Guide to Tax Form 1099SA

Don’t be scared if you received Form 1099-SA in your mailbox this year. This guide will explain what a 1099SA form is, how you received it, and what to do next. By the end, you’ll know exactly how to report it on your income tax return and have one less thing to worry about on Tax Day.

At a glance:

- Form 1099-SA reports distributions from health savings accounts and medical savings accounts.

- Withdrawals from these accounts are tax-free if used for qualified expenses.

- Nonqualified expenses are subject to income tax plus additional tax.

What is a 1099-SA form?

The Internal Revenue Service (IRS) officially calls Form 1099-SA Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. Basically, the agency uses this form to track distributions made from your health savings account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage Medical Savings Account (MA MSA).

HSAs and MSAs explained

HSAs and MSAs are tax-advantaged accounts designed to help Americans covered under a High Deductible Health Plan (HDHP) pay for qualified medical expenses. Contributions are tax deductible and can be reinvested, but there is a limit to the amount you can contribute each year. Unspent contributions can be carried over from one year to the next until you need them. The IRS wants to know when you use money from your HSA or MSA to cover healthcare expenses. The IRS wants to know when you withdraw money from your HSA to cover healthcare costs. The IRS Form 1099SA looks something like this:

On left side of the form you will find the contact details of the financial institution and their taxpayer identification numbers (TIN). You will also see your account number and TIN as the account holder. All distributions are reported here, even if you used the funds for qualified medical expenses.

Box 2: Earnings on excess contributions

– If you contributed more than the allowable limit to your HSA or MSA, any earnings on those excess contributions are reported here.

Box 3: Distribution code

– This number indicates the type of distribution — whether it was for a qualified medical expense, a non-medical expense, or another reason entirely (retirement, death, disability, etc.). The IRS website has a complete list of codes. It shows the fair market value of your account on the date the account holder died. It shows the fair market value of your account on the day the account holder died.

- Box 5: Type of account – This checkbox tells you whether the distribution came from an HSA, Archer MSA, or Medicare Advantage MSA.

- Form 1099-SA instructionsOkay, so now you know what’s on the form. What do you do with the form?

- First of all, take a deep breathe. If you withdrawn money to pay for qualified medical costs, you shouldn’t be required to pay tax on it. However, you must report it. Here’s what to do:Check the records

- : Compare the amount shown in Box 1 with those on your own records. Check that the amount in Box 1 matches what you took. If you notice an error, contact your plan administrator right away to get it corrected.Report the distribution on your tax return

- : Taxable HSA distributions are reported on Form 8889, while taxable MSA distributions are reported on Form 8853. Even if the distributions are not taxable, you should still report them. When you e-file with TaxAct(r), we help you fill out these forms by asking questions about your 1099-SA.Non-qualified distributions

: If you used the funds for non-medical expenses, the distribution will be taxed, and you’ll owe an additional 20% penalty. Our software can help calculate this, too, if needed.

E-file your return

: Once you’ve filled out the proper forms, TaxAct can help you e-file everything electronically with our tax preparation software. If you received an HSA or MSA payout, your account provider should send you a Form 1099SA by mid-February. Many providers now offer these forms electronically instead of mailing them, so check your HSA account to see if you have any tax forms. Check your account to see if you can download the 1099-SA form directly. If you are still unable to locate your 1099-SA, contact your provider immediately. For certain treatments, you may need to obtain a letter of medical necessity from your healthcare provider.

- Your HSA or MSA provider may have their own list of common IRS-qualified medical expenses to reference like this one from HSA Bank(r). For further reading, check out our article on 9 Surprising Health Expenses Covered by Your HSA or FSA.

- What if there’s a mistake on my 1099-SA?Mistakes happen! If the form contains an error, such as an incorrect amount or distribution code, contact your HSA or MSA provider to get a corrected version ASAP.

- Why did I get Form 5498-SA?Unlike Form 1099-SA, which reports distributions, Form 5498-SA reports contributions to your HSA, Archer MSA, or MA MSA. It shows all of your contributions for the year including any employer contributions. This form can be used to keep track of any contributions made after-tax without going through an employer. These contributions may be deductible. If you didn’t make any after-tax contributions to an HSA or MSA, you likely won’t need this form when filing your federal tax return.

