Local Income Taxes by State: Local Income Tax Data

Key Findings

- Although most states forgo local income taxes, they are a significant source of local tax revenue in six states and at least a modest source of revenue in 10 others.

- Some use state definitions of income, while others define income separately or make modifications to the state base.

- Localities that “piggyback” on the state definition of income and rely on the state for collection and administration see a smaller administration burden. Localities that define income and collect the tax on their own increase administration costs for themselves and the compliance burden for taxpayers.

- Eight states (Alabama, Colorado, Delaware, Kansas, Kentucky, Missouri, Pennsylvania, and West Virginia) use the direct collection method of local income tax administration. Four states (Indiana, Iowa, Maryland, and New York) use the piggyback method. Four states (Minnesota, New Jersey, Ohio, and Oregon) use a combination of the two by either adopting the state income definitions or collecting the tax on the local level.

- While municipalities may be tempted to use an income tax to bring down property taxes, experience suggests that such swaps can often lead to higher overall tax burdens.

- To the extent that localities choose to impose local income taxes, they should be imposed at low rates, with uniform definitions and sourcing rules across the state. Ideally, they should be administered at the state level to reduce both compliance and administrative costs.

Introduction

As is the case anywhere in America, a new employee in New York City will need to fill out a tax withholding form before receiving his first paycheck. But there is an extra step to this process in the city that never sleeps: New York City levies its own income tax on top of the state and federal systems. It may not surprise anyone that a high-tax city like New York would have its own income tax, but the Big Apple is far from alone.

Although the majority of U.S. cities and counties do not impose a local income tax, they are imposed by 5,055 jurisdictions (encompassing counties, cities, school districts, and special taxing districts) in 16 states. Ranging from de minimis wage taxes in some states to a statewide average of more than 2.3 percent of adjusted gross income in Maryland, these taxes are a long-standing and significant source of revenue for many cities in Rust Belt states in the northeastern United States.[1]

Cities, counties, school districts, and other localities that have instituted taxes on their residents’ incomes have done so either to reduce other taxes or to raise more revenue for local services. These may be laudable goals on paper, but local income taxes come with more undesired consequences than other local revenue sources, both for taxpayers and the governments that rely on these revenue streams—a point that was brought home during the pandemic.

History and Rates

While the first state-level income was levied in Wisconsin, local income taxes began in Philadelphia, Pennsylvania. The city, which was granted authority for a local income tax in 1932, adopted one in 1938, only to have its provisions run afoul of the uniformity clause in the state constitution. The city succeeded in its second attempt, authorizing a 1.5 percent tax on income from wages and salaries in December of 1939. This ushered in the era of local income taxation.[2]

New York City was actually the first city to adopt an income tax ordinance in 1934, but city leaders developed cold feet, repealing the tax before it could take effect in 1935. After Philadelphia’s 1939 tax, it would be another seven years before Toledo, Ohio became the second municipality to delve into municipal income taxation in 1946.[3]

Other Ohio cities—Columbus, Springfield, Youngstown, Dayton, Warren, Canton, and Cincinnati—adopted their own municipal income taxes in short succession.[4] In 1947, 11 municipalities in Pennsylvania were given the power to implement their own income taxes, and many quickly took the state up on the offer.[5] At that time, Pennsylvania and Ohio still chose to forgo state income taxes, a policy choice that made it politically easier for local governments—vested with this authority—to impose their own.

| Municipal Income Tax Collections as a Percentage of | |||

|---|---|---|---|

| State | Adjusted Gross Income | Local Tax Collections | Local Revenue |

| Alabama | 0.10% | 2.04% | 0.54% |

| Colorado | (a) | (a) | (a) |

| Delaware | 0.16% | 4.68% | 1.35% |

| District of Columbia | 6.03% | 28.52% | 13.45% |

| Indiana | 0.62% | 13.46% | 3.63% |

| Iowa | 0.11% | 1.75% | 0.61% |

| Kansas (b) | 0.00% | 0.03% | 0.01% |

| Kentucky | 1.33% | 26.17% | 9.68% |

| Maryland | 2.40% | 34.88% | 17.31% |

| Michigan | 0.17% | 3.82% | 1.05% |

| Missouri | 0.22% | 3.52% | 1.42% |

| New York | 1.63% | 13.28% | 6.38% |

| Ohio | 1.57% | 22.51% | 9.41% |

| Oregon (c) | no data | ||

| Pennsylvania | 1.23% | 18.83% | 7.56% |

| West Virginia | (a) | (a) | (a) |

|

(a) Flat-rate wage taxes are imposed in Denver and four other Colorado cities, along with four cities in West Virginia. (b) Kansas imposes a local “intangible tax” on interest and dividend income. (c) Oregon imposes significant municipal income taxes in the Portland area, but they were implemented after the latest Census data (2020). Sources: U.S. Census Bureau; Internal Revenue Service; Tax Foundation calculations. |

