Capital Cost Recovery under BEFIT vs EU Member State Policies

On 12 September, the European Commission released the Business in Europe: Framework for Income TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

ation (BEFIT) proposal to reduce tax compliance costs for large businesses and encourage cross-border investment in the European Union. BEFIT replaced the Commission’s previous proposals aimed at creating a common corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

called CCTB (common corporate tax base) and CCCTB (common consolidated corporate tax base).

Legally, under Article 115 of the Treaty on the Functioning of the European Union, the Commission may intervene in tax policy with unanimous agreement by Member States, and in accordance with the principles of subsidiarity and proportionality, to improve the functioning of the internal market. This traditionally means proving that an EU-level policy harmonization provides an added value vis-a-vis an uncoordinated mix of 27 different national policies. In BEFIT’s case, it is straightforward to see the theoretical case for compliance savings (even if this may be less obvious in practice).

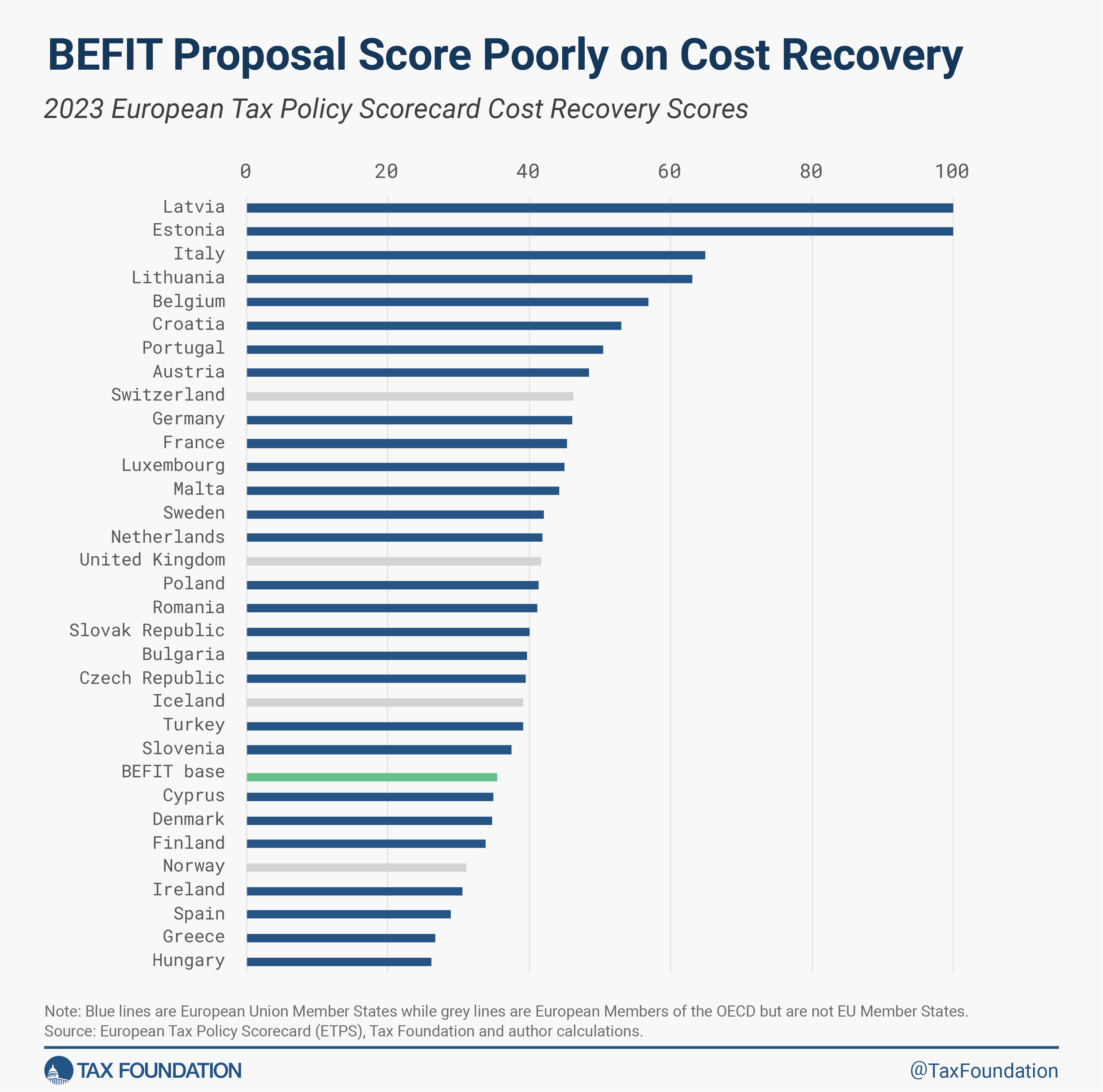

But what if the harmonized EU policy is economically worse than a majority of the 27 Member State policies? The trade-off for a business becomes the cost of compliance versus the benefits of better-designed national tax policy. For capital cost recovery, this is the scenario that BEFIT presents to firms operating in multiple Member States according to Tax Foundation’s new European Tax Policy Scorecard (ETPS).

