Bipartisan Tax Framework: Low-Income, Wealthy Households Benefit Most

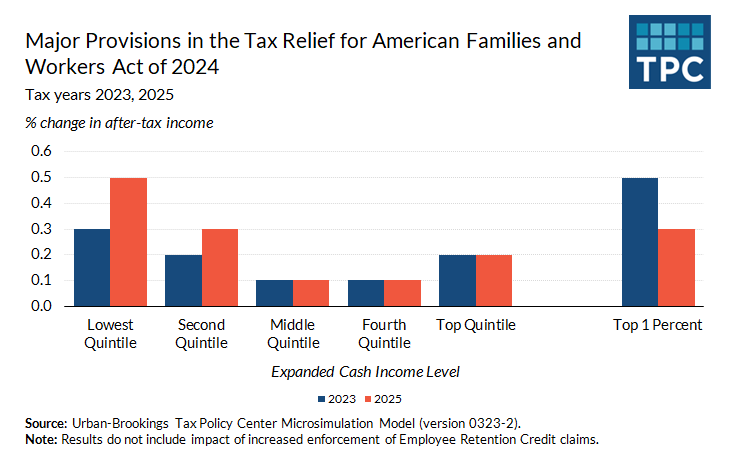

Legislation to temporarily enhance certain business tax deductions and the child tax credit (CTC) would boost after-tax incomes for households by an average of $160 in 2023, with more noticeable tax cuts at both the top and bottom of the income distribution, according to a new Tax Policy Center analysis.

The Tax Relief For American Families And Workers Act of 2024 would alter business tax breaks impacted by the 2017 Tax Cuts and Jobs Act. The bill would restore the ability of businesses to immediately deduct investments in both new equipment and machinery and expenses for research and development, while making the cap on deductions for interest expenses less restrictive.

The legislation would also make the low-income housing tax credit more generous and expand the CTC by accelerating the credit phase-in for large families, making more of the CTC refundable, and indexing the CTC to inflation. The CTC and business tax changes all offer retroactive tax relief, so our model results include tax year 2023. The provisions would also be in effect for tax years 2024 and 2025, after which these policy changes and other large pieces of the TCJA are set to expire.

If the bill is enacted, households in the lowest income quintile (incomes up to $29,800) would see gains in after-tax income averaging 0.3 percent ($60) in 2023. Average tax cuts for households in the bottom two quintiles would increase by 2025.

Meanwhile, the top 1 percent (those with annual income above $980,000) would get an average after-tax income boost of 0.5 percent ($9,500) in 2023. Benefits for the wealthy would moderate in 2025, with average after-tax income gains of 0.3 percent for those in the top 1 percent. This is due to the partially retroactive nature of the business tax changes.

TPC’s model allocates a portion of corporate tax changes to both the labor force and shareholders. However, our model assumes that retroactive business tax breaks mostly benefit shareholders—cutting taxes for decisions a business already made is more likely to boost short-term profits than encourage new investment. As a result, benefits from these provisions in 2025 (table LINK) are distributed more evenly among different income groups than in 2023.

Gains for the lowest two quintiles are primarily driven by the CTC adjustments. You can read about the CTC proposal in more detail in our preliminary analysis here.

What’s Next

The House Ways & Means Committee today approved a marked-up version of the legislation, with a vote of 40-3 in favor. Whether the proposal can pass Congress and get to President Biden’s desk is unclear. But negotiations have progressed considerably from when these talks were first reported on in late 2022.

The Joint Committee on Taxation estimates the legislation is revenue neutral over the 10-year budget window. Most of the offsets to the tax cuts discussed above come from tighter enforcement of employee retention tax credit, which was established as an additional relief measure for smaller businesses struggling at the height of the COVID-19 pandemic. The program has since become a magnet for fraud, with aggressive marketing by intermediaries offering deals to firms that may not be eligible for the tax break. TPC did not include this provision in its analysis above, due to the difficulty of distributing the burden of enforcement changes.