Plaintiff’s Response to Defendant’s Counterclaim

Plaintiff Twitter, Inc. (“Twitter”), by and through its undersigned counsel, replies as follows to the Verified Counterclaims (the “Counterclaims”) of Elon R. Musk (“Musk”), X Holdings I, Inc., and X Holdings II, Inc. (each a “Defendant” and together, “Defendants” or the “Musk Parties”) as follows.

Introduction

Musk begins his answer to Twitter’s claims for breach of their merger agreement with more than ninety pages of counterclaims. According to Musk, he—the billionaire founder of multiple companies, advised by Wall Street bankers and lawyers—was hoodwinked by Twitter into signing a $44 billion merger agreement.

That story is as implausible and contrary to fact as it sounds. And it is just that—a story, imagined in an effort to escape a merger agreement that Musk no longer found attractive once the stock market—and along with it, his massive personal wealth—declined in value. After spending months looking for an excuse to get out of the contract, Musk claimed to terminate it, explaining his supposed reasons for doing so in a July 8 letter to Twitter. When Twitter sued to enforce its rights and exposed the weakness of those reasons, Musk spent weeks coming up with more supposed reasons—the Counterclaims—which offer up an entirely new set of excuses for his breach.

The Counterclaims are a made-for-litigation tale that is contradicted by the evidence and common sense. Musk invents representations Twitter never made and then tries to wield, selectively, the extensive confidential data Twitter provided him to conjure a breach of those purported representations. Yet Musk simultaneously and incoherently asserts that Twitter breached the merger agreement by stonewalling his information requests. As explained below and will be demonstrated at trial, the Counterclaims are factually inaccurate, legally insufficient, and commercially irrelevant:

The Counterclaims fail to justify Musk’s plan to dishonor the merger agreement. Musk claims that he has the right to walk away from the deal if Twitter was “miscounting” the number of false or spam accounts on its platform. That is incorrect—as the facts and terms of the merger agreement show. When Musk offered to buy Twitter, he did not ask for—and Twitter did not make—any representations regarding the number of false or spam accounts. The merger agreement does not contain a single reference to false or spam accounts. Nor did Musk ask Twitter for any information to “verify” the number of false or spam accounts before he entered into the merger agreement. To the contrary, Musk forwent all due diligence—giving Twitter twenty-four hours to accept his take-it-or-leave-it offer before he would present it directly to Twitter’s stockholders.

What Musk did ask for—and what he got—was a customary representation that Twitter’s SEC filings since January 1, 2022 did not contain any false or misleading statement of material fact, with no right to terminate the deal based on any inaccuracies in those filings unless they have a “material adverse effect” on Twitter, as narrowly defined in the “seller-friendly” merger agreement. Musk neither sought nor obtained any “information rights” that would allow him to investigate the accuracy of those SEC filings as part of some post-signing due diligence project. All Musk got was a limited right to receive information only for “a reasonable business purpose related to the consummation” of the merger—that is, for the purpose of closing the deal, not abandoning it. Musk’s repeated mischaracterizations of the merger agreement cannot change its plain words.

The facts Musk pleads do not even state a claim. In the disclosure Musk claims was false or misleading, Twitter stated: “We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the fourth quarter of 2021 represented fewer than 5% of our mDAU” or “monetizable daily active users,” which Twitter defines not as all accounts, but only as accounts who logged in or were otherwise authenticated and accessed Twitter through a variety of ways on any given day. Twitter 2021 10-K at 5, 24. Twitter cautioned that “[i]n making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated.” Id. at 24.

Musk does not identify any false or misleading statement of fact in this disclosure. Instead, he asserts that his own analysis, using a publicly available website, indicates that false or spam accounts constitute at least 10% of Twitter’s monetizable daily active users. But that claim is untenable on its face, because Musk is not measuring the same thing as Twitter or even using the same data as Twitter. Musk can produce a higher estimate only by running a data set neither limited to nor inclusive of mDAU through a generic web tool that designated his own Twitter account a likely “bot.” The result is a distortion that Musk is hoping will nonetheless make waves.

Musk also attacks Twitter’s process for estimating the proportion of false or spam accounts among monetizable daily active users as unreasonable because Twitter’s quarterly estimates are based on daily samples of 100 mDAU, combined for a total sample of approximately 9,000 mDAU per quarter. But attacking an estimate as unreliable based merely on the size of the sample relative to the size of the population is an elementary statistical error.

Unable to identify any false or misleading statement in Twitter’s disclosures regarding false or spam accounts, Musk takes a swing at alleged inaccuracies in the company’s disclosures about the implications of the mDAU metric generally. Musk just now invented this new pretext for avoiding the merger agreement, as these supposed inaccuracies are nowhere mentioned in his July 8 letter to Twitter explaining the bases for his purported termination of the merger agreement, nor in any other communication with Twitter since signing the merger agreement. In any event, Twitter never made the disclosures he now asserts are false. For example, Musk says Twitter misled investors when it “represent[ed]” that the mDAU metric “is determinative of ‘long-term financial performance.’” While Twitter has repeatedly described mDAU as an indicator of revenue growth, Twitter has not described mDAU as solely “determinative” of either revenue growth or long-term financial performance. Twitter’s actual disclosures concerning mDAU as a business metric make this clear. One example: “Our mDAU and their level of engagement with advertising are critical to our success and our long-term financial performance will continue to be significantly determined by our success in increasing the growth rate of our mDAU as well as the number of ad engagements.” Twitter 2021 10-K at 13 (emphasis added). Musk also asserts that Twitter’s disclosures misleadingly suggest that accounts counted in mDAU necessarily generate ad revenue. But mDAU is a measure of monetizable daily active users, not monetized daily active users—by its nature, mDAU represents an opportunity to monetize those users, rather than a confirmation that each user has generated ad revenue on any given day. And in addition to mDAU, Twitter reports other key metrics closely related to advertising revenue, such as changes in ad engagements and in cost per ad engagement.

The other pretexts Musk offers—supposed failures to gain Musk’s consent for ordinary-course actions like employee terminations and protection of users’ rights in foreign jurisdictions—offer no more valid basis to escape the deal. As detailed in the Complaint and set out below, Twitter has complied in every respect with the merger agreement. Musk’s Counterclaims, based as they are on distortion, misrepresentation, and outright deception, change nothing. Musk signed and is obligated to consummate the merger agreement. Twitter is entitled to specific performance.

Answer

The headings and footnotes in the Counterclaims are repeated herein for convenience of reference only and are not statements or admissions by Twitter. To the extent a response to the headings and footnotes in the Counterclaims is required, Twitter denies any allegations therein. All allegations not expressly admitted herein are denied.

Preliminary Statement

1. This action arises out of Twitter’s misrepresentations to the Musk Parties regarding the condition of the company and the “key metrics” Twitter uses to evaluate the number of users on its platform. While the Musk Parties negotiated for representations as to the truth of Twitter’s SEC disclosures, relying on their accuracy, the statements in these SEC disclosures were far from true. Instead, they contain numerous, material misrepresentations or omissions that distort Twitter’s value and caused the Musk Parties to agree to acquire the company at an inflated price. Twitter’s Complaint, filled with personal attacks against Musk and gaudy rhetoric more directed at a media audience than this Court, is nothing more than an attempt to distract from these misrepresentations.

RESPONSE: Denied. Twitter’s SEC disclosures are accurate and Twitter misrepresented nothing. Musk’s allegations attacking Twitter’s SEC disclosures are not supported by any facts. Musk’s allegations regarding negotiation and reliance are likewise contrary to the facts. Musk sought an urgent deal, undertook no due diligence, and offered a self-described “seller friendly” merger agreement that contained no representations about false or spam accounts or mDAU. Twitter respectfully refers the Court to the Complaint, to its SEC disclosures, and to the Agreement and Plan of Merger by and among X Holdings I, Inc., X Holdings II, Inc., and Twitter, Inc., dated as of April 25, 2022 (“the Merger Agreement”) for their complete and accurate contents.

