EBITDA vs. EBIT: Business Interest Limitation Deduction

As Congress continues its work on the fiscal year 2024 appropriations process and associated tax provisions, it should consider an often-overlooked taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

provision: the limitation on deductions companies take for interest payments.

In 2017, policymakers limited business interest deductions to 30 percent of earnings before interest, taxes, depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

, and amortization (EBITDA). Starting in 2022, this limitation tightened to 30 percent of earnings before interest and taxes (EBIT).

There are three reasons why policymakers should prioritize switching the interest limit back to using EBITDA. First, using EBIT is an outlier internationally, harming U.S. competitiveness. Second, high and rising interest rates negatively impact businesses more under the tighter interest limitation. Third, using an EBITDA-based limitation would increase long-run economic growth.

An EBIT-Based Interest Limitation Is an International Outlier

While the amount of deductible interest varies across countries, an EBIT-based limit makes the U.S. an outlier in the Organisation for Economic Co-operation and Development (OECD). 27 OECD countries use EBITDA to limit interest deductions (see table below). Notably, no country in the OECD uses an EBIT-based limitation.

Many European countries have adopted an EBITDA-based limit because they have a shared definition through the European Commission’s 2016 directive implementing the OECD’s base erosion and profit shifting (BEPS) recommendations. The most common limit is set at 30 percent of EBITDA along with separate safe harbor and transfer pricing rules.

| Country | Interest Deduction Limitations |

|---|---|

| Australia | For income years starting on or after July 1, 2023, debt deductions are limited to 30% of EBITDA. Deductions disallowed can be carried forward up to 15 years in some cases. |

| Austria | Interest limitation rule applies for “excessive borrowing costs,” i.e., costs greater than €3 million and greater than 30% of adjusted EBITDA No formal safe harbor rule, but informal 4:1 debt-to-equity ratio applies |

| Belgium | Interest deductions limited to the higher of €3 million or 30% of EBITDA 5:1 debt-to-equity ratio applies to intragroup loans 1:1 debt-to-equity ratio applies to receivables from shareholders or directors, managers, and liquidators |

| Canada | For tax years beginning after 2022 and before 2024, corporate interest deductions will be limited to 40% of EBITDA. For tax years after 2023, deductions will be limited to 30% of EBITDA 1.5:1 debt-to-equity ratio for tax years beginning after 2012 |

| Czech Republic | Interest deductions limited to the higher of 80 million Kč or 30% of EBITDA 4:1 debt-to-equity ratio (6:1 debt-to-equity ratio for certain financial services companies) applies |

| Denmark | Interest deductions are limited to 2.2% of assets and to 30% of EBITDA 4:1 debt-to-equity ratio applies |

| Estonia | For multinational firms, interest deductions limited to the higher of €3 million or 30% of EBITDA |

| Finland | Intragroup interest expense limited to 25% of the company-adjusted taxable income (“taxable EBITD,” which includes taxable income and adds back interest expenses and tax depreciation) Net interest expense up to €500,000 fully deductible Company equity/assets ratio is equal to or greater than the group ratio Net interest expenses between non-related parties limited to €3 million |

| France | Interest deductions limited to the higher of €3 million or 30% of EBITDA Different limits apply to related-party debt, and banking & credit institutions |

| Germany | Interest deductions limited to the higher of €3 million or 30% of EBITDA |

| Greece | Net interest deduction limitation in certain categories of interest if it exceeds €3 million or 30% of EBITDA after tax adjustments |

| Hungary | Interest deductions limited to the higher of HUF 939,810 or 30% of EBITDA Loans concluded before June 2016 are subject to the previous thin-cap rules and a 3:1 debt-to-equity ratio applies |

| Iceland | Interest deductions limited to 30% of EBITDA Rule does not apply if total interest paid does not exceed 100 million kr |

| Ireland | As of January 1, 2022, Ireland restricts corporation interest deductions to 30% of tax-adjusted EBITDA New rules do not apply to loans concluded before June 17, 2016; there is an exemption for taxpayers with net borrowing costs under €3 million |

| Israel | No thin capitalization rules and no specific debt-to-equity ratio requirements for interest deductions |

| Italy | Interest deductions limited to 30% of EBITDA |

| Japan | Corporation deductible net interest expense is limited to 20% of EBITDA, adjusted to exclude extraordinary income or loss Exemptions apply for those with net interest expenses of less than ¥20 million |

