Attract, retain, and upskill tax talent in era of AI

Jump to:

Future of Professionals ReportHow AI is the Catalyst for Transforming Every Aspect of Work

|

In the new era of artificial intelligence (AI), businesses across industries are rethinking how they attract, retain, and upskill talent. If not, they should be. This also holds true for accounting firms, as staffing constraints continue to be a top concern for the tax profession.

“The focus on retaining, attracting, training, and upskilling talent should remain a top-of-agenda organizational issue if businesses are to continue to provide the value that customers and stakeholders have come to expect, especially as we put more emphasis on the tech changes that are disrupting all industries,” stated Thomson Reuters CEO and President, Steve Hasker.

In the Thomson Reuters Future of Professionals report, to help businesses better understand the role that AI can play in the war on talent, the report surveyed more than 1,200 individuals working in the tax and accounting, legal, global trade, risk, and compliance fields to get their insights.

While the full impact of AI is still unfolding, what is clear is that the innovative technology is sparking change in how businesses operate and approach staffing.

Tax staff a top priority

It is likely no surprise that attracting and retaining top talent remains a leading priority for tax businesses. According to the report, nearly half (44%) of tax firms surveyed cited staff recruitment and retention as a top concern, followed by corporate tax departments at 34%.

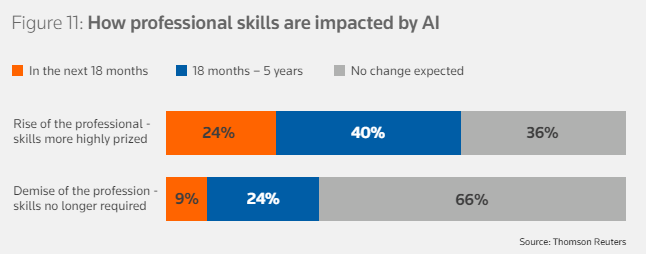

Fortunately, businesses can harness the power of innovative technology to help broaden bandwidth and, at the same time, uplift their tax talent. To further highlight this point, the majority of professionals surveyed (64%) said they believe that AI will result in a rise in the appreciation of their professional skills.

As a growing number of businesses take a closer look at AI, it is becoming increasingly evident that those professionals who are AI-empowered will surpass those professionals who are not leveraging the benefits of AI.

When businesses cultivate a corporate culture that is open to change management, and they provide staff the tools and resources needed to upskill and grow, it significantly sharpens their competitive edge. Technology, such as AI and greater automation, can be the key to unlocking these growth opportunities.

Businesses must not fear AI, but rather embrace it and use it to augment staff. This requires a shift in mindset and acceptance of the fundamental changes in how professionals do their work. It also means that tax professionals must think strategically about how they can reimagine their role as advisors and deliver even greater value-added services to their clients.

The research shows that, in the talent arena, one of the biggest transformations is the evolution of the roles that professionals will play in serving external or internal clients. Not only will automation weed out inefficiencies and provide professionals with more free time to focus on higher-level services, but AI will create even greater capacity for professionals to provide clients and stakeholders with additional value.

Many professionals surveyed said they predict that, within the next five years, new career paths will emerge (68%) as AI becomes a fixture in the workplace, as well as increases in non-traditional work roles, such as those that do not require the conventional tax qualifications (66%).

How will AI impact training and development?

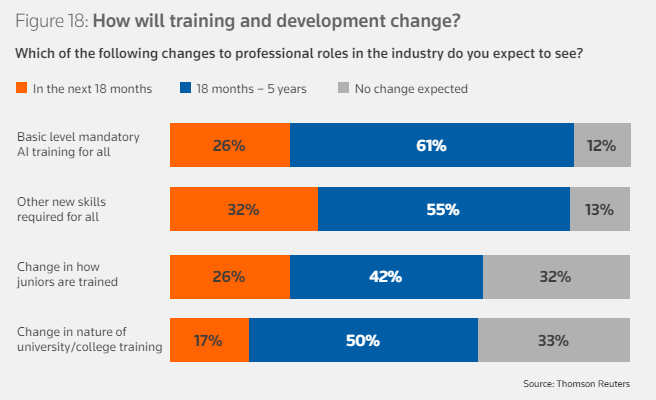

AI is bringing with it a rush of new training and development requirements. From basic training on how to make the best use of AI, to the need for upskilling and reskilling of existing talent, to changes in how junior staff are trained on the job, training and development needs will expand.