2. In fact, that has been Twitter’s strategy all along: to distract from and obfuscate the truth about its disclosures—first from its investors and then from the Musk Parties when they began to discern the truth. Following the adage “trust but verify,” the Musk Parties negotiated not only for representations and warranties about the truthfulness of Twitter’s SEC filings, but also for significant information rights entitling them to access to the company’s books and records. They fully expected that Twitter would hide nothing from its would-be owner, including about the magnitude of its false or spam account problem. Instead, the opposite happened. Twitter played a months-long game of hide-and-seek to attempt to run out the clock before the Musk Parties could discern the truth about these representations, which they needed to close. The more Twitter evaded even simple inquiries, the more the Musk Parties grew to suspect that Twitter had misled them.

RESPONSE: Denied. Twitter’s conduct, and the evidence, shows that Twitter’s only strategy has been to advance the interests of the company and its stockholders and comply with the Merger Agreement. Musk, on the other hand, has been on a months-long campaign to repudiate the contract he signed. As to Musk’s claim that Twitter has played “hide-and-seek,” the truth is the exact opposite—Musk has received massive amounts of information from Twitter, for months, and has been unable to find a valid excuse to back out of the contract. Twitter respectfully refers the Court to the Merger Agreement for its complete and accurate terms and to the parties’ correspondence for the truth of what unfolded post-signing.

3. In its disclosures, Twitter claims to have nearly 238 million monetizable daily active users (“mDAU”) who participate on the platform, and tells its investors that this userbase metric is a bellwether for its ability to generate revenue and the “best way to measure [Twitter’s] success . . . .” As the Musk Parties began to peel the onion of false and spam accounts, two things became abundantly clear. First, Twitter was miscounting the number of false and spam accounts on its platform, as part of its scheme to mislead investors about the company’s prospects by focusing on its purported hundreds of millions of mDAU. Second, while Twitter has repeatedly touted mDAU as a “key metric” for revenue growth, mDAU is not as closely tied to revenue as Twitter leads the public to believe.

RESPONSE: Denied. The Musk Parties have spent months trying to invent a spam disclosure problem and have found nothing. Their complaints about the mDAU metric were not even among their reasons for termination—they are a newly invented litigating position. Twitter accurately discloses in its SEC filings its efforts to estimate the percentage of its mDAU that are false or spam accounts after it detects and removes spam. Twitter also accurately discloses in its SEC filings the definition and significance of the mDAU metric. Twitter respectfully refers the Court to those disclosures for their complete and accurate contents.

4. Musk is an avid Twitter user who believes in free speech and open debate, and he appreciates Twitter’s role as the world’s town hall. Musk, who has owned and founded several successful companies, including PayPal, Tesla, and SpaceX, invests only in companies that make products he uses and enjoys. Thus, when Musk decided to identify another public company in which to invest, Twitter was a natural option.

RESPONSE: Twitter admits that Musk is a Twitter user and has founded several companies. Twitter otherwise lacks knowledge or information sufficient to form a belief as to the truth of the allegations of Paragraph 4, and denies them on that basis.

5. While Musk actively uses Twitter, he has grown increasingly concerned in recent years with the company’s direction and poor user experience, given the flood of misinformation, scams, and other undesirable content he regularly sees. Twitter has attempted to solve issues like these through aggressive content moderation and suspension of accounts that propagate misinformation. But to Musk, and many others, eliminating free speech is a cure worse than the disease, and that open discourse is essential to a functioning democracy.

RESPONSE: Twitter admits that Musk actively uses Twitter and that many people believe that open discourse is essential to a functioning democracy. Twitter lacks sufficient knowledge or information to form a belief as to the truth of the allegations in Paragraph 5 concerning Musk’s beliefs and experience, and denies them on that basis. Twitter otherwise denies the allegations in Paragraph 5.

6. Musk believes that a key issue for Twitter is the elimination of false and spam accounts and discerning who Twitter’s verifiable, real users are. Musk believes that by verifying who is real, and eliminating false and spam accounts—accounts that bad actors employ to manipulate public discourse or propagate scams on a global scale—Twitter would be able to flourish.

RESPONSE: To the extent Paragraph 6 contains allegations about Musk’s beliefs in general, Twitter lacks knowledge or information sufficient to form a belief as to the truth of the facts alleged and denies them on that basis. Twitter otherwise denies the allegations in Paragraph 6. As facts alleged in the Complaint demonstrate, Musk’s recent complaints about the prevalence of spam and the mDAU metric are a pretext to avoid honoring the Merger Agreement.

7. Musk’s thesis for Twitter was simple—false and spam accounts have an outsized effect on public discourse, and are often amplified by Twitter’s timeline algorithm—the algorithm that determines what posts users see on their feed. Together, both problems detract from Twitter’s user experience, which Twitter has deprioritized in service of focusing all of its efforts on growing mDAU.

RESPONSE: To the extent Paragraph 7 contains allegations about Musk’s “thesis,” Twitter lacks knowledge or information sufficient to form a belief as to the truth of the facts alleged and denies them on that basis. Twitter otherwise denies the allegations in Paragraph 7.

8. At the same time, Musk believed Twitter was over-reliant on advertising revenue, with over 90% of its revenue generated by ads. When he signed the deal, Musk believed he could kill two birds with one stone: by implementing certain changes, such as requiring effective verification of all users, he could eliminate what he thought—based on what Twitter misrepresented—was a less-than-5% false or spam account problem. Musk could then better engage the over 220 million mDAU that Twitter represented were real, monetizable users, to create greater engagement and subscription revenue.

RESPONSE: To the extent Paragraph 8 contains allegations about Musk’s beliefs, Twitter lacks knowledge or information sufficient to form a belief as to the truth of the facts alleged and denies them on that basis. Twitter otherwise denies the allegations in Paragraph 8. Twitter avers that Musk’s voluminous post-signing requests for information have not been undertaken in an effort to close the deal—as required by the contract—but rather to undermine it. Twitter respectfully refers the Court to the Merger Agreement and Twitter’s SEC disclosures for their complete and accurate contents.

9. After signing the Merger Agreement, however, the Musk Parties learned troubling facts that have called into serious doubt Twitter’s representations. Just three days after signing the Agreement, Twitter restated three years of its mDAU figures because it had been double-counting certain users. Twitter failed to advise the Musk Parties that the restatement was coming before they signed the Merger Agreement.

RESPONSE: Denied. Musk’s unsupported claims of misrepresentation and his claim to be “troubled” are pretext aimed at escaping his contractual obligations. Twitter denies that it “restated three years of its mDAU figures,” and respectfully refers the Court to its responses to Paragraphs 79 and 149. Twitter admits that it did not provide the information in the April 28, 2022 press release to the Musk Parties before the Merger Agreement was signed and before the parties had a non-disclosure agreement in place. Twitter avers that Musk failed to mention that information among his purported bases of termination or in any conversation with Twitter. Moreover, Musk did not seek any diligence information at all before signing the Merger Agreement, including information related to the subject matter of the April 28, 2022 press release.

10. Shortly thereafter, at a May 6, 2022 introductory meeting, Musk began asking questions, expecting to be reassured that Twitter’s SEC filings were the product of a thoughtful, robust process. Musk wanted to understand Twitter’s mDAU figure, Twitter’s representations that less than 5% of that figure is comprised of false or spam accounts, and the processes Twitter used to reach those figures.

RESPONSE: Twitter admits that on May 6, 2022, there was a meeting between Musk and Twitter at which Musk asked some questions on a range of topics, and otherwise denies the allegations of Paragraph 10. Twitter further states that it has not “represented” that false or spam accounts comprise less than 5% of mDAU (but rather that it estimates as much), that the Merger Agreement contains no representations about either mDAU or spam, and that the SEC filings Twitter has made regarding its estimates of false or spam accounts in mDAU are accurate (as Musk’s inability to point to any inaccuracy in those disclosures confirms).

