A Survey of Patenting Activities for Different Physical Realization Methods

“As manufacturers begin to introduce commercially viable quantum computers that outperform classical counterparts and generate substantial revenue, they will begin to become targets for patent assertions, making the competition in the realm of intellectual property increasingly relevant.”

The year 2023 marked another year of rapid advancements in quantum computing technology, showcasing significant progress in key areas such as scalable quantum computing and quantum error correction. Multiple physical realization approaches or modalities for creating quantum bits (qubits) are under development, offering different tradeoffs in performance metrics such as qubit count, error rate, decoherence time, and gate speed. Patenting activities are effective indicators of innovation speed and resource distribution in a technology field. As 2024 begins, this post explores the newest development focus and trends in the quantum computing industry through the angle of its patent landscape and discusses strategic considerations for patenting in this rapidly evolving field.

Patent Landscape

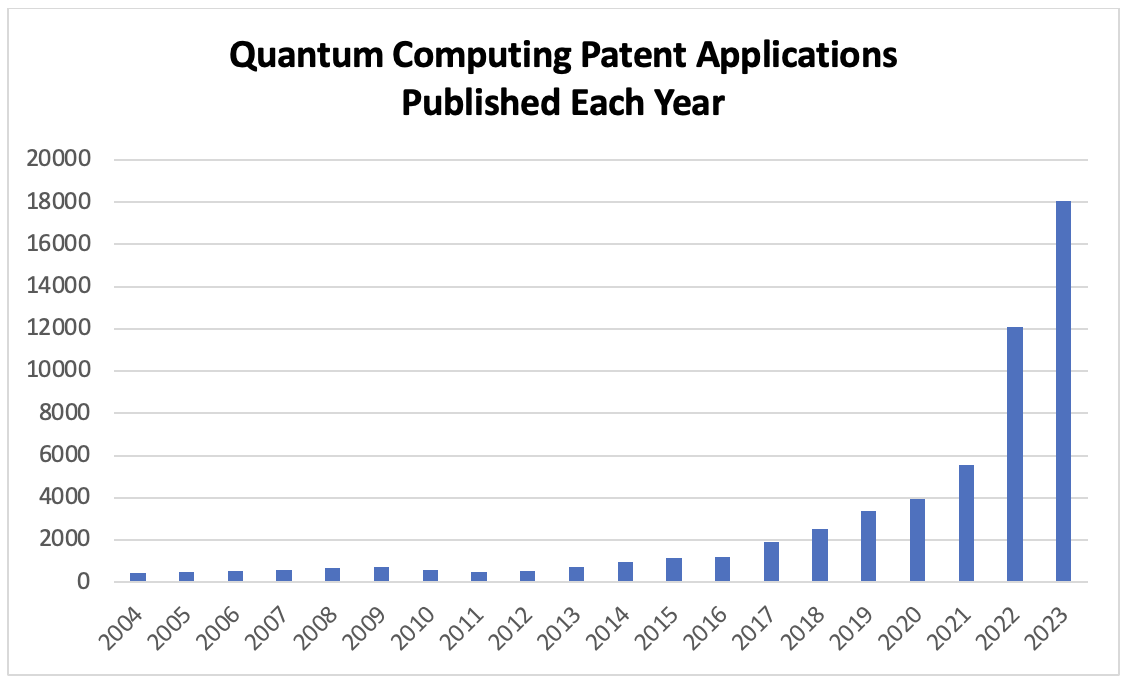

The publication rate of new quantum computing patent applications continued its upward trajectory through 2023.

