EU Tobacco & Cigarette Taxes

The EU Tobacco

TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. The EU Tobacco TaxA Tax is a mandatory payment that is collected by local, State, and National governments from individuals and businesses to cover costs of government services, goods, or activities.

The Directive mandates that all Member States levy at least a excise Tax. An excise is a tax levied on a particular good or activity. Excise taxes can be levied on a variety of items, including cigarettes, alcohol, soda, gasoline and insurance premiums.

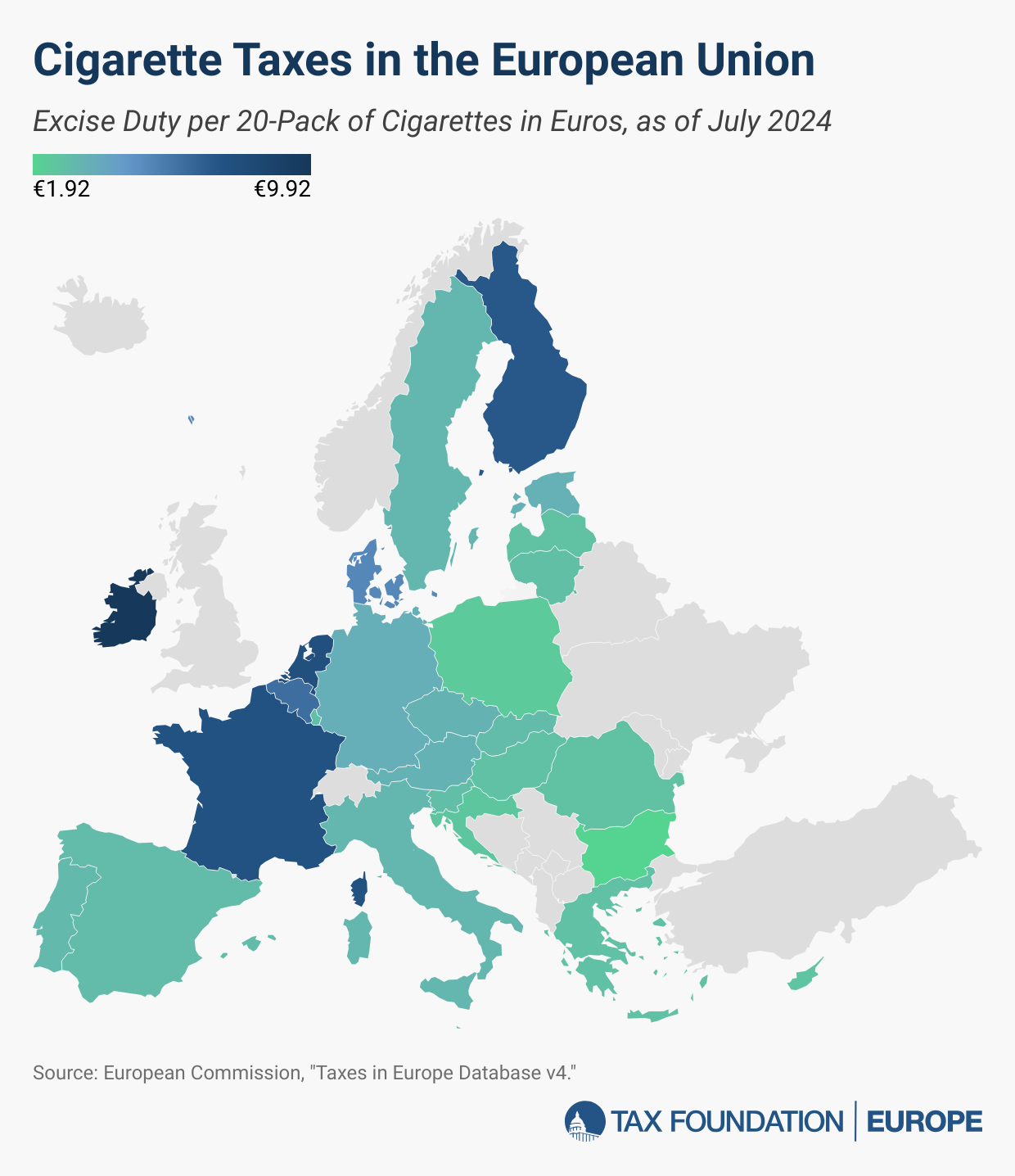

on tobacco products and cigarettes. The EU imposes a specific ad-quantum cigarette tax (a fixed amount for each pack of cigarettes), and an ad-valorem excise (an additional percentage on the retail price). The 60 percent requirement is not applicable to Member States that levy higher specific rates of at least EUR2.30 a pack. The EU Directive only sets minimum rates. However, all countries have higher rates. The taxes increased the average price of cigarettes by over 450 percent. The highest cigarette excise tax in the EU comes from Ireland, at EUR9.92 ($10.72), followed by the Netherlands with EUR7.66 (8.28) and France with EUR7.45 (8.05).

The Bulgarian excise tax for a pack of twenty cigarettes is EUR1.92 ($2.08). The next lowest taxes are imposed in Poland and Croatia at EUR2.33 ($2.52) and EUR2.52 ($2.72), respectively.

The excise taxes are levied in addition to VATs applied to cigarettes. The average tax share for 2023 weighted retail prices in EU countries varies from 67.5 percent to 110 percent. The data is calculated and published by European Commission based on weighted average prices from the previous year in accordance with Article 8 (Subsection 2). Taxes as a percentage of WAP are less than 100 percent for all countries for which we have data using same-year average retail prices.

Cigarette taxes are regressive, both because excise taxes are generally regressive and because smoking is more prevalent in people with lower incomes. The narrow base of cigarette taxes and the declining consumption trend makes them volatile sources for revenue. These revenues are often used to fund spending that is unrelated to smoking. Cigarette taxes tend to encourage cigarette smuggling, and drive consumers towards illicit markets. France (32%) Ireland (24%) and Greece (21%) were the top three markets for illicit cigarettes in terms of percentages of total consumption. The EU Tobacco Tax Directives have been considered for major updates but they were put on hold indefinitely. As cigarette smoking continues, and consumption of counterfeit and contraband cigarettes continues to grow, the European Commission may seek to reconsider updates to the EU tobacco tax policy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe to our Newsletter

Share