11. But at that meeting, Musk was astonished to learn just how meager Twitter’s processes were. Human reviewers (not AI) apply unidentified standards to somehow conclude every quarter for nearly three years that fewer than 5% of Twitter users were false or spam on the basis of a sample of just 100 accounts per day (less than 0.00005% of daily users). Even worse, Twitter’s CEO and CFO were unable to explain both how those 100 accounts per day were selected to ensure a representative sample or what criteria were applied other than a reviewer’s gut judgment. Unlike other platforms, Twitter did not send email, text, or other push notifications to users to verify them. Musk realized that, at best, Twitter’s reliance on and touting of its process was reckless; at worst, it was intentionally misleading.

RESPONSE: Denied. In Paragraph 11, Musk intentionally misrepresents what Twitter does to detect and combat spam—all of which is well known to the Musk Parties. As Twitter has explained repeatedly and in detail to the Musk Parties, and summarized publicly, Twitter deploys spam-detection capabilities that typically remove more than one million spam accounts each day during or shortly after creation, including both automated and manual reviews of accounts and activity on the Twitter platform during and after signup. Twitter also locks millions of accounts each week that cannot pass human-verification challenges, such as CAPTCHAs or phone verifications. Separate from these automated and manual spam-detection processes, Twitter estimates the prevalence of false or spam accounts within mDAU reported each quarter through multiple human reviews (in replicate) of thousands of randomly selected accounts each quarter using both public and private data. Twitter respectfully refers the Court to its SEC disclosures concerning its estimate of spam or false accounts in quarterly mDAU and to the May 16, 2022 Tweet Thread posted by its CEO concerning the company’s spam-fighting efforts.

12. Since then, Twitter’s disclosures have slowly unraveled, with Twitter frantically closing the gates on information in a desperate bid to prevent the Musk Parties from uncovering its fraud. Twitter’s delay tactics have been two-fold: it has dragged its feet in responding to the Musk Parties’ data requests and has repeatedly provided sanitized, incomplete information that it admits does not answer the Musk Parties’ most basic questions. Moreover, Twitter continues to refuse to explain which accounts it includes in mDAU and why, what criteria it tells its human reviewers to apply, and how often it overrides those reviewers’ determinations.

RESPONSE: Denied. The allegations that Twitter’s disclosures have “unraveled” and that Twitter is “closing the gates on information” are not true. Twitter has made and continues to make available to Musk massive flows of data. Moreover, as set forth in detail in its Complaint, Twitter spent significant time and resources to compile, and in many instances create, data collections and information requested by the Musk Parties. As the Musk Parties know, and contrary to these allegations, Twitter has explained what accounts it includes in mDAU and why they are included there, just as it has explained the criteria and indicators used to estimate spam or false accounts and the data showing the determinations made by the human reviewers.

13. What limited information has come to light proves Twitter’s disclosures about the number of false or spam accounts are false. Notwithstanding Twitter’s stonewalling, preliminary expert estimates of the false or spam accounts in Twitter’s mDAU population, based on the data Twitter has provided and using a publicly available machine learning algorithm, yield findings that are shocking. They show that in early July fully one-third of visible accounts may have been false or spam accounts—resulting in a conservative floor of at least twice as many false or spam accounts as the 5% that Twitter discloses for the entire mDAU population. Moreover, Twitter’s own post-signing disclosures indicate that those false or spam accounts most likely formed a disproportionate portion of monetized users (those that actually see ads). Twitter even admitted on diligence calls with the Musk Parties that, contrary to Twitter’s disclosures that they remove false or spam accounts from mDAU figures once they are suspended, millions of accounts suspended in any given quarter (including for spam) are nevertheless included in the mDAU calculations of that same quarter.

RESPONSE: Denied. Musk’s “preliminary expert estimates” are nothing more than the output of running the wrong data through a generic web tool. The data are wrong because, as Musk knows, the “Firehose” from which the data were collected reflects many Twitter accounts that are not included in mDAU and, at the same time and as Musk admits in footnote 2, does not reflect the majority of those accounts that are included in mDAU because those accounts, though logged in, are not Tweeting or taking other actions. Confirming the unreliability of Musk’s conclusion, he relies on an internet application called the “Botometer”—which applies different standards than Twitter does and which earlier this year designated Musk himself as highly likely to be a bot. Twitter further denies that it “admitted on diligence calls” that its disclosures regarding the removal of false or spam accounts from mDAU are inaccurate. Twitter respectfully refers the Court to those disclosures, which, as explained below in response to Paragraphs 75 and 122, are accurate.

14. Most concerning of all, the Musk Parties’ investigation revealed that Twitter’s misrepresentations run far deeper than simply providing incorrect numbers of false or spam accounts. In fact, while Twitter represents that mDAU—a proprietary metric that only Twitter uses and is first among its “Key Metrics”—is “critical to [Twitter’s] success” and is determinative of “long-term financial performance,” that is misleading. Twitter’s own disclosures to the Musk Parties show that although Twitter touts having 238 million “monetizable daily active users,” those users who actually see ads (and thus, would reasonably be considered “monetizable”) is about 65 million lower than what Twitter represents. Moreover, mDAU is not by itself a useful metric to forecast revenue growth, despite Twitter’s public statements to the contrary, because while mDAU has grown, Twitter relies on advertising revenue, and users that see zero or almost zero ads account for almost all of the growth in mDAU. Thus, many users who are counted as “monetizable” do not bear on Twitter’s long-term financial success, as Twitter represents. In fact, the majority of ads are served to less than 16 million users—a mere fraction of the 238 million mDAU figure that Twitter misleadingly touts to the market.

RESPONSE: Denied. Twitter’s disclosures regarding mDAU in its SEC filings—to which Twitter respectfully refers the Court for their complete contents— are accurate. As set out below in response to Paragraphs 138-46, the allegations of Paragraph 14 are Musk’s attempt to distort data received from Twitter to sponsor wild conclusions about Twitter’s mDAU, reflecting his apparent and inappropriate effort to use this litigation to undermine Twitter’s business. But here again, as set out below in response to Paragraphs 141-42, Musk has pleaded nothing inconsistent with Twitter’s public disclosures.

15. The Musk Parties’ investigation has determined that, contrary to what Twitter leads investors to believe, mDAU’s relationship with financial performance is much more indirect and nuanced. While other social media platforms provide investors with markers of daily engagement beyond mDAU, Twitter continues to push mDAU as “the best way to measure” performance.

RESPONSE: Denied. Twitter’s disclosures regarding mDAU are accurate. Musk’s Counterclaims seek to distort them through selective omission and misleading bolding. Twitter respectfully refers the Court to its SEC disclosures for their complete and accurate contents.

16. In fact, Twitter concocted the mDAU metric after three straight quarters of declining numbers of monthly active users (“MAUs”)—its previous “key metric,” and one that is widely used in the social media industry. Twitter also ties mDAU goals to executive compensation. In 2020 Twitter based its executives’ cash bonus pool on revenue, operating income, and adjusted EBITDA. After Twitter missed those targets in 2020, and only 32% of the cash bonus pool was funded, Twitter determined that mDAU (a highly manipulable number) should be considered in determining whether executives received these bonuses. Following that change, in 2021, 100% of this executive bonus pool was funded. And since Twitter’s adoption of mDAU over MAU, it has reported ten straight quarters of “growth” despite stagnant financial results.

RESPONSE: Denied. The allegations of Paragraph 16 are manifestly irrelevant to the Merger Agreement and aimed at disparaging the company. Only SEC filings since January 1, 2022 can serve as a basis for any claim by Musk under that agreement. Twitter’s adoption of mDAU occurred and was disclosed and explained in 2019. Musk’s reliance on this issue is further demonstration that he has found nothing, in months of trying, to justify his refusal to perform under the Merger Agreement. To the extent the allegations of Paragraph 16 purport to characterize Twitter’s SEC filings, Twitter respectfully refers the Court to those documents for their complete and accurate contents.