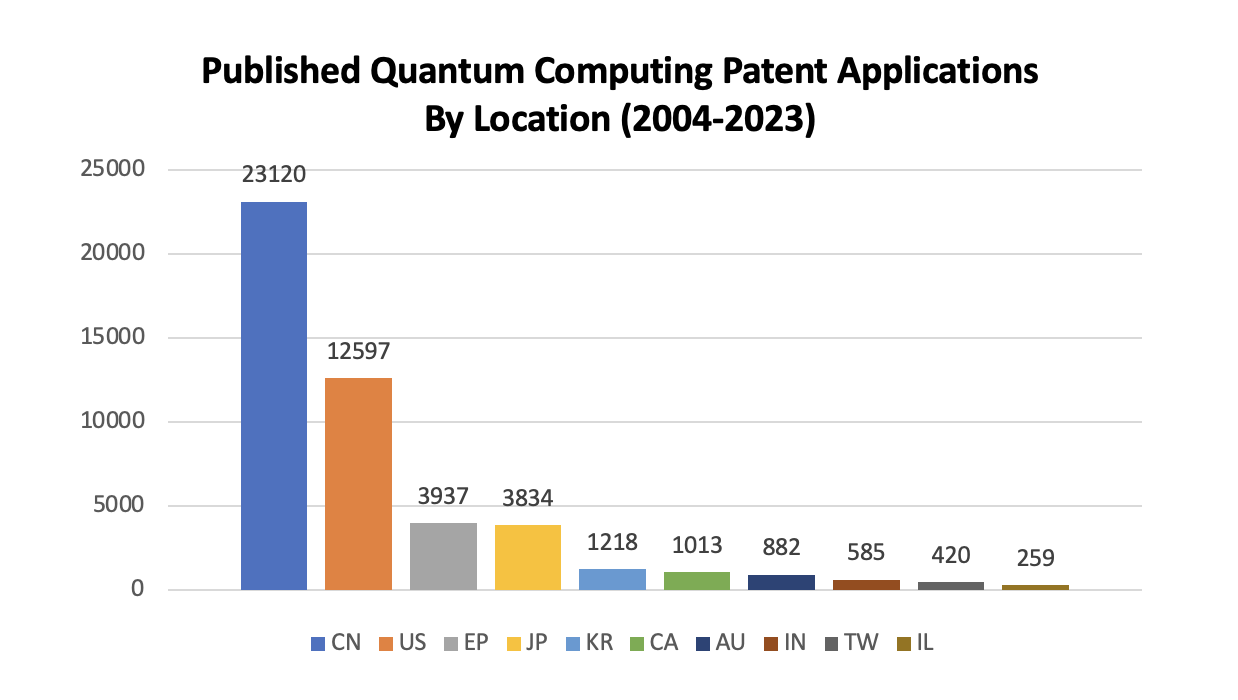

As shown below, the China National Intellectual Property Administration (CNIPA) leads in the number of published quantum computing patent applications, with the U.S. Patent and Trademark Office (USPTO), the European Patent Office (EPO), and the Japan Patent Office (JPO) following closely. Significant numbers of quantum computing patent applications were also filed with the patent offices of South Korea, Canada, Australia, India, Taiwan, and Israel. While companies have the option to file patents globally, there is a tendency to prioritize filings in home countries, followed by strategic filings in key foreign markets. This distribution pattern of patent applications suggests the leadership of China, the United States, Europe, and Japan in quantum computing research and investment, but also reflects their significant market sizes and established patent systems.

