Accounting Firm Leaders Discuss Challenges/Benefits of a Remote Workforce

Employers and payroll professionals face a complex web of challenges while managing remote and hybrid work arrangements, particularly concerning state income tax withholding and compliance with varying state labor laws. However, implementing clear policies, fostering effective communication, and leveraging technology can help organizations navigate the ever-evolving landscape of remote and hybrid work.

Recently, Checkpoint Payroll Update spoke with Kim Wylam, Managing Principal of Baker Tilly’s human capital consulting practice and Timothy J. Beary, a state and local tax (SALT) principal with Baker Tilly’s specialty tax practice, about managing the obstacles and highlighting the benefits of a remote workforce.

Remote work challenges

One of the primary hurdles in remote work arrangements is the potential for multiple tax nexus points, leading to intricate taxation scenarios.

Regarding nexus, Beary said that a main concern with remote work arises “when you have an employee working in another state that maybe the employer is not located in – that employee being physically located there – most often gives the employer nexus.” He explained that in such a situation, the employer would typically have to collect tax withholding on that employee’s income and report it to the proper tax jurisdiction.

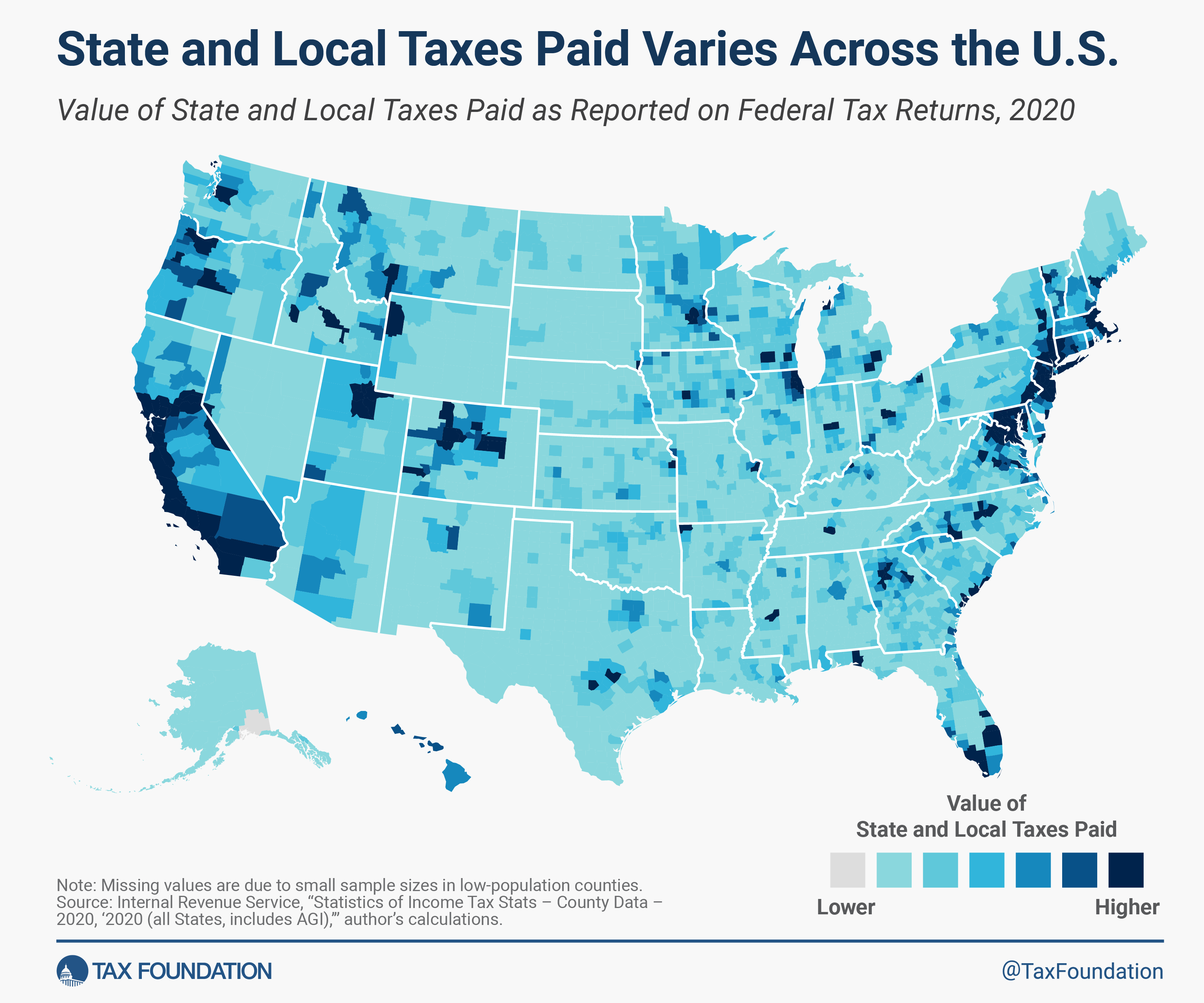

Wylam added that these additional tax jurisdiction concerns can also occur at the local level. “So, not only do you have to worry about the state, but most of our larger metropolitan cities in the U.S. all have their separate set of taxation rules as it relates to employees,” she said.

And there are more than just tax challenges an employer may face when employees work remotely. “It’s not just the payroll taxation issue,” Wylam stressed. She explained that states have differences in their employment laws, which can create multiple layers of complexity regarding compliance, including leaves of absence, paid sick and disability leave, break times, and pay transparency laws.

Additionally, Wylam explained that employees working remotely do not always notify their employer when they move to another state, which may result in an unemployment claim from a state that the employer is not even licensed to do business in if the employment relationship is terminated.

Failure to properly address these challenges can result in penalties and other issues. Wylam noted that employers should aim to avoid being in a position to deal with tax and non-tax compliance issues for remote workers in a reactive, retrospective manner and instead plan ahead to avoid dealing with these issues after the fact.

Shifting to hybrid