| Latvia | Interest deductions limited to 30% of EBITDA for deductions exceeding €3 million (certain financial institutions exempt) 4:1 debt-to-equity ratio applies for deductions up to €3 million (certain financial institutions exempt) |

| Lithuania | Interest deductions limited to €3 million or 30% of EBITDA 4:1 debt-to-equity ratio applies Rule does not apply if entity’s debt-to-equity ratio is not (or at most 2 percentage points) lower than the group-consolidated ratio |

| Luxembourg | Interest deductions limited to the higher of €3 million or 30% of EBITDA |

| Mexico | Limits of 30% of adjusted taxable income (adding interest, depreciation, amortization, and pre-operative expenses) and Mex$20 million in total interest expense apply 3:1 debt-to-equity ratio for interest payments between related parties |

| Netherlands | Interest deductions limited to the higher of €1 million or 20% of EBITDA, though in mid-2022, the Dutch Supreme Court ruled that interest deductions are allowed beyond this in certain circumstances |

| Norway | Interest deductions limited to 25% of EBITDA if deduction exceeds 25 million kr |

| Poland | Interest deductions limited to 30% of EBITDA if deduction exceeds 3 million zł |

| Portugal | Interest deductions limited to the higher of €1 million or 30% of EBITDA |

| Slovak Republic | Interest deductions limited to 25% of EBITDA (financial institutions exempted) |

| Slovenia | 4:1 debt-to-equity ratio applies |

| South Korea | 2:1 debt-to-equity ratio (6:1 for financial institutions) applies; interest deductions limited to 30% of EBITDA (financial institutions exempt) |

| Spain | Interest deductions limited to 30% of EBITDA if deduction exceeds €1 million |

| Sweden | Interest deductions limited to 30% of EBITDA if deduction exceeds 5 million kr |

| Switzerland | Debt-to-equity ratios apply and vary by asset class |

| Turkey | 3:1 debt-to-equity ratio (6:1 for financial institutions) applies |

| United Kingdom | Interest deductions limited to 30% of EBITDA if deduction exceeds £2 million |

| United States | Interest deductions limited to the sum of business interest income, 30% of adjusted taxable income, and floor plan financing interest |

| Source: Bloomberg Tax, “Country Guides: Anti-Avoidance Provisions – Thin Capitalization/Other Interest Deductibility Rules”; and PwC, “Worldwide Tax Summaries: Corporate – Group taxation,” “Worldwide Tax Summaries: Corporate – Deductions,” Tax Foundation, “International Tax Competitiveness Index, 2022.” | |

Rising Interest Rates Increase the Bite of EBIT-Based Interest Limitation

Since 2022, businesses with debt are not only dealing with a tighter interest limit. Rapidly rising interest rates have also increased the cost of servicing their debt. For example, medium-grade corporate bonds yielded about 3.3 percent at the end of 2021 and have since risen to about 6 percent or more in recent trading.

The impact of higher rates will grow over time as this debt matures and firms refinance new debt at the current interest rates. Goldman Sachs estimates that about $600 billion in corporate debt matures this year, growing to over $1 trillion per year by 2025, which will add about 2 percent to corporate interest expense in 2024 and 5.5 percent in 2025.

The tightened interest limit will add to the squeeze as a greater share of interest deductions will be disallowed.