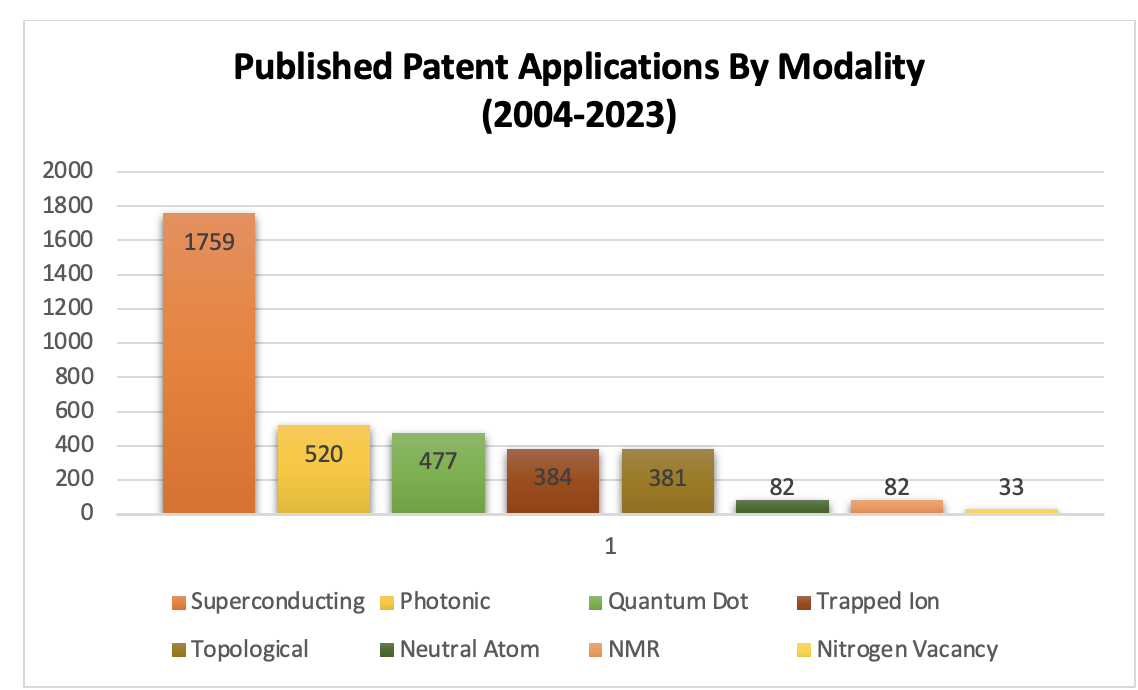

The diagram below illustrates the distribution of patent applications directed to leading quantum computer modalities (a patent application is categorized as directed to a particular modality if its abstract or claims contain keyword(s) associated with that modality). The number of patent applications directed to superconducting quantum computing nearly matches the total number of other modalities combined. This suggests that superconducting quantum computing is the most commercially mature approach and reflects the influence of resourceful large corporations that lead this area. Following superconducting quantum computing, the highest numbers of patent applications are for technologies based on photonic, quantum dot, trapped ion, and topological methods. The relatively few patent applications for neutral atom, nuclear magnetic resonance, and nitrogen vacancy quantum computing indicate that these technologies are primarily being developed by academic institutions and early-stage companies.

