California Prepares for PHE Unwinding through Release of Operational Plan

CMS is requiring that states prepare unwinding plans in preparation for the eventual expiration of the federal COVID-19 Public Health Emergency (PHE). While not required, CMS has encouraged states to make their plans publicly available. In their latest guidance to states, CMS outlines detailed requirements and recommendations for states to effectively return to normal business operations when the PHE ends. In May, California’s Medicaid agency, Department of Health Care Services (DHCS), released their Public Health Emergency Unwinding Operational Plan in May. While it’s unclear how many states have developed operational plans to date, California was the first state to release it publicly.

Since early 2020, after passage of COVID-19 relief federal legislation, California has halted Medi-Cal terminations or reductions in benefits for most enrollees during the PHE conditioned on enhanced federal funding. The “maintenance of effort” requirement has been a lifeline during the ongoing pandemic as Medi-Cal enrollees have kept their Medi-Cal coverage uninterrupted during the PHE. However, it also means that all 58 counties face a heavy lift once the PHE expires as counties will have to review eligibility for the approximately 14.5 million people on Medi-Cal. The PHE was recently extended by the Secretary of Health and Human Services to October 13th and the Administration has promised to give states 60-days advance notice of the PHE end date.

A Detailed Roadmap

DHCS’ operational plan provides a roadmap of how the state, counties, and managed care plans will resume normal operations. The plan also explains what changes to expect when the PHE ends and which PHE-related policies will stop. By planning as early and proactively as possible, California can mitigate interruptions in health coverage for millions of low-income individuals and families. The document is divided into two parts: first, the unwinding of Medi-Cal program flexibilities and second, resuming normal Medi-Cal operations.

Overall, the plan reflects many of the stronger policy recommendations from CMS’ guidance letters. This will go a long way in mitigating churn among the large caseloads that counties will eventually process. Below are some of the key parts of the plan.

- Staggering the unwinding period to the latest possible time frame

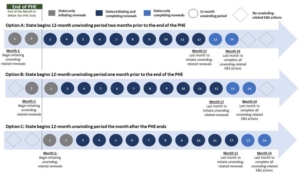

CMS will require that state Medicaid agencies initiate renewals for all cases within 12 months of the unwinding period and to complete all renewals by 14 months. The “unwinding period” may begin no sooner than two months prior to the end of the month when the PHE ends and no later than the first of the month right after the month when the PHE ends.

DHCS has opted to initiate the state’s unwinding period at the latest possible date: the month immediately following the month when the PHE expires. [See Option C above]. This option benefits enrollees as it allows more time for uninterrupted coverage for enrollees while counties gear up for case processing once the Biden Administration provides 60-day notice to states that the PHE will expire. Medi-Cal terminations or reductions in coverage (negative actions) will happen no sooner than 90 days after the month in which the PHE ends. For example, if the PHE expires on October 13th, then counties will initiate renewals starting in November, which means that negative actions would occur no earlier than January 2023. Staggering the unwinding period to the latest possible time frame buys everyone more time to prepare.

- Renewals for all Medi-Cal enrollees

DHCS’ operational plan requires counties to conduct fresh renewals for all Medi-Cal cases in their county. This will ensure that every current Medi-Cal enrollee is redetermined regardless of when or if they were recently renewed during the PHE. By maintaining everyone’s pre-PHE annual renewal month, even if individuals reported changes in circumstance during the PHE, DHCS has simplified the enormous task of case processing activities for counties. Maximizing the opportunity to prolong health coverage while assessing eligibility based on the most up-to-date information – by “starting over” on each enrollee’s annual redetermination month – is an efficient and orderly approach to ensuring county readiness.

- Additional authority to seek flexibility in the federal rules

While DHCS obtained waiver flexibilities to protect access to Medi-Cal coverage during the PHE, some of those flexibilities will end when the PHE ends. Thankfully, CMS has provided state Medicaid agencies with time-limited authority to continue certain PHE-related flexibilities under section 1902(e)(14)(A) of the Social Security Act. Section 1902(e)(14)(A) waiver authority allows states to employ necessary flexibilities to “establish income and eligibility determination systems” that protect beneficiary access to coverage. The operational plan outlines several flexibilities under this authority for appeal rights, updating beneficiary contact information, and ex parte renewals.

- Acceptance of beneficiary contact information from Medi-Cal managed care plans

Normally counties cannot accept updated contact information from Medi-Cal managed care plans unless it’s verified by the beneficiary either through the plan or by directly contacting the beneficiary. However, this rule has been temporarily changed through waiver authority, which permits counties to accept updated contact information from health plans without the added step of contacting the beneficiary. It is imperative that counties receive the most current contact information to ensure that all enrollees are appropriately assessed and notified about their Medi-Cal coverage once the PHE ends. We know that many people have moved during the COVID pandemic and the more current the information there is, the less likely people will fall through the cracks and lose coverage.

- State Fair Hearing timeframe extension and Continuing Benefits protections

DHCS has sought approval from CMS to extend the timeframe for Medi-Cal enrollees to appeal negative actions through federal waiver authority. During the PHE, DHCS obtained waiver authority (through Section 1135) to add an additional 120 days for enrollees to request a Medi-Cal appeal. Like other 1135 waiver authorities, this extension will end when the PHE ends. Once approved, enrollees will continue to have extra breathing room to dispute issues with their Medi-Cal coverage or benefits as many juggle competing needs and are struggling to get by. Enrollees are also entitled to continuation of benefits pending their appeal (also called “aid paid pending”), and DHCS cannot recoup any costs from the beneficiary regardless of the outcome of their appeal. Providing enrollees with ample time to appeal, and the extra security of aid paid pending, protects enrollees’ due process rights to push back on wrongful county actions.

