Biden Admin and U.S. Chamber Clash Over IRA Drug Pricing Impact

“All health systems struggle with rising costs; this is not a uniquely American phenomenon. Imposing a system of ‘take it or leave it’ price controls targeting medicines will, inevitably, reduce patient access to new life sciences products and technologies.” – GIPC report

Today, the U.S. Department of Health and Human Services (HHS) made its initial offers to pharmaceutical companies pursuant to the Biden Administration’s Inflation Reduction Act of 2022 (IRA), which allows the U.S. Government to “negotiate” Medicare drug prices under a set framework based upon the amount of time a drug has spent on the market. Opponents of the program, including the U.S. Chamber of Commerce, which is suing the government over the plan, argue it cannot be characterized as a voluntary negotiation since the affected companies would be subject to onerous excise taxes for refusing to participate and because it would have devastating consequences for patients if companies were to actually pull the affected drugs. The amounts of today’s initial offers were not revealed.

How the IRA Program Will Work

Prescription drug pricing controls are one aspect of the IRA, a landmark piece of legislation passed by Congress in August 2022 that also directs funding to be spent on clean energy projects and increased tax enforcement. The IRA authorizes the HHS Secretary to establish a Drug Price Negotiation Program, codified at 42 U.S.C. § 1320f, to establish maximum fair prices of certain drugs that become eligible for the program because they constitute a large portion of expenditures by Medicare Part B and Part D patients. Pharmaceutical companies that do not agree to the price set during negotiations with HHS will have to pay a new excise tax codified at 26 U.S.C. § 5000D, calculated based on daily sales.

At last year’s IPWatchdog Life Sciences Masters program, Corey Salsberg, Vice President and Global Head of IP Affairs for Novartis, used Novartis’ IRA-selected heart failure drug, Entresto, to demonstrate how this would practically impact companies. Salsberg explained that the excise tax – which starts at 187% of national sales and goes to 1900% by some estimates – would mean a $45 billion fine in the first year were they to decline the program. “The only other way out of this whole thing is to pull all products out of Medicare entirely,” said Salsberg, which would mean taking drugs away from the millions of Americans on Medicare, “which of course is totally unethical and infeasible,” he added.

But HHS Secretary Xavier Becerra said in the announcement today that the program is a “milestone on the march to ensure people with Medicare get fair prices for prescription drugs” and that he is “confident that this process will lead to lower prices, putting an end to exorbitant price gouging by pharmaceutical companies.”

The Centers for Medicare & Medicaid Services (CMS) will continue to negotiate with the participating drug companies through August 2024 and agreed upon prices will take effect in Medicare beginning in 2026.

The Data

Despite Becerra’s confidence that the IRA program will have positive results, the U.S. Chamber of Commerce’s Global Innovation Policy Center (GIPC) released a report yesterday, titled “The True Price of Cost Controls,” revealing data that shows patient access is negatively impacted by price controls.

