU ETS since 2020 and covers the same sectors.[181] Emissions covered by the Swiss ETS are exempt from the Swiss carbon tax.

The Swiss carbon tax ranks in the middle among the surveyed jurisdictions. This can in part be attributed to excluding the emissions base already covered under the Swiss ETS. Switzerland also utilizes some other exemptions for specific energy-intensive industries. Firms in these industries can gain carbon tax abatements in exchange for committing to emission reduction targets or using carbon offsets.[182] The tax is also based on CO2, so it excludes methane, nitrous oxide, and other greenhouse gases, but those pollutants make up under 15 percent of the country’s total GHG emissions as of 2019.[183]

Ukraine

Ukraine first introduced a carbon tax in 2011. Throughout most of the carbon tax’s existence, the rate has been low—using March 2023 exchange rates, it has been well below USD 1 per ton of CO2.[184] In early 2022, Ukraine raised its carbon tax from UAH 10 to UAH 30 per ton (approximately 1 USD), but due to revenue data limitations for 2022, we consider rate and revenue data for 2021 instead.

While Ukraine imposes a very low carbon tax rate, the broad carbon tax base covering CO2 emissions, such as emissions from industrial activities, electricity and heat generation, and residential and commercial buildings, leads it to perform well under the c-efficiency ratio.[185] However, the tax excludes mobile CO2 emissions from transportation, as well as non-CO2 GHG emissions, the latter of which make up around a quarter of the nation’s total emissions as of 2019.[186]

One possible justification for excluding the transportation sector would be a high fuel excise tax. However, Ukraine does not have a large fuel excise tax acting as an implicit carbon price for transportation emissions. Before Ukraine suspended its fuel excise tax in response to the 2022 Russian invasion, the tax was levied at a rate well below the lowest fuel excise tax of any EU country.[187]

The United Kingdom introduced a carbon tax (known as the Carbon Price Support) in 2013. As the EU ETS’s price had been low and volatile, the British government introduced the carbon tax to provide a stable incentive for reducing carbon emissions.[188] The Carbon Price Support originally acted as a top-up tax in addition to the EU ETS to reach a combined targeted price set three years in advance.[189] Since Brexit, the UK has established its own ETS system, in addition to the existing carbon tax. The EU ETS still applies in Northern Ireland post-Brexit, and correspondingly the UK ETS does not apply there.[190]

In some ways, the United Kingdom’s low efficiency score partly reflects its successes as a policy, as the tax has significantly shrunk the size of its already-limited base. The tax is solely focused on the power sector, which now accounts for a small share of the country’s overall greenhouse gas emissions.[191] Since the carbon tax was introduced, emissions from the power sector have shrunk dramatically, while emissions in other sectors have been much more stable.[192] The primary driver of the reduction in power sector emissions is a dramatic decline in coal usage, with coal predominantly being replaced by natural gas.[193]

However, the policy’s success at driving down power sector emissions, and the existence of another carbon pricing mechanism, do not fully explain the UK carbon tax’s low efficiency rating. The carbon price support and UK ETS are both largely focused on the power sector, with the ETS covering some industrial and aviation emissions.[194] Other than aviation, transportation emissions are largely ignored, as are agricultural emissions.

Uruguay

Uruguay passed a carbon tax in November 2021, which took effect on January 1, 2022, through Presidential Decree No. 441/021.[195] The tax is adjusted according to changes in the consumer price index and it applies to all liquid fuels, with the exemption of jet fuel and sales of fuel to gasoline manufacturers. The carbon tax rate for 2022 is UYU 5,645.45, or USD 137.30. Decree 435/022 set the new value of the Uruguayan carbon tax at UYU 6,024 (USD 155.86) per ton for 2023.[196]

A large portion of Uruguay’s emissions come from the agricultural sector—over 70 percent, as of 2019.[197] This provides the primary explanation for the country’s carbon tax performing poorly on the c-efficiency ratio, as the tax is focused on CO2 emissions from liquid fuel combustion, ignoring the methane and nitrous oxide emissions coming from agricultural processes. The exemption for jet fuel, and not taxing industrial processes, further chip away at the tax’s efficiency, but agriculture has the largest impact.[198]

References

[1] Alex Muresianu, “Carbon Taxes in Theory and Practice,” Tax Foundation, May 2, 2023,

[2] OECD, “Consumption Tax Trends 2020: VAT/GST and Excise Rates, Trends and Policy Issues,” 2020, Sometimes also referred to as VAT Revenue Ratios, or VRRs.

