Further Tax Reforms Needed in 2025

On May 23rd, the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Foundation hosted a conference on Capitol Hill to discuss the legacy of the 2017 Tax Cuts and Jobs Act (TCJA) and the looming expiration of many of those provisions at the end of 2025. The conference was recorded and is worth viewing in its entirety (video available here). The following is a summary of the event.

First, Chairman Kevin Brady, former Chairman of the House Ways and Means CommitteeThe Committee on Ways and Means, more commonly referred to as the House Ways and Means Committee, is one of 29 U.S. House of Representative committees and is the chief tax-writing committee in the U.S.

The House Ways and Means Committee has jurisdiction over all bills relating to taxes and other revenue generation, as well as spending programs like Social Security, Medicare, and unemployment insurance, among others.

and key architect of the TCJA, provided his insights into the process and thinking behind the design of the TCJA. He noted the desire among policymakers in 2017 to reform the tax code to improve competitiveness, make America more attractive as a place to do business, and grow the economy broadly. Looking forward, he noted the need to further reform the tax code to reduce complexity and support economic growth, warning against raising the corporate tax rate to uncompetitive levels.

Next, a panel discussion featuring Michelle Hanlon (MIT Sloan School of Business), George Callas (Arnold Ventures), and Katherine Monge (Capitol Tax Partners) covered myths and misconceptions surrounding the TCJA, noting several examples of how the law has been poorly understood and misconstrued.

While the TCJA was designed effectively to cut taxes for most people across the income scale, many perceived it to be a tax increase. This basic outcome of the law was lost in the shuffle of partisan politics and the complexity of the tax code: the TCJA both lowered and raised taxes in a multitude of ways through a combination of reforms that most people did not fully grasp.

The panel also discussed how the TCJA was not created overnight. The law was the result of a years-long effort to resolve complex trade-offs, including discussion drafts going back more than five years prior to enactment.

The panel discussed the sometimes-loose language about the TCJA paying for itself. One need only look at the name “Tax Cuts and Jobs Act”: it was designed to be a tax cut and certainly was in the initial years when the tax cuts were fully in place.

The next panel covered domestic corporate tax policy, featuring Jeff Hoopes (University of North Carolina Kenan-Flagler Business School), Bill Gale (Urban-Brookings Tax Policy Center), Loren Ponds (Miller & Chevalier Chartered), and Eric Zwick (University of Chicago Booth School of Business).

The panel discussed the importance of a competitive corporate tax rate. Leading up to the TCJA, the U.S. had the highest statutory corporate tax rate in the developed world: 35 percent plus state taxes. It was the driving force behind the TCJA, as both parties recognized the imperative of getting the corporate tax rate closer to other countries.

The TCJA brought the federal corporate tax rate down to 21 percent, giving us a combined rate (including state taxes) somewhere in the middle of the OECD range. Such a large drop in the corporate tax rate greatly improved the U.S.’s investment climate, making many more projects economically viable.

The panelists also discussed the importance of getting the business tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

right so that businesses can fully deduct the cost of investment. Expensing does this, as it allows businesses to fully deduct investment costs in the year incurred. The TCJA increased expensing for equipment to 100 percent through bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

, but it did so temporarily. Today, only 60 percent of equipment can be expensed, and the policy phases out completely over the next three years. Bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

has been shown in many studies to substantially improve incentives to invest.

However, the TCJA went backward on R&D, taking away expensing after 2021 and requiring amortization over 5 or 15 years.

The careful studies on the TCJA’s economic impacts distinguish between short-term and long-term effects because it takes years—even more than a decade—for these effects to fully unfold. Eric Zwick and his co-authors have a paper looking at the first two years after the TCJA was enacted and find a 20 percent increase in business investment. The long-term benefits, they conclude, will continue to accrue some 15 or 20 years later. That is, we are still feeling the economic benefits of the TCJA: some of this year’s economic growth, and some of next year’s, is due to the TCJA.

Not every change in the TCJA was a home run. Much of the law was made temporary, reducing the long-run economic benefits. In some ways, it further complicated the tax code with special deductions for some businesses.