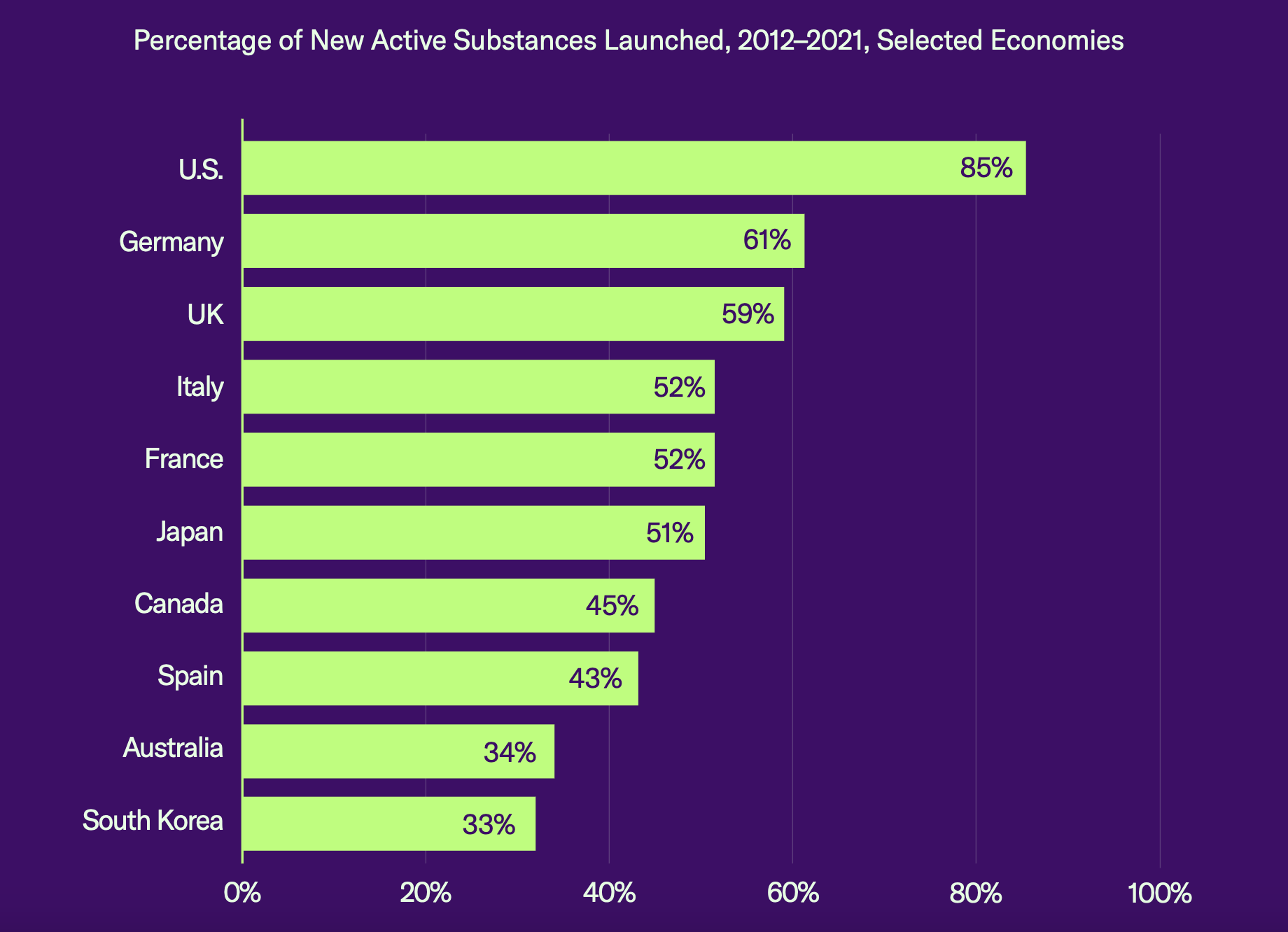

The report compared market availability of new drugs across 10 key countries and found that the percentage of new substances launched in the United States was 85%, while the runner-up, Germany, came in at only 61%. “Many new health technologies and medicines are never launched in economies that have strict pricing and reimbursement controls in place,” said the report.

Source: GIPC report

The GIPC report also predicted that the number of new products launched post-IRA will be cut by between 29% and 44% and that the United States will fall from the head to the middle of the pack when it comes to medical innovation and access.

Another report published in July 2022 found that price controls have significant negative effects on patient access to new therapies because they severely curtail funding for research and development. That report estimated that, with government price fixing, “only 6 of 110 previously approved therapies would be considered ‘not at risk’ of being cancelled, or at very least divested.”

But HHS released its own report along with today’s announcement, citing data that shows U.S. prices across all drugs (brands and generics) in 2022 were nearly three times as high as prices in 33 OECD comparison countries; that U.S. prices for brand drugs were 422% of prices in the comparison countries; and that U.S. prices for unbranded generics were lower than prices in comparison countries. The report also found that unbranded generics made up 90% of U.S. prescription volume, compared with 41% of volume in the other countries.

Court Battle

The U.S. Chamber sued HHS in early June, raising several constitutional and administrative law challenges to the implementation of the IRA’s drug pricing controls. The suit alleges that the IRA is essentially disguising a mandatory price control regime as a negotiation process that has no voluntary nature due to statutory difficulties for drug manufacturers attempting to leave the Medicare program, as well as the exorbitant excise tax. Both the Chamber’s motion for preliminary injunction and the government’s motion to dismiss were denied in September 2023.

Neil Bradley, the Chamber’s Executive Vice President and Chief Policy Officer, said in response to the Administration’s announcement today that “the real costs will be paid by American patients,” citing statistics from the GIPC report.

The report concluded by urging the U.S. government to “pause and consider the full ramifications of its pending policy actions,” adding:

“All health systems struggle with rising costs; this is not a uniquely American phenomenon. Imposing a system of ‘take it or leave it’ price controls targeting medicines will, inevitably, reduce patient access to new life sciences products and technologies. Regardless of where the U.S. post-IRA experience falls on the spectrum of that of other OECD economies, one undeniable conclusion is that the imposition of national price and reimbursement controls invariably comes at a cost: fewer new medicines and longer wait times.”

The drugs selected for the price negotiation program under the IRA are: Eliquis (Anticoagulant, Bristol-Myers Squibb); Jardiance (Diabetes, Lilly); Xarelto (blood thinner, Janssen); Januvia (diabetes, Merck); Farxiga (chronic kidney disease, AstraZeneca); Entresto (heart failure, Novartis); Enbrel (autoimmune diseases, Amgen); Imbruvica (Leukemia, AbbVie/Johnson & Johnson); Stelara (Crohn’s disease and Ulcerative Colitis, Janssen); and Fiasp (insulin, Novo Nordisk).

Image Source: Deposit Photos

Author: robeo123

Image ID: 1733104