BEFIT’s Overall ETPS Capital Cost RecoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages.

Ranking

The ETPS evaluates 32 European countries on the structure of their tax systems. It includes all 27 EU Member States and five European members of the Organisation for Economic Co-Operation and Development (OECD) that are not EU Member States but tend to have significant economic relationships with the EU (Iceland, Norway, Switzerland, Turkey, and the United Kingdom).

Cost recovery is the ability of businesses to deduct the costs of their investments, which plays an important role in investment decisions. In the ETPS, capital cost recovery is measured along seven variables, including loss carryover provisions, inventory treatment, allowance for corporate equity, and capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances.

s. The combination of these variables is calculated to give a final capital cost recovery ranking.

The poorer the treatment of these aspects, the more biased the tax code will be against new investment, creating a drag on economic growth.

This year, Estonia and Latvia rank the best on capital cost recovery thanks to their cash-flow tax model, which allows for a capital cost recovery rate of 100 percent, followed by Italy and Lithuania. However, rather than harmonizing the EU’s policy to the best national policies, BEFIT would rank in the bottom third of ETPS countries.

This means that the BEFIT proposal would negatively impact most investment decisions compared to the status quo for a business operating in multiple Member States. For major capital investments, this could mean losing hundreds of thousands of euros to save money on compliance and administration costs.

Carryover Scenarios

The overall ranking above could slightly change based on language clarifications in the BEFIT proposal. Net operating loss (NOL) carryforwards allow businesses suffering losses in one year to deduct them from future years’ profits while net operating loss carrybacks allow businesses to deduct losses from previous years’ profits. In both cases, businesses are taxed on their average profitability, making the tax code more neutral.

However, the proposal’s language regarding the harmonized tax base is unclear on the duration of carryforwards and does not mention carrybacks at all. The table below shows how BEFIT’s overall ranking could change depending on the treatment of NOL carryforwards and carrybacks.

As policymakers clarify the text in the future, they should strive for the best-case scenario by allowing non-time-limited carryforwards with generous carryback provisions to smooth businesses’ profitability over the business cycle.

Inventory Treatment and Allowance for Corporate Equity

Businesses cannot deduct the cost of inventories when they first produce or purchase them. Instead, businesses must deduct the cost of inventories when they are sold. Businesses are generally allowed to choose among three methods when calculating their cost in a given year: first-in, first-out (FIFO); last-in, first-out (LIFO)Last-In, First-Out (LIFO) inventory deductions allow companies to deduct the cost of inventory at the price of the most recently acquired items and assumes that the last inventory purchased is the first to be sold. LIFO limits the impacts of volatile prices or inflation and lowers the tax cost of new inventory.

; and weighted-average cost.

Ideally, BEFIT would allow for the LIFO method because it limits the impacts of volatile prices or inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

and lowers the tax cost of new inventory. Twelve countries in the ETPS already allow for the use of LIFO. However, the proposal mandates the use of FIFO or the weighted-average cost methods.

The BEFIT proposal does not include an allowance for corporate equity (ACE), as currently in place in nine countries in the ETPS. While this is likely due to the EU’s (wishful) adoption of the DEBRA proposal, an agreement has yet to be reached. Therefore, the lack of an ACE in BEFIT negatively impacts its ranking.

Businesses can finance their operations through debt or equity. However, the returns on these types of financing are taxed differently. Traditional corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

systems allow tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state/local taxes paid, mortgage interest, and charitable contributions.

s of interest payments but not of equity costs, effectively providing a tax advantage for debt over equity financing—the so-called “debt bias.” This tax-induced debt bias encourages businesses to use debt financing, increasing leverage and thus potentially negatively impacting financial stability.

Treatment of Capital Allowances

A capital allowance is the amount of capital investment costs a business can deduct each year from its revenue via depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

. Depreciation schedules specify the life span of an asset—often derived from the economic life of an asset—and determine the number of years over which an asset must be written off.

Ideally, BEFIT would harmonize the EU’s policy to permanent full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

by allowing businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. Otherwise, when businesses are not allowed to fully deduct capital expenditures in real terms, they make fewer capital investments, which also reduces worker productivity and wages. However, BEFIT mandates a straight-line depreciation schedule.

