Revised Public Charge Rule Effective Beginning Dec. 23, 2022

Effective December 23, 2022, the U.S. Department of Homeland Security’s final rule regarding the amended criteria for a person to be deemed a public charge will go into effect. The changes fall in line with the Immigration and Naturalization Service (INS) direction dating back to the late 90s.

What Does it Mean to Be a Public Charge?

In lament terms, a noncitizen is considered a public charge if they depend on one or more public benefits from the United States government to survive. This could be in the form of public cash assistance or long-term institutionalization at the government’s expense.

Being a public charge is taken very seriously and grounds of inadmissibility (unless a waiver of inadmissibility is permitted). It is a valid reason for federal officials to deny someone’s adjustment of status application to legal permanent resident, admission into the country or other visa application.

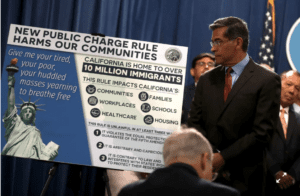

In the past administration, under President Trump, the Department of Homeland Security enforced a more strict and elaborate benchmark for determining who was considered a public charge. As a result, the rule was blocked in a number of federal courts and eventually, DHS rescinded the rule in March 2021 and then presented what is now the finalized rule in February of this year.

Photo Source:

Criteria For Becoming a Public Charge

A number of factors are used by immigration officials to determine someone’s probability of becoming a financial burden to the government including their:

- Age

- Health

- Assets

- Family status

- Financial status and resources

- Education and skills

Other information submitted in the Form I-864 Affidavit of Support will also be taken into close consideration by officials.

If I received public benefits in the past does that hinder my case?

Based on the final rule just published, federal officials will take into consideration any public assistance you have received in the past or are presently receiving when making a determination. These may include supplemental security income, public cash aid, long-term institutional care funded by the government, etc. It’s best to consult your immigration attorney if you find yourself in this situation.

Public benefits that were previously factored in during the Trump administration (including non-cash benefits like food stamps, housing assistance, Medicaid and credit history ) will no longer be used as criteria.

These revised guidelines aim to make the process fairer and streamlined while still bearing in mind the U.S. taxpayer’s best interest.

“…DHS will implement section 212(a)(4) of the INA, 8 U.S.C. 1182(a)(4), in a manner that will be clear and comprehensible for officers as well as for noncitizens and their families and will lead to fair and consistent adjudications, thereby mitigating the risk of unequal treatment of similarly situated individuals.”

If you have questions pertaining to this published rule, it’s best to schedule a consultation with a VisaNation Law Group attorney.