|||

Until 1962, only two other states—Kentucky (1947) and Missouri (1948)—joined Pennsylvania and Ohio in implementing local income taxes. Municipal income taxation was, to an extent, an Appalachian phenomenon, geographically contained. Michigan then followed in 1962, and Baltimore and New York City adopted municipal income taxes in 1966. Today, local governments in 16 states tax income in some form.[6]

| State | Jurisdiction | Local Rate |

|---|---|---|

| Alabama (a) | Birmingham | 1.00% |

| Colorado | Denver | $9.75 per month |

| Delaware | Wilmington | 1.25% |

| Indiana | Indianapolis | 2.02% |

| Iowa (b) | Des Moines | 0.085% |

| Kentucky | Louisville | 1.45% |

| Maryland | Baltimore | 3.20% |

| Michigan | Detroit | 2.40% |

| Missouri | Kansas City | 1.00% |

| New Jersey | Newark | 1.00% |

| New York | New York City | 3.876% |

| Ohio | Columbus | 2.50% |

| Oregon (c) | Portland | 4.00% |

| Pennsylvania | Philadelphia | 3.8712% |

| West Virginia | Charleston | $6 per pay period |

|

(a) Birmingham is not Alabama’s largest city by population, but it is the largest city that taxes income. (b) Des Moines, Iowa and Polk County do not impose local income taxes, but some school districts within the city do. (c) Portland’s 4 percent local income tax includes a 1 percent regional and 3 percent county tax. It does not include another 4.6 percent in business income taxes imposed by the city and county which fall on pass-through income otherwise taxed by individual income taxes. Notes: Kansas is excluded from the list because no major cities impose a municipal income tax, which is limited by the state to a base of interest and dividend income. Sources: Local revenue departments; Tax Foundation research. |

||

While local income taxes are widespread, they are anything but uniform. Such taxes can be found under a variety of names, from Colorado’s Occupational Privilege Tax to Kansas’s local intangibles tax, and their forms are as diverse as their names. Whereas Kansas localities only tax interest and dividend income, for instance, Pennsylvania jurisdictions (except Philadelphia) do the opposite, taxing only earned income.

| State | Tax Name |

|---|---|

| Alabama | Occupational Tax |

| Colorado | Occupational Privilege Tax |

| Delware | Wage Tax |

| Indiana | Income Tax |

| Iowa | Local Income Surtax |

| Kansas | Local Intangibles Tax |

| Kentucky | Occupational License Tax |

| Maryland | Income Tax |

| Michigan | Income Tax |

| Missouri | Earnings Tax |

| New Jersey | Payroll Tax |

| New York | Income Tax |

| Ohio | Municipal Income Tax/School District income Tax |

| Oregon | Transportation District Income Tax |

| Pennsylvania | Wage Tax |

| West Virginia | City Service Fee |

|

Source: State Departments of Revenue. |

|

Types of Local Income Tax Systems

Local income taxes vary widely from state to state, not only in their tax bases but also in the manner of collection and administration. States generally fall into one of three categories: direct collection, piggyback collection, or a combination of the two. The choice of method has implications for definitions of income as well as the collection of revenues.

Direct Collection

In the case of direct collection, the locality takes charge of both factors. The municipality assumes total responsibility for the administration, assessment, collection, and enforcement of the income tax. This means localities are responsible for creating an income tax code from the ground up—including creating definitions and setting rates. This is no easy task. Significant time and resources must be spent to do the job properly, even if many of the definitions and concepts are borrowed from the state or federal tax codes.

If a local government does not want to copy the entire state or federal code, it can selectively conform to various parts as a starting point for determining the tax base. But even that level of conformity comes with costs. The more changes a locality makes to the federal or state tax base, the more compliance costs are imposed on taxpayers.

Along with other duties, direct collection requires localities to take up audit responsibility. This gives communities direct and total control over their income tax systems, but it increases administrative costs for local governments and compliance costs for individuals—particularly when systems vary enough that taxpayers cannot simply pull figures from their state tax returns, and localities cannot lean on state audits to flag issues of local concern as well.