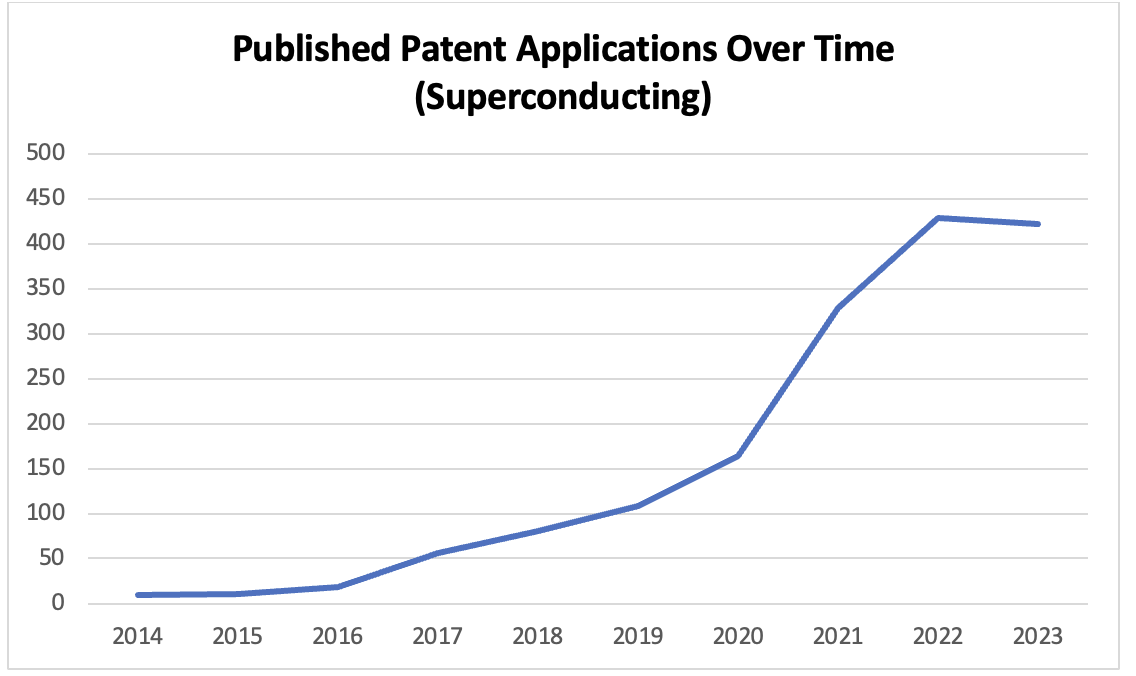

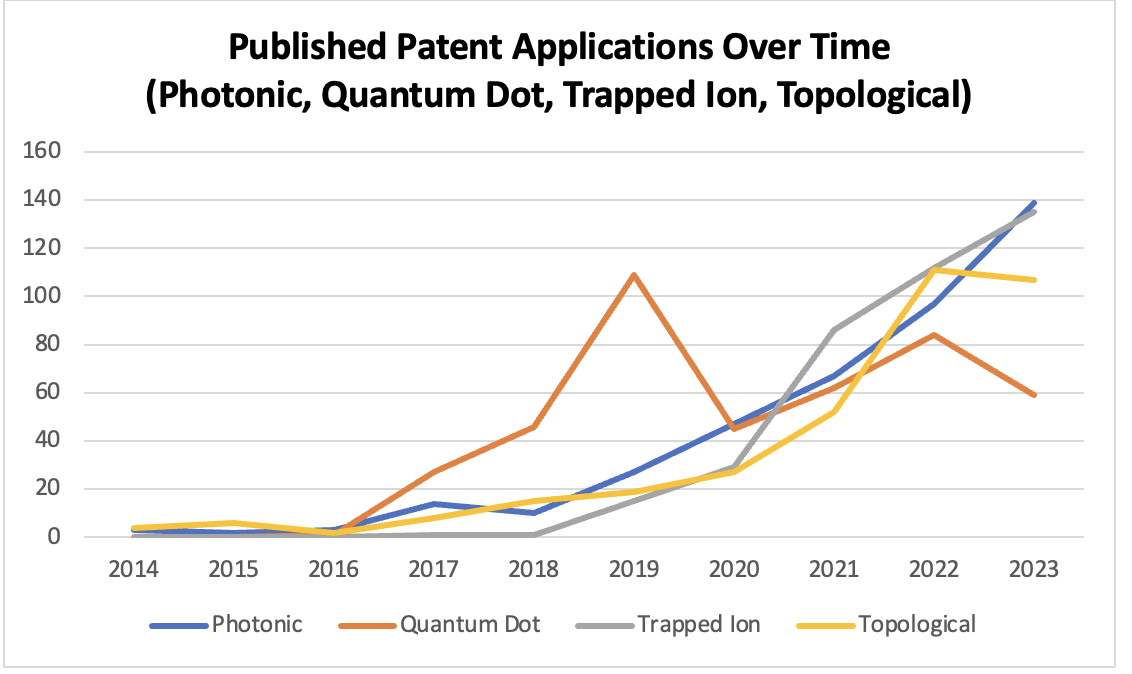

The trends in patent filing activities across different physical realization approaches for quantum computing are illustrated below. While the number of published patent applications for superconducting quantum computing generally exhibits a healthy growth trend, there is a noticeable slight slowdown in 2023.

Patent application publication rates for both photonic and trapped ion quantum computing have been rapidly increasing. Topological quantum computing experienced a slight decrease in patent publications in 2023. Notably, quantum dot technology reached a peak in patent application publications in 2019, followed by a downward trend, potentially indicating waning interest in this area.

