Delaware Supreme Court Provides Important Guidance on Application of MFW Framework to Controlling Stockholder Transactions

On April 4, 2024, the Delaware Supreme Court issued its decision on a stockholder suit challenging the fairness of IAC/InterActiveCorp’s separation from its controlled subsidiary, Match Group, Inc.[1] In this decision, the Delaware Supreme Court provided clarity and guidance on two important issues involving the application of the MFW framework.

First, the MFW framework, which provides a path for a conflict transaction to be reviewed under the more deferential business judgment rule, applies to all controlling stockholder transactions in which the controller receives a non-ratable benefit (and not just squeeze-out mergers). Second, the MFW framework requires that each director on the special committee be independent from the controlling stockholder. Therefore, the appointment to the special committee of any director who is not independent of the controlling stockholder will lead to the application of the entire fairness standard.

Key Facts

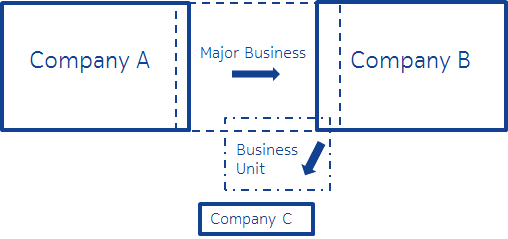

As set forth in the complaint, prior to the transaction at issue, the former IAC/InterActiveCorp (“IAC”) held 24.9% of common stock and all of the high-vote shares of the former Match Group Inc. (“Match”), possessing 98.2% voting power in total.[ii] In 2019, IAC and Match entered into a transaction agreement to separate the business of Match from the remaining business of IAC.[iii] As a result of the transaction, the pre-transaction stockholders of IAC would own shares in two, separate public companies—one company owning the businesses of Match and bearing an approximately $1.7 billion debt obligation of IAC (“New Match”), and a second company owning IAC’s other businesses—and the pre-transaction stockholders of Match (other than IAC) would own shares in New Match. New Match would have only one class of shares, with one vote per share. Additionally, Match would issue a $2 billion dividend to its stockholders before the transaction, with most of the dividend going to IAC due to its majority ownership of Match.

At the outset of the transaction, IAC conveyed to Match that any transaction would be conditioned from the start upon both the recommendation of a special committee of the Match board of directors and the approval of the Match minority stockholders.[iv]

One of the directors appointed to the special committee was previously employed by IAC for a total of 12 years, including 7 years as IAC’s CFO.[v] The director earned at least $58 million for his positions at IAC or IAC affiliates.[vi] When the director stepped down as IAC’s CFO, he also publicly expressed his gratitude to the IAC Chairman for the opportunities to serve IAC. The director played a meaningful role in the negotiation of the transaction, meeting with IAC’s CEO (who had been his direct report at IAC) several times and conveying a proposal to IAC’s CEO at the special committee’s instruction that resulted in a preliminary agreement on certain deal terms.[vii]

In 2020, certain stockholders of Match filed a lawsuit, alleging that the transaction was unfair because IAC, a controlling stockholder of Match, received benefits in the transaction at the expense of the Match minority stockholders.[viii]

Delaware Court of Chancery Decision

In May 2022, the Delaware Court of Chancery held that all the required elements for the application of the MFW framework were satisfied and hence the transaction would be subject to the business judgment standard of review.[ix] Importantly, the Delaware Court of Chancery recognized that there was a reasonable inference based on the pled facts that the director with prior ties to IAC lacked independence due to his prior association with IAC.[x]

However, the Delaware Court of Chancery viewed the relevant question on special committee independence to be one of whether the majority of special committee was independent, and even if so, whether the director with prior ties to IAC nonetheless “infected” or “dominated” the decision-making of the special committee (thus undermining the independence of the special committee).[xi] Having found that the director did not undermine the decision-making process of the special committee or exert undue influence over fellow committee members, the Delaware Court of Chancery held that the special committee was independent.[xii]

Reviewing the action under the business judgment standard, the Delaware Court of Chancery dismissed the plaintiffs’ lawsuit.[xiii]

Delaware Supreme Court Decision

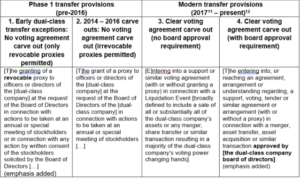

In the appeal, the Delaware Supreme Court first analyzed whether the MFW framework applies to a controlling stockholder transaction outside of the context of a squeeze-out merger. The defendant alleged that while both a well-functioning special committee and a “majority of the minority vote” were required in a squeeze-out merger, in other types of conflict transactions, either a well-functioning special committee or a “majority of the minority vote” should suffice to lower the standard of review from entire fairness to business judgment.[xiv] Following a thorough review of case law, the Delaware Supreme Court affirmed that in all cases of a conflict transaction where a controlling stockholder stands on both sides of a transaction and receives a non-ratable benefit, the default standard review is entire fairness unless both a well-functioning special committee and a “majority of the minority vote” were present.[xv]

Next, the Delaware Supreme Court addressed the question of whether each member of the special committee is required to be independent from the controller. Disagreeing with the Court of Chancery’s holding that only a majority of the special committee must be independent, the Delaware Supreme Court pointed out that the controlling stockholder’s influence would not be “disabled” when the special committee included member(s) loyal to the controlling stockholder.[xvi] Therefore, for the business judgment standard to apply, each member of the special committee must be independent of the controlling stockholder.[xvii]

Practical Takeaways

The Delaware Supreme Court’s affirmation that the MFW framework applies not only to squeeze-out mergers but also to other corporate transactions where the controlling stockholder stands on both sides of the transaction and receives a non-ratable benefit will provide certainty to dealmakers in structuring an MFW-compliant transaction.

However, whether a transaction can benefit from the business judgment rule as a result of applying the MFW framework will now depend on whether each of the special committee members is independent. Delaware courts have indicated that certain friendships can call a director’s independence from the controlling stockholder into question, including serving as each other’s maid of honor, being each other’s college roommates, and sharing a family beach house for a decade.[xviii]

Therefore, for the independence of a special committee to withstand the attack of plaintiffs, thorough inquiry should be made of each special committee member’s past business, social and other relationships with the controlling stockholder. Erring on the side of prudence in assessing potential director conflicts would be well advised given what is at stake and the Delaware courts’ reluctance to weigh the risks of the director serving on the committee against the rewards in this context.

[1] In re Match Grp., Inc. Derivative Litig., No. 2020-0505, 2024 WL 1449815 (Del. Apr. 4, 2024).

[ii] Id. at *2.

[iii] Id. at *2–3.

[iv] Id. at *2.

[v] Id. at *18.

[vi] In re Match Grp., Inc. Derivative Litig., No. 2020-0505-MTZ, 2022 WL 3970159, at *19 (Del. Ch. May 4, 2022).

[vii] In re Match Grp., 2024 WL 1449815, at *3.

[viii] In re Match Grp., 2022 WL 3970159, at *8.

[ix] Id. at *33.

[x] Id. at *19.

[xi] Id.

[xii] Id. at *19–21.

[xiii] Id. at *33.

[xiv] In re Match Grp., 2024 WL 1449815, at *10.

[xv] Id. at *11–13.

[xvi] Id. at *19.

[xvii] Id.

[xviii] See In re MFW S’holders Litig., 67 A.3d 496, 509 n.37 (Del. Ch. 2013).