Economies of scale favor state governments here, and the duplication of administrative functions at the local level is challenging and frequently wasteful. While localities may value having administrative autonomy over their income tax system, they should seriously consider the additional burden it creates on taxpayer resources, and, where such systems are necessitated by state law or constitution, state lawmakers should consider consolidation.

Even beyond administrative burdens, taxpayer compliance can also be costly. Michigan, for instance, has a hybrid method, and some cities administer their own income taxes, while others allow the state to take over that responsibility. Taxpayers in Albion, Michigan, must fill out a city income tax form of 16 pages with instructions, which is entirely separate from state and federal income tax forms. Since 2015, however, Detroit has relied upon state collections of its local tax as a simplification measure.[7]

Eight states (Alabama, Colorado, Delaware, Kansas, Kentucky, Missouri, Pennsylvania, and West Virginia) use the direct collection method for local income taxes.

Piggyback Collection

In many states, local administration works with the state department of revenue to “piggyback” on the tax system already in place. The locality relies on the state definition of income for calculations of tax liability and local taxes are collected on the state return. This alleviates the cost of compliance for taxpayers and, in large part, keeps local governments out of the business of income tax administration.[8]

Under this system, local taxes are usually calculated as a percentage of the state income tax owed, making the tax code both simple and predictable. Local governments have the authority to set their own rates, but the tax base is set by the state, and administration is housed at the state level as well.

Consequently, a piggyback system also gives the state audit authority in most cases, as both taxes are calculated on the same form.

The piggyback method provides the lowest administration costs, while still producing revenue. This means a larger percentage of collections can go toward public investment instead of administration. Four states (Indiana, Iowa, Maryland, and New York) use the piggyback method of levying local income taxes.

Hybrid Methods

Finally, some states adopt hybrid methods that are not easily classified as direct or piggyback collections. In hybrid states, state definitions of income are used, but local governments are still responsible for tax collection and administration. Four states (Michigan, New Jersey, Ohio, and Oregon) opt to combine local collection with state-level definitions. In Oregon, though, while income taxes in and around Portland are locally administered using state tax definitions, income taxes are also levied by transit authorities, which do the opposite, adopting their own income tax calculations with separate returns, but having those returns filed through the state. Separately, Colorado and West Virginia both levy employment taxes at a specific dollar amount, rather than calculating based on a percentage of income, and collect these amounts on the local level.

| Direct | Piggyback | |||

|---|---|---|---|---|

| State | Creates Own Definition of Income | Locality Collects | Uses State/Federal Definition of Income | State Collects |

| Alabama | X | X | ||

| Colorado | Set Dollar Amount | X | ||

| Delware | X | X | ||

| Indiana | X | X | ||

| Iowa | X | X | ||

| Kansas | X | X | ||

| Kentucky | X | X | ||

| Maryland | X | X | ||

| Michigan | X | X | ||

| Missouri | X | X | ||

| New Jersey | X | X | ||

| New York | X | X | ||

| Ohio | X | X | ||

| Oregon | X | X | ||

| Pennsylvania | X | X | ||

| West Virginia | Set Dollar Amount | X | ||

| Source: State Departments of Revenue and statutes. | ||||

Local Income Tax Considerations

Income taxes take a backseat to property and sales taxes in the local tax toolkit, and for good reason. Even apart from administrative issues that arise from differing approaches to local income tax systems, there are several issues that plague local income taxes however they are implemented, and those problems may be exacerbated by the rise of remote work in the wake of the COVID-19 pandemic. In 2020, property taxes accounted for 72 percent of local tax revenue, with general sales taxes generating another 13 percent. Excise taxes and individual income taxes each accounted for a mere 5 percent of collections, while all other taxes combined for the final 6 percent. Whereas individual income taxes generated over $385 billion for state governments that year (37 percent of state tax revenue), they were responsible for just over $39 billion in local tax collections.

In Maryland, where municipal income taxes have a statewide effective rate of 2.4 percent of state adjusted gross income, these taxes are responsible for just over one-third of local tax revenue. Although responsible for almost 5 percent of local tax revenue nationwide, these collections are concentrated in a few states, such that only six are above the national average: Maryland (34.9 percent), Kentucky (26.2 percent), Ohio (22.5 percent), Pennsylvania (18.8 percent), New York (13.3 percent), and Indiana (13.5 percent). (See Table 1.)

