The M&A Resourcing Imperative: Staffing Your M&A Team for Optimal Impact

M&A Resourcing Imperative: Staffing Your M&A Team for Optimal Impact

By M&A Leadership Council

One of the most persistent and perplexing challenges many acquirers struggle with is inadequate M&A team resourcing.

The M&A resource problem plagues experienced acquirers as well as inexperienced ones. There simply never seems to be a good match between the resources actually needed and the resources made available.

Predictably, resource constraints negatively impact the ability to achieve the deal’s intended financial and business objectives or impede the ability to quickly mobilize and execute on fast-paced, opportunistic acquisitions.

Some acquirers lament about not having enough resources. Many say they don’t have the right resources. A few are experiencing a shift in the volume, type, size, pace or complexity of deals they’re anticipating and are unsure how best to ramp staff up or down on future deals for success.

To more fully understand this important issue, we convened a brief panel discussion of corporate M&A leaders and practitioners who shed light on why M&A team resourcing is such a dilemma. Perhaps your company can identify with one or more of these very transparent acknowledgements:

“When an M&A deal hits, it simply gets added to the already long list of strategic initiatives on our plates without resources being adequately reallocated to reflect the significance of the financial investment.”

“Our leaders think we can manage M&A projects with tier-two talent. Instead of putting our best and brightest on critical M&A programs, we staff as if it were a ‘developmental role’ where junior people can learn ‘on the job’.”

“Our organization has a short attention span. We pull our M&A resources off the program before their work is complete. Rarely is the business case achieved.” “Our organization doesn’t have the skill sets required to effectively perform M&A. Due diligence, integration planning, project management, change management, cultural integration…these are not our strong suits. And yet, they are crucial to M&A success.”

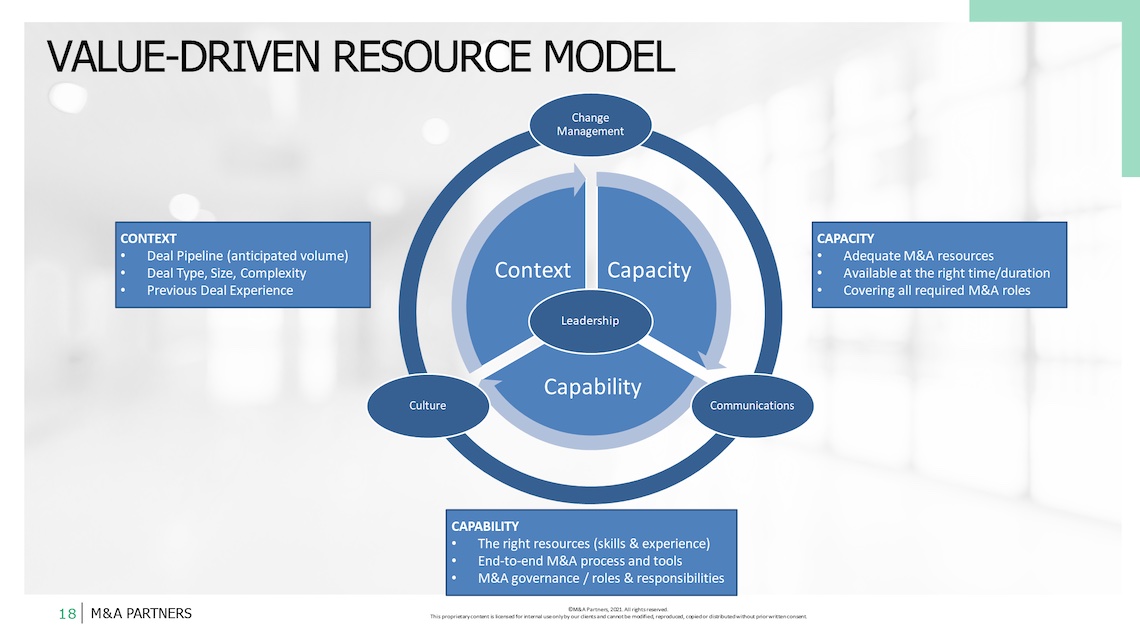

To help acquirers think through their respective M&A resourcing challenges, we’ve developed a framework that we call the Value-Driven M&A Resourcing Model™.

It won’t provide you with a pat answer. Instead, it’s designed to organize your thinking and structure the right discussions.

The model suggests you begin by considering three fundamental questions that can help you determine the M&A resource component that is most appropriate for your organization:

- M&A Context: What volume, pace, and types of deals do you anticipate doing in the future?

- M&A Capability: What capabilities do your M&A resources need to be effective?

- M&A Capacity: How many M&A resources do you need and when do you need them?

In addition to these three core questions, the model also introduces four key assets which can significantly de-risk your deals.

a. Leadership: Does your Leadership Team understand and accept their responsibility for developing and maintaining an M&A talent bench to ensure availability of top-tier resources in each area as opposed to defaulting in a pinch to whoever is available?

b. Change Management: Does your organization have the skilled change management resources necessary to ensure a smooth transition of all key stakeholder groups from current state to future state with minimal value erosion?

c. Communications: Is your organization adequately staffed with M&A Communication professionals to provide clear, compelling messaging throughout the entire deal lifecycle?

d. Culture: Do your internal resources have the capacity and capability to lead the appropriate level of cultural assessment, planning and integration activities to ensure minimal disruption to the business?

Taken together, these seven key considerations can help you take a first step in developing a M&A Resource Model that’s right for your organization. Additional quantitative and qualitative analysis will be necessary to develop the level of detail required to make your M&A Resource Model truly value-driven. The sweet spot is a model that provides just enough resources to ensure the deal meets its business case and strategic objectives without over-investing.

MINI-CASE STUDY:

The Executive Sponsor for a multi-billion dollar energy company was tasked with estimating the resource demand for their announced acquisition of a major competitor.

Working with both the IMO and their Integration Advisor, they analyzed the type, size, pace and complexity of the target company.

They then analyzed the Buyer’s internal M&A capabilities, including strengths and gaps.

Next, they benchmarked against other industries.

They then solicited input from functional workstream leads to assess how many resources they had deployed on previous acquisitions and how many they estimated needing to complete this one. They also determined what resources from TargetCo might be tapped at what points in the deal lifecycle.

Finally, they assessed where staff augmentation and specialty expertise from external third-party resources might be required and vetted those resources proactively.

The result was a resource demand estimate that was grounded in reality and focused on value-creation. Given the size of the target company and complexity of the integration requirements, the agreed level and duration of anticipated resources required enabled the Executive Team to adjust other portfolio initiatives and make the necessary decisions to dynamically reallocate key resources to the highest priority assignments. However, the Resource Model justified the need and ensured that adequate resources were ready and able to make the upcoming deal a success.

————————————————–

Learn more about M&A teams at any of our upcoming virtual or in-person training courses, where you’ll interact with peers in small-group breakout sessions, explore case study deep-dives and absorb the war stories and real-world experiences of working presenters. See our Training Calendar for more details and registration.