17. The Musk Parties’ preliminary analysis shed light as to why Twitter has stonewalled—Twitter did not want the Musk Parties (or the market) to discover that Twitter has been misleading investors regarding its “key metric.” As a long bull market was coming to a close, and the tide was going out, Twitter knew that providing the Musk Parties the information they were requesting would reveal that Twitter had been swimming naked.

RESPONSE: Denied. Musk does not have and has not pleaded a shred of evidence for the rhetoric-heavy, fact-free allegations of Paragraph 17.

18. These obfuscations and misrepresentations are not Twitter’s only sins. Since the Merger Agreement was signed, Twitter has also made significant changes to its business without obtaining the consent required by the Merger Agreement. Twitter has terminated its product lead and another key executive, retained a board member whose reelection was rejected by stockholders, instituted a hiring freeze, and disobeyed orders from and initiated risky litigation against the Indian government—thereby placing Twitter’s third largest market at risk.

RESPONSE: Twitter admits that it ended its employment relationship with certain employees, declined to accept the resignation of a board member, and initiated litigation in India. Twitter denies that it instituted a “hiring freeze.” Twitter also denies that any of this required Musk’s consent, insofar as Twitter negotiated for the ability under the Merger Agreement to retain control over hiring and terminating employees, and otherwise denies the allegations in Paragraph 18.

19. On July 8, 2022, faced with Twitter’s misrepresentations, breaches of its information-sharing obligations, ordinary course violations, and the prospect of an MAE, the Musk Parties terminated the Merger Agreement. While Twitter asks the Court to force the Musk Parties to close over Twitter’s misrepresentations and contractual breaches, the Musk Parties seek relief from the grave inequity of such a result. Accordingly, the Musk Parties bring their counterclaims for breach of contract and rescission on the basis of Twitter’s fraud.

RESPONSE: Twitter admits that on July 8, 2022 Defendants purported to terminate the Merger Agreement, that Twitter subsequently filed litigation seeking specific performance of the Merger Agreement, and that Defendants have filed counterclaims. Twitter otherwise denies the allegations in Paragraph 19.

Parties

20. Defendant and Counterclaim-Plaintiff Elon R. Musk is a Texas citizen. Musk is the CEO of Tesla, Inc., the world’s most valuable automobile manufacturer and fifth largest company by market capitalization in the world. Tesla has revolutionized electric cars and helped accelerate the world’s move to sustainable energy, preventing tens of millions of metric tons of carbon from entering the atmosphere. Musk also founded and leads SpaceX, which works with NASA and the International Space Station to both launch satellites into orbit and to send astronauts into space. SpaceX also provides “Starlink,” a satellite system that provides internet access to dozens of countries. Indeed, when Russia disrupted internet service in Ukraine during its invasion of that country, Ukrainian officials reached out to Musk on Twitter and worked to bring Starlink to Ukraine, providing crucial internet access in under 11 hours.

RESPONSE: Twitter admits that Musk is the CEO of Tesla, Inc., and that Tesla, Inc. manufactures automobiles. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in the body of Paragraph 20, and therefore denies them on that basis. Footnote 4 purports to refer to an Inc. article, to which Twitter respectfully refers the Court for its complete and accurate contents.

21. Defendant and Counterclaim-Plaintiff X Holdings I, Inc. (“Parent”), is a Delaware corporation. Parent is wholly owned and controlled by Musk.

RESPONSE: Admitted.

22. Defendant and Counterclaim-Plaintiff X Holdings II, Inc. (“Acquisition Sub” and together with Parent “Buyers”), is a Delaware corporation. Acquisition Sub is wholly owned and controlled by Parent.

RESPONSE: Admitted.

23. Plaintiff and Counterclaim-Defendant Twitter is a publicly traded Delaware corporation with its principal place of business in San Francisco, California. Twitter operates a microblogging social network on which users write and share short messages, or “tweets.”

RESPONSE: Twitter admits that it is a publicly traded Delaware corporation headquartered in San Francisco, California. Twitter denies the remaining allegations in Paragraph 23 and avers that it owns and operates a global platform for real-time self-expression and conversation, including in the form of Tweets.

Factual Allegations

A. Twitter’s Business

24. Twitter was founded in March 2006 by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams. Twitter’s primary business is operating a microblogging social media network where users share 280 character messages called “tweets.”

RESPONSE: Twitter admits it was launched by its founders in 2006. Twitter denies the remaining allegations in Paragraph 24 and avers that its primary product, Twitter, is a global platform for real-time self-expression and conversation, including in the form of Tweets. Twitter further avers that Tweets have a maximum length of 280 characters.

25. Twitter is free to use for most users and generates the vast majority of its revenue through advertising. For example, for the fiscal year ending December 31, 2021, Twitter reported revenue of just over $5 billion. Of that, $4.5 billion was generated through advertising services. For the fiscal year ending December 31, 2020, Twitter reported $3.7 billion in revenue, with $3.2 billion generated through advertising services.

RESPONSE: Twitter admits that its primary product, Twitter, is free of monetary charge to use for its users and that Twitter generates the majority of its revenue through advertising. Twitter otherwise denies the allegations in the first sentence of Paragraph 25. The remaining allegations in the body of Paragraph 25 purport to characterize Twitter’s Fiscal Year 2020 and 2021 Annual Reports, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter denies the allegations in the first sentence in footnote 5. The second sentence in footnote 5 purports to characterize Twitter’s Quarterly Report for the second quarter of 2022, to which Twitter respectfully refers the Court for its complete and accurate contents.

26. Twitter uses the site’s mDAU count to induce investors to purchase Twitter securities. This wasn’t always the case. Until late 2018, Twitter told investors that its key metric was MAU—a widely accepted metric in the social media industry. But after three straight quarters of decreasing MAUs, Twitter developed a new proprietary “key” metric—mDAU—that conveniently resulted in ten straight quarters of “growth.” In its disclosure replacing MAU with mDAU Twitter noted that “we believe that mDAU, and its related growth, are the best ways to measure our success against our objectives and to show the size of our audience and engagement going forward, so we will discontinue disclosing MAU after the first quarter of 2019,” clearly implying that mDAU predicted future revenue better than MAU. Twitter went on to stress that “[o]ur mDAU and their level of engagement with advertising are critical to our success and our long-term financial performance will continue to be significantly determined by our success in increasing the growth rate of our mDAU as well as the number of ad engagements” and that “our revenue growth is primarily driven by increases in the number of our mDAUs, increases in ad pricing or number of ads shown driven by strong advertiser demand, increases in our clickthrough rate, as well as other factors.”

RESPONSE: To the extent Paragraph 26 purports to quote from and characterize the contents of Twitter’s SEC filings, Twitter respectfully refers the Court to those filings for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 26.