Volatility

The wage-based nature of income makes related tax collections more volatile than consumption taxes.[9] When the economy contracts and wage growth falls, income tax collections follow suit. The opposite is also true: when the economy enters a period of rapid expansion, collections rise. This can be seen clearly when we compare how different revenue streams were affected by the Great Recession.

After the 2008 financial crisis and accompanying recession, state tax collections fell dramatically across the board. Local taxes, on the other hand, tell a different story. Most local revenue streams (property, sales, and excise taxes) remained strong and actually saw increases over the course of the recession. But by 2010, local income tax revenues had fallen by 9 percent, and local corporate income tax collected plummeted by 17 percent. These two revenue streams took until 2013 to catch up with other tax collections.

The comparative stability of sales taxes should not be surprising: even though people will certainly cut their spending if they face job loss or a recession, there is only so much they can cut. People with reduced incomes are also more likely to cut their savings more drastically than their consumption. Even those without income continue to consume, supported by savings and governmental assistance. Though unemployment benefits are taxable in 35 states, the amount of the benefit is usually smaller than the amount earned during employment, thus reducing the amount of income that can be taxed.

This volatility can cause revenue estimation problems that hit smaller governments especially hard, due to the relatively small number of employers concentrated in their jurisdictions. This throws a wrench in the works of the budgeting process.

Investment income follows economic performance to an even greater extent than wage income. Localities may end up taxing such income either by conforming with state or federal definitions or by consciously including it in their own definition of income. Conformity eases tax compliance costs, but as investment income is not derived from activities in the city, the right of localities to tax this income is on shakier ground.

Kansas is a special case in that it allows localities to tax investment income only. This results in a lighter burden because it exempts wage income, but it doubles down on the problems with instability and the questionable connection between investment returns and location.

Because income follows fluctuation in the markets, a large reliance on wage and investment income taxes will hamstring municipalities’ revenue collections when they need it most. Municipalities can avoid falling victim to large swings in income tax collections by using extremely conservative income tax revenue estimates to reduce reliance on that revenue. Using income tax revenue above estimated levels to pad “rainy day funds” is more desirable than relying on it to fund daily operations.

Total Tax Burden

Local income taxes are not levied in a vacuum. Municipalities that are considering income taxes must remember that even a small city income tax will add to the burden that residents already face from federal and state taxes.

Income is taxed at both the federal level and (in most cases) state levels. The consumption of that income is then taxed through sales and use taxes, although many states exempt goods like food or clothing. A person then pays government-imposed service fees like wireless taxes, gas taxes, and tolls. Finally, a resident pays property taxes on real estate and possibly personal property taxes on other big-ticket items. The federal government allows taxpayers to deduct taxes paid to state and local governments from their federal returns if they itemize. Following the 2017 Tax Cuts and Jobs Act (TCJA), this state and local tax (SALT) deduction was capped at $10,000.

