Mastering global indirect taxes and e-invoicing

Learn how to future-proof your compliance and maintain a strong competitive edge using Thomson Reuters and Oracle

– Home of the blog

Global indirect taxes and eInvoicing compliance are more important than ever. Corporations must navigate a complex network of regulations and mandates. Non-compliance with regulations can lead to substantial financial penalties, increased risk of audit, and reputational damage. Thomson Reuters leaders focused on future-proofing global indirect tax compliance and eInvoicing at the Oracle CloudWorld event 2024. The discussion highlighted the importance of technology partnerships in addressing compliance gaps, particularly through the integration of Thomson Reuters tax solutions with Oracle’s ERP systems. The discussion underscored the importance of technology partnerships in addressing compliance gaps, particularly through the integration of Thomson Reuters tax solutions with Oracle’s ERP systems.

Highlights:

TR and Oracle’s partnership offers seamless integration for global indirect tax and e-invoicing compliance.

|

Jump to |

Trends increasing business risk

In today’s fast-changing global market, corporations must ensure global tax compliance using standardized operations and centralized tax management. Brad Colie, Director Pagero Sales for Thomson Reuters, drew attention to global regulatory trends that increase business risks. These trends are driving the need for enhanced tax compliance strategies and advanced e-invoicing processes:

Increased tax audits:

- Frequent and stringent tax audits are on the rise. The 2024 State of the Corporate Tax Department found that on average 62% of businesses were audited last year, with under-resourced departments (72%) experiencing higher audit rates and facing average fines of $50,000.Continuous tax law changes:

- Legislative changes are accelerating, influenced by economic and market conditions like inflation and global pandemics. The government aims to boost tax revenues to lessen reliance on income tax.E-Invoicing mandates:

- Numerous countries are mandating real-time e-invoicing to close VAT gaps and increase revenue. The invoices must be sent to the corresponding government before products or services reach consumers.More “green” fees and taxes:

- New environmental taxes and fees are constantly being instated and often change. Different industries have different policies and fees. To avoid penalties, businesses must keep accurate records and report on time. They must also account for all taxable activity. They must ensure that their systems are robust, and constantly protected against cyber threats. Failure to do this could have severe legal repercussions, and damage their reputation. Staying ahead of global regulatory requirements and implementing stringent data security measures will be crucial as technology evolves.

Real-time global e-invoice reporting challenges

The convergence of e-invoicing and tax is a critical trend. Real-time eInvoice reporting is seen by many as the key to closing a VAT gap estimated at EUR124 billion within the EU. The tax department has become a key player in these mandates even though it does not control the budget. Accurate upfront tax calculations are essential to avoid higher operational and compliance costs, such as cancel/rebills, delayed billing and payment, reconciliation with VAT returns, and increased audit exposure.

