“Statutory Interpretation 101” in government sovereign immunity claim

ARGUMENT ANALYSIS

on Nov 7, 2023

at 5:20 pm

When a private lender fails to respond promptly to a consumer’s claim that it falsely presented the consumer’s borrowing history, Congress established under the Fair Credit Reporting Act that the lender is liable for damages. The justices on Monday, at oral argument in U.S. Department of Agriculture Rural Development Rural Housing Service v. Kirtz, considered whether the federal government is exempt from that regime.

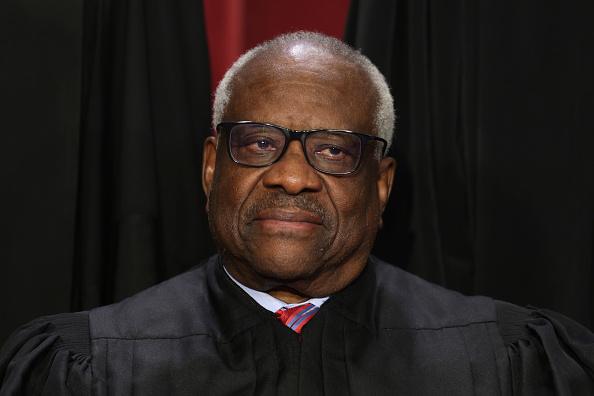

For several of the justices, the language of the statute seemed more than enough to impose liability on the federal government. As Justice Clarence Thomas put it, “the statute defines a person as [including] any government or governmental subdivision or agency,” which seemed to him at least to “suggest that it applies to the U.S. Government.” Why then, he asked, “isn’t that sufficient to waive sovereign immunity?”

Justice Elena Kagan seemed most set on that idea, as she explained that “it’s statutory interpretation 101 that we take a defined term, we plug the definition in, and that’s what the meaning of the statute is.” When Assistant to the U.S. Solicitor General Benjamin Snyder (defending the government’s view) suggested that the question is what the “logical implication” of the statute is, Kagan retorted sternly: “Well, the necessary logical implication of what Congress has done is authorize a suit against … persons, as defined in the definitions section. Then you go to the definitions section,” she continued, and then you discover that what Congress has done is authorize a suit against natural persons, enterprises, and governments.”

That line of reasoning seemed to be shared completely by Justice Neil Gorsuch, who characterized it as “virtually conclusive” that the statutory definition would apply.

Justice Ketanji Brown Jackson weighed in from a similar perspective, pointing to amendments to the statute that expanded liability by replacing the narrower term “consumer reporting agency or user of information” with the broader phrase “any person,” which is defined elsewhere in the statute to include “government.”

The argument was not one-sided, though, as two of Snyder’s points appeared to resonate with some of the justices. Most importantly, Snyder pointed to a parallel provision of the FCRA that imposes criminal penalties on any “person.” Several justices scoffed at the idea of government-on-government prosecutions. Justice Samuel Alito, for example, asked whether “there [had] been real cases in which the United States has criminally prosecuted itself,” and Chief Justice John Roberts asked (to laughter) “what would the pre-sentencing report look like” if “the United States were convicted?” Justice Brett Kavanaugh also expressed concern about that reading of the statute, which he found “very unusual.”

Having said that, Justice Sonia Sotomayor rejected the point out of hand, explaining that she didn’t “know why it’s incongruous or why it suggests a problem.” She explained that before argument she had “researched the Clean Water Act, the Safe Drinking Water Act, and the Agricultural Adjustment Act” – all of which, she explained “include a criminal provision that applies to the United States that’s nearly identical to this one.” Because “there’s no question that there’s a waiver of sovereign immunity” in those other statutes, she didn’t see any reason “why copying what has been used in [those] other acts … means that somehow sovereign immunity wasn’t waived.”

The other successful point from the government was its reliance on the Supreme Court’s 1973 decision in Employees of the Department of Public Health & Welfare v. Department of Public Health & Welfare (discussed in some detail in my preview). That case involved a statute much like this one – where “plugging in” a definition to a liability provision would have abrogated sovereign immunity – but the court held it was not enough to vitiate sovereign immunity. Kavanaugh, for one, commented to Nandan Joshi, representing borrower Reginald Kirtz, that “you’re in trouble if we take Employees seriously” and Alito pressed Joshi on whether he was arguing that the justices “should disregard [Employees] [just] because we disagree with the method of statutory interpretation.” Again, Sotomayor argued that Employees reflected precisely the kind of “magic words” requirement that the court has been rejecting for most of this century. But the discussion suggested a fair chance that some of the justices will stand by the government’s argument there.

The most interesting jurisprudential move in the argument surely came from Gorsuch, who questioned the whole enterprise of a clear-statement rule in this context. For him, it makes little sense to worry about sovereign immunity when “we have the sovereign itself speaking, right? It’s not waiving someone else’s immunity. … It’s Congress, which has control over the federal fisc, itself deciding. So I wonder,” he continued, “why the clear statement rule would be appropriate in those circumstances.” For Gorsuch, the case is much stronger in the areas in which Congress legislates to take away immunity from some other entity. “It is one thing to waive a tribe, a state, a foreign government’s immunity,” he said. “Congress purports to exercise that power under the Constitution, an extraordinary power. It’s permissble sometimes, but generally we think of it as inconsistent with the structure of our Constitution, and that’s why we have traditionally required a clear statement rule.” A separate opinion from Gorsuch laying out that position would plant the kind of seed that would make the government wish it had never brought this case to the Supreme Court.

I don’t think it is all that easy to read the position of the justices here. Clearly there is a strong group that finds the government’s argument for immunity almost comical. But it is not obvious that they have a majority for that view, and it is just as clearly not obvious how many would take the trouble to disagree with it. I guess we’ll know more when the flowers start to bloom in the spring.