- Improvements to ex parte renewals

When renewing eligibility, counties are required to check for available information on their own without contacting the enrollee before they can terminate their Medi-Cal. This is also known as conducting renewals ex parte. Once counties have reviewed various sources of data and information to assess whether or not a person remains eligible for Medi-Cal, they must inform the enrollee. This gives the enrollee a chance to provide the necessary information to show they are still eligible for coverage. After counties complete this process, they must send the enrollee written notice of a proposed termination or reduction of coverage.

Under DHCS’ plan, counties can complete ex parte renewals when a person or family who reported no income within the last 12 months and no information is returned through the data review process. Renewal efforts can be accomplished more efficiently for enrollees without income, especially individuals experiencing homelessness, so they aren’t burdened with completing a renewal packet. Households where no asset information is returned (via Asset Verification System Data) within a reasonable timeframe will also be renewed ex parte.

- Reasonable compatibility of income threshold increase and reasonable explanation

The operational plan also includes additional tools to enable counties to continue health coverage for enrollees. Currently, the income reported by an enrollee is cross-referenced with their income information found in electronic data sources. This is to assess whether or not the two reports of income are “compatible” enough to determine eligibility. DHCS increased the compatibility standard from 10% to 20% for the PHE unwinding period only. However, other states have permanently set their reasonable compatibility standard to 20%. This helps streamline the ex parte process so more individuals continue coverage uninterrupted without having to complete lengthy renewal packets. As the largest Medicaid program in the country, Medi-Cal should make the expanded reasonable compatibility threshold permanent. It will mitigate the administrative burden on counties and help mitigate churn by continuing Medi-Cal coverage for more individuals and families.

Under DHCS’ plan, enrollees can provide a “reasonable explanation” for discrepancies between the information they report and the information found in electronic verification sources. The Department will be developing a tool for counties to use in order to build in this functionality for case processing when the PHE ends.

- Maintaining expanded Hospital Presumptive Eligibility

During the PHE, DHCS expanded Hospital Presumptive Eligibility (HPE) to those who are age 65 years or older, persons with disabilities, and blind individuals. They also allowed two HPE periods per year. Including these three populations into HPE eligibility was an important move by the Department as they are at heightened risk of COVID-19. While DHCS has kept this expansion, it is planning to discontinue the two HPE periods once the PHE ends. While ensuring that HPE is available to more people, especially at-risk populations, is a welcome policy, reducing the HPE periods to only one per year when COVID-19 appears to be here to stay will likely not meet the needs and realities for many people who are more susceptible to fluctuating Medi-Cal eligibility. Since two PE periods are allowed for children, the Department should provide more parity between populations who would benefit from HPE.

- Eliminating premium waivers

During the PHE, DHCS waived premiums and cost-sharing for Medi-Cal programs, but enrollees had to opt in. This important policy was recently extended through the state budget to permanently eliminate all Medi-Cal premiums. DHCS officially began zeroing out premiums as part of this important policy change in July. Eliminating premiums for enrollees, especially during a particularly challenging economic time, is an equitable step to making health care more affordable and keeping extra money in the pockets of low-income individuals and families.

- Minor Consent Medi-Cal and Family PACT program enrollment

DHCS also made permanent two enrollment policies for Minor Consent Medi-Cal and Family Planning, Access, Care, and Treatment (PACT) program applications. Prior to the PHE, counties only accepted Minor Consent Medi-Cal and Family PACT applications and renewals in person. During the PHE, minors and individuals needing services in either program were allowed to apply via telephone. Importantly, this policy change will be made permanent after the PHE ends.

- COVID-19 Uninsured Group program continuity of coverage

In 2020 at the start of the pandemic, DHCS launched the COVID-19 Uninsured Group program. This program provides temporary coverage for COVID-19 testing, testing-related treatment, and treatment services for uninsured and underinsured Californians. However, the program will expire when the PHE ends. This means that hundreds of thousands of enrollees on this program risk losing this important coverage while COVID-19 remains a major public health concern. While DHCS explains in its operational plan that enrollees will receive notices about how to apply for coverage through Medi-Cal and Covered California, this policy should go further. Many individuals, including those who work lower wage jobs that don’t provide health benefits and immigrants without documentation, will lose this extra safety net coverage without going through the same redetermination process as other Medi-Cal related populations. This is a missed opportunity to catch these individuals who may be newly eligible for full Medi-Cal coverage or an affordable Covered California insurance plan and the redetermination obligations should be extended to this group as well.

- PHE Monthly Data Dashboard

DHCS details their efforts to capture coverage data in a PHE Data Dashboard. This is an important tool to monitor trends in enrollment and disenrollment by counties as well as other demographic data to identify and address disparities. DHCS is taking important steps to collect data at a critical time when millions could lose coverage. However, currently the data elements only cover total numbers of enrollees, where race/ethnicity data is only broken down for total enrollment and not for all of the other data elements. While DHCS has engaged stakeholders in this effort, they should integrate a break down of this important data for all of the data measures. More consistent and thorough data provides a clearer picture of where disparities are showing up.

Overall, California has taken critical strides to proactively plan for the end of the PHE and we support and laud these efforts. As the PHE is expected to continue through the rest of the year, we urge the state to adopt even stronger policies to meet this critical moment.