[3] Serhan Cevik, Jan Gottschalk, Eric Hutton, Laura Jaramillo, Pooja Karnane, and Mousse Sow, “Structural Transformation and Tax Efficiency,” International Monetary Fund Working Paper 19/30 (February 2019),

[4] Ibid.

[5] Grzegorz Poniatowski, Mikhail Bonch-Osmolovsky, Adam Smietanka, Agnieszka Pechcinska, and Aleksandra Sojka, “VAT Gap in the EU Report 2022,” European Commission, Directorate-General for Taxation and Customs Union, December 2022,

[6] World Bank, “Carbon Pricing Dashboard,” last updated Apr. 1, 2023, We exclude several subnational Mexican carbon taxes due to data sufficiency issues. These parameters also exclude the Netherlands (which introduced a carbon tax in 2022) and Slovenia (which repealed its carbon tax in 2022). Meanwhile, New Brunswick’s carbon tax is still included because it was active for the entirety of 2022, even though it has since been superseded by Canada’s federal carbon pricing backstop.

[7] EPA, “Sources of Greenhouse Gas Emissions,” Apr. 28, 2023,

[8] Alex Muresianu, “Carbon Taxes in Theory and Practice.”

[9] European Commission, “What is the EU ETS?,” accessed Oct. 22, 2023,

[10] European Court of AuditA tax audit is when the Internal Revenue Service (IRS) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return.

ors, “Energy Taxation, Carbon Pricing, and Energy Subsidies,” EU Commission, January 2022,

[11] Gilbert Metcalf and David Weisbach, “The Design of a Carbon Tax,” Harvard Environmental Law Review (2009),

[12] Shuting Pomerleau, “Administrative Costs of a Carbon Tax,” Niskanen Center, February 2021,

[13] Melanie Krause, Barry W. Johnson, Peter J. Rose, and Mary-Helen Risler, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2014-2016,” Internal Revenue Service, August 2022,

[14] Office of Management and Budget, “Table 2.1: Receipts by Source, 1934-2028,” Historical Tables, accessed Jun. 20, 2023,

[15] Center for Social and Economic Research, “VAT Gap in the EU,” December 2022,

[16] U.S. Environmental Protection Agency, “Sources of Greenhouse Gas Emissions,”

[17] U.S. Environmental Protection Agency, “Inventory of U.S. Greenhouse Gas Emissions and Sinks,” Apr. 13, 2023,

[18] Jack Calder, “Administration of a Carbon Tax” in Implementing a US Carbon Tax: Challenges and Debates, ed. Ian W.H. Parry (Routledge, March 2015),

[19] Gilbert Metcalf, “Implementing a Carbon Tax,” Resources for the Future, May 2017, see also Metcalf and Weisbach, “The Design of a Carbon Tax.”

[20] Alex Muresianu and Sean Bray, “Carbon Taxes, Trade, and American Competitiveness,” Tax Foundation, Nov. 3, 2022,

[21] Ibid.

[22] Shuting Pomerleau, “Administrative Costs of a Carbon Tax.”

[23] World Bank, “Carbon Pricing Dashboard,” last updated Apr. 1, 2023,

[24] Ibid., European Commission, “Global Greenhouse Gas Emissions,” EDGAR v7.0, 2022,

[25] The c-efficiency ratio should not be sensitive to exchange rate fluctuations, as revenues and rates are both adjusted by the same exchange rate.

[26] World Bank, “Carbon Pricing Dashboard.”

[27] Consider a country that had a carbon tax of $10 per ton from January 1st to June 30th that raised the tax rate to $20 in July. If they produced 100 tons of emissions in that year (and the tax was perfectly administrated and all-encompassing) they would raise $1,500 in carbon tax revenue. Using the tax rate as of April 1, this country would have an impossible c-efficiency ratio of 1.5, as their potential revenue calculated using the April 1 rate would be $1,000.

