Court conflicted over Purdue Pharma bankruptcy plan that shields Sacklers from liability

ARGUMENT ANALYSIS

on Dec 4, 2023

at 4:42 pm

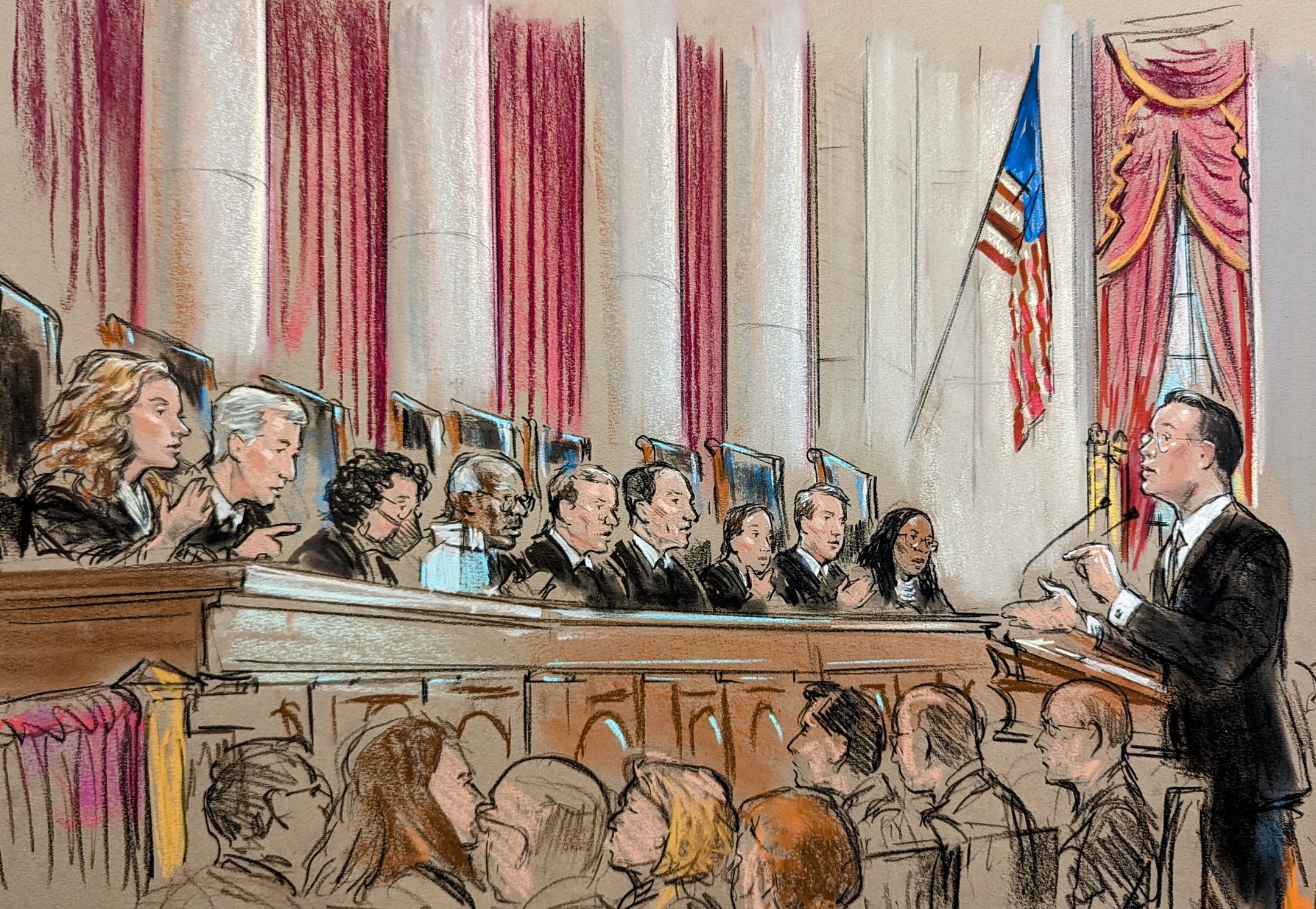

Deputy Solicitor General Curtis Gannon argues for the government in Harrington v. Purdue Pharma. (William Hennessy)