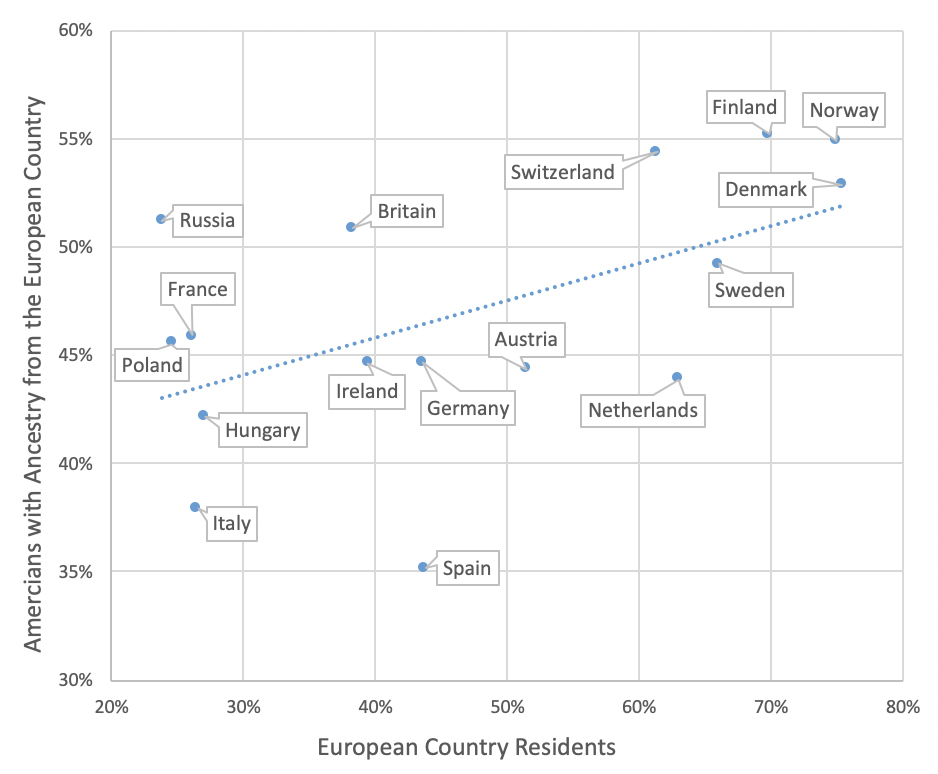

In addition to these more visible taxes, a significant portion of the tax burden comes even before someone receives a paycheck. To help compare how much someone brings home in after-tax income in different countries, the OECD produces a report on the tax burden on labor.[10] This tax wedge is made up of the difference between labor costs to the employer and the net take-home pay of the employee. To calculate a country’s tax wedge, the OECD adds the income tax payment, employee payroll tax payment, and employer-side payroll tax payment of a worker making the country’s average wage. The OECD divides this amount by the total labor cost of this average worker, or what the worker would have earned in the absence of these three taxes.

In the U.S., that tax wedge made up 29.8 percent of an individual’s income on average in 2019. This means an employee that was earning $59,485 pre-tax would take home $41,889 before consumption taxes reduced the real value of that income. After sales taxes, the tax wedge was 31.6 percent. As this is only an average number, places with higher-than-average income or sales taxes would see a higher tax wedge.

Localities should be prudent when imposing taxes—especially those on income—on their residents, making sure to raise only the revenue they truly need so they avoid overburdening taxpayers. Frequently, the existence of local income taxes does not offset property or other tax burdens so much as supplement them.

Nonresidents and the Problem of Double Taxation

Local taxes are meant to fund services for local residents. In practice, however, residents of neighboring localities may also be able to use some of these services without providing any funding. Things like public parks and bike trails can be easily used by people from neighboring cities. This is known as the “spillover effect,” which can theoretically make those living in the locality less willing to fund projects that are not exclusive to residents. [11]

Commuters are one group that can benefit from this spillover effect. When a commuter works in a city, she falls under the protection of that city’s police and fire services, works in buildings inspected for code compliance, eats in establishments inspected by health inspectors, and drives on roads maintained by the locality. This spillover effect is often cited as a rationale for imposing income taxes on commuters.

But there are many other services that non-residents never interact with, like the education system, which makes up 43 percent of local spending on average.[12] Municipalities should be sure that this and other localized expenses are being covered by residents instead of non-residents. (This is one reason why schools are frequently, though not always, funded by property taxes at the local level.) While it is reasonable to want commuters to contribute to some local spending, localities should be careful not to expect revenue from commuters to cover things that do not “spill over.”

States, moreover, have the authority to set parameters for local income taxation, and to the extent that it is permitted, they might consider sourcing income to the taxpayer’s place of residence, given that the cost of government services to an individual is disproportionately borne by the jurisdiction in which they live. However, if states do allow localities to tax income where earned—consistent with how states tax income—they should, at a minimum, require that credits be provided for taxes paid to other jurisdictions, to avoid double taxation. Local income taxes, particularly when imposed where income is earned, may also play into remote work considerations. Working remotely may be an opportunity to avoid a city’s higher municipal income tax, or to avoid municipal income taxation altogether. These income taxes are, therefore, a source of risk for large municipalities which may see fewer workers commuting into the city on a daily basis, eroding the tax base.

Withholding

Just as a person can withhold state and federal taxes before receiving her income, she can also withhold local income taxes by filling out a local withholding certificate. If she lives and works in multiple jurisdictions that levy local income taxes, she or her employer will generally have to fill out a form for each jurisdiction. Traditionally, sourcing income where earned has been easier for employers, as they can withhold at the jurisdiction in which they are located, though it represents a less ideal distribution of funds to localities. This may prove less true, however, in an era of increased work flexibility. If local income is sourced where it is earned, then an employee who works in the office three days a week, but from home (in a neighboring jurisdiction) the other two, will likely require withholding in both locations, prorated according to the amount of work performed in each. Assigning all income to their home jurisdiction is administratively much less complex.