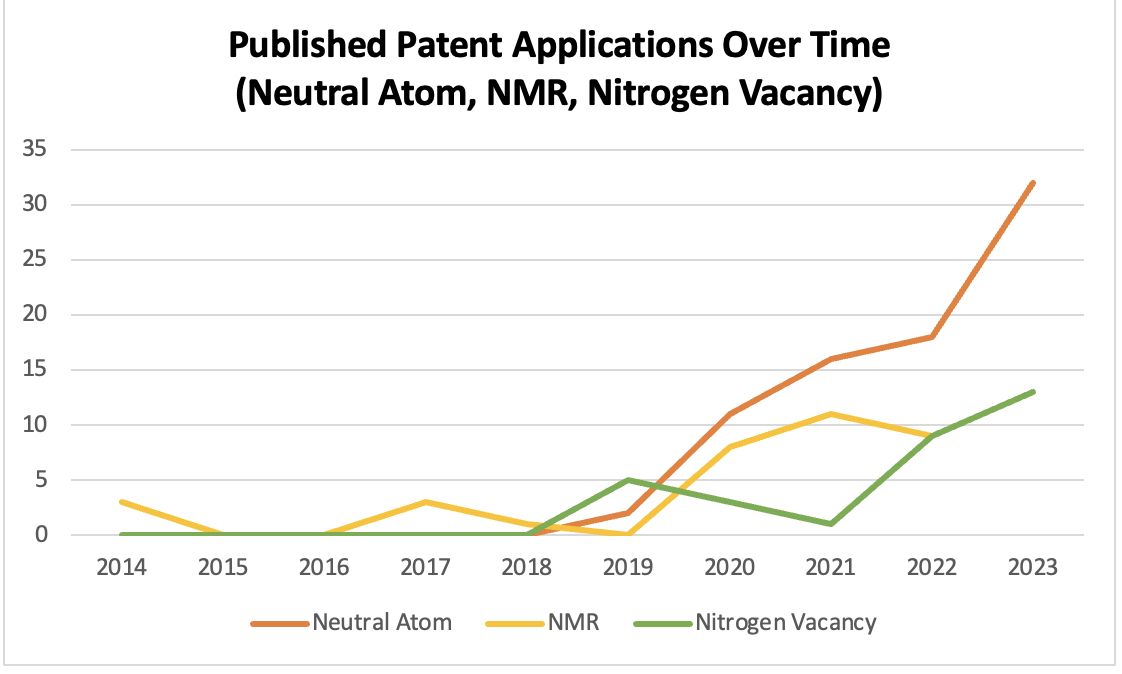

Despite their small numbers, patent applications for neutral atom, NMR, and nitrogen vacancy quantum computing have seen a rapid increase in recent years. Notably, the growth pattern in neutral atom quantum computing closely mirrors that of photonic and trapped ion quantum computing, but with a three-year delay. This trend indicates the potential of neutral atom quantum computing to become a mainstream approach.