- How to file Form 1099-SA with TaxActTaxAct’s intuitive software takes the guesswork out of tax filing, so you can confidently report your 1099-SA with ease. Depending on the type of account you have, you can report your 1099-SA distributions in three ways:

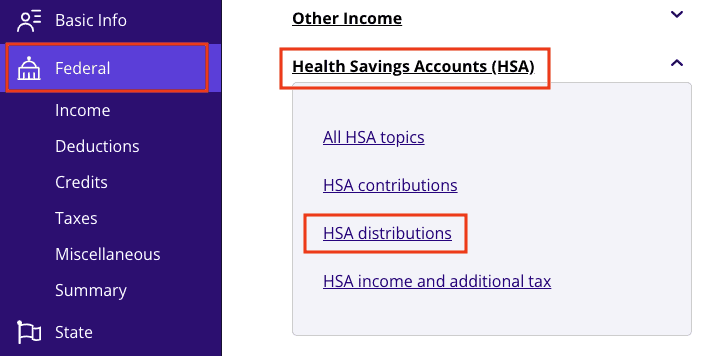

HSA distributions

From within your TaxAct return (

Online

or Desktop), click

Federal.

(On smaller devices, click in the top left corner of your screen, then click

Federal

).Click the

Health Savings Accounts (HSA)

dropdown as shown below, then click

HSA distributions.

3. Continue with the interview process until you reach the screen titled

Form 1099-SA – Type of Account

, then click the

circle

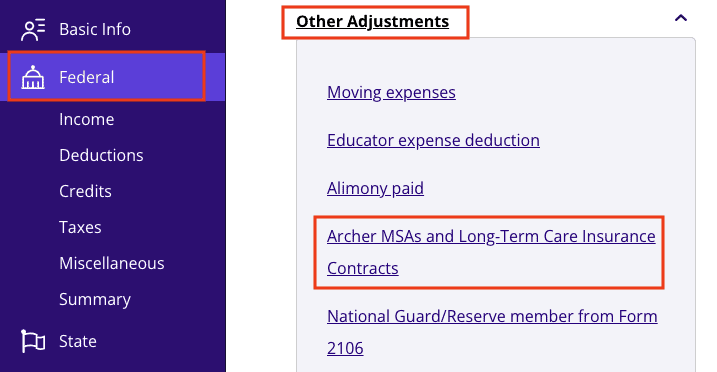

- next to HSA.Archer MSA distributionsFrom within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click

- Federal).Click the Other Adjustments

dropdown as shown below, then click Archer MSAs and Long-Term Care Insurance Contracts.3. Click MSA Distributions

and continue with the interview process to enter your information.

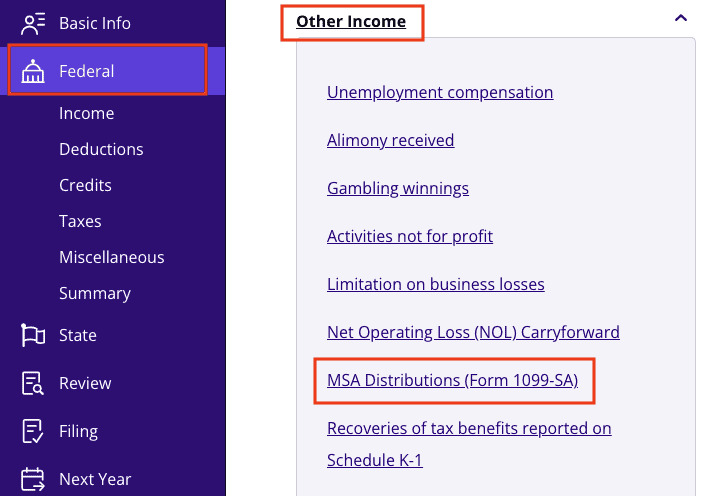

- Medicare Advantage MSA distributionsFrom within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal

- ).Click the Other Income dropdown as shown below, then click MSA Distributions (Form 1099-SA)

.3. Click +Add

Forms 1099-SA or

- Edit for a new form. (Desktop program: click Review instead of Edit).4. Continue with the interview process to enter your information.

- The bottom lineIf you took distributions from an HSA or MSA during the tax year, expect to receive Form 1099-SA this season. TaxAct can help you with the details so that you can relax knowing that your taxes will be taken care of. Let TaxAct handle the details, and your taxes will be over with before you know it!This article is for informational purposes only and not legal or financial advice.All TaxAct offers, products and services are subject to applicable terms and conditions.All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, sponsored by, or sponsors of TaxAct, Inc.