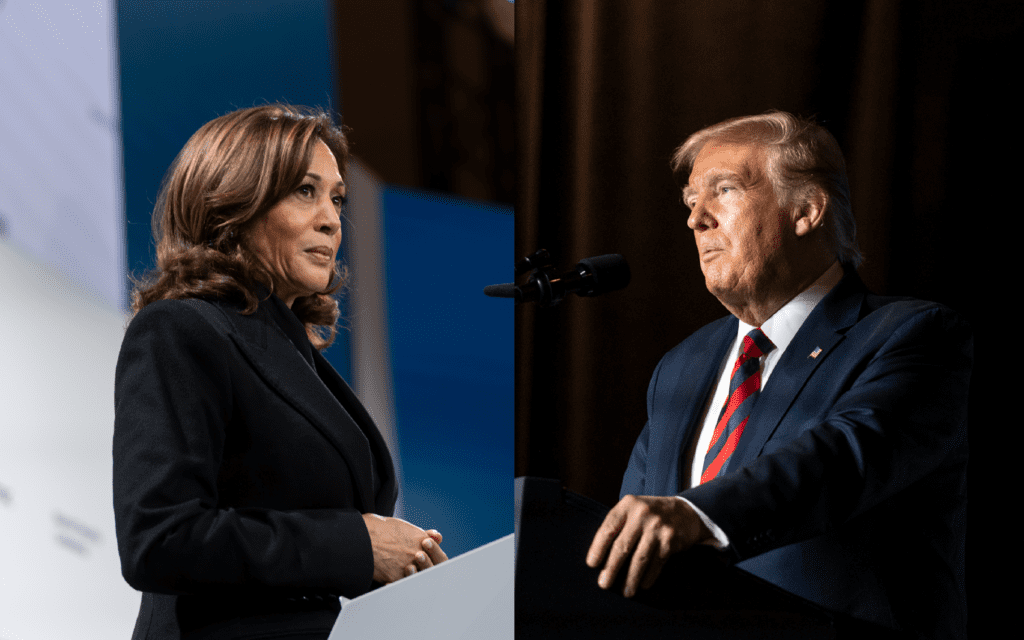

Place Harris and Trump Tax Plans into Historical Context

Presidential candidate Donald Trump and Kamala Harri have both called for significant changes to the US tax A tax is an obligatory payment or charge that local, state and national governments collect from individuals and businesses to cover costs of general government goods

system. We compared the projected revenue changes of both candidates’ plans to historical tax change since 1940. We averaged the annual revenue change for each law or proposal in terms of GDP over years where data was available. Trump’s combination tax changes and tariffs would rank as the sixth largest tax cut since 40. However, Trump has indicated he would pursue

tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers which increase prices, reduce the amount of goods and services available to US businesses and consumers and place an economic burden on foreign suppliers.

increases on their own, without requiring Congressional consent. If tariffs rise without accompanying tax cuts, they would rank as the 7th largest tax increase since 1940, and the largest tax increase outside of wartime over the same period.Comparing Harris and Trump on Taxes

Harris has proposed a collection of tax increases, tax cuts, and expanded tax credits we estimate would raise tax revenues on net by $1.7 trillion from 2025 through 2034, an average increase of 0.5 percent of GDP. That’s due to a combination of $4.1 trillion of tax increases (1.2 percent of GDP) and $2.4 trillion of tax cuts and expanded credits (-0.7 percent of GDP).

Harris’s tax plan would rank as the 15th largest tax increase since 1940, and 6th largest tax increase outside of wartime over the same period.

Trump has proposed a collection of tax cuts, tax increases, and tariff increases we estimate would reduce tax revenues on net by $3 trillion from 2025 through 2034, an average decrease of 0.8 percent of GDP. This includes $7.8 trillion in tax cuts (-2.2%), $921 billion in higher revenues from repealing the green energy tax credit (0.3%) and $3.8 trillion from increased tariff revenue (1.1%). Trump has indicated that he intends using executive authority to impose the tariffs The five largest tax increases from 1940 to 1951 all occurred during wartime, between 1941 and 1951. They raised revenue ranging from 1.2 percent to 5 percent on average. The Revenue Acts of 1941 and 1942 and the Current Tax Payment Act of 1943 helped finance defense spending during WWII, and the Revenue Acts of 1950 and 1951 helped fund the Korean War.

By comparison to the largest historical tax increases, the 2018-2019 tariffs imposed by President Trump on more than $380 billion of foreign products increased customs duties between 0.1 percent to 0.2 percent of GDP, ranking as the 21st largest tax hike since 1940.

The Inflation Reduction Act (IRA) enacted under President Biden ranks as the 23rd largest tax hike since 1940, increasing taxes by 0.1 percent of GDP in years with significant revenue effects (though the actual revenue effects of the IRA are highly uncertain given changing utilization and rules surrounding its energy tax credits).

Largest Tax Decreases since 1940

The five largest tax reductions since 1940 are the Revenue Acts of 1945, 1948, and 1964; the Economic Recovery Tax Act of 1981; and the American Taxpayer Relief Act of 2012. The five largest tax reductions since 1940 are the Revenue Acts of 1945, 1948, and 1964; the Economic Recovery Tax Act of 1981; and the American Taxpayer Relief Act of 2012. The Revenue Act of 1965 was proposed by President Kennedy, and signed by President Johnson, to “reduce drag on private buying power, profits, employment,” and significantly lower both corporate and individual tax rates. The Economic Recovery Tax Act of 1980 was passed under President Reagan. It simplified business taxation, and reduced

individual taxAn individual tax is a tax that is imposed on wages, salaries, investment, or other types of income. The U.S. has a progressive income-tax system where rates increase as income increases. The Federal Income Tax was created in 1913, with the ratification 16th Amendment. Individual income taxes, which are only 100 years old but are the biggest source of tax revenue for the United States, have been around since 1913.

rates. The American Taxpayer Relief Act of 2012 extended many of the Bush-era tax cuts, among other tax changes.

By comparison to the largest historical tax cuts, the 2017 Tax Cuts and Jobs Act (TCJA) enacted under Trump ranks as the 10th largest tax cut since 1940, reducing tax revenues by an annual average of 0.7 percent of GDP, according to estimates from the Congressional Budget Office.

Pandemic-relief legislation also ranks relatively high, as policymakers under Trump and Biden relied on the tax code to distribute relief payments and support to individuals and businesses. Enacted under Trump, the CARES Act (-0.5 percent of GDP) ranks as the 14th largest tax cut since 1940, the Families First Coronavirus Response Act (-0.3 percent of GDP) as the 20th, and the Consolidated Appropriations Act of 2021 (-0.2 percent of GDP) as the 26th.

The American Rescue Plan Act (ARPA), enacted under Biden, would rank 20th based on its first two years of tax cuts (-0.3 percent of GDP), but incorporating the outyear effects, it falls to the 36th largest since 1940, at -0.1 percent of GDP overall.NotesWe rely on two data sources for the revenue effects of past tax bills: a US Treasury paper titled “Revenue Effects of Major Tax Bills,” and the Congressional Budget Office’s “Estimates of the Revenue Effects, in Billions of Dollars, of Legislation Enacted From 1981 to 2023 That Has a Significant Impact on Revenues.”

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe to our Newsletter