During the COVID-19 pandemic, remote work became much more prevalent, with a U.S. Census survey estimating that the number of people working from home tripled between 2019 and 2021. Post-pandemic, some employers began requiring employees to report back to physical office locations. However, others adopted a flexible work arrangement that allows certain employees to work remotely some of the time.

Wylam said that hybrid work is the preferred method for both employers and employees, based on several studies and surveys she recently read. Wylam noted the importance for employers to define their hybrid relationship and provide clear expectations for both parties. “You really want to be as detailed as possible to define what the working situation needs to be for employees,” she said.

Wylam also said that because the employer is ultimately responsible for understanding where their employees live, it is important to be familiar “with the labor laws of each state when [allowing] employees to work outside of the physical location.” She urged implementing flexible policies but also to understand the compliance requirements with a thoughtful process to ensure the policies are clearly defined.

Wylam believes that the “laundry list of paid leaves is usually the single most hot topic that employers have to contend with” when considering hybrid work arrangements because “many of these leaves have a taxation element” and “they all have an eligibility and a benefit requirement,” which makes it important for both the employer and employee.

Company communication and AI

Wylam talked about the importance of communication when it comes to understanding policies on remote work arrangements. This can be a challenge for employers of all sizes, though Wylam pointed out that smaller and mid-sized companies can face more issues with tax and compliance requirements compared to larger enterprises when allowing remote work across multiple states. “The larger companies have better technology to be able to assist them in this manner,” Wylam said.

She noted the importance of having systems in place to help catch all of the complexities that come with a multi-state workforce. “What’s the mechanism in which somebody changes their residence?” Wylam inquired. “Do you have a system in place that’s going to note…the employee needs to complete this form?”

She posed several other questions that are important to managing a remote workforce, like if a business has prompts in place if it is not registered in a state where an employee may begin working remotely, so the employer can withhold income tax and pay unemployment tax. “The payroll manager or the HR person [or] the controller, they need to really be keeping their eye out for when people are moving,” Wylam said.

