Tax and accounting productivity: insights to unlock the potential

For professionals in nearly all industries, AI’s transformative impact is reshaping the work, driving productivity and fostering innovation. This is particularly true for the accounting and tax professions.

In recent years, small and midsized tax and accounting firms have increasingly adopted automation as a key strategy for streamlining their operations.

Initially, automation efforts targeted routine manual tasks, tax preparation, and back-office functions. With the advent of AI, these benefits are amplified. Let’s explore how tax and accounting professionals can prepare for the challenges of tomorrow and stay ahead of the curve.

Jump to |

The transformative impact of AI on accounting productivity

One of the primary benefits of integrating AI into your firm’s daily workflow is that AI-enabled tax software can analyze vast volumes of financial data in a fraction of the time it would take a human accountant — identifying patterns, anomalies and trends with precision.

In addition, AI-powered tax research can help staff find targeted search results in less time. By providing professionally summarized answers, complete with citation links to relevant editorial content and source materials, even junior staff can quickly answer complex client questions with confidence.

Gauging sentiment on the power of AI

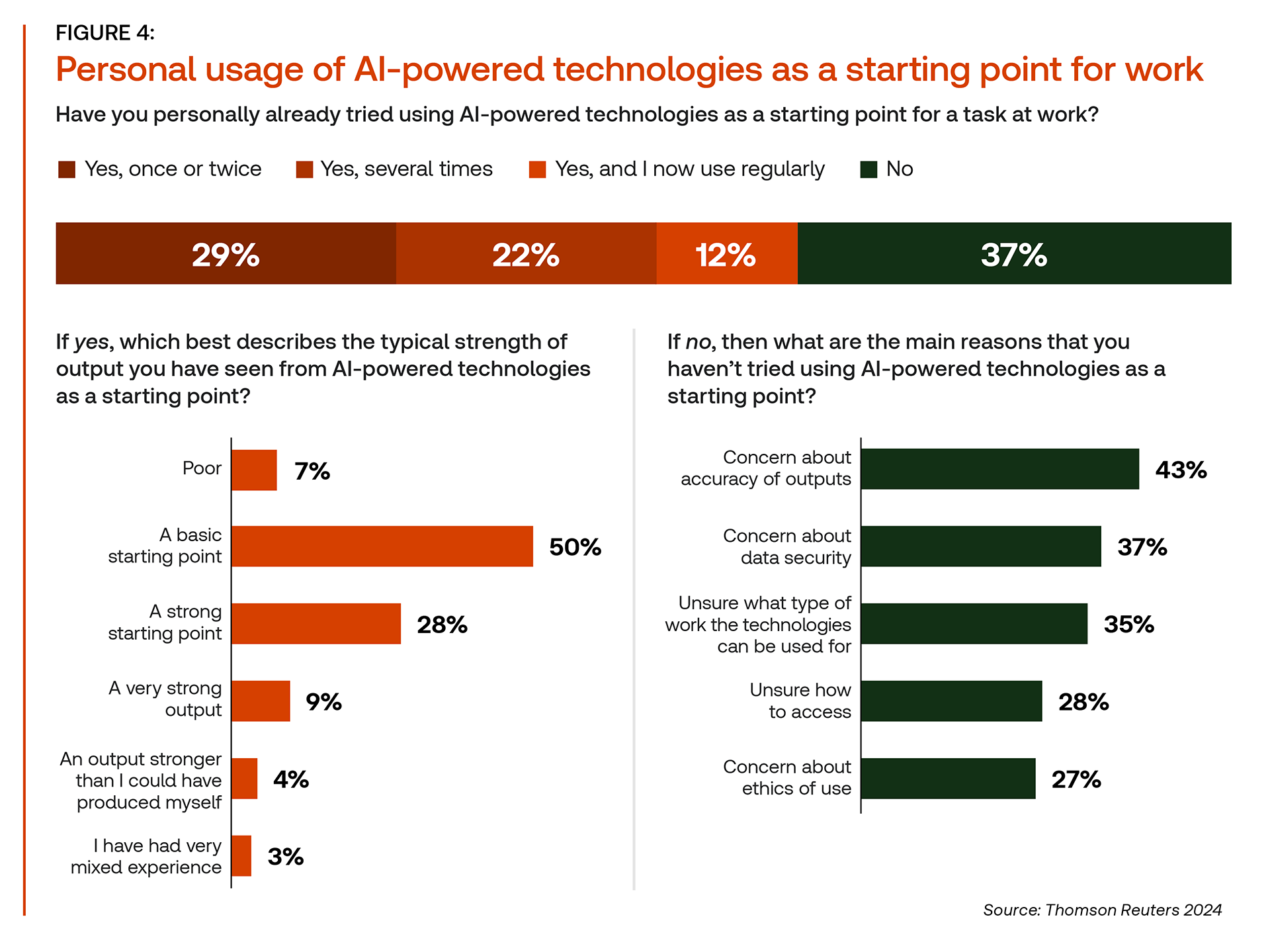

According to Thomson Reuters’ 2024 Future of Professionals report, 77% of professionals see AI as having a high or transformational impact on careers, up from 67% the previous year. The excitement around AI is palpable, given the value and time savings AI-powered technology brings to everyday work. The majority of respondents in all industries, including 82% of tax and accountancy professionals, believe AI is a force for the good. However, some hesitance remains in terms of ensuring AI is used ethically and without compromising sensitive data, which are specific areas of concern for accountants.

Strategic trends for tax professionals

For accountants, AI’s unique ability to analyze data can be a transformative force. Advanced analytics, such as predictive modeling and forecasting, can help predict future trends and outcomes using historical data. Tax and accounting professionals can identify potential risks, market trends, and opportunities for clients. By leveraging the power of AI, you can shift your firm’s focus from traditional compliance to personalized advisory services and meaningful insights. AI usage for productivity in tax and accounting profession

