Activism Vulnerability Report: Q1 2022

Introduction and Market Update

This post will present findings from our Activism Vulnerability Screener for the first quarter of 2022 and discuss other notable trends in the world of shareholder activism and engagement.

Markets experienced heightened volatility during the quarter, with Russia’s invasion of Ukraine exacerbating already challenging inflation, pandemic, supply chain and oil price considerations, amongst others. Many nations, including the U.S., have imposed heavy economic sanctions on Russia, with almost 1,000 companies worldwide having curtailed their Russian operations as the war continues to escalate.

In May, the U.S. Federal Reserve took its first major step to combat the fastest reported inflation growth in 40 years by committing to a 50 basis-point rate increase, and rate hikes are likely to continue as inflation persists. This news caused financial markets to continue to trend downward with considerable volatility, and navigating this challenging inflationary, supply chain and human capital environment will remain a central focus for corporate executives, boards of directors and investors for at least the next 12 to 18 months.

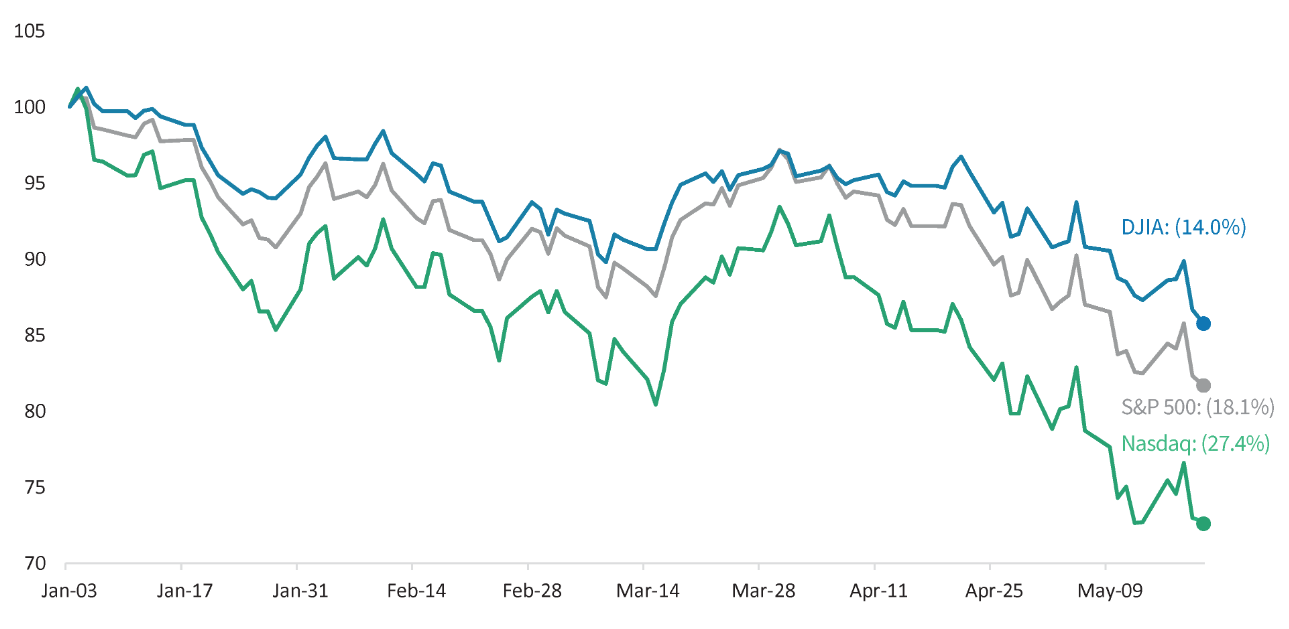

In the same month, the Dow Jones Industrial Average (“DJIA”) and the Nasdaq Composite each experienced their single worst day of declines since 2020. Likewise, the S&P 500 hit its lowest level in a year, approaching bear market levels. Year-to-date through May 20, the DJIA was down 14.0%, the S&P 500 was lower by 18.1% and the Nasdaq Composite fell by 27.4%. Over the same period, the CBOE Volatility Index (“VIX”), an index that measures market volatility, was up over 49.9%. As shown below, the Nasdaq Composite’s precipitous tumble has been further weighed down by its technology components, as investors are evaluating risks associated with lofty growth projections and potential recession impacts and are instead seeking stability from companies with sizable cash flows, i.e., value stocks.