[28] Hannah Ritchie, Pablo Rosado, and Max Roser, “Greenhouse Gas Emissions,” Our World in Data, Jun. 10, 2020,

[29] Asa Johansson, Christopher Heady, Jens Arnold, Bert Brys, and Laura Vartia, “Tax and Economic Growth,” OECD Economics Department Working Paper No. 620 (July 2008),

[30] Gilbert Metcalf and James Stock, “Measuring the Macroeconomic Impact of Carbon Taxes,” AEA Papers and Proceedings 110 (May 2020), see also Alex Muresianu, “Carbon Taxes in Theory and Practice.”

[31] Emily Giovanni, Fatima Khalid, and Kenneth Richards, “Case Study: Carbon Tax in Argentina,” Gnarly Tree Sustainability Institute, July 2022,

[32] World Bank, “Carbon Pricing Dashboard,” last updated Apr. 1, 2023,

[33] Hannah Ritchie and Max Roser, “Argentina: CO2 Country Profile,”

[34] Hannah Ritchie and Max Roser, “Argentina, Energy Country Profile,” 2022, Our World in Data,

[35] Kathryn Harrison, “Lessons from British Columbia’s Carbon Tax,” Policy Options (July 2019),

[36] Brian Murray and Nicholas Rivers, “British Columbia’s Revenue-Neutral Carbon Tax: A Review of the Latest ‘Grand Experiment’ in Environmental Policy,” Energy Policy 86 (November 2015),

[37] Alex Muresianu, “Carbon Taxes in Theory and Practice,” Tax Foundation, May 2, 2023,

[38] World Bank, “Carbon Pricing Dashboard.”

[39] Government of British Columbia, “Motor Fuel Tax and Carbon Tax Exemptions,” see also Vanessa Corkal and Phillip Gass, “Locked In and Losing Out: British Columbia’s Fossil Fuel Subsidies,” International Institute for Sustainable Development, November 2019,

[40] Government of British Columbia, “Clean Economy,”

[41] Government of Canada, “The Federal Carbon Pollution Pricing Benchmark,” accessed Aug. 10, 2023,

[42] Steven Guilbeault, “Greenhouse Gas Pollution Pricing Act, Annual Report to Parliament 2021,” Ministry of Environment and Climate Change,

[43] Government of Canada, “Overview – Output-Based Pricing System Regulations Under the Greenhouse Gas Pollution Pricing Act,” updated Feb. 22, 2023,

[44] Grantham Research Institute, “Climate Change Laws of the World,”

[45] International Energy Agency, “Energy Policies Beyond IEA Countries: Chile 2018 Review,” January 2018,

[46] Santiago Martinez, “Environmental Taxation in Chile: A Critical Analysis,” Latin American Legal Studies 6 (2020), see also World Bank, “Carbon Pricing Dashboard.”

[47] Diego Mesa Puyo and Karlygash Zhunussova, “Chile: An Evaluation of Improved Green Tax Options,” International Monetary Fund Country Report No. 23/35, Jan. 19, 2023.

[48] Hannah Ritchie and Max Roser, “Chile: CO2 Country Profile,” Our World in Data, accessed Sep. 19, 2023,

[49] World Bank, “Carbon Pricing Dashboard.”

[50] World Bank, “Carbon Pricing Dashboard.”

[51] Gustavo Adolfo Lorenzo Ortiz, Nicole Velasquez, Juan Camilo Roa, and Felipe Baron, “Colombia Introduces Environmental Taxes in Tax Reform Bill,” EY, Sep. 21, 2022, see also

[52] World Bank, “Carbon Pricing Dashboard.”

[53] Hannah Ritchie and Max Roser, “Colombia: Energy Country Profile,” Our World in Data, accessed Sep. 19, 2023,

[54] Hannah Ritchie and Max Roser, “Colombia, CO2 Emissions Profile,” Our World in Data, accessed Sep. 19, 2023,

[55] Gilles Dufrasne, “Two Shades of Green: How Hot Air Forest Credits Are Being Used to Avoid Carbon Taxes in Colombia,” Carbon Market Watch, June 2021,

[56] OECD, “Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action,” Nov. 3, 2022,

[57] World Bank, “Carbon Pricing Dashboard”; see also Mie Olsen, “New Danish Carbon Tax Gives a Considerable Discount to Larger Emitters,” Courthouse News Service, Apr. 28, 2022,

[58] OECD, “Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action.”