In fact, the majority (87%) of respondents said they believe everyone will need training on new skills, with the majority (55%) saying these needs may not show up until 18 months from now. At the same time, more than two-thirds of professionals said they see a change in how junior professionals will need to be trained.

As outlined in the report, two areas that are likely to change quickly are: 1) technology skills; and 2) the professionals’ capabilities around deepening expertise and specialization. For example, there will be evolving skillsets to learn how to maximize the outputs of AI — known as prompt engineering, which is a way of refining large language models with specific prompts for better output from generative AI services.

Furthermore, the time-savings and efficiencies gained through AI will create greater mental bandwidth for professionals to deepen their specialization in specific areas of expertise and focus on higher-level thinking.

That’s not to say, however, that AI may not present challenges within training and development. Many respondents pointed out, for instance, that early career professionals will still need oversight since they may lack the training needed to effectively interpret AI outputs. Another challenge may arise when seasoned professionals feel they are being asked to shift into more technologist roles and are frustrated by the amount of training and development that may be needed on AI. Such challenges are not to be overlooked as businesses increasingly embrace AI.

Ultimately, communication and transparency will be key to achieving organizational goals. Businesses must clearly communicate the benefits of AI, why they are making the shift, and ensure that tax professionals understand AI should be used to enhance and augment their work rather than provide quick answers.

Furthermore, businesses will need to adapt training programs to help staff oversee and interpret AI outputs and increase the implementation of AI solutions. This will ultimately enhance the staff’s capacity and range of abilities.

|

Future of Professionals ReportHow AI is the Catalyst for Transforming Every Aspect of Work

|

How will AI impact recruitment?

Recruitment disruptions are to be expected as AI increasingly impacts a business’s approach to talent.

The reality is that AI is already bringing some efficiencies to candidate screening and, going forward, is likely to play a fundamental role in attracting a new generation of tech-savvy accountants. This is an important factor as the tax industry has faced a dwindling pipeline of new talent entering the profession. The desirability of those firms that are viewed as tech-savvy and forward-looking will be greater.

And while the number of professionals may increase, research indicates a slight preference in forecasting a decline in entry-level positions. This finding makes sense when you consider that technology will automate many basic tasks and more emphasis will be placed on tapping those professionals with specialized skills and tech savviness.

It should be noted that some professionals, especially in-house professionals, have some concerns that AI could negatively impact recruitment goals.

As one survey responder suggested, “I think recruiting true talent will be more difficult because lack of skill will be concealed by applicants’ use of AI.” And some respondents expressed concern that changes to roles might make the job less attractive.

Nevertheless, technology is seen, overall, as a key element in attracting talent — especially a new generation of talent.

In short, expect to see more firms and corporations thinking outside of the box to target those professionals with more specialized skillsets and a greater understanding of technology.

Perspective from tax professionals

Change isn’t easy. And it’s important for businesses to keep in mind that, for some, AI may induce images of sci-fi robots storming in to steal their jobs before taking over the world and wreaking havoc. This, of course, isn’t the case but the fear of change is real.

According to the research, job displacement is one of the biggest macro-fears of AI, fueled by the perception that the new technology is a competitor — rather than a complement — to the professional skills and capabilities of talent. Some also expressed concern that professionals’ capabilities may no longer be valued as a result of AI.

Yes, there will be changes. However, businesses are in a great position to help tax professionals better understand these changes and how their jobs will improve as a result despite concerns. Tax professionals need to understand that AI is designed to enhance and augment their jobs, not replace.

As noted earlier, businesses must not overlook the importance of clear communication and transparency with staff. Doing so will go a long way in helping to alleviate fear of change.

To learn more about the impacts of AI on the tax profession and how your business can better attract, retain, and upskill talent in an AI-powered environment, be sure to check out the Future of Professionals report.