2022 Year-to-Date Performance

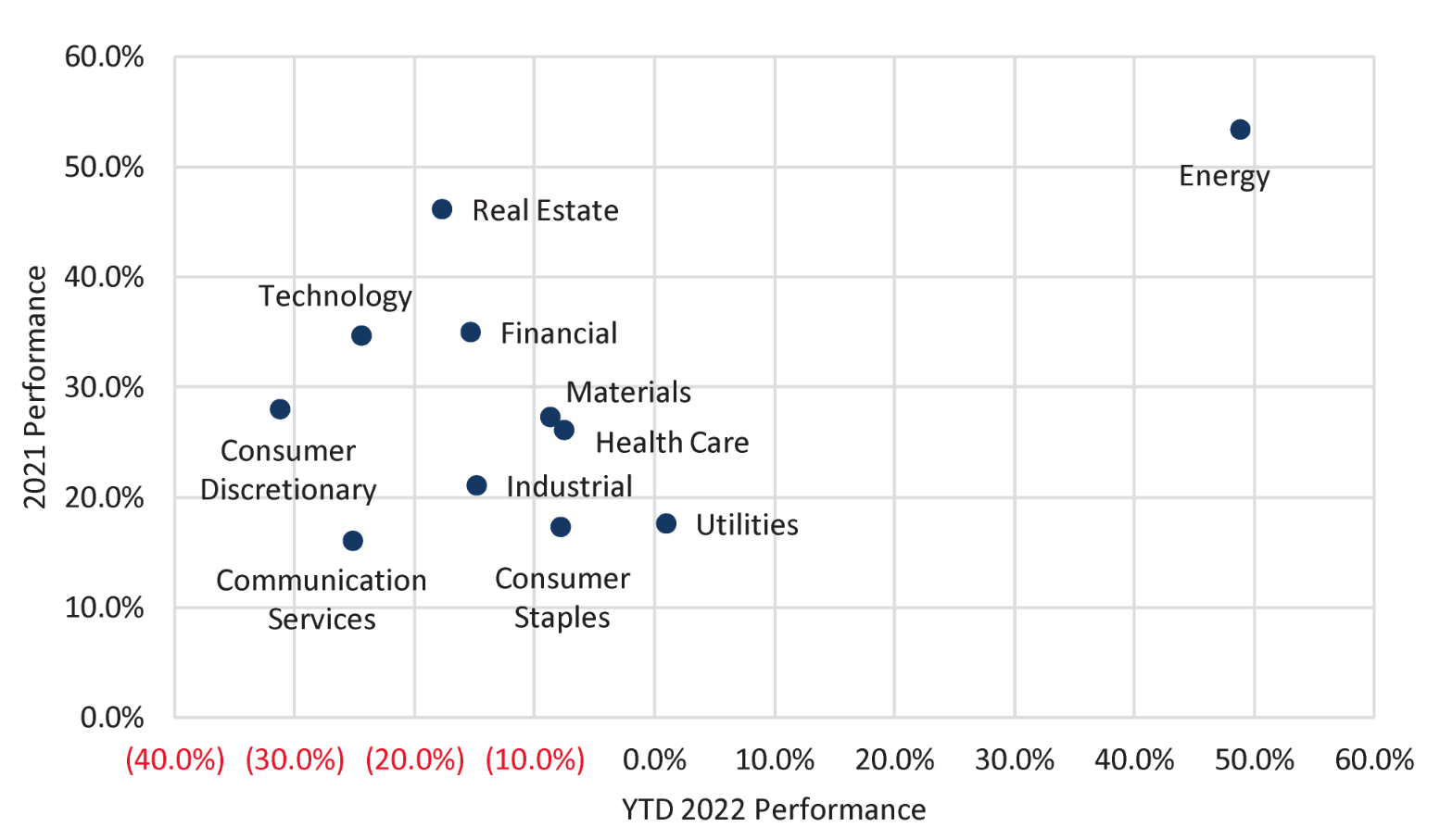

As measured by the S&P 500 Sector Select ETFs, the major sectors that drove the financial markets higher in 2021 have been some of the biggest laggards year-to-date in 2022. Energy remained the highest performing sector during both periods, as increased energy prices have significantly enhanced the sector’s profitability. The remaining sectors, however, reflected the broader markets’ sharp declines, with Consumer Discretionary and Communication Services as the two worst performing sectors thus far in 2022.