[59] World Bank, “Carbon Pricing Dashboard.”

[60] Riigi Teataja, “Environmental Charges Act,” accessed Sep. 27, 2023,

[61] Ibid., see also Estonian Tax and Customs Board, “Environmental Charges,” last updated Dec. 12, 2021, Eurostat, “Environmental Tax Statistics–Detailed Analysis,” December 2022, Adam Hoffer, “Gas Taxes in Europe,” Tax Foundation, Jul. 12, 2022,

[62] Hannah Ritchie and Max Roser, “Estonia: CO2 Country Profile,” Our World in Data, 2020, see also OECD, “Taxing Energy Use 2019 – Country Note: Estonia,” Oct. 15, 2019, Jordan Kearns and Emmet Tuohy, “Trends in Estonian Oil Shale Utilization,” International Centre for Defence and Security, October 2015,

[63] International Energy Agency, “Energy Policies of IEA Countries: Estonia 2019 Review,” October 2019,

[64] Ibid., see also Hannah Ritchie and Max Roser, “Estonia: CO2 Country Profile.”

[65] Michal Nachmany, Sam Fankhauser, Jana Davidova, Nick Kingsmill, Tucker Landesman, Hitomi Roppongi, Phillip Schleifer, Joana Setzer, Amelia Sharman, C. Stolle Singleton, Jayaraj Sundaresan, and Terry Townshend, “Climate Legislation in Finland” from 2015 Global Climate Legislation Study: A Review of Climate Change Legislation in 99 Countries, Grantham Institute,

[66] Ibid., see also World Bank, “Carbon Pricing Dashboard.”

[67] Finnish Tax Administration, “Tax Rates on Liquid Fuels,” accessed Sep. 27, 2023, see also Adam Hoffer, “Gas Taxes in Europe,” Tax Foundation, Jul. 12, 2022,

[68] Hannah Ritchie and Max Roser, “Finland: CO2 Country Profile,” Our World in Data, accessed Sep. 27, 2023, see also World Bank, “Carbon Pricing Dashboard.”

[69] Ibid., see also Hannah Ritchie and Max Roser, “Finland: CO2 Country Profile.”

[70] Adrien Fabre and Thomas Douenne, “Public Support for Carbon Taxation: Lessons from France,” VoxEU, May 1, 2022,

[71] Alex Mengden, “Carbon Taxes in Europe,” Tax Foundation, Sep. 5, 2023,

[72] World Bank, “Carbon Pricing Dashboard.”

[73] Ibid., see also Hannah Ritchie and Max Roser, “France: CO2 Country Profile,” Our World in Data, accessed Sep. 6, 2023,

[74] Ibid., see also Hannah Ritchie and Max Roser, “France: Energy Profile,” Our World in Data, accessed Sep. 6, 2023,

[75] Hannah Ritchie and Max Roser, “France: CO2 Country Profile.”

[76] Jeremy Carl and David Fedor, “Tracking Global Carbon Revenues: A Survey of Carbon Taxes versus Cap-and-Trade in the Real World,” Energy Policy 96 (September 2016),

[77] OECD, “OECD Economic Surveys: Iceland,” Jul. 7, 2021,

[78] World Bank, “States and Trends of Carbon Pricing 2023,” May 2023, see also Alex Mengden, “Carbon Taxes in Europe 2023,” Tax Foundation, Sep. 5, 2023,

[79] Hannah Ritchie and Max Roser, “Iceland: CO2 Country Profile,” Our World in Data,

[80] World Bank, “Carbon Pricing Dashboard.”

[81] Hannah Ritchie and Max Roser, “Iceland: CO2 Country Profile.”

[82] Ibid.