The Trade-off between Income and Property Taxes

Property taxes are popular with economists, who praise them for hewing closely to the benefit principle (that is, tax liability increases roughly in proportion to the benefit of services received) and for being relatively economically efficient, since they have less of an impact on economic decision-making than other major taxes. The transparency of property taxation also wins high marks from economists and public finance scholars. Property owners, however, often find them more odious than other taxes, ironically at least in part due to that same transparency: people often have a better sense of what they pay in property taxes than they do of their income tax burden (much of which can be obscured in withholding), let alone their payroll or sales tax liability. Rising property tax burdens, moreover, often lead to concerns about ability to pay. Consequently, local officials frequently mull alternative forms of taxation as a way to reduce reliance on property taxes. Most commonly, this alternative is the sales tax, but municipal income taxes can take on this role as well. However, localities should be wary of treating local income taxes as a panacea, as the income tax is not only less economically efficient, but experience suggests that attempts to shift away from property taxation often yield higher overall taxation, not a rebalancing of revenue sources.

The efficiency of property taxation should not be ignored. The benefit principle of public finance suggests that the people benefiting from public services should be the ones funding them. This principle has its limits; by definition, welfare transfers are intended to benefit those who would be unable to fund them. But the property tax aligns with this concept in areas where it makes considerable sense, taxing those who drive on local roads, send their children to local schools, and rely on local police and fire departments. Property taxes are also among the most stable sources of revenue. They also have less of an effect on investment and do less to distort economic decision-making more broadly than income taxes.

Moreover, shifting the funding burden from property to income may not provide the anticipated relief to homeowners, and may actually increase the overall tax burden over time. This is one of the biggest objections to state-for-local tax swaps, and while there are mechanisms to mitigate the risk, it is difficult to avoid it altogether.[13] Property taxes will lower initially, as typical proposals for tax swaps impose some sort of rollback. For example, property tax millages might have to decline by 20 percent, be capped below current levels, or be subject to a reduction by the amount necessary to ensure a dollar-for-dollar reduction against the new local aid. Each approach has its own implications for local budgets. But it is difficult to ensure that the rates remain lower because of the tax swap.

Once rates are rolled back after the swap, state officials can impose limits on the growth of tax collections (often called levy limits) to prevent local tax jurisdictions from reverting to their old rates while pocketing the new state aid, but most limits permit some growth factor and often authorize voter overrides.[14] If property taxes are suddenly lower—even if other taxes have, with little transparency, risen to offset them—localities could easily max out their annual growth, or even secure voter approval to raise rates outside the cap, resulting in net tax increases while failing to reach the ostensible goal of the swap: lowering property taxes.

Competitiveness

Any increase in the cost of doing business in a city compared to a substantially similar neighboring city will cause at least some relocation to the more affordable alternative. The extent to which this “tax flight” occurs in practice is debated, though it certainly occurs. Although there are many considerations at play in business location decisions, taxes certainly play a part in decision-making and can tip the scales in favor of one location over another.

Historically, tax-related migration has garnered more attention at the state level, but it is arguably a bigger issue at the local level. After all, it is easier to move a town over than it is to move to a different state. A person who moves locally can retain their social contacts, religious communities, and employer.[15] This lower cost of movement makes it much more likely that high-income residents may feel that enough is enough and decide to relocate after a tax increase. These tax-motivated moves are hard to track because intra-state migration is not documented as thoroughly as interstate migration.[16] Increased workplace mobility, however, is likely to enhance local as well as state tax competition. Not only will there be a rise of fully remote workers, but even those who work in the office some days may be willing to tolerate a longer commute if they have more flexibility to work from home some days. Local income taxes not only increase tax liability for these individuals, but also create added complexity, as discussed previously. More taxpayers than ever may be able to “vote with their feet.”[17]

Conclusion

Most states avoid municipal income taxes for good reason. They add substantial complexity for governments and taxpayers alike, particularly since taxpayers are far more likely to live and work across town lines than state lines. They are more volatile and less economically competitive than other forms of taxation available to local governments. And particularly in an era of enhanced mobility, they have the potential to drive outmigration or accelerate remote work.

To the extent that local governments continue to impose income taxes, policymakers should simplify administration by using state definitions of income as a starting point and, wherever possible, allowing the state to collect the tax. (Where this is not currently permitted, state lawmakers should adopt laws to this effect.) To avoid the double