S&P Sector Level Indices: 2021 vs. Year-to-Date 2022 Performance

Activism Update

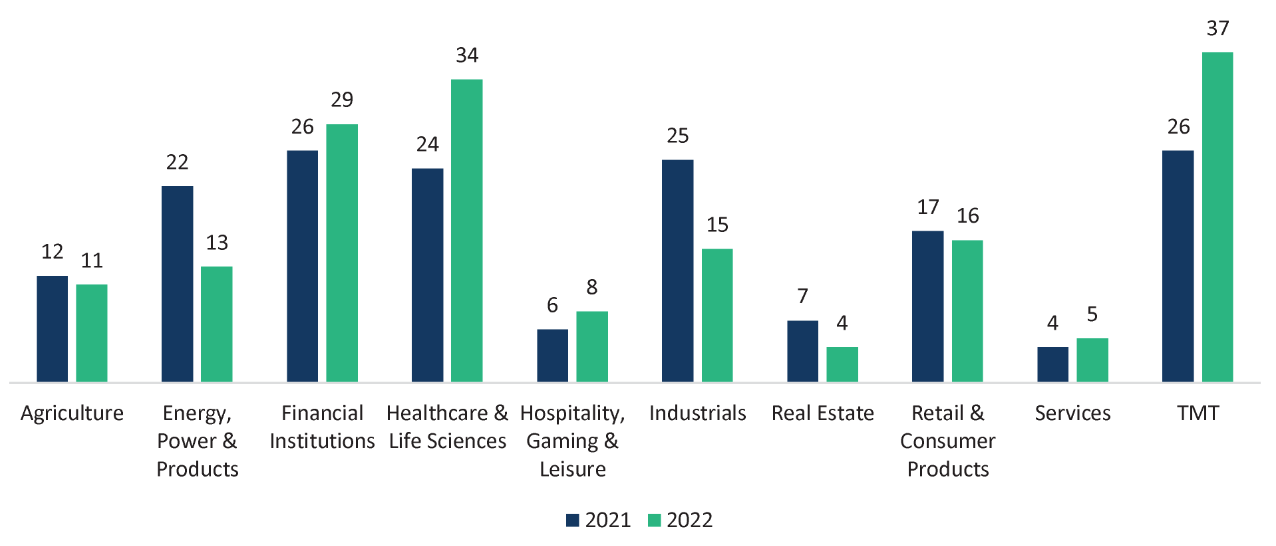

The first quarter of 2022 represented a mild activism resurgence with 172 campaigns launched against U.S.-based companies, compared to Q1 2021 when there were 169 campaigns launched. Technology, Media and Telecom (“TMT”) was FTI Consulting’s most targeted sector (of 10 total sectors) for shareholder activists in Q1 2022, representing 22% of all U.S. campaigns in the quarter, closely followed by Healthcare & Life Sciences (20%). Within the Healthcare & Life Sciences sector, Biotechnology companies have experienced notable activist attention. Financial Institutions represented the third most targeted sector. When compared to Q1 2021, Industrials experienced the largest decrease in activist attention, while the TMT sector saw the largest uptick, as determined by new campaigns launched.

Activist Campaigns by Sector—Q1 YoY Change

Shareholder activists have continued to target large-cap companies (>$10 billion market-cap) at an increasing rate. A longer-term view of the trend suggests that activists, with sufficient assets under management to initiate a meaningful stake, prefer to target companies with a multitude of operational and financial levers for value creation and more robust shareholder bases. In Q1 2022, large-cap companies represented 48% (82 total) of all new U.S. activist campaigns, up from 47% (80 total) of all campaigns in Q1 2021.