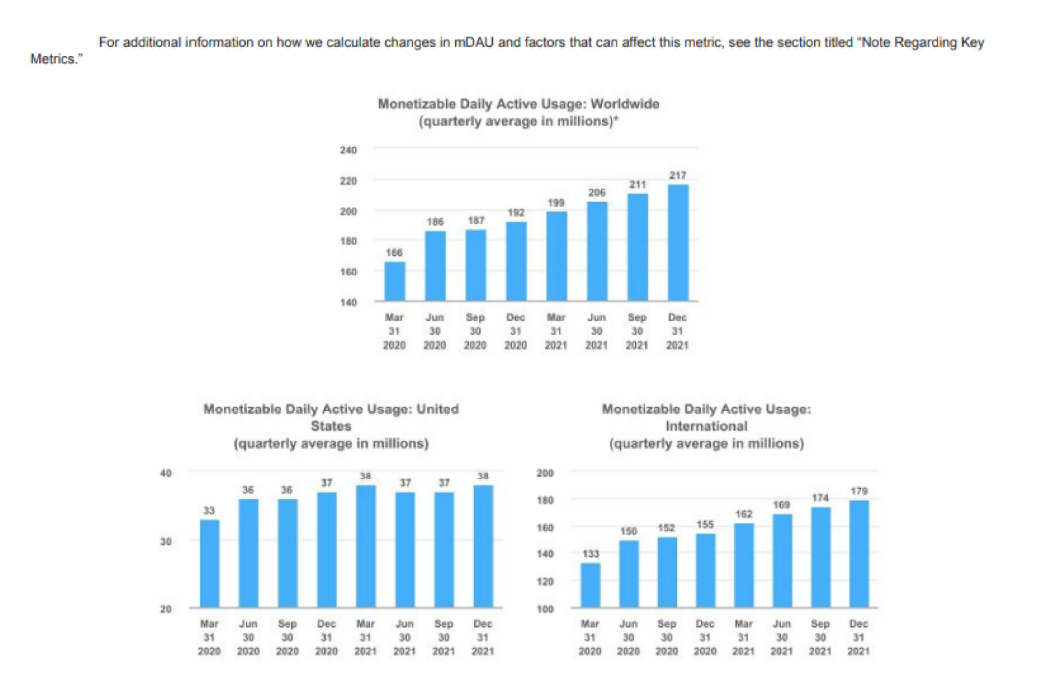

27. Twitter defines mDAU in its 2021 10-K as “people, organizations, or other accounts who logged in or were otherwise authenticated and accessed Twitter on any given day through twitter.com, Twitter applications that are able to show ads, or paid Twitter products, including subscriptions.” Twitter calculates the average mDAU for a period as “the number of mDAU on each day of such period divided by the number of days for such period.” The average mDAU figure was 217 million for the fourth quarter of 2021, 229 million for the first quarter of 2022, and 238 million for the second quarter of 2022.

RESPONSE: Paragraph 27 purports to quote from and characterize the contents of Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 27.

28. Twitter represents that mDAU reflects how many Twitter users access the site on a daily basis, reflects the population that is being exposed to advertisements, is crucial to understanding Twitter’s total audience for advertisers, and thus is the central metric to understand in estimating future revenue growth. As such, Twitter prominently touts mDAU as its first “Key Metric[]” in its SEC disclosures:

RESPONSE: Twitter admits that mDAU is a “Key Metric” Twitter uses to evaluate its business because, among other reasons, it reflects daily engagement with Twitter and the size of its audience capable of being monetized. Twitter denies that mDAU reflects the population of its users that is being exposed to advertisements on a daily basis. Twitter defines mDAU “as people, organizations, or other accounts who logged in or were otherwise authenticated and accessed Twitter on any given day through twitter.com, Twitter applications that are able to show ads, or paid Twitter products, including subscriptions.” Paragraph 28 purports to quote from and characterize the contents of Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 28.

29. Twitter’s only other Key Metric—ad engagements—is itself a metric that Twitter links with mDAU, noting that “[w]e believe that mDAU, and its related growth, is the best way to measure our success against our objectives and to show the size of our audience and engagement.” Similarly, during earnings calls, Twitter touts its mDAU growth alongside its revenue numbers as the most important information for investors.

RESPONSE: Twitter admits that year-over-year changes in ad engagements (not “ad engagements”) are a Key Metric that Twitter has disclosed to investors. Twitter avers that Defendants have omitted important disclosures about the relationship between ad engagements and revenue. Twitter has disclosed that the growth of its advertising revenue depends on increases in the number of mDAU; increases in ad pricing or the number of ads shown, which is driven by advertiser demand; increases in the clickthrough rate; as well as other factors. Paragraph 29 purports to quote from and characterize the contents of Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 29.

B. Musk’s Relationship With Twitter

30. Musk is an active Twitter user with over 100 million Twitter followers, making his the sixth most followed account on the site. Musk tweets frequently and enjoys the direct interaction he can have with his followers on the site. He has previously stated that he prefers communicating over Twitter to more traditional mediums, such as press releases or interviews.

RESPONSE: Twitter admits that Musk is a Twitter user and has over 100 million followers, but otherwise denies the allegations in the first sentence of Paragraph 30. Twitter admits that Musk Tweets frequently, but otherwise lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in the second and third sentences of Paragraph 30, and therefore denies them on that basis.

31. Despite his growing concerns with the company’s direction, he still believed in Twitter as a product—one that provided a necessary public good while still offering significant untapped opportunity for monetization. He thus invested in the company in early 2022 by buying common stock in the market.

RESPONSE: Twitter admits that Musk bought Twitter’s common stock in early 2022. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in Paragraph 31, and therefore denies them on that basis.

32. In late March 2022, Dorsey and other members of Twitter’s board approached Musk to ask him to join the board. Musk was hesitant at first, but listened to their pitches over the next couple weeks. During that time, he had several conversations with Twitter CEO Parag Agrawal about his views of free speech on the platform, ideas for improving Twitter’s algorithm, and the need to improve user experience by removing bots. Specifically, Musk places tremendous importance on the value of free speech and believes that it is “the bedrock of a functioning democracy.” He considers Twitter to be “the digital town square where matters vital to the future of humanity are debated,” and therefore believes that open discourse on Twitter must be protected. Over time, Musk began growing concerned that Twitter’s content moderation policies were leading to a chilling effect on debate and public discourse. Given the importance of Twitter as a public platform, this chilling effect could not only drive users away from Twitter, harming the company’s finances, but also have a broader detrimental impact on the free speech climate. Among other things, Musk believed that a better way to protect the platform from abuse was through greater transparency and more robust user verification: by limiting discourse to actual humans, truth and good ideas can defeat misinformation and hateful content—rather than getting drowned out by false and spam accounts that have an outsized impact in relation to actual humans. For example, on April 8, 2022, Musk sent Agrawal an example of a scam tweet from a spam account, stating “I am so sick of stuff like this.” Agrawal replied, acknowledging “[w]e should be catching this.”

RESPONSE: Twitter denies the allegations in the first and second sentences of Paragraph 32. Twitter admits that Musk had multiple conversations with Parag Agrawal in March 2022, and that they discussed, among other topics, Musk’s ideas for improving the platform, but otherwise denies the allegations in the third sentence of Paragraph 32. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the allegations in the fourth, fifth, sixth, seventh, and eighth sentences of Paragraph 32, and therefore denies them on that basis. Twitter admits that the correspondence referenced in the ninth and tenth sentences of Paragraph 32 occurred, and respectfully refers the Court to that correspondence for its complete and accurate contents.

33. Musk eventually realized that Twitter’s current management was not up to the task of fixing Twitter as it needed to be fixed. He determined that to do the job right, he would need more than a single board seat. Musk thus rejected Twitter’s offer to join the board on April 9, 2022, and instead, notified Agrawal of his intent to submit an acquisition offer.

RESPONSE: Twitter admits that Musk abruptly changed his mind about joining Twitter’s board (after first negotiating an offer to join the board,, accepting it in writing, and Tweeting that he was “looking forward” to taking the position), notified Mr. Agrawal of the same, and also notified Mr. Agrawal of his intent to make an offer to buy Twitter. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in Paragraph 33, and therefore denies them on that basis.

34. On April 13, 2022, Musk sent Twitter’s board an offer to purchase all outstanding shares of the company at $54.20 per share—a total acquisition price of about $44 billion. Twitter’s stock closed at a trading at a price of $44.48 the day before the offer. Musk’s offer price was based on a financial model prepared by his bankers at Morgan Stanley, which relied, in significant part, on Twitter’s representations that mDAU was “the best way to measure [Twitter’s] success” and only a small group comprising less than 5% of mDAU were non-monetizable false or spam accounts. Indeed, a model that Musk relied on directly ties Twitter’s revenue growth to its mDAU growth.

