Guide to omnichannel retail in the digital age

The retail landscape has undergone a dramatic transformation in recent years. Customers now expect a seamless and friction-free shopping experience in-store and online.

For retailers, the omnichannel approach is essential to remain competitive, but it presents significant challenges for Tax departments. To ensure accurate tax determination, retailers must navigate a complex labyrinth of tax calculations across a vast array of products and jurisdictions, all while trying to keep up with ever-evolving regulations and high-speed transaction volumes. Our guide to digital omnichannel retail covers pitfalls, new strategies, incorporating automation, and the benefits of centralized tax management systems.

The pitfalls of inaccurate taxes in a digital omnichannel world

Missteps in this tax labyrinth can have severe consequences. Inaccurate tax classification of products, tax rates, or tax rules are costly and can create friction during customer checkout and return events. If shoppers are frustrated, they may take their business elsewhere, damaging the brand’s reputation and causing a loss of sales.

Under-resourced Tax departments struggling with outdated technology, encumbered with manual processes and spreadsheets are even more susceptible to these pitfalls. Temporary fixes by IT, patchwork solutions, and/or manual workarounds have difficulty keeping up with transaction volumes and the downstream impacts on reporting and compliance in an omnichannel sales environment and don’t facilitate the communication necessary for data sharing between channels.

Temporary fixes by IT, patchwork solutions, and/or manual workarounds have difficulty keeping up with transaction volumes, and the downstream impacts on reporting and compliance in an omnichannel sales environment don’t facilitate the communication necessary for data sharing between channels.

Re-thinking brand channels and systems

Legacy approaches are relics of the pre-omnichannel era when brick-and-mortar stores and mail-order catalogs were the primary places where sales occurred. Continuing to rely on these outdated systems and processes increases the risk of calculation errors, missed tax updates, and potential compliance issues. Consequently, retailers are having to re-think how their brand channels interact with one another and re-imagine their business systems to operate more effectively and efficiently in the digital omnichannel retail environment of the future.

Tax is a critical part of this conversation. After all, if companies promise customers that they can purchase and return merchandise anywhere through whichever channel they prefer, a company’s tax systems must be up to the task. Supporting that kind of flexibility in an omnichannel retail ecosystem is no easy feat, however—it requires more powerful systems with a broader range of capabilities and leaders who understand why these systems are necessary.

The power of tax automation

An effective digital omnichannel tax-management system requires several components, but it all starts with automation. Tax automation streamlines compliance and ensures accurate tax determination at the point of sale, resulting in a more efficient checkout process for customers, regardless of the channel they use or their location. A well-supported centralized tax engine should also be able to scale up during peak seasons, ensuring a seamless check-out experience even during periods of high demand.

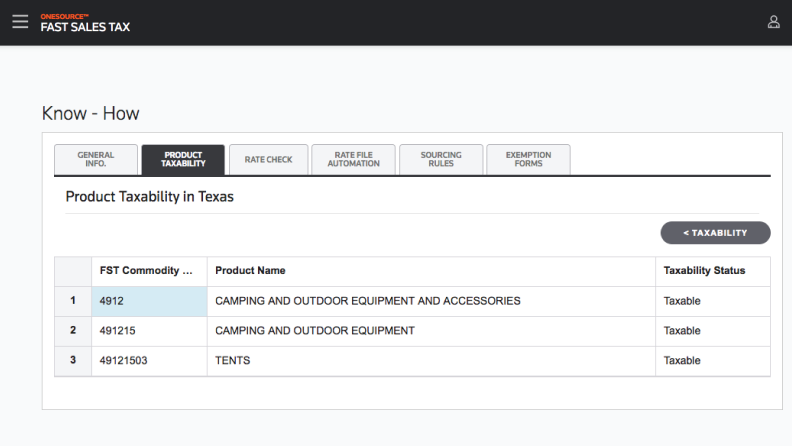

Another reason tax automation is so effective in an omnichannel sales environment is that it uses comprehensive tax rates and rules to navigate the complexities of

product classification and coding, as well as the various unique tax scenarios that retailers face. Sales taxes alone are complicated enough, but retailers must also contend with everything from sales-tax holidays and social-program interactions (like SNAP benefits) to delivery fees, specific product taxes, and environmental levies.

Automation also makes it possible to keep up with the speed and volume of omnichannel transaction volumes, during checkout and during compliance activities, where millions of transactions per month—or even hundreds of transactions per second—are not uncommon.

Centralized tax management systems: The key to success

The more demands that are made on a company’s tax system, however, the more sophisticated the underlying architecture of the system must be to meet that demand. That’s why many large retailers are transitioning to centralized, cloud-based (or hybrid “edge”) tax-management systems.

A centralized, cloud-based tax-management system creates a single platform common hub for tax policy to be managed and maintained, and digital omnichannel sales data retained supporting reporting, compliance, and audit needs, eliminating the technical and geographical limitations that plague outdated legacy systems. Centralized systems are also extremely flexible, and, if they include automated content support and advanced API architecture, can instantly accommodate new regulations and adapt to future retail innovations. Scalability is an equally important feature of a centralized tax platform, because any modern tax system needs to grow with the business.

Benefits far beyond tax

The benefits of a centralized tax-management system extend far beyond accurate tax calculations as well. High-quality tax data empowers tax departments to move beyond compliance and take on a more strategic role within the organization. With the right analytics, tax data can even improve supply-chain monitoring, support strategic planning, and ultimately lead to better decision-making.

Incorporating new tax technologies into a company’s software ecosystem is also an intelligent strategic decision. Centralized, cloud-based tax technologies help lay the foundation of resilience companies need to adapt to the demands of digital e-invoicing, real-time reporting, and other technological innovations to come. Indeed, investing in tax infrastructure is not just about meeting current needs, it’s about future-proofing the business and ensuring that the enterprise is prepared to navigate every turn in the long tax labyrinth ahead.

To learn more, Thomson Reuters has developed a three-part series of whitepapers on how automated tax management solutions can help large companies meet the challenges of omnichannel retailing:

_____________________________________________________________________________________________

Part 1 focuses on the role of automation in retail taxation.

__________________________________________________________________________________________

_____________________________________________________________________________________________

Part 2 addresses the technical challenges of omnichannel retailing.

__________________________________________________________________________________________

___________________________________________________________________________________________

Part 3 is about managing regulatory change and risk in an omnichannel ecoysystem

_________________________________________________________________________________________

Download all three whitepapers today.