In regards to current adoption and use of AI, half of those surveyed stated that new AI-powered technology typically provides a basic start, but they still have to do most of the work themselves. Another 28% said that it was a good starting point, and they only needed to edit. This can take hours, especially for junior staff who need to vet answers through senior colleagues. This can often take hours, especially for junior staff who need to vet answers through senior colleagues.

But with an AI-powered tax research solution, accountants can save time and transform tax research challenges with easy-to-digest answers synthesized from trusted resources and vetted sources, along with citations for fast verification.

The importance of responsible AI use

Even amidst all its benefits, the enormous potential of AI is tempered by concerns about data security and ethical use. Addressing these realities requires clear principles and guardrails for responsible AI usage.

Building trust in AI requires transparency, benchmarking, and standards. Educating your staff on ethical AI usage and employing only industry-specific AI-powered tax solutions can help bridge this gap while also ensuring accuracy, security, and professional safeguards necessary for tax and accounting firms.

The role of AI-driven productivity in a collaborative future

When survey respondents were asked what percentage of work currently produced by their team will be completed with AI-powered technologies, the results pointed to rapid AI adoption in the workplace with technology providers as the main influencers.

On average, professionals predict that over half of their work will utilize new AI-powered technologies to at least some extent within the next five years. From Thomson Reuters’ standpoint, it is likely that all professionals will have a generative AI assistant within the next five years to assist them in their daily work.

The future of AI for accounting firms

By integrating AI-powered tax technology, accounting firms can not only enhance their operational efficiency but also better serve clients with meaningful data-driven insights that improve financial well-being and strengthen relationships.

As AI continues to shape the future of work, accounting firms that invest in AI early can gain a competitive edge by getting ahead of the learning curve and realizing a faster return on investment.

At the end of the day, the integration of AI represents a transformative opportunity to enhance productivity, unlock new insights, and elevate the client experience. The integration of AI represents a transformative opportunity to enhance productivity, unlock new insights, and elevate the client experience.