However, despite the increase in campaigns launched, board seats gained by activist investors in the U.S. in Q1 2022 represented the fewest gained in the first quarter over the past four years, with 39 seats gained. The first quarter of 2022 also witnessed the fewest settlements through the first quarter in the past four years with just 23 during the period.

Moving to individual activists, high-profile funds continued to deploy the most capital in Q1 2022, with Third Point Partners leading the charge as the most active fund with $5.7 billion invested in new campaigns, followed by Elliott Management and Starboard Value, with $1.7 billion invested each.

Other established, high-profile activists have been generating significant media attention with ESG-focused campaigns launched during the quarter. In February 2022, Carl Icahn nominated two dissidents to the Board of McDonald’s Corp., due to the perceived mistreatment of its suppliers’ pigs, despite only owning a stake worth roughly $50,000. In March 2022, Icahn launched a similar campaign at Kroger. The billionaire activist has urged BlackRock, which voted in favor of 47% of ESG shareholder proposals in 2021, as well as other ESG-minded investors, to champion this cause. So-called “trojan horse” campaigns, where activist investors combine ESG initiatives with more traditional activist proposals, allow activists to appeal to a broader set of institutional investors, many of whom are expressing growing interest in ESG investing and can then lend their pressure to these overall campaigns. Support from the so-called “Big Three” asset managers (BlackRock, Vanguard Group and State Street) heavily contributed to the unlikely victory of Engine No. 1 against ExxonMobil last year, when the first-time activist won three seats on the oil giant’s Board, despite owning just a small fraction of ExxonMobil’s shares.

In late May, however, McDonald’s shareholders, including BlackRock, voted to reelect all of McDonald’s directors based on preliminary tallies.

Effective January 2022, BlackRock announced that it would give its largest investors the opportunity to participate in proxy voting decisions including board seats, ESG proposals and say-on-pay; this opportunity will be extended to approximately 40% of BlackRock’s $4.8 trillion in index equity assets in 2022. Though it is unclear which of BlackRock’s institutional clients will take advantage of their new influence in voting, the asset manager will likely use this as a competitive advantage to attract and retain clients in the future. If other index funds follow suit, proxy fights are likely to be less predictable and it could become more difficult for companies to influence the voting process by appealing to a small cohort of large investors.

Breakout/Case Study

In the fourth quarter of 2021 and into the beginning of 2022, FTI Consulting observed an interesting trend that involved current or former leaders of a company initiating public campaigns against their current or former employers to wrestle back control. Public disputes among company leaders or family members of this nature have occurred in the past and do occasionally result in proxy contests; however, having three occurring simultaneously is unusual. If the dissidents in each of these campaigns are successful, other disgruntled, current or former employees or founders may be encouraged to push for changes they deem necessary for their respective companies.

Velodyne Lidar

Company founder David Hall was removed from his role as Executive Chairman in early 2021 and left the firm shortly after. In October 2021, he initiated a campaign against the company with plans to nominate two directors (including his wife, Marta, who was already a director) to the Board, claiming the current Board members misguided the company, resulting in the rapid decline in share price. In March 2022, Hall added himself to the slate. Velodyne pushed back, claiming Hall was acting in his own self-interest and pointed to an independent investigation conducted by the company’s Audit Committee that allegedly asserted Hall is unfit to regain power within the company. Velodyne also claimed Hall was trying to divert attention from a lawsuit the firm filed against him for misappropriating around 300,000 company documents. In late April, Hall’s wife resigned from the Board of Velodyne. The campaign is ongoing, with the annual meeting set for June 16.

Aerojet Rocketdyne

In February 2022, the company’s Executive Chairman, Warren Lichtenstein, put forth a seven-person slate of directors, allegedly seeking to retain his seat on the Board, while claiming management was not doing enough to protect shareholders if the proposed sale to Lockheed Martin fell through (which it did on February 14). Lichtenstein then successfully sued the current CEO (Eileen Drake) and three other directors, legally restraining them from using company assets in the proxy fight. Both sides have claimed that the other is “pursuing personal gains” and are now dueling over scheduling, with Drake calling for a special meeting in late-May, while Lichtenstein is pushing for a late-June annual meeting. The matter is ongoing and will be decided at their upcoming meeting, which has yet to be set.

