Acquisitions Often Fail… So Are They Worth the Risk?

The Art of M&A® / Strategy

An excerpt from The Art of M&A, Sixth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux

Research shows that a significant percentage of acquisitions “fail” in some way. Are they worth the risk?

This is a question of facts and circumstances. Sometimes an acquisition is the right strategic choice, and other times this would be the wrong move. Chapter 9 of this book, on postmerger integration, discusses postmerger returns, based on the latest research.

To begin with, let’s consider the clearly positive case of one small company buying another in an emerging industry. Few would criticize Alteryx’s 2021 decision to acquire Lore as a kind of “acqui-hire” in its roll-up of companies in the cloud-centric engineering space.19

This said, it is notable that acquisitions are particularly risky for small-cap firms in public markets because of the chain of events that may occur if shareholders do not agree with the deal. Whereas companies with a vast number of holders can weather a shareholder revolt over an unpopular deal, a small-cap company cannot.

- First, if investors sell the company’s stock, short it, or simply don’t trade it at all, stock price and/or volume might suffer, making any attempts to access the equity capital markets more dilutive. In the worst-case scenario, it could all but foreclose access to the equity markets.

- Second, if trading volume dries up, the company also won’t be able to use its stock as acquisition currency; that is, high-quality companies won’t want illiquid stock as purchase consideration.

- Third, high-quality, sell-side research firms have seen the same small-cap M&A “movies” that fund managers have, so the chance of getting impactful research is going to be diminished.

- And, fourth, but certainly not least important, many small-cap officers and directors underestimate how much a pressured/ languishing stock can impact employee recruitment, retention, and morale.20

Do you mean to say that small-cap, buy-side folks are intuitively against all acquisitions? Even “one-offs”?

The short answer is that organic growth is nearly always going to be valued more highly than corporate acquisitions in the small-cap realm. That said, there is a “flavor” of small-cap M&A that can be quite successful: “tuck-in” deals that obtain technology/IP assets, or “acqui-hire” deals made to obtain talent. It is typically faster, easier, and cheaper to buy such assets than to buy an entire company. And with a tuck-in you are not buying the liabilities, business models, or corporate cultures—you are just buying tech or talent.

SWOT ANALYSIS

What exactly is SWOT analysis, and how is it used in the strategic planning process?

SWOT analysis is a useful framework often used at the kickoff of a strategy formulation that is intended to help management develop a sustainable niche in the company’s target market. One early proponent of this idea—perhaps the originator—was Albert S. Humphrey, a management consultant for the Stanford Research Institute (now known as SRI International) in the 1960s.

Ultimately, SWOT analysis is intended to identify the internal and external factors that either support or hinder an organization’s ability to achieve its stated mission.

Factors internal to the organization are its strengths and weaknesses, while external factors are the opportunities and threats presented by the outside operating environment.

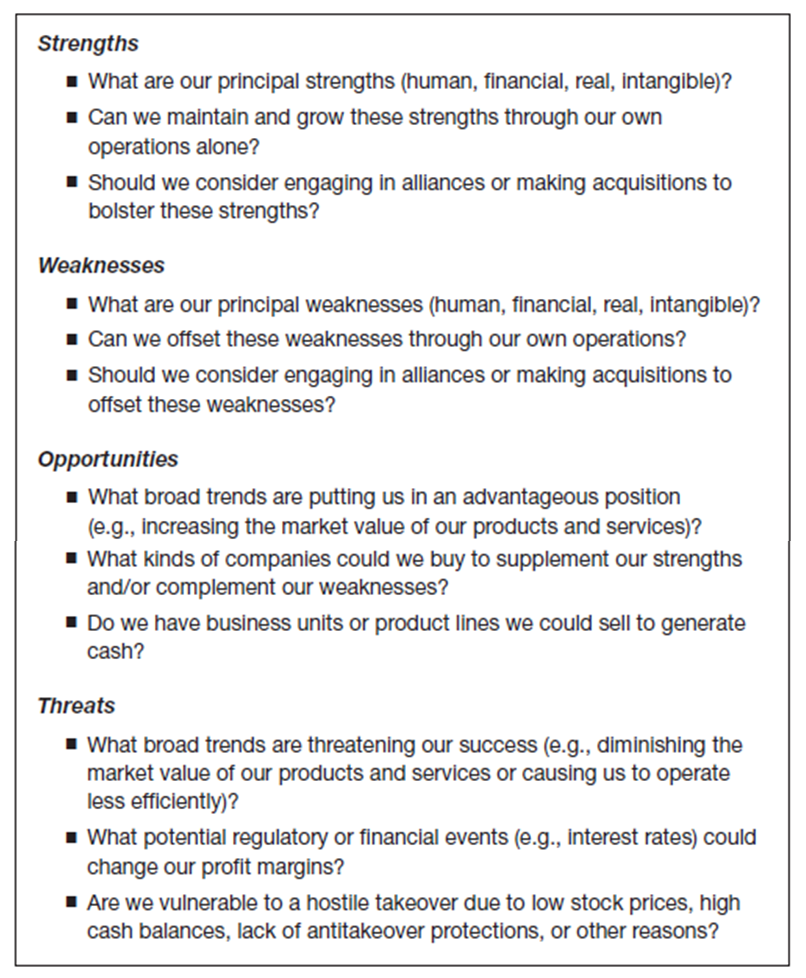

Exhibit 2-7 provides sample questions that can help to guide an organization’s SWOT analysis.

Sample SWOT Analysis Questions for M&A

Exhibit 2-7

The SWOT approach implies that the ideal M&A process will target industries and companies where an acquisition will exploit strengths and/or shore up weaknesses.

In the 1970s, inspired by the SWOT model, Stanley Foster Reed developed a proprietary methodology for determining strategic direction and target fit called the Wheel of Opportunity and Fit Chart (WOFC) approach, which allows decision makers to generate and prioritize target criteria.21

Planning of this sort greatly reduces the cost of analyzing randomly submitted opportunities. Do they fit at all? If so, how well do they fit?

A truly sophisticated strategic plan will measure quantitatively how well or how poorly potential opportunities fit into it, and, given several competing opportunities, it will rank them against each other by degree of desirability to a team of senior managers and trusted advisors. (See Exhibits 2-8 and 2-9 for samples).22

_________________________________________________________________________

Learn more about mergers, acquisitions and divestitures at M&A Leadership Council’s virtual or in-person training courses. Network with other M&A professionals while our expert consultant trainers will get you ready for your next transaction (or help an ongoing one) through practical insights, group discussions, case studies, and breakout exercises.

Lajoux, Alexandra Reed with Capital Expert Services. The Art of M&A, 6th Edition: A Merger, Acquisition, and Buyout Guide. United States of America: McGraw Hill, 2024. Pp. 23-26. Print.