Caps, Costs, And Considerations | Tax Policy Center

The House is preparing for SALT legislation. Legislation sponsored by Rep. Michael Lawler (R-NY) would increase the federal cap on state and local tax (SALT) deductions from $10,000 to $20,000 for married couples who file jointly and make up to $500,000. The change would only cover tax year 2023. The Washington Post reports on the prospects for the effort amid continued disagreements among members of the House majority.

Why is Congress trying to expand the LIHTC? The LIHTC program costs roughly $13.5 billion annually, and finances between 50,000 and 60,000 housing units each year. But TPC’s Howard Gleckman argues that it is an inefficient and complex way to deliver housing assistance to low-income families.

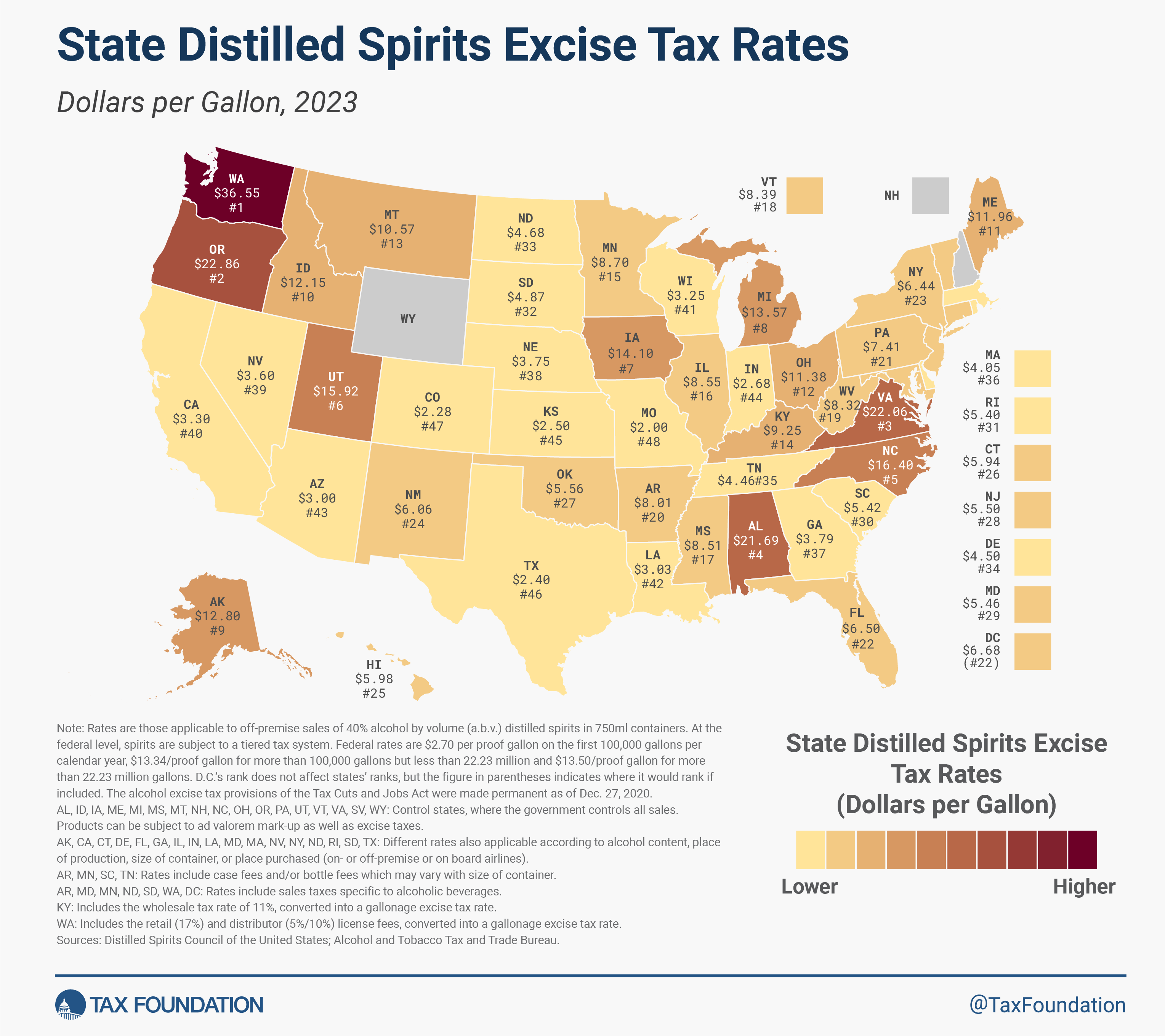

Would raising taxes on beer and wine reduce the public costs of hard drinking in Oregon? The Oregon Health Authority did not publish a report that estimates the effects of such taxes in 2021. A state task force is considering an excise tax increase on beer, wine, and hard cider producers. The report found that a major excise tax increase on these drinks would reduce consumption among by 2 percent among the state’s heaviest drinkers. That group has a disproportionate impact on the state’s public health and criminal justice costs.

Minnesota families can enroll in the state’s new child tax credit program. Democratic Gov. Tim Walz and other elected state leaders are urging Minnesotans to see if they qualify for the child tax credit of up to $1,750 per child on their 2023 state income tax returns. The credit was enacted last year and lawmakers hope it can reduce child poverty in Minnesota by one-third.

Pennsylvania budget setters still need a plan for more education funding after court ruling. Last year, a Commonwealth Court judge ruled Pennsylvania’s school funding system was unconstitutionally inequitable and ordered an overhaul. A bipartisan legislative commission approved a report, without Republican votes, directing at least $5.4 billion in new money for underfunded districts, $955 million in aid to ease property tax burdens in high-tax districts, and more funding for school construction and infrastructure upgrades. Gov. Josh Shapiro (D) and state lawmakers will have to determine where that money would come from. Shapiro is expected to cover the issue in his budget address this evening.

Florida lawmakers are exploring whether the state can eliminate property taxes. The state’s House Ways and Means Committee is considering a bill calling for a study of how much money would be lost if property tax were eliminated in Florida and how local governments might raise revenue elsewhere. Florida already does not have a personal income tax, ,leaving sales taxes as the primary mechanism to make up for lost revenue. Under the House bill, the study would have to the legislature no later than Feb. 1, 2025. There is no Senate version of the bill.

For the latest tax news, subscribe to the Tax Policy Center’s Daily Deduction. Sign up here to have it delivered to your inbox weekdays at 8:00 am (Mondays only when Congress is in recess). We welcome tips on new research or other news. Email Renu Zaretsky at [email protected].