Lifeway Foods

In March 2022, two members of Lifeway Foods’ founding family launched a campaign on the heels of their own departures from the company to remove a relative from the Board and CEO role. Edward and Ludmila Smolyansky have nominated themselves and three others on a slate for the upcoming annual meeting and have also called for a strategic review. In early May 2022, Lifeway added two independent directors to its slate of existing nominees, expanding the slate to seven director nominees. As of May 20, 2022, Lifeway Foods failed to file its 2021 Annual Report after the discovery of an error in deferred income tax liability reporting, and the company recently restated several filings dating back to Q1 2020. This contest is ongoing.

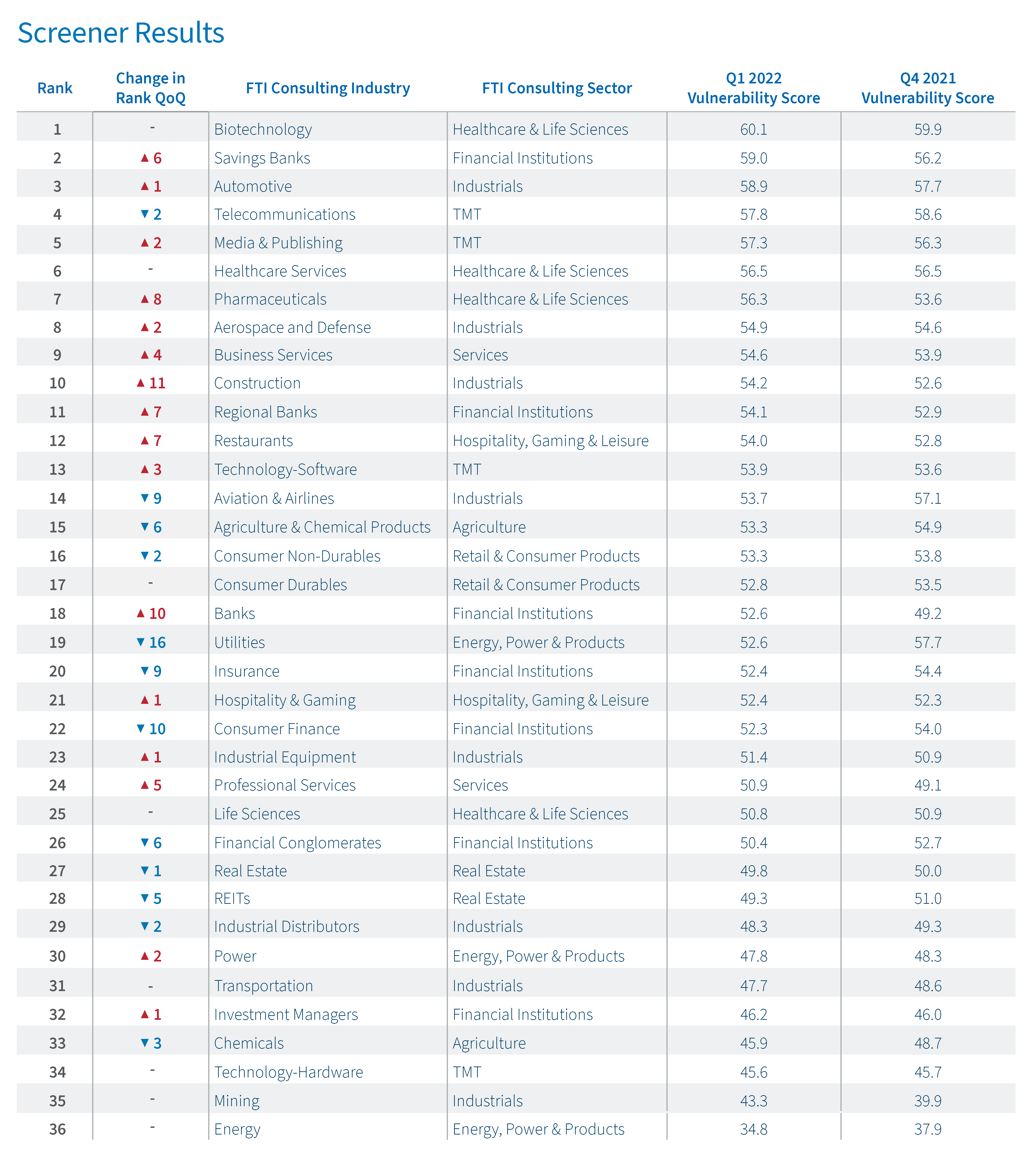

Screener Results

The vulnerability ranking volatility many industries experienced in Q1 2022 contributed to four industries moving by 10 or more places this quarter, and three new industries entering the top 10 most vulnerable industries.