It has been 27 years since the prescription opioid OxyContin first came on the market. The manufacturer of the drug, Purdue Pharma, promoted the drug as less susceptible to abuse, but OxyContin proved instead to be highly addictive. The result was a public health crisis and, eventually, thousands of lawsuits seeking trillions of dollars against Purdue Pharma and the Sackler family, which principally owns the company and controlled it until recently, accusing them of having deceptively marketed the drug.

At the Supreme Court on Monday, the justices appeared conflicted over whether to allow a multi-billion-dollar bankruptcy plan for Purdue Pharma to move forward. The federal government is seeking to block the plan because it releases members of the Sackler family from civil liability for opioid-related claims, but the company’s creditors – which include state and local governments and victims of the opioid crisis – broadly support the plan as the only way to ensure that they will receive compensation and funding for opioid recovery projects.

Monday’s oral argument was the latest chapter in four years’ worth of litigation over the efforts to seek a fresh start in the face of the opioid lawsuits. Purdue Pharma – but not the Sacklers – filed for bankruptcy in 2019, and a bankruptcy court in New York put lawsuits against both the company and the Sackler family on hold shortly after that.

In Sept. 2021, the bankruptcy court confirmed a plan to remake Purdue Pharma as a nonprofit devoted to addressing the public-health problems created by the opioid epidemic. Members of the Sackler family, who had taken pre-tax distributions of $11 billion from Purdue Pharma in the years leading up to the bankruptcy, agreed to contribute up to $6 billion to the plan. In exchange, provisions in the plan shielded them from future civil liability for opioid-related claims.

A federal district court struck down the bankruptcy court’s ruling, but a federal appeals court reinstated it earlier this year. That prompted the Department of Justice to come to the Supreme Court in August, seeking to have the implementation of the plan put on hold to give the Supreme Court time to weigh in. The justices granted that request and set the case for oral argument.

One of the provisions of the Bankruptcy Code on which the U.S. Court of Appeals for the 2nd Circuit relied in upholding the bankruptcy plan was 11 U.S.C. § 1123(b)(6), a “catchall” provision indicating that a bankruptcy plan may “include any other appropriate provision not inconsistent with the applicable provisions of” the Bankruptcy Code.

Representing the federal government, Deputy Solicitor General Curtis Gannon told the justices that the releases for the Sacklers go beyond what Section 1123(b)(6) allows. He urged the justices to hold that such nonconsensual third-party releases are not authorized by the Bankruptcy Code because they extinguish property rights that do not belong to the bankruptcy estate.

But Gregory Garre, who argued on behalf of Purdue Pharma, countered that the court should reject the government’s argument that nonconsensual releases are always invalid. Congress’s use of the words “any” and “appropriate” in Section 1123(b)(6) belie the idea, he contended, that bankruptcy plans can never include third-party releases – and indeed, he noted, they have been used for nearly 30 years.

Greg Garre argues for Purdue. (William Hennessy)

Justice Brett Kavanaugh was the most sympathetic to Purdue’s position. He noted that the term “appropriate” was “broad.” There is, he added, 30 years’ worth of practice in the bankruptcy courts approving releases like the one shielding the Sacklers from liability when the parties are officers or directors in the company and the company indemnifies them against liability, so that a claim against the company official is effectively a claim against the company. “I’m trying to figure out,” he told Gannon, “with all that practice under the judiciary’s belt, why we would say it’s categorically inappropriate.”