The final panel covered the TCJA’s international provisions, featuring Jim Hines (University of Michigan), Kim Clausing (UCLA School of Law), Scott Dyreng (Duke University), and Teri Wielenga (Gilead Sciences [retired]).

Another driving force behind the TCJA was our uncompetitive tax treatment of foreign income. Prior to the TCJA, we had a complicated worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation.

, subjecting the foreign income of U.S.-based multinationals to the uncompetitive 35 percent corporate tax rate. Most of our peers had simpler tax systems that largely exempted foreign income from domestic tax, leaving other countries to tax those profits. Major U.S. companies were literally changing their residence to get out from under the burdensome U.S. tax rules—a process called inversion. Teri Wielenga described how many of her colleagues lost their jobs through this process.

Profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens.

was also a major concern, as U.S. companies found various ways to move profits offshore to legally avoid the high U.S. tax burden.

By lowering the corporate tax rate and implementing a more standard exemption of foreign income, the TCJA ended corporate inversions completely. It also encouraged companies to move their profits back to the U.S., boosting U.S. tax revenue.

However, it made business taxes more complicated in a few ways, particularly through new provisions aimed at preventing more profit shifting out of the U.S., such as the so-called GILTI and BEAT provisions.

To wrap up the conference, I offered some thoughts on how lawmakers should approach the TCJA’s expiring provisions, recommending four main goals: simplification, economic growth, fiscal responsibility, and consensus.

We have a very complex tax code, especially for businesses. It is long past time to consider fundamental reforms to ease the burden of complying with the tax code and make it more transparent, understandable, and administrable for the IRS.

Lawmakers should also seek to reduce the economic drag of the tax code. Over the long term, economic prosperity, including higher wages and better job opportunities, depends significantly on innovation and robust business investment. Innovation comes largely from businesses finding better ways to satisfy customers’ needs. Through greater innovation and investment, businesses create better tools for workers and better products for consumers—everything from computers and software to cars and home appliances. If we want sustainable economic growth, then the tax code should not penalize these investments.