For the second quarter in a row, Biotechnology held the top spot for the most vulnerable industry, while Energy retained its post as least vulnerable. Notable movers were Pharmaceuticals, which jumped eight spots to become the seventh most vulnerable industry, Construction, which jumped 11 spots into the top ten most vulnerable industries, and Utilities, which dropped 16 places, exiting the top ten most vulnerable industries for the first time since Q2 2020. And, as may have been expected, Aviation & Airlines dropped a sizeable nine spots, continuing its downward trend as travelers increasingly put the worries of the pandemic behind them.

Observations & Insights

“The sanctions and export controls deployed by the U.S. and its allies against Russia, as well as Belarus, have been unprecedented in their breadth, the level of coordination among so many countries and the speed at which they have been announced. Certainly, there are direct impacts to the U.S. and global markets related to prohibitions on the importation of Russian oil. There are also other significant supply chain disruptions (e.g., fertilizer, specialty gases for semiconductor manufacturing processes, palladium and other metals), potential energy shortages primarily across Europe and increased uncertainty leading to selloffs in global markets.

We’ve even seen the Biden Administration explore the possibility of increasing the supply of oil from places like Saudi Arabia, but also from other countries that are themselves subject to significant sanctions, such as Venezuela. Beyond that, the costs for businesses to comply with the sanctions and export controls are meaningful, and businesses will have to spend considerable time and effort to understand their impact and how to comply.

The self-imposed corporate policy decisions to exit Russia that go beyond the legal requirements set up the possibility of litigation related to force majeure clauses, divestment restrictions put in place by Russia and shareholder lawsuits related to whether fiduciary obligations to shareholders have been upheld. On one hand, if you refuse to exit Russia, your company will face serious backlash from the public and your stock price may tank based on this reality. On the other hand, if you choose to exit and abandon billions of dollars in business, assets and future earnings, you could face lawsuits for the economic losses caused by that decision.

While some of the decisions being made by global industry may seem easy from an ethics and morals perspective, the reality of executing those decisions and living with the fallout from them will be hard for many companies.”

— Matt Bell—Senior Managing Director, and Eric Rudolph—Managing Director, Export Controls, Sanctions & Trade

What This Means/Conclusion

Given the increase in activist campaigns in Q1 2022 compared to the same period last year, it does not appear that the recent market volatility has muted activism like it did at the onset of the pandemic in 2020, when campaigns launched during the year were down 34% from 2019. If interest rates continue to rise and stocks continue to teeter, there may be more opportunities for activists to find attractive entry points and generate significant alpha at underperforming companies.

What remains to be seen is how private equity investors will deploy capital in the future if public markets continue to deteriorate. Though these investors flocked to technology companies and encouraged rapid spending when the sector was trading at record-high valuations, the recent Nasdaq Composite sell-off has caused these firms to tighten their belts. This slowdown in capital infusion may trigger a deceleration in the number of companies entering the public markets, especially via the SPAC market, which is being closely watched by the SEC. And with IPO activity down 72% compared to the same period last year, IPOs will likely only pick up steam once active SPACs either close on a tense acquisition market, or run out of time and expire later in the year and in the beginning of 2023.

Endnotes

1 back)

2 back)

3FactSet. Market data as of May 20, 2022.(go back)

4Ibid.(go back)

5Ibid.(go back)

6Ibid.(go back)

7Insightia.(go back)

8Ibid.(go back)

9Ibid.(go back)

10 back)

11 back)

12 back)

13 back)

14 back)

15 back)

16 back)

17 back)

18 back)

19 back)

20 back)

21 back)

22 back)

23 back)