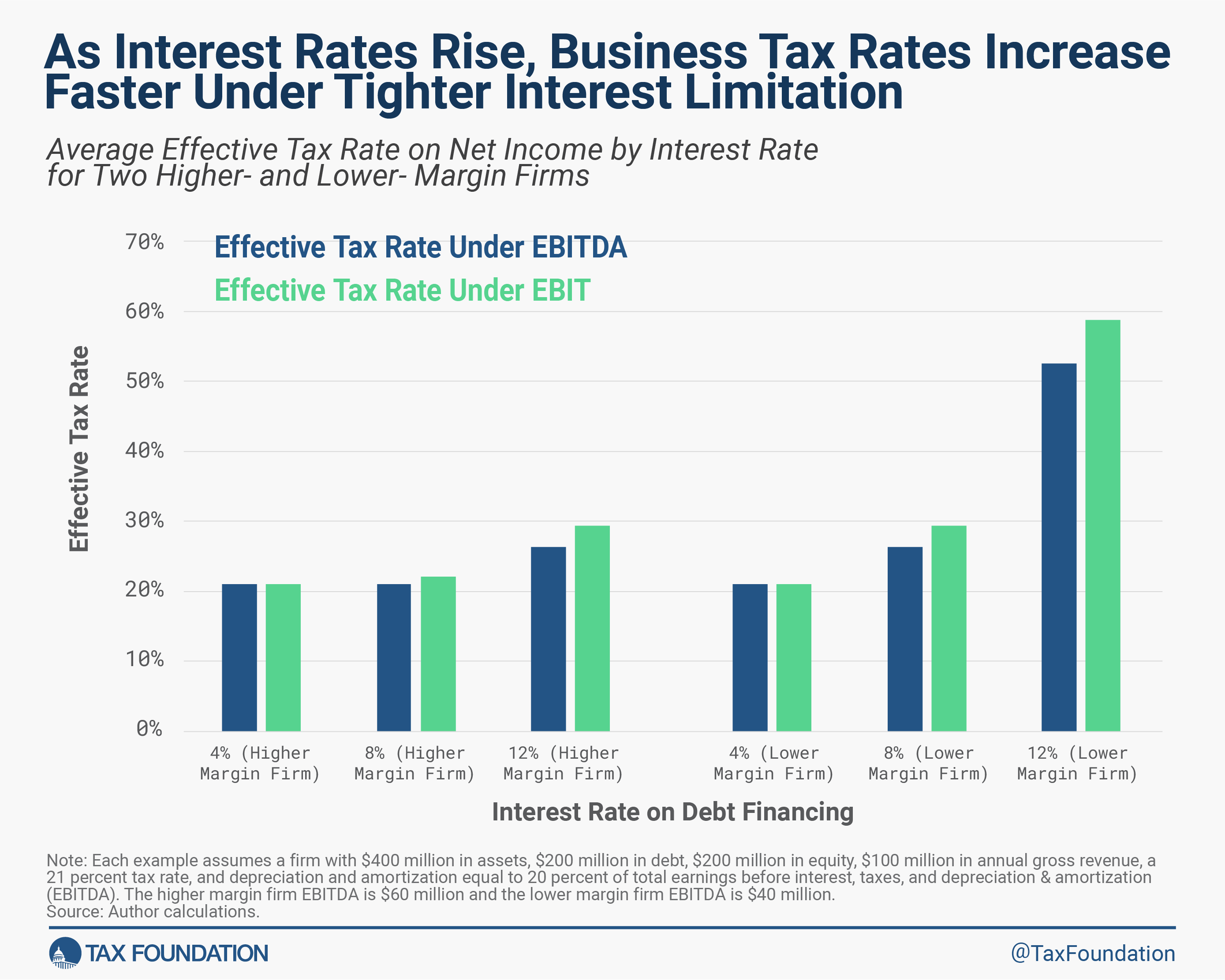

For example, a high-margin firm with EBITDA equal to 60 percent of gross revenue and an even split of equity and debt financing at an 8 percent interest rate may see their effective tax rate increase from 21 percent under the EBITDA-based limitation to 22.1 percent under EBIT (see table below). If rates increase to 12 percent, their effective tax rate rises to 26.3 percent using EBITDA and 29.4 percent under EBIT.

Lower-margin firms will be especially impacted. For example, if the firm above has EBITDA equal to 40 percent of gross revenue and rates rise to 12 percent, its tax rate jumps to 52.5 percent under an EBITDA-based limitation and 58.8 percent under EBIT.

Lastly, turning to the economy-wide effects, based on our modeling of this provision done last year where we assumed low interest rates, switching the interest limitation to EBITDA would modestly increase economic growth, create about 8,000 full-time equivalent jobs, and increase the capital stock by 0.1 percent. This change would have a budgetary cost of about $44 billion over 10 years.

However, as more business debt is rolled over at interest rates that are nearly double what they were two years ago, the economic benefits of loosening the current interest expense limitation will grow accordingly, as will the budgetary cost.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share

![[Hybrid Event] Advanced Trade Secrets 2023: New Challenges, New Solutions, and New Opportunities – October 17th, San Francisco, CA | Practising Law Institute (PLI) [Hybrid Event] Advanced Trade Secrets 2023: New Challenges, New Solutions, and New Opportunities – October 17th, San Francisco, CA | Practising Law Institute (PLI)](https://www.pli.edu/globalassets/faculty/c/cu/cundiff_victoria_20230816.jpg?h=138&w=138)