When it comes to using artificial intelligence (AI) as a tool to help with planning and communication for having an effective remote workforce plan, Wylam said that the technology can be helpful from an informational standpoint “to be able to educate both the employer and employee and what the next steps need to be.” She added that advanced systems have triggers and workflow components to notify others of changes or actions needed, such as payroll, benefits and HR. “It’s helping those departments be able to perform the action faster,” Wylam said.

Beary also pointed out that, in today’s world, people work from anywhere using mobile devices and non-invasive AI technology can be used to track location changes and send reminders to employees and employers to stay on top of taxation and other issues when it comes to remote work. “To stay in front of it from both an employee and employer standpoint, so you don’t play catch up too much,” he said.

Reciprocity

Currently, there are 30 reciprocal agreements across 16 states and the District of Columbia, facilitating tax compliance for remote workers in those regions. Without reciprocity, remote workers who live in one state but work in another could potentially face double taxation.

Beary explained that employers could struggle to understand when to trigger filing and reporting requirements for payroll taxes due to varying rules across states. Rules vary greatly, from as little as withholding tax for an hour of work to up to 30 days if under a certain threshold.

Beary stressed the importance for employers to understand where their employees are moving and when to start complying with tax reporting and compliance requirements. “It’s very challenging for the employers especially to understand when and where their employees are moving to, but then once they get there, when [does the employer] have to start actually doing anything from a tax reporting and compliance standpoint,” he said.

Convenience of employer

Convenience in the employer rule states that payroll tax is withheld and paid where the employer is located, not necessarily where the employee is working. Currently, only a few states have adopted the convenience of the employer rule, including New York, Connecticut, Delaware, Nebraska, Pennsylvania, and New Jersey.

For remote workers and employers, the convenience of the employer rule can create complex tax situations, potential double taxation, and the need for careful consideration of policies and individualized remote work arrangements to ensure compliance.

“Where you have to be careful is there’s not very many states that still have these rules,” Beary started. “If you have a state on one side that has the convenience of the employer rule, but on the other side doesn’t, it can result in potential double taxation.”

Wylam added that “the rule only applies if the remote work location is not necessary to perform the job duties” and pointed to increased scrutiny regarding positions that permit employees to work remotely. She noted that there is a particular focus on ensuring that remote work arrangements are convenient and fully supported by all necessary elements.

Best practices

Beary believes a best practice for businesses to consider regarding remote workers is to have clear policies for changing work locations to help prevent legal and tax issues. He also said that employers should plan for changes upfront and have procedures for approval, but should also consider changes that may occur after the employment relationship begins.

“You can plan for this all upfront when you hire the employee and come to an agreement on where they’re going to work…but when that changes, especially when it changes without the employer knowing or may knowing on very short notice is where it gets really tricky and the reporting gets pretty difficult,” Beary said.

Wylam noted that additional help can be found with a “payroll system that’s going to flag those situations” related to remote work, taxation, and other compliance-related scenarios. “You want to make sure that your payroll system or your outsourced payroll provider is staying on top of this,” she added.

Wylam also explained that it is even more important for employers with a remote workforce to pay attention to state and local taxation “since the COVID-19 rules went away and now states are getting a lot more prickly around these situations because they want their dollars.”

Beary said that he has observed smaller and mid-sized employers competing with larger businesses with remote work offerings when it comes to attracting talent. However, a challenge can arise for smaller businesses when it comes to tax compliance and reporting. “The biggest companies are probably already reporting and filing payroll tax returns in all the states anyway,” he noted.

The difficulty, Beary believes, is when the smaller companies have a presence in new states with more complex rules, like California. “Now, it’s like, wait a second, I have 10 new things I have to do here that I didn’t realize I had to do before,” he said.

Ultimately, both Beary and Wylam agree that, overall, offering remote work can be helpful to both employers and employees. “It’s really opening up doors to candidates, as well as employers, [by] being able to extend their reach and open up their candidate pool,” Wylam reasoned.