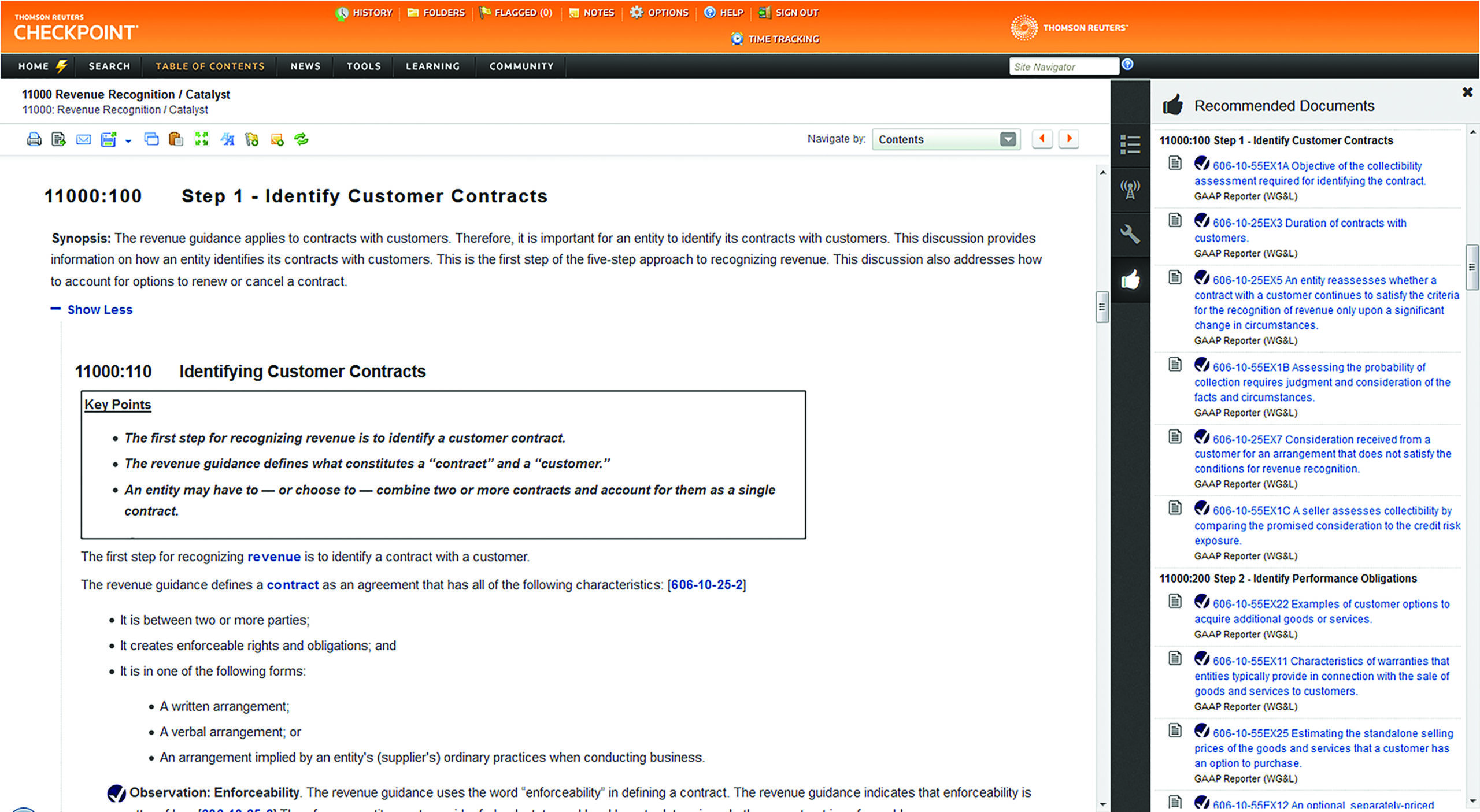

Adam Schaffner, Director of Product for Indirect Tax at Thomson Reuters, discussed the increasing complexity of real-time global e-invoice compliance. He says that a recent report showed that real-time reporting was becoming the norm, and 83 countries have already mandated this requirement. These mandates are often country-specific and complex, posing significant challenges for multinational corporations. The key global tax challenges are complying with diverse, evolving e-invoicing requirements, inefficiencies of localized tax operations and lack of centralized controls, as well as the complexity of changing tax laws. She focused on the seamless collaboration between Thomson Reuters and Oracle, which offers a comprehensive solution from end-to-end as well as e-invoices compliance. ONESOURCE’s solutions cover income tax, tax provision and reporting, global trade, indirect taxes, and eInvoicing. All of which provides a holistic approach to managing tax and trade complexities.

The ONESOURCE Indirect Tax suite runs natively on Oracle Cloud Infrastructure (OCI) and with its pre-built connector, seamlessly integrates with Oracle Fusion Cloud ERP, ensuring accurate tax calculations and tax filings. ONESOURCE’s Pagero, with its pre-built Oracle connector, ensures global eInvoice compliance and automated AR/AP. As an Oracle ISV partner, Thomson Reuters deploys its core products and integrations on OCI.

ONESOURCE global trade solutions have helped customers save over a billion dollars in duties by managing foreign trade zones and leveraging free trade agreements.

“In statutory reporting, our clients have seen a 68% increase in efficiency, transforming what was once a manual process into a streamlined operation. Our solutions have led to an average 50% increase in efficiency for indirect tax. Our solutions for Base Erosion & Profit Shifting (BEPS), have resulted in savings of 38% to 50 percent.” These tools use prebuilt connectors to ensure seamless integration, rapid deployment, enhanced accuracy, and eliminated reconciliation issues. They implemented a solution to standardize and simplify operating procedures while ensuring regulatory requirements were met. They use ONESOURCE’s products, including Indirect Tax compliance, Pagero Statutory Reporting and Checkpoint Research. As a result, JLL reduced their compliance risk and improved team efficiency by 60%.

Product solutions for global indirect tax compliance success

Oracle and Thomson Reuters integrated solutions assist tax teams with global compliance and regulatory changes. These include ONESOURCE Indirect tax compliance for centralized operations, Pagero to automate tax calculations across multiple countries and ONESOURCE Indirect tax determination for automated tax calculation. These tools aim to enhance accuracy, reduce risks, and streamline tax processes within Oracle systems, supporting businesses in adopting advanced e-invoicing solutions, automating sales tax processes, and standardizing tax operations globally.

Learn more about Thomson Reuters and Oracle’s integrated product solutions to help your business achieve global tax compliance.

|

|

– Back to blog