RESPONSE: The first sentence of Paragraph 34 purports to characterize a letter sent by Musk to Twitter’s Board of Directors on April 13, 2022, to which Twitter respectfully refers the Court for its complete and accurate contents. The second sentence of Paragraph 34 purports to characterize publicly available information pertaining to the public trading price of shares of Twitter’s common stock, to which Twitter respectfully refers the Court for an accurate record of such trading price as of any particular point in time. To the extent the third sentence of Paragraph 34 purports to quote from or summarize Twitter’s public SEC filings, Twitter respectfully refers the Court to those filings for their complete and accurate contents. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in the third sentence of Paragraph 34, and therefore denies them on that basis. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the allegations in the fourth sentence of Paragraph 34, and therefore denies them on that basis.

35. In response to Musk’s offer, Twitter’s board formed a transaction committee and hired J.P. Morgan, Goldman Sachs, and Allen & Co. as financial advisors. On April 15, 2022, the board adopted a poison pill to try to make it harder for Musk to purchase the Company.

RESPONSE: Twitter admits that its Board of Directors formed a Transactions Committee to, among other things, assist the board’s evaluation of Musk’s acquisition proposal and that the board retained financial advisors to Twitter and its board in connection with Musk’s proposal and potential strategic alternatives thereto, and otherwise denies the allegations in the first sentence of Paragraph 35. Twitter admits that its board adopted a shareholder rights plan on April 15, 2022, and otherwise denies the allegations in the second sentence of Paragraph 35. Twitter avers that Musk himself admitted this allegation is not true, having Tweeted on April 16 that the Twitter board may have adopted the rights plan due to “a concern about other potential bidders.”

36. Musk’s thesis for Twitter is based on two principal concepts. First, he believes that Twitter’s approach to combatting false or spam accounts is flawed. Instead of suspending or banning accounts that violate Twitter’s rules, which keeps the company a step behind spammers and stifles the open exchange of ideas, Twitter should instead require users to be effectively authenticated at the front end. This would prevent false or spam accounts from being created in the first instance and requires less subjective and unevenly applied content moderation. He further believes that solving Twitter’s false or spam account problem through effective authentication would make the platform more attractive to use, driving further engagement by existing users and attracting new active users.

RESPONSE: Twitter lacks knowledge or information sufficient to form a belief as to Musk’s “thesis” and therefore denies the allegations of Paragraph 36 on that basis. Twitter further denies that it does not “effectively authenticate[]” users “at the front end.” As Twitter has publicly disclosed, it typically detects and removes more than a million spam accounts each day during or shortly after creation.

37. Musk’s Twitter feed has long been plagued by an ever-present swarm of false or spam accounts that incessantly reply to tweets with scams and misinformation. But, like any reasonable public company investor, Musk relied on Twitter’s SEC filings for the truth. In those filings, he saw that the company represented that it had a constantly growing mDAU population, that this growth was the “best way to measure our success against our objectives,” and that no more than 5% of its mDAU was comprised of false or spam accounts. Musk thus assumed that his own experience was unique because of his high profile and that spam accounts were simply disproportionately visible to him.

RESPONSE: Twitter denies the allegations in the first sentence of Paragraph 37, and lacks sufficient knowledge or information to form a belief as to the truth of the allegations in the second sentence and so denies them on that basis. The third sentence of Paragraph 37 purports to quote from and characterize Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter avers that its SEC filings do not make a representation as to the percentage of spam included in its mDAU; rather, Twitter provides its estimate thereof pursuant to an estimation methodology detailed therein. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the allegations in the fourth sentence of Paragraph 37, and therefore denies them on that basis. Footnote 8 purports to characterize a Newsweek article, to which Twitter respectfully refers the Court for its complete and accurate contents.

38. Musk also believes that Twitter’s algorithm is fundamentally flawed in a way that compounds the false or spam account problem. Twitter allows a user’s feed to sort others’ posts by chronology, but the default setting is for the algorithm to provide a generated list of “Home Tweets.” Twitter notes that “Home serves Tweets from accounts and Topics you follow as well as recommended Tweets.” Thus, if a user frequently interacts with tweets regarding a certain topic, Twitter will push more tweets about that topic onto one’s feed, regardless of whether the user follows that account. The Home Tweets algorithm boosts tweets with high engagement, regardless of whether they are generated by real humans or false or spam accounts. This results in Russian propaganda accounts like the now-banned @ten_GOP account going viral by posting misinformation. Musk has previously spoken out about the problems with this algorithm and how it amplifies false or spam accounts.

RESPONSE: Twitter lacks knowledge or information sufficient to form a belief as to the truth of the allegations in the first sentence of Paragraph 38, and therefore denies them on that basis. Twitter admits the allegations in the second sentence of Paragraph 38. The third and fourth sentences of Paragraph 38 purport to quote from the webpage “About your Home timeline on Twitter,” to which Twitter respectfully refers the Court for its complete and accurate contents. Twitter denies the allegations in the fifth and sixth sentences of Paragraph 38. Twitter expressly denies that its algorithm “results in Russian propaganda accounts … going viral by posting misinformation.” Twitter further avers that the account referenced in Paragraph 38 was, in fact, permanently suspended. To the extent that the seventh sentence of Paragraph 38 quotes from or characterizes any Tweets or communications from Musk, Twitter respectfully refers the Court to those Tweets or communications for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 38.

39. Second, Musk believes that Twitter’s ad-based revenue model is dated. Prior to the Merger Agreement, Musk believed he could unlock Twitter’s true potential by shifting away from an advertising-only model (in Q2 2022, advertising made up over 90% of Twitter’s revenue) to other forms of revenue, like a hybrid subscription-based model for verified users and enabling payments and creator monetization tools. Because these additional business models require legitimate users, the Musk Parties calculated their purchase price with reference to Twitter’s mDAU figures, in accordance with the company’s representations as to the mDAU figure’s accuracy and the reliability of that measure in predicting revenue.

RESPONSE: To the extent the allegations in Paragraph 39 make assertions about Musk’s beliefs, Twitter lacks knowledge or information sufficient to form a belief as to the truth of those allegations and denies them on that basis. To the extent that the allegations in Paragraph 39 purport to characterize Twitter’s SEC filings, Twitter respectfully refers the Court to those disclosures for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 39.

40. This thesis makes his investment in Twitter distinctly vulnerable to any misstatements about how many mDAU were actually real, monetizable users. First, misrepresentations regarding the number of active users on Twitter would, according to Twitter, impact Twitter’s advertising revenue because it discloses that “[o]ur advertising revenue growth is primarily driven by increases in mDAU” and other factors. As explained further below at infra ¶¶130-46, contrary to Twitter’s representations, a total mDAU figure does not accurately reflect Twitter’s revenue generation capacity. But, separately, Musk understood that each mDAU represented an active Twitter user who could potentially be convinced to pay a nominal monthly subscription fee for the service. If that number were inflated, then the number of potential subscribers would drop in tandem, endangering the viability of Musk’s proposed subscription model.

RESPONSE: Denied. Twitter’s SEC disclosures are accurate and Twitter misrepresented nothing regarding mDAU. To the extent the second sentence of Paragraph 40 purports to quote from or characterize Twitter’s SEC filings, Twitter respectfully refers the Court to those disclosures for their complete and accurate contents, and otherwise denies the allegations in the second sentence of Paragraph 40. Twitter denies the allegations in the third and fourth sentences of Paragraph 40. The allegations in the fifth sentence of Paragraph 40 contain a hypothetical to which no response is required; to the extent a response is required, Twitter denies the allegations in the fifth sentence of Paragraph 40. To the extent not otherwise addressed, Twitter denies the allegations of Paragraph 40.

41. Thus, both principles of Musk’s investment thesis were supported by Twitter’s disclosures, which represented that Twitter had over 220 million mDAU (with that number consistently growing), that mDAU was an approximate measure of the users who used Twitter enough to see ads each day, that mDAU was a “key” metric for assessing growth, and that the false or spam account problem, while truly frustrating, was a relatively contained, fixable issue. And while he believed there would be some pain in shedding user counts through removing false or spam accounts and requiring verification, he believed that in the long run, this would attract more users and provide more diverse revenue streams for the Company, all while supporting his vision of Twitter as the public square.