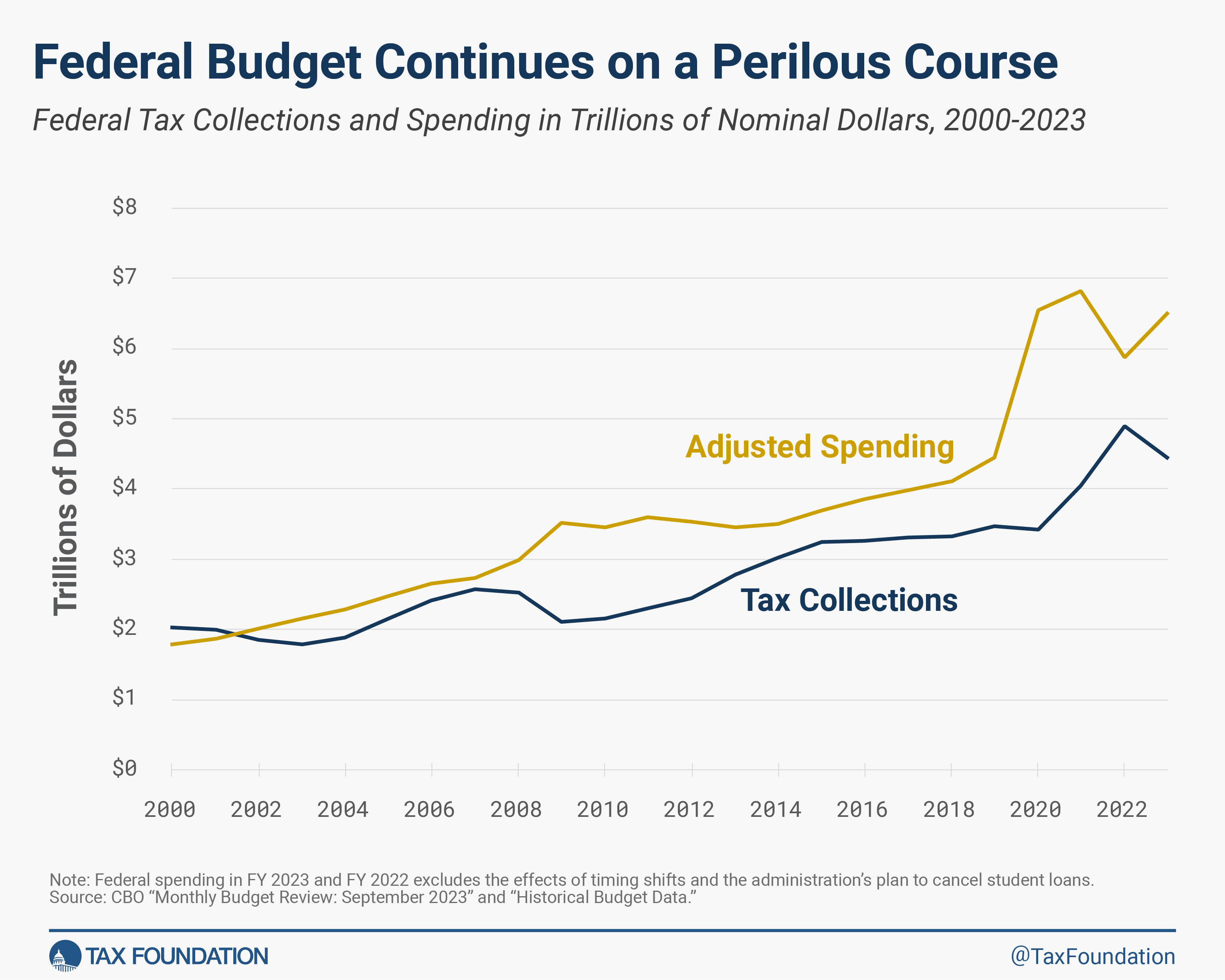

Lawmakers should also be fiscally responsible. The federal government’s budget trajectory is not sustainable. Trillion-dollar deficits cannot go on forever. We’re already seeing some of the costs of excessive deficits and debt, including high inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

and high interest rates. While the main drivers of the debt are unsustainable growth rates in benefits for Social Security and Medicare, lawmakers should not make matters worse by pursuing irresponsible tax policies that worsen the country’s debt burden. The most important measure of the debt burden is the debt-to-GDP ratio, which is about 100 percent currently and set to grow to more than 160 percent over the next 30 years if policies are not changed. Note that debt-to-GDP includes GDP: economic growth is a primary determinant of the country’s debt burden, as a growing economy generates the tax revenue the federal government needs to pay its expenses and reduce debt.

A fourth goal of the next tax reform should be consensus. Building consensus among policymakers and other stakeholders around key measures will make the law more stable and more likely to be continued under different leadership in Congress and the White House. Stability is important for economic growth—for businesses, investors, and other taxpayers as they plan. One of the most pro-growth features of the TCJA was the lower corporate tax rate. If it was not made permanent, businesses would not have increased investment nearly as much as they did, and the broader economy would have suffered.

These goals are self-reinforcing. Simplification of the tax code would free up armies of accountants, lawyers, and lobbyists to do something more productive. Fiscal responsibility and economic growth together will help us avoid a looming debt crisis, resulting in less inflation, lower interest rates, and ultimately a higher standard of living. Consensus leads to stable laws, reducing uncertainty and further boosting economic growth.

Lastly, lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all. The following fundamental reforms are worth considering:

- To boost investment, provide permanent full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

for all assets, including for structures. - To reduce the double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

of corporate investment, integrate the corporate and individual tax codes. - To simplify business taxes and reduce compliance costs, remove overlapping minimum taxes and redundant provisions that apply to foreign income.

- To simplify saving and improve financial security, implement universal savings accounts (register for our upcoming discussion here).

Learn more about our conference, including featured speakers, agenda, and photos here. You can also explore our latest research and analysis of the Tax Cuts and Jobs Act here.

Stay Informed on Upcoming Events.

Get exclusive invites to virtual and in-person panel discussions, debates, and lectures, featuring today’s leading tax and economic experts.

Sign Up

Share