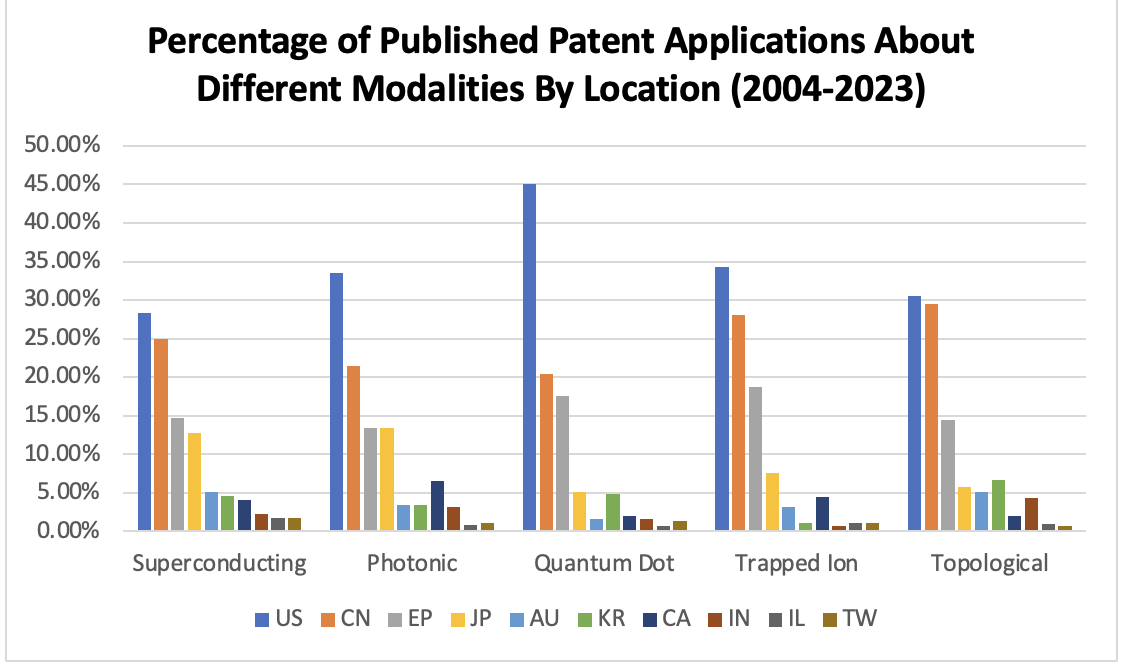

The following chart depicts the number of patent applications for each mainstream quantum computing modality, as published by major patent jurisdictions. Notably, although China has the highest overall number of quantum computing patent applications, the United States leads in patent filings specific to each main physical realization approach. This may suggest that the U.S. leads in R&D activities for quantum hardware, while China focuses more on quantum software and applications of quantum computers.

Companies from different countries exhibit varying emphases on different quantum computing modalities. For instance, the number of U.S. patent publications dominates in photonic and quantum dot technologies, whereas Chinese publications are notably competitive in superconducting, trapped ion, and topological quantum computing. European patent publications display a more balanced distribution across various modalities, while Japanese filings demonstrate a particular concentration on superconducting and photonic technologies.

