How to stay on top of reporting

Save time and resources in the everchanging world of indirect tax reporting

– Blog home

For large companies operating in a digitalized global economy, indirect tax compliance has evolved from an arduous manual task to a largely hands-off process performed by sophisticated tax technologies that execute most tax functions–data gathering, computation, reconciliation, invoicing, reporting, filing, etc.–automatically and in close to real time.

Much of this shift to digital tax compliance has been driven by governments and tax authorities around the world who are adopting e-invoicing, real-time reporting, electronic tax filing, and other digitalized forms of tax compliance, all of which require tax technologies that can keep pace with the massive amounts of data these systems generate and the reporting speeds that digitalized tax regimes require.

Jump to |

Saving time and resources

To help tax professionals adapt to this new era of digital tax compliance, Thomson Reuters recently hosted a webinar discussion with tax specialists from Deloitte, who shared many of the insights and strategies they use to help their clients position themselves for success.

Faraz Hussain, a partner in Deloitte Tax LLP’s tax technology consulting practice, explains that the shift to automated tax processes has not necessarily made the job of corporate tax compliance any easier–it has simply made it possible for companies and tax authorities to share information more efficiently.

“The access and availability of tax information, and the ability to process and assess the volumes of data that is in those electronic filings–it saves time and frees up resources,” Hussain says–resources that can be devoted to other important activities.

|

“When tariffs are enacted, then paused, then changed again, “it can be challenging to get ahead of that, but with the right technology in place, companies can make those changes very quickly, and accurately, and remain compliant.” –Tracy Davis |

Thomson Reuters global specialist director Tracy Davis also notes that modern tax technologies are helping many global companies keep up with the on-and-off nature of changing tariffs and tax rules. When tariffs are enacted, then paused, then changed again, “it can be challenging to get ahead of that,” Davis says, “but with the right technology in place, companies can make those changes very quickly, and accurately, and remain compliant.”

At the center of it all: data

To enjoy the many benefits of modern tax technology, however, companies should have the proper systems and processes in place, and those systems need to have access to clean, high-quality data.

An enterprise resource planning (ERP) system coupled with a tax engine that can scale as the company grows is the most common solution to the data challenges faced by global companies. Tools built specifically for such tasks as e-invoicing, tax compliance, and supply-chain visibility can be useful as well, the panelists agree, though they caution that the efficacy of these systems and tools depends largely upon the quality of the data they are processing.

“Garbage in, garbage out” certainly applies to tax data, says Lindsay McAfee, a principal in Deloitte Tax LLP’s indirect tax practice. “Companies that want to improve and enhance their tax reporting should look at their data and processes, engage with stakeholders, and make sure they have the technology in place that can support the globalization of their business,” McAfee says.

|

“The problem with putting off the technological upgrades a company knows it is going to need in the future, is that when the future arrives, the data fields needed to comply with global requirements often aren’t there.” –Lindsay McAfee |

Challenges and decisions

Companies in need of upgraded technology often face considerable challenges, however.

“Companies of all sizes are dealing with technology constraints,” McAfee explains. McAfee explains that “companies of all sizes are dealing with technology constraints.” She acknowledges that these are real challenges. In such cases, McAfee explains, the company that initially complained about its limitations will end up making a business case for technological change. From that point, one of the most critical challenges is developing a strategic plan that will allow the organization to upgrade and adapt its systems while at the same time maintaining the standards of accuracy and efficiency needed for global compliance.

“Whether we’re talking about digital reporting or tax rates and rules, companies should consider using software solutions like Thomson Reuters ONESOURCE to do the heavy lifting globally,” says Tracy Davis, adding that “even with a large tax department or organization, it’s nearly possible for humans alone to keep up with all that’s going on globally.”

Different technology tools for automating tax reporting were also discussed during the webinar, though ONESOURCE was mentioned as the preferred choice for tax automation and compliance because of its comprehensive breadth of options and the experienced team supporting it.

Practical tips and strategies

Hussain and McAfee shared several practical tips for companies and tax professionals facing similar challenges as they embark on their own technological journey:

Develop a digital transformation strategy:

-

-

-

- Piecemeal solutions rarely work on such extensive projects. A thorough plan guided by a clear strategy is the best way to ensure success.Bring tax into the decision-making process from the beginning:

- Tax is largest consumer of data in most companies, so give tax teams a seat the table.Collaborate and communicate with internal teams (IT, finance, legal, HR):

- Better cross-departmental communication gives companies a better chance at creating a more effective system, smoother processes, cleaner data, and improved compliance.Invest in the right technology solutions:

- Understand the company’s needs and goals to ensure that new tax technologies are a good fit.Stay informed and think globally:

- Tax rules and regulations change quickly, so stay informed through research and/or content provided by a reliable third party.Engage with stakeholders:

- You are not alone, so it’s important to communicate with internal teams, external clients, advisors, tax authorities, professional organizations, and stakeholders to gather information and build trust.Get the data piece right:

- Because getting the data wrong is not an option.Indirect tax automation software

Harness the power of automation with ONESOURCE Indirect Tax Determination

Learn more about /

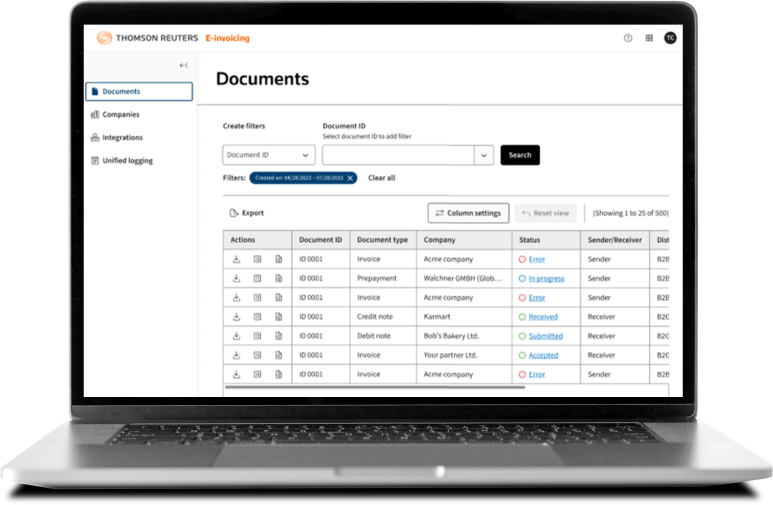

E-invoicing compliance software

-

-

ONESOURCE Pagero: Accelerate growth with trusted, automated e-invoicing software

Learn more about /

-