RESPONSE: To the extent that Paragraph 41 purports to quote from or characterize Twitter’s SEC filings, Twitter respectfully refers the Court to those disclosures for their complete and accurate contents. To the extent that Paragraph 41 makes allegations about Musk’s “thesis” and what he “believed,” Twitter lacks knowledge or information sufficient to form a belief as to the truth of those allegations and therefore denies them on that basis. Twitter otherwise denies the allegations in Paragraph 41.

42. Musk announced on April 21, 2022, that he had secured financing sufficient to fund his $54.20 per share offer. On April 23, 2022, he communicated to Twitter that he was unwilling to increase his offer, and that he was willing to take the offer directly to Twitter’s stockholders if the board rejected it. He reiterated that promise on April 24, 2022, and his counsel delivered a draft merger agreement to Twitter shortly thereafter. The parties negotiated a merger agreement on April 24 and April 25, 2022.

RESPONSE: As to the allegations in the first, second, and third sentences of Paragraph 42, Twitter admits that the referenced announcements and communications occurred, and respectfully refers the Court to those announcements and communications for their complete and accurate contents. Twitter admits the allegations in the fourth sentence of Paragraph 42.

43. On April 25, 2022, Goldman Sachs and J.P. Morgan delivered opinions that Musk’s $54.20 offer was fair to Twitter’s shareholders, and Twitter’s board formally voted to approve the merger.

RESPONSE: Twitter admits the allegations in Paragraph 43, except Twitter avers that Goldman Sachs and J.P. Morgan opined on the fairness of the proposed merger consideration to Twitter’s shareholders from a financial point of view.

C. The Merger

44. On April 25, 2022, the Musk Parties entered into the agreement to purchase Twitter. From the start, consistent with his goals to promote free speech and verify users, Musk announced his intent to “defeat” the “bots” that plague the platform and degrade the user experience.

RESPONSE: Twitter admits the allegations in the first sentence of Paragraph 44. To the extent the allegations in the second sentence of Paragraph 44 purport to quote from or characterize certain statements by Musk, Twitter respectfully refers the Court to those statements for their complete and accurate contents. Twitter otherwise denies the allegations in the second sentence of Paragraph 44.

45. The acquisition, if completed, would be funded with two financing streams. First, Musk (along with certain co-investors) would provide equity funding of $33.5 billion (as memorialized in a May 24, 2022 Equity Commitment Letter). Second, a syndicate of banks, led by Morgan Stanley, would provide debt financing of $13 billion under a Debt Commitment Letter. The Debt Commitment Letter expires on April 25, 2023.

RESPONSE: The allegations in the first sentence of Paragraph 45 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents. The remaining allegations in the body of Paragraph 45 purport to characterize the terms of the Equity Commitment Letter and the Debt Commitment Letter, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter admits that Musk increased his equity commitment to $33.5 billion, but avers that Musk replaced his margin loan because Tesla’s declining share price would have required Musk to pledge far more Tesla shares or cash as collateral to the margin lenders than Musk originally anticipated. The allegations in the first sentence of footnote 9 purport to characterize the terms of Musk’s original financing arrangements in connection with the Merger Agreement, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter admits the allegations in the second sentence of footnote 9.

46. Musk also agreed to a Limited Guarantee setting forth the limited circumstances under which he may be liable for certain fees in connection with the Merger Agreement.

RESPONSE: To the extent the allegations in Paragraph 46 purport to characterize the terms of the Limited Guarantee, Twitter respectfully refers the Court to the Limited Guarantee for its complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 46.

i. Conditions to Closing

47. The conditions to closing the merger appear in Article VII of the Merger Agreement. Section 7.2(b) requires that all representations and warranties be “true and correct as of the Closing Date” and does not require Buyers to close if a representation is false and the result is a material adverse effect. More broadly, under Section 7.3(c) the occurrence of a “Company Material Adverse Effect” relieves Buyers of their obligation to close.

RESPONSE: The allegations in Paragraph 47 purport to quote from and characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

48. Company Material Adverse Effect (“MAE”) is defined, in relevant part, as “any change, event, effect or circumstance which, individually or in the aggregate, has resulted in or would reasonably be expected to result in a material adverse effect on the business, financial condition or results of operations of the Company and its Subsidiaries, taken as a whole,” subject to certain carveouts.

RESPONSE: The allegations in Paragraph 48 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

49. Section 7.2(a) requires that Twitter “shall have performed or complied, in all material respects, with its obligations required under this Agreement. ” (the “Covenant Condition”) (emphasis added). The Covenant Condition contains no MAE qualifier.

RESPONSE: The allegations in Paragraph 49 purport to quote from or characterize the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

ii. Termination

50. Under Section 8.1, the parties can terminate the Merger Agreement at any time by mutual consent.

RESPONSE: The allegations in Paragraph 50 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

51. Buyers may also unilaterally terminate if the transaction does not close before October 24, 2022, although that termination date automatically extends under Section 9.9I if either party is seeking an order of specific performance to enforce the terms of the Merger Agreement.

RESPONSE: The allegations in Paragraph 51 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

52. The Musk Parties are not obligated to close if (a) the Company has not materially performed the covenants; (b) its representations and warranties are inaccurate and cause an MAE; or, (c) an MAE has occurred and is continuing. See Merger Agreement § 7.2.

RESPONSE: The allegations in Paragraph 52 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

53. Following a thirty-day cure period commencing upon notice of a covenant breach or the inaccuracy of a representation, the Musk Parties may terminate the Merger Agreement (a) due to a material covenant breach or (b) if any of the representations and warranties are untrue as of the closing date and have or will be reasonably expected to result in an MAE. See id. § 8.1(d)(i).

RESPONSE: The allegations in Paragraph 53 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

54. If the Company terminates because Buyers have breached their representations and warranties or have not complied with their covenants such that a closing condition has failed, then Buyers are required to pay $1 billion (the “Termination Fee”). If Buyers terminate because the Company’s board has recommended against the deal or if Twitter enters into a different merger agreement, then Twitter must pay Buyers a $1 billion Termination Fee. The parties agreed the Termination Fee is the sole and exclusive remedy for damages resulting from a failure to close.

RESPONSE: The allegations in Paragraph 54 and footnote 10 purport to characterize the terms of the Merger Agreement and Limited Guarantee, to which Twitter respectfully refers the Court for their complete and accurate contents.

iii. Twitter’s Covenants

55. The Merger Agreement contains several covenants, and a material breach of these covenants may excuse closing. In Section 6.1, Twitter covenanted to “use its commercially reasonable efforts to conduct the business of the Company and its Subsidiaries in the ordinary course of business” between the date of the Merger Agreement and closing. While there is a carve-out for actions taken in response to COVID-19, there is no carve-out related to executive and employee departures.

RESPONSE: The allegations in Paragraph 55 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

56. While Twitter attempted to insert flexibility into this provision, by including express language allowing Twitter to adopt employee retention plans without seeking consent, the Musk Parties rejected those attempts. The signed Merger Agreement contains neither a carveout to the ordinary course covenant nor any other express provision authorizing Twitter to make material personnel and compensation changes without consent.

RESPONSE: Twitter denies the allegations in the first sentence of Paragraph 56. The allegations in the second sentence of Paragraph 56 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents. Twitter also avers that, during the negotiation of the Merger Agreement, it rejected Musk’s proposal that would have required Twitter to obtain Musk’s consent prior to terminating the employment of any executive above the level of Vice President.