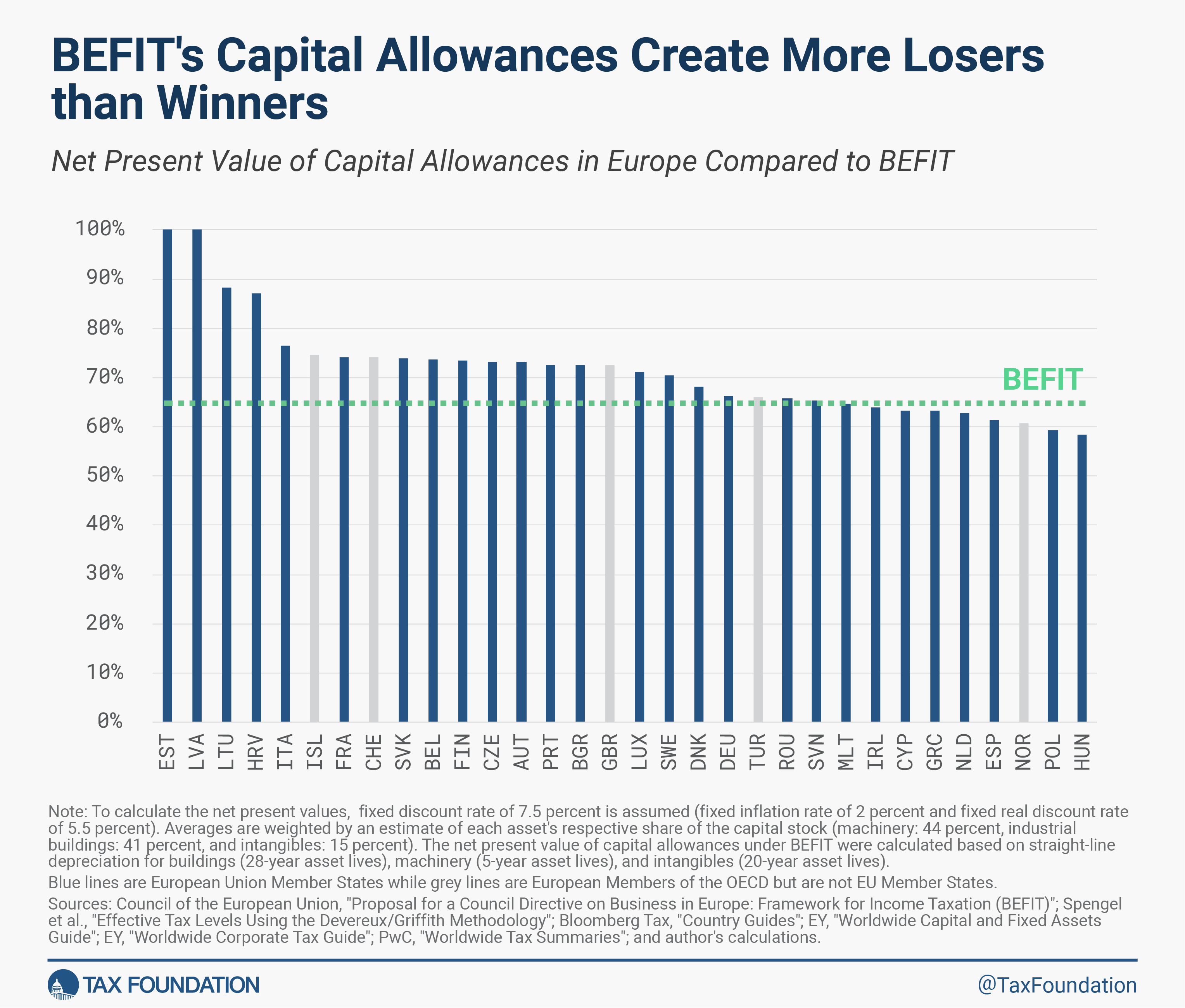

The net present value of capital allowances can be estimated using similar methods as those used for individual countries. On average, across the three general asset categories of buildings, machinery, and intangibles, the net present value of capital allowances under BEFIT is 64.7 percent. This is lower than 24 ETPS countries. It is also worse than the previous CCTB proposal that allowed 67.3 percent.

For each individual category, BEFIT is worse than the ETPS average. For machinery, BEFIT would provide an 87 percent allowance compared to an 86 percent average assuming a 5-year depreciation schedule; BEFIT would provide a 44 percent allowance for buildings assuming a 28-year depreciation schedule while the ETPS average is 52 percent; and the allowance for intangibles would be only 55 percent compared to an 83 percent average assuming a 20-year depreciation schedule, the standard duration of patent protection. The actual net present value of allowances will depend on companies’ own accounting for the useful life of capital assets.

This comparison shows that BEFIT would be significantly less pro-growth than the status quo. The EU would be better off pursuing a principled tax base rather than one that penalizes business investment.

Conclusion

A harmonized EU tax base is a project in the making. Policymakers have a chance to put the Union on a path for increased investment and economic growth by focusing on the details of capital cost recovery. Current Member State policies, especially in Estonia and Latvia, offer examples of best practices to implement across the EU.

Reducing compliance costs can save businesses in the long run and increase cross-border investment. However, policymakers should not harmonize just for the sake of having a common policy. There needs to be an EU added value in both the legal sense and the economic sense. Ultimately, it is the latter that will secure unanimous support in the Council and with European citizens.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share