But other justices were less convinced. Justice Neil Gorsuch told Garre that the term “appropriate” in Section 1123(b)(6) doesn’t mean “anything goes” but instead has “some limits.” If you look at the structure and context of the Bankruptcy Code, historical practice, and background constitutional concerns, Gorsuch said, Purdue Pharma has “a lot running against you, don’t you?”

Justice Ketanji Brown Jackson also pressed Garre on the limits of his position. Could the Sacklers condition their funding of the bankruptcy plan, she asked, on anything that the Bankruptcy Code does not specifically bar?

Garre responded that they could not, because the provisions of the plan must be “necessary.” Here, he emphasized, without the releases and the settlement, Purdue Pharma would be liquidated and the victims would not receive anything.

Jackson was still not satisfied. The releases were only “necessary,” she posited, because “the Sacklers wouldn’t give the money back,” not because the law required it. “It is necessary to do this,” she repeated, “because the Sacklers have taken the money and are not willing to give it back unless they have this condition.” If the key fact is the Sacklers’ willingness to contribute to the settlement, she asked, why can’t they ask for anything and say that it’s necessary?

Chief Justice John Roberts suggested that Section 1123(b)(6)’s “catchall” provision was “a fairly clear case for the application of our major questions doctrine” – the idea that when Congress intends to give an administrative agency the power to make decisions of vast economic or political significance, it must say so clearly. The Supreme Court has relied on the major questions doctrine in recent terms to invalidate the Biden administration’s student-loan debt relief program and to restrict the Environmental Protection Agency’s ability to regulate greenhouse gases. Is there any reason, he asked Gannon, why the federal government didn’t rely on that doctrine?

The justices spent much of the argument, however, focusing on the broader and more practical question of whether the current version of the bankruptcy plan is the best or only version of a plan to help opioid victims and their families.

Both Garre and Pratik Shah, who argued on behalf of a committee appointed to represent the interests of creditors (including victims), repeatedly told the justices that it was. Garre stressed that because of the “inextricable” relationship between Purdue and the Sacklers who served as officers in the company, victims have filed identical claims against them. The releases at the center of the case, Garre explained, prevent victims from jumping the line and depleting Purdue’s assets through the “back door” through their lawsuits against the Sacklers, which is why the creditors and victims insisted on the releases in the first place.

Shah echoed Garre’s explanation, telling the justices that the victims have “no love lost for the Sacklers” and that no one would “want retribution against the Sacklers” more than the victims. But if the plan as currently drafted is not confirmed, and with $40 trillion in lawsuits against Purdue and the Sacklers, he stressed, the first successful lawsuit will eliminate any other victim’s ability to recover in future lawsuits. The victims, he concluded, can only get “life saving abatement and recovery dollars” through the current plan, which has the support of 50 state attorneys general.

But Gannon pushed back against the idea that if the current plan does not go forward, it would preclude any recovery at all for the victims. The Sackler family had already agreed to put more money into the plan after a lower court rejected it, he noted. If the Supreme Court were to rule for the government, he suggested, it would give the victims more leverage and the Sacklers might once again agree to contribute still more money to the plan.

Patik Shah argues for the creditors. (William Hennessy)

Shah resisted this idea, telling the justices it was “irresponsible” for the government to now suggest that there is some “secret path” to a more lucrative recovery for the victims. The creditors, he said, spent several years thoroughly investigating the Sacklers, and a better deal “does not exist.” If this settlement plan blows up, he concluded, the victims “are going to get zero dollars.”

Kavanaugh appeared persuaded, describing what he saw as a “disconnect” between the government’s position that a better plan is possible and its failure to account for future unknowns, such as the need to litigate claims and the ability to recover from either Purdue or members of the Sackler family. The releases for the Sackler family, Kavanaugh suggested, “takes into account those uncertainties in thinking about whether this is ‘appropriate.’”