[83] Frank Convery, Louise Dunne, and Deirdre Joyce, “Ireland’s Carbon Tax and the Fiscal Crisis: Issues in Fiscal Adjustment, Environmental Effectiveness, Competitiveness, Leakage, and Equity Concerns,” OECD Environmental Working Papers 59 (October 2013),

[84] Irish Tax and Customs, “Natural Gas Carbon Tax,” Irish Tax and Customs, “Solid Fuel Carbon Tax,” Irish Tax and Customs, “Mineral Oil Tax,”

[85] Alan Kilmartin, “Developments in VAT and Energy Taxes on Irish Fuel,” International Tax Review, Apr. 22, 2022,

[86] Chartered Accountants Ireland, “’Greening’ the Tax System – Budget 2023,” Sep. 27, 2022,

[87] World Bank, “Carbon Pricing Dashboard.”

[88] Hannah Ritchie and Max Roser, “Ireland: CO2 Country Profile,” Our World in Data,

[89] Ministry of the Environment, “Details on the Carbon Tax,” Government of Japan, Oct. 1, 2012,

[90] Ministry of the Environment, “Details on the Carbon Tax,” Government of Japan, Oct. 1, 2012, see also International Carbon Action Partnership, “Japan’s Cabinet Approves Policy Roadmap Including Plans for National ETS,” Feb. 22, 2023,

[91] World Bank, “Carbon Pricing Dashboard.”

[92] Yuka Obayashi and Katya Golubkova, “Explainer: Japan’s Carbon Pricing Scheme Being Launched in April,” Reuters, Mar. 30, 2023, see also Satoshi Hashimoto, “Carbon Pricing in Japan: A Policy Perspective,” Mitsubishi Research Institute, Jul. 26, 2023,

[93] Hemangi Gokhale, “Japan’s Carbon Tax Policy: Limitations and Policy Suggestions,” Current Research in Environmental Sustainability 3 (2021), see also World Bank, “Carbon Pricing Dashboard.”

[94] Hannah Ritchie and Max Roser, “Japan: Energy Country Profile,” Our World in Data,

[95] Hannah Ritchie and Max Roser, “Japan: CO2 Emissions Profile,” Our World in Data,

[96] World Bank, “Carbon Pricing Dashboard.”

[97] World Bank, “State and Trends of Carbon Pricing 2017,” Nov. 2017,

[98] Legal Acts of the Republic of Latvia, “Natural Resources Tax Law,” last updated Aug. 6, 2023, accessed Oct. 16, 2023,

[99] OECD, “OECD Environmental Performance Reviews: Latvia 2019,” OECD Environmental Performance Reviews (2019),

[100] Janis Eglits, “Latvia’s Challenges and Achievements Towards Low Carbon and Climate Resilient Development,” Ministry of Environmental Protection and Regional of Development, Oct. 30, 2017,

[101] See Switzerland’s carbon tax country profile for details.

[102] Liechtensteinische AHV-IV-FAK, “Rückverteilung der CO2-Abgabe,” accessed Oct. 5, 2023,

[103] World Bank, “Carbon Pricing Dashboard”; see also State Administration of the Principality of Liechtenstein, “Landesgesetz Verordnung vom 29. Oktober 2013 über die Reduktion der CO2-Emissionen (CO2-Verordnung),“ Oct. 29, 2013,

[104] Ibid.

[105] World Bank, “Carbon Pricing Dashboard.”

[106] Adam Hoffer, “Diesel and Gas Taxes in Europe,” Tax Foundation, Jul. 11, 2023,

[107] Luxembourg Institute of Science and Technology, “Stickstoffoxidbelastung in Luxemburg: Ergebnisse eines landesweiten Screenings,“ Feb. 18, 2020,

[108] Tax Foundation, “Taxes In Luxembourg,” accessed Oct. 5, 2023,

[109] Hannah Ritchie and Max Roser, “Luxembourg: CO2 Country Profile,” Our World in Data, accessed Oct. 6. 2023,

[110] Ibid.

[111] World Bank, “Carbon Pricing Dashboard.”

[112] David Alire Garcia and Adriana Barrera, “Mexico’s Carbon Tax Faces Headwinds from Energy Revamp,” Reuters, Oct. 7, 2013,

[113] World Bank, “Carbon Pricing Dashboard.”

[114] International Energy Agency, “Carbon Tax,” last updated Feb. 8, 2023,