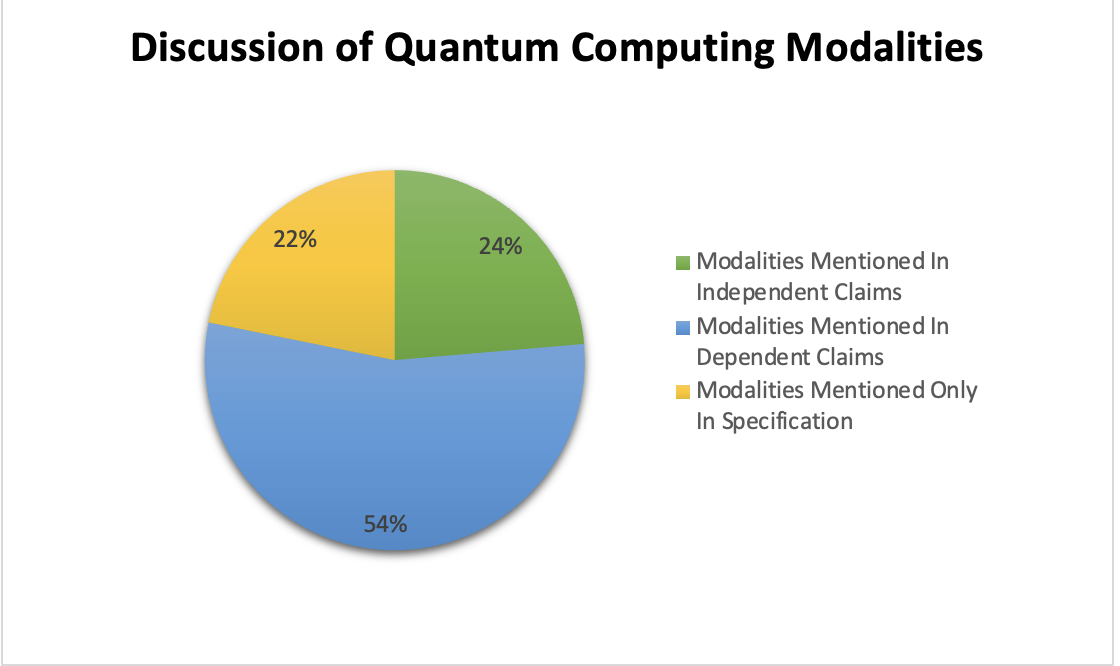

This post also examines the extent to which physical realization of quantum computing is referenced in patent applications. Among the patent applications that mention at least one physical realization modality, it is found that 24% of these applications incorporate keyword(s) associated with at least one modality in their independent claims, potentially limiting the patent’s scope to a particular modality. Meanwhile, 54% include a modality in dependent claims but not in independent claims, indicating that the technology might be suitable for various quantum computing types, without confining the patent to a single modality. Finally, 22% of the applications discuss physical realization in the specification but omit them from the claims, suggesting that these patents focus on areas other than the physical realization of quantum computers and mention it primarily as background information or enabling disclosure.

Discussion

The rate of patenting in quantum computing is escalating, mirroring the rapid growth of the sector. As manufacturers begin to introduce commercially viable quantum computers that outperform classical counterparts and generate substantial revenue, they will begin to become targets for patent assertions, making the competition in the realm of intellectual property increasingly relevant.

Patents concerning the physical realization of quantum computers are potentially influential as they encompass foundational technologies utilized across the entire industrial chain that are often easy to detect and hard to design around. Yet, patents specifically targeting physical realization modalities of quantum computers account for a small fraction (less than 10%) of all quantum computing patents. The volume of patent applications for most modalities is still modest compared to more established industries. This relatively open field presents unique opportunities for companies to secure broad and impactful patents.

Even for inventions not centered on a specific physical realization of quantum computers, detailing hardware features can be advantageous. Such disclosures not only fulfill the requirement for an enabling written description but also provides options for effectively differentiating prior art that lacks corresponding disclosures. Disclosures as to how higher-level techniques or applications can be adapted or optimized for particular physical realizations becomes particularly valuable in this context, offering strategic benefits in highlighting the patent’s novelty and positioning the patent for potential assertions.

Patent data reveal disparate maturity levels among quantum computing modalities. Superconducting technologies show a lead of two to three years over other key approaches like photonic and trapped-ion technologies. Concurrently, emerging fields such as neutral atom quantum computing are seeing a rise in patent activities. In a field rife with uncertainty, where the future might favor a single modality or foster the coexistence or integration of multiple ones, this varied patent landscape becomes a critical factor in strategic patent planning. While securing robust patent protection in the leading modality is vital for success, investing in lesser-protected areas could yield disproportionately high returns.

The patent data also underscores intense global competition in quantum computing, with the United States leading in patent applications for all key modalities, yet often holding a smaller share than the combined total of China and Europe. Given the perception of quantum computing as a matter related to national security, companies may encounter regulatory hurdles in entering certain markets. In response, they might consider patent licensing as an alternative revenue source in inaccessible markets. In such cases, target licensees will gain considerable leverage if they are capable of counter-asserting patents in competitors’ home markets. Consequently, it may be strategically beneficial for companies to seek patent protection not only in their operational markets but also in the home countries of their primary competitors.

Author’s Note: The data in this post were obtained using custom queries on LexisNexis TotalPatent One®, spanning 20 years from January 1, 2004, to December 31, 2023. There is typically an 18-month delay between the filing and publication of a patent application. Therefore, the data presented offer a somewhat delayed reflection of patent trends.

Image Source: Deposit Photos

Author: perig76

Image ID: 241846620