Justice Elena Kagan also appeared skeptical of the government’s position. She observed that the support for the plan is “overwhelming,” “among people who have no love for the Sacklers, who pretty much think the Sacklers are the worst people on earth.” And although the government’s argument, in her view, is based on “highfalutin principles of bankruptcy law,” another principle of bankruptcy law is the obligation to maximize the value of the bankruptcy estate. Here, she emphasized, a “huge, huge, huge majority” of the creditors and victims have decided that if the current plan isn’t confirmed, they won’t receive anything.

Jackson took a less sympathetic view of the plan. Even if releases like the ones that shield the Sacklers could generally be authorized, she asked, why should we do it in this case? The reason why Purdue Pharma does not have money to pay its creditors, she said, is because the Sacklers took money out of the company for themselves.

Garre responded that of the $11 billion that the Sacklers took out of the company in the years leading up to the bankruptcy, 40% went to pay taxes, so that 97% of the post-tax funds transferred to the Sacklers would in fact be included in the settlement. The bankruptcy court, he said, made careful findings that the Sacklers’ contribution was best possible one available for the victims. If the plan doesn’t go forward, he added, there would be “serious issues” for the victims in trying to collect any award that they might receive in a lawsuit.

Jackson remained skeptical, telling Garre that any collection problems could be attributed to the fact that the Sacklers have taken the money out of the United States.

Justice Amy Coney Barrett also appeared unconvinced. She noted (as did Gorsuch) that if the Sacklers filed for bankruptcy, they would not be shielded from liability for claims alleging fraud. Some justices questioned whether the federal government has the right to challenge the confirmation of the plan at all. Justice Clarence Thomas asked Gannon what the interest of the U.S. Trustee, the Department of Justice official appointed by the attorney general to oversee bankruptcy cases, has in “undoing” the Purdue Pharma plan when the overwhelming majority of creditors and victims want to have their claims against the company and the Sacklers resolved.

Gannon responded that the U.S. Trustee plays a “watchdog” role. Congress, he explained, gave the U.S. Trustee the power to “raise” and “be heard” on any issue, which is precisely what the government is doing in this case. The presence of the U.S. Trustee, Gannon added, “helps to ensure that there is a disinterested observer.

Gannon’s response did not mollify Thomas or Kavanaugh, who told Garre that he had a “strong argument” that the U.S. Trustee did not have a right to challenge the plan. But, Kavanaugh asked, what about Ellen Isaacs, whose son died of an opioid overdose, and opposes the bankruptcy deal.

Garre pushed back against any suggestion that Isaacs would have a right to sue, noting that she had not identified a claim based on Purdue Pharma’s conduct that would be affected by the plan. Moreover, he noted, it would be unusual to rely on the standing of a party, like Isaacs, who had not addressed the legal question presented in the case in her brief.

Barrett, however, saw the federal government’s position differently, characterizing the U.S. Trustee as representing the “invisible debtors” in the case.

Barrett also raised questions about the use of the bankruptcy system to resolve mass tort cases – that is, lawsuits brought by a group of people who have been harmed in a similar way, such as in a plane crash or by a defective product. Both the U.S. Conference of Catholic Bishops and the Boy Scouts of America, which have been the targets of litigation relating to sexual abuse allegations, filed “friend of the court” briefs in this case arguing that releases from liability have been essential to the institutions’ survival.

In response to a question from Barrett about what might happen to similar cases in the future if the Supreme Court were to rule that releases are not available for individuals or entities that are not part of the bankruptcy plan, Gannon observed that bankruptcy cases have already proceeded in some parts of the United States without releases. If Congress wants to step in to allow third-party releases, as it did when it enacted a provision to deal with future asbestos claims against a company in bankruptcy, Gannon said (and Barrett appeared to agree), it can do so.

A decision in the case is expected by the end of June.

This article was originally published at Howe on the Court.

Correction (Dec. 5 at 7:43 a.m.): An earlier version of this article incorrectly reported that there are $40 billion in lawsuits against Purdue and the Sacklers. The number is $40 trillion.