57. The Merger Agreement also contains an information covenant, requiring Twitter to “furnish promptly to [The Musk Parties] all information concerning the business, properties and personnel of the Company and its Subsidiaries . . . for any reasonable business purpose related to the consummation of the transactions contemplated by this Agreement . . . .” Merger Agreement § 6.4 (emphasis added). Similarly, Twitter must provide information relevant to obtaining financing. Id. § 6.11. Twitter can only decline to provide this information if it reasonably determines doing so would “cause significant competitive harm to the Company or its Subsidiaries . . . violate applicable Law or the provisions of any agreement to which the Company or any of its Subsidiaries is a party, or (iii) jeopardize any attorney-client or other legal privilege.” Id. § 6.4.

RESPONSE: The allegations in Paragraph 57 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

58. Buyers covenanted in Section 6.10 to take necessary action to obtain the requisite financing to consummate the transaction. If financing becomes unavailable, Buyers must “use their respective reasonable best efforts to arrange and obtain, as promptly as practicable . . . and to negotiate and enter into definitive agreements with respect to alternative financing . . . not less favorable” to the terms of the extant financing.

RESPONSE: The allegations in Paragraph 58 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

59. In turn, the Company covenanted in Section 6.11 to use its “commercially reasonable best efforts” to assist Buyers in securing financing, including by providing information related to the efforts to secure financing.

RESPONSE: The allegations in Paragraph 59 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

iv. Twitter’s Representations And Warranties

60. Believing that due diligence processes can be costly and inefficient, the Musk Parties instead focused on bargaining for contractual representations that the information they relied upon in deciding to acquire Twitter is accurate.

RESPONSE: Twitter avers that the Musk Parties declined to undertake any due diligence prior to signing the Merger Agreement. To the extent that Paragraph 60 purports to characterize the terms of the Merger Agreement, Twitter respectfully refers the Court to the Merger Agreement for its complete and accurate contents. Twitter lacks knowledge or information sufficient to form a belief as to the truth of the remaining allegations in Paragraph 60, and therefore denies them on that basis.

61. If these representations cannot be “brought down” at Closing, they may excuse a party from closing if the failure to bring such representations down results in an MAE.

RESPONSE: The allegations in Paragraph 61 purport to characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.

a. Twitter’s Representations That Its SEC Filings Are True

62. In Section 4.6(a), the Musk Parties secured a representation from Twitter that its SEC filings—and thus its userbase disclosures and identification of mDAU as a key metric—are accurate. Twitter represented that “none of the Company SEC Documents at the time it was filed . . . contained any untrue statement of a material fact” or omitted facts necessary to make the statements included misleading. The Musk Parties relied on this representation—and Twitter’s SEC disclosures—to sign the deal.

RESPONSE: The first and second sentences of Paragraph 62 purport to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents. Twitter denies the allegations in the third sentence of Paragraph 62. Twitter avers that the Merger Agreement contains no specific representations related to Twitter’s “userbase disclosures” or mDAU.

63. Importantly, this representation encompasses Twitter’s disclosures regarding its mDAU, including what share of its mDAU calculation is comprised of genuine accounts and spam accounts. In substance, this representation means that Twitter’s representations in its SEC filings regarding mDAU and false accounts must be true to comply with the Merger Agreement.

RESPONSE: Twitter avers that the Merger Agreement contains no representations about Twitter’s mDAU or false or spam accounts. The allegations in Paragraph 63 purport to characterize and interpret the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents. To the extent the second sentence of Paragraph 63 states a legal conclusion, no response is required. To the extent any further response is required, Twitter denies the allegations in the second sentence of Paragraph 63.

64. Twitter makes numerous representations regarding mDAU in its 2021 10-K, published on February 16, 2022, including:

- “We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the fourth quarter of 2021 represented fewer than 5% of our mDAU during the quarter.” (emphasis added).

- “In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated.”

- “We are continually seeking to improve our ability to estimate the total number of spam accounts and eliminate them from the calculation of our mDAU, and have made improvements in our spam detection capabilities that have resulted in the suspension of a large number of spam, malicious automation, and fake accounts. We intend to continue to make such improvements.”

- “After we determine an account is spam, malicious automation, or fake, we stop counting it in our mDAU, or other related metrics.”

- “Our advertising revenue growth is primarily driven by increases in mDAU, increases in ad pricing or number of ads shown and increases in our clickthrough rate.”

RESPONSE: Paragraph 64 purports to quote from Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 64.

65. Twitter consistently discusses its risk factors in terms of mDAU:

- “If we fail to increase our mDAU, ad engagement or other general engagement on our platform, our revenue, business and operating results may be harmed;” “If we are not able to compete effectively for audience, content and platform partners, our mDAU and engagement would decline and our business and operating results would be materially and adversely impacted;” (emphasis added).

- “Our mDAU and their level of engagement with advertising are critical to our success and our long-term financial performance will continue to be significantly determined by our success in increasing the growth rate of our mDAU as well as the number of ad engagements.” (emphasis added).

- “Our content and platform partners may choose to publish content on, or develop applications for, other platforms, and if they cease to utilize our platform or decrease their use of our platform, then mDAU, engagement, and advertising revenue may decline;” “If we are not able to compete effectively for advertiser spend, our mDAU and engagement would decline and our business and operating results would be materially and adversely impacted;” (emphasis added).

- “If we make a sudden improvement in one of the algorithms we use to detect spammy or suspicious behavior, we may remove a larger number of accounts as a result and impact the year-over-year average of mDAU growth.” (emphasis added).

RESPONSE: Paragraph 65 purports to quote from Twitter’s SEC filings, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 65.

66. Twitter broadly touts its mDAU metric to the investing public. Indeed, Twitter’s CFO has said “[w]hen we look at other markets, we’ve been really pleased with the DAU growth, which is the foundation of any revenue opportunity that we have.” Similarly, Twitter’s former head of its consumer division told analysts that “[u]ltimately, we measure our long term success through our ability to grow monetizable daily active usage (mDAU),” and that while “there are a variety of metrics that help us gauge whether our product solutions are working, [] in [the] aggregate the best way to measure our success is mDAU.”

RESPONSE: Paragraph 66 purports to quote from and characterize Twitter’s public statements, to which Twitter respectfully refers the Court for their complete and accurate contents. Twitter otherwise denies the allegations in Paragraph 66.

67. Pages 20 and 158 of the July 26, 2022 definitive proxy disclose that “Twitter stands behind the accuracy of its public disclosures, including with respect to its estimates of false and spam accounts.”

RESPONSE: Paragraph 67 purports to quote from Twitter’s Definitive Proxy Statement, to which Twitter respectfully refers the Court for its complete and accurate contents.

68. Section 4.7 represents that “[n]one of the information supplied or to be supplied by or on behalf of the Company or any of its Subsidiaries expressly for inclusion or incorporation by reference in the proxy statement relating to the matters to be submitted to the Company’s stockholders at the Company Stockholders’ Meeting (such proxy statement and any amendments or supplements thereto, the ‘Proxy Statement’) shall, at the time the Proxy Statement is first mailed to the Company’s stockholders and at the time of the Company Stockholders’ Meeting to be held in connection with the Merger, contain any untrue statement of material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading at such applicable time . . . .” Twitter’s proxy incorporates its 2021 10-K and Q-2 2022 10-Q by reference.

RESPONSE: Paragraph 68 purports to quote from or characterize the terms of the Merger Agreement and to characterize the contents of Twitter’s Definitive Proxy Statement. Twitter respectfully refers the Court to those documents for their complete and accurate contents.

b. Twitter’s Other Representations

69. The Merger Agreement also contains several other representations and warranties. Section 4.9 represents that “Since January 1, 2022 and until the date of this Agreement, (a) the businesses of the Company and its Subsidiaries have been conducted in the ordinary course of business (other than as a result of COVID-19 and COVID-19 Measures or with respect to the Existing 2030 Notes or the transactions contemplated hereby) and (b) there has not been any adverse change, event, development or state of circumstances that has had a Company Material Adverse Effect.”

RESPONSE: Paragraph 69 purports to quote from or characterize the terms of the Merger Agreement, to which Twitter respectfully refers the Court for its complete and accurate contents.