Guide to IRS Form 1040 Individual Income Tax Return

Knowing your way around IRS form 1040 can make tax filing much easier. This guide will help you understand what Form 1040 is, how it’s used, and the related forms and schedules that you may need. Let’s dive right in.

Form

Description

|

Due Date |

1040 |

Standard individual tax return for U.S. taxpayers. |

|

April 15 (or next business day if it falls on a weekend/holiday) |

1040-SR |

Another version of Form 1040 for taxpayers aged 65 and older. |

|

April 15 |

1040-ES |

Used to file quarterly estimated tax payments for those who are self-employed or taxpayers with untaxed income. |

|

April 15, June 15, Sept 15, Jan 15 (next year) |

1040-V |

Payment voucher for those filing paper returns and sending tax payments by mail. |

|

April 15 |

1040-X |

Used to amend a previously filed tax return. |

|

3 years from original due date (or 2 years after taxes paid, whichever is later) |

1040-NR |

Used by nonresident aliens to report U.S.-sourced income. |

|

April 15 (or next business day if it falls on a weekend/holiday) |

What is Form 1040? |

Form 1040, U.S. Individual Income Tax return is the IRS form that you use to file your federal tax return. It gathers all the information about your income, tax credits, and deductions to determine if you owe money or if you will get a refund. Form 1040 is also used to determine your filing status, such as single, married filing jointly or other. It consists of two pages: |

While the form may look complex, it’s essentially asking for a few key details:

Your personal information

: The top section gathers details like your name, Social Security number (SSN) or individual taxpayer identification number (ITIN), and filing status. It is two pages long:

While it may appear complex, the form only asks for a few important details:

Your Personal Information

The top section asks for your name, Social Security Number (SSN) / individual taxpayer identification number(ITIN), and filing state. This section also includes information about your spouse or dependents. You can check boxes for each dependent indicating their eligibility for the Child Tax Credit or the Credit for Other Dependents.

- Income: Here, you’ll report all types of income, including wages, distributions, ordinary dividends, and capital gains, to calculate your total income. Include any tax deductions that you wish to claim. This section accounts for all tax credits that you are eligible to claim, like the Earned income credit or Child Tax Credit. It then calculates your total tax liability for the year (line 24).

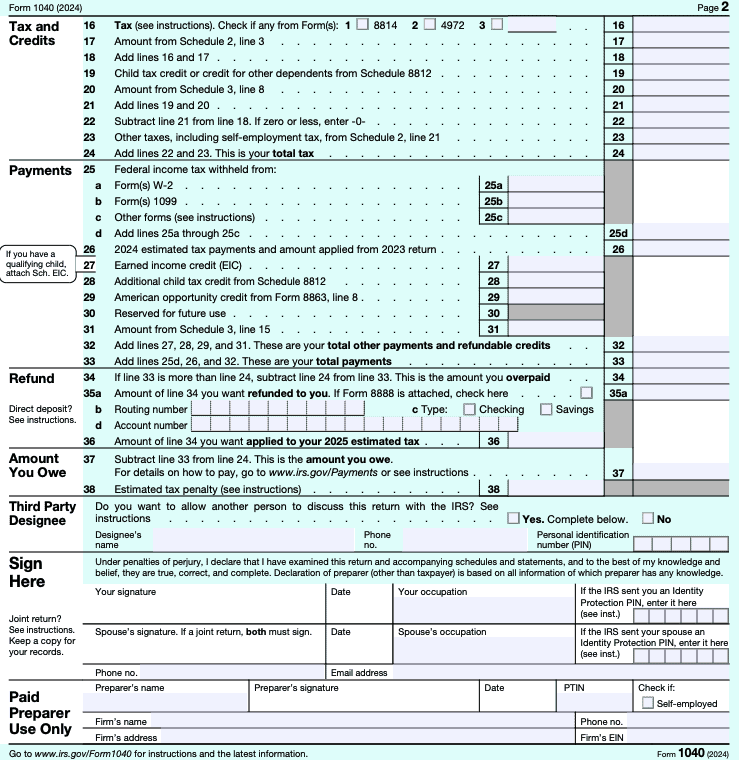

- Payments: This section accounts for tax payments you already made, such as withholding from your regular paychecks or estimated tax payments you made. Line 33 shows the total tax payments you made for the year. If line 33 is higher than line 24, the difference will be refunded. If line 24 is greater than line 33, you owe the IRS the difference.

- Overview of key schedules for Form 1040Sometimes, Form 1040 is just the start. Depending on your situation, you may need to file additional schedules along with it to fully report your income or credits, such as:

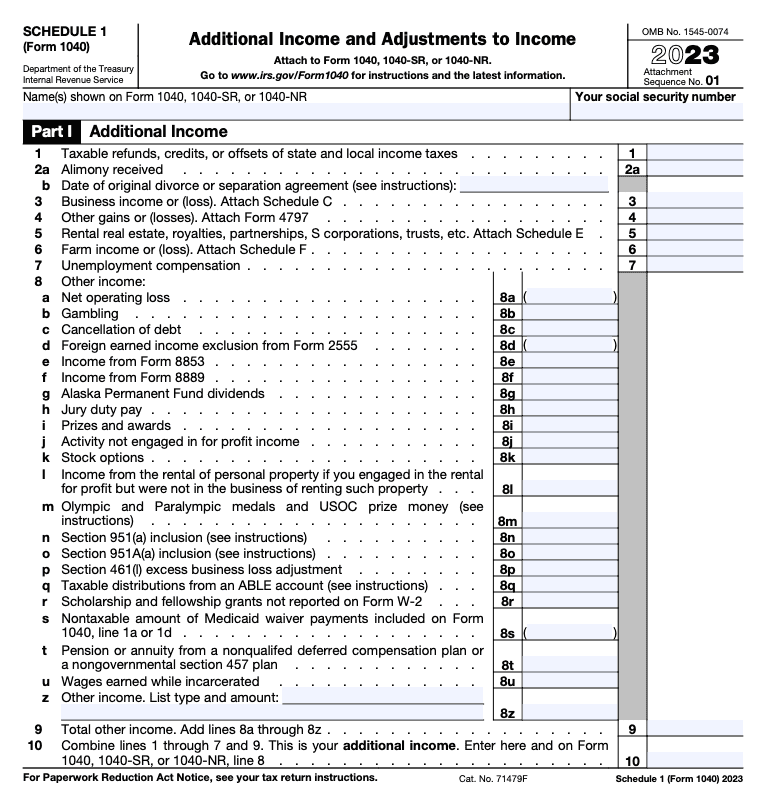

- Schedule 1: Additional Income and Adjustments to IncomePage 1 of Schedule 1 reports additional income and looks like this:

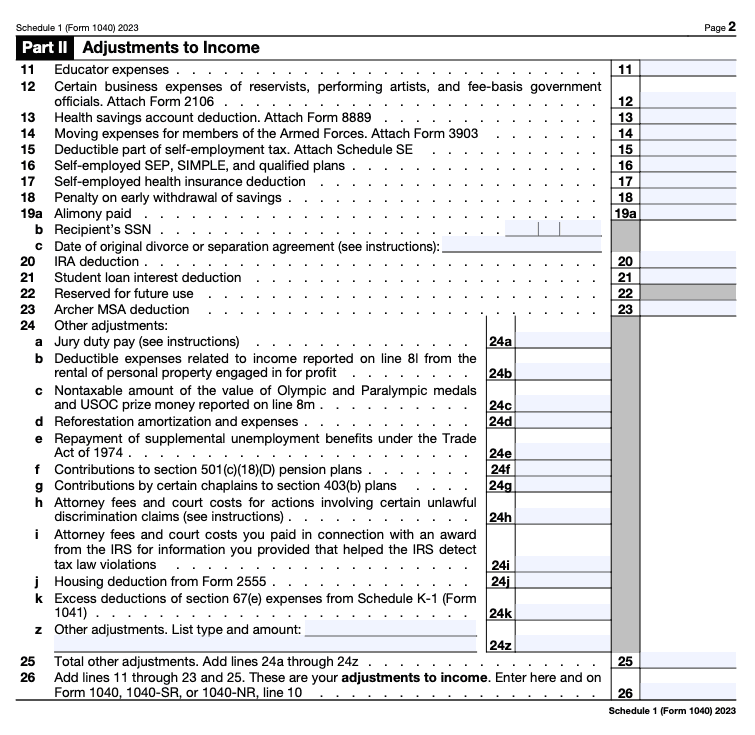

- Some reasons for filing Schedule 1 include having any of the following income types during the tax year:Page 2 of Schedule 1 covers adjustments to income and looks like this:

Here, you can report income adjustments like the following:

Student loan interest deduction

Deductible educator expenses

Deductions for retirement contributions

Health savings account (HSA) deductions

Self-employment health insurance deduction

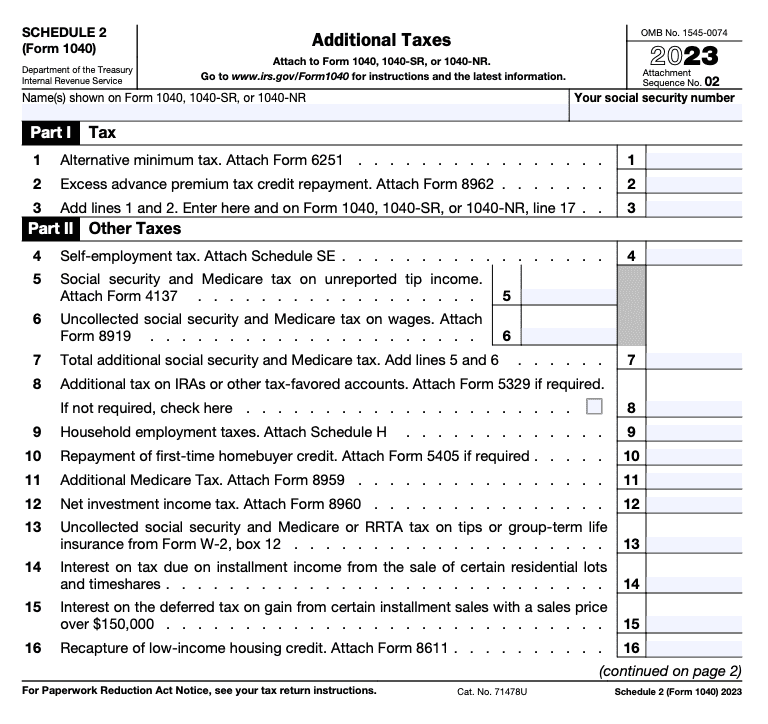

Schedule 2: Additional Taxes

- Schedule 2 reports additional taxes and looks like this:

- Some reasons for filing Schedule 2 include having any of the following during the tax year:

- Alternative minimum tax (AMT)

- Excess advance premium tax credit repayment

- Self-employment tax

Additional Social Security and Medicare tax

Additional taxes on IRAs and other tax-favored accounts

Household employment taxes (you may also need Schedule H, Household Employment Taxes)

- Repayment of first-time home buyer credit

- Recapture of low-income housing credit

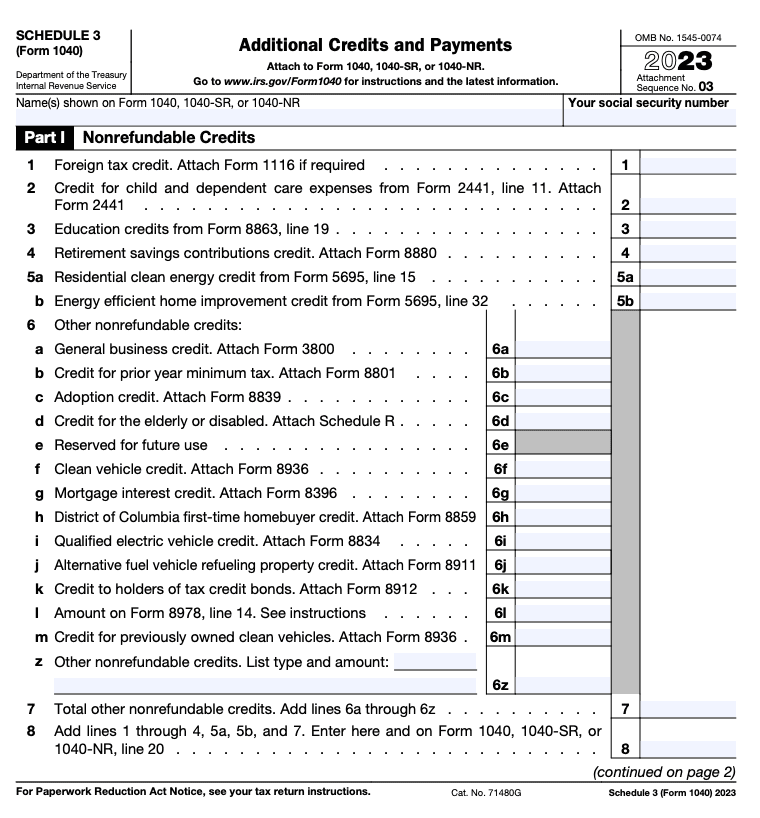

- Schedule 3: Additional Credits and Payments

- Schedule 3 reports additional tax credits and payments. Here’s what it looks like:

- Use Schedule 3 to claim nonrefundable credits like:

- Form 1040 instructions

- Filling out Form 1040 and its schedules isn’t as complicated as it may seem, especially if you use tax software like TaxAct(r). We walk you through the filing process, filling out Form 1040 and any accompanying schedules for you based on the information you give us.

- Here’s how to get started:

Gather documents

: Before filing, collect all necessary tax documents like your W-2s, 1099s, and any statements for IRAs, pensions, or other retirement plans. You’ll need to gather any information on tax deductions, and other forms that are relevant to your tax situation. Fill out your personal information

– Start with your name and address. Don’t forget your filing status and dependent information.

Report your income

: Report all types of income. This could include self-employment taxes, unemployment benefits, or Social Security. If you have additional income or adjustments, you’ll also use Schedule 1 (more on schedules in the next section).

Claim tax deductions and credits

- : Claim any tax deductions and credits that apply to you. TaxAct asks you questions when you file to determine if you qualify for any tax credits or deductions. This can help you save money on your tax bill. Our software will also help you decide whether to use the standard deduction, or itemized deductions. (Using Schedule A). If you are eligible for a refund, we will help you complete your direct deposit information. If you owe a tax bill, we can help you pay it or even set up a payment plan if necessary.Other types of 1040 tax forms

- There are multiple versions of the 1040 form, each designed to address specific taxpayer situations. Here’s a deeper look at some of these and how they differ from the standard Form 1040:1040-SR

- This form is designed for older taxpayers, specifically those aged 65 and above. It has a larger font and a more simple layout to make it easier for seniors to use. Form 1040-SR contains the same sections as Form 1040 but is formatted to make it more user-friendly for those who have difficulty reading small text. It also includes a table showing the larger standard deduction amounts available to taxpayers over 65.1040-ES

- This form is used to make estimated tax payments throughout the year, typically by individuals with income not subject to withholding, such as self-employment income, rental income, or investment income. This form helps you calculate and pay your estimated taxes on time. This form helps you calculate and pay your estimated taxes on time.Tax Tip:

- If you e-file your tax return with us, TaxAct can help you set up automatic estimated tax payments via Electronic Funds Withdraw.1040-V

The 1040-V form is a payment voucher used when you owe taxes and submit a check or money order to the IRS by mail. It is different from Form 1040 because it is not a return, but a way of accompanying your payment when you file a paper tax return. Using

Form 1040-V

helps ensure that your payment is correctly applied to your tax account.

1040-X

This form is called an amended tax return. Form 1040-X is available if you need to correct errors on your Form 10, such as income, deductions or credits. Unlike the regular Form 1040, which is filed for the current tax year, Form 1040-X is used to adjust information from a prior year, typically within a three-year window from the original due date.

1040-NR

Form 1040-NR is used specifically by nonresident aliens who are not U.S. residents but have U.S.-sourced income, such as wages or investment returns. You may need to use Form 1040 if you’re a representative for a trust or estate or a deceased individual who would have been required to file Form 10040-NR. You’ll need the SSNs of you, your spouse and any dependents if applicable. You may not have all the documents you need. Use our tax preparation checklist to check off your spouse, your dependents and yourself. The standard deduction varies yearly depending on your filing status. For 2024, it is $14,600 for single filers and those married filing separately, $21,900 for heads of household, and $29,200 for married couples filing jointly and surviving spouses. For 2024, it’s $14,600 for single filers and those married filing separately, $21,900 for heads of household, and $29,200 for married couples filing jointly and surviving spouses.Who should use Form 1040-SR?

Form 1040-SR is for taxpayers aged 65 and older who want a more straightforward form that’s easier to read and understand.

What’s the difference between Form 1040, 1040-A, and 1040-EZ?Form 1040-A and Form 1040-EZ were simplified versions of Form 1040, but they are no longer in use as of 2018. The differences between Form 1040-A, 1040-EZ and Form 1040 are listed below. As of 2018, these simplified versions of the 1040 form have been discontinued. It was available to taxpayers who did not itemize deductions or had only income from wages, dividends, interest, pensions, and certain other sources. It allowed for some adjustments and credits, but was less flexible than the standard Form 1040. It was only available to single or married filers who had no dependents and taxable income under $100,000. There were no adjustments or itemized tax deductions. TaxAct makes it easy to file your Form 1040. Here’s how to get started:Sign up or log in

: Head to TaxAct.com and create an account.

Enter information

: Follow the guided prompts to input your personal and income information. TaxAct will review and file your return and guide you through the electronic filing process. We’ll file everything for you. With the right documents plus some guidance and assistance from TaxAct, you can complete Form 1040 with confidence and be well on your way to spending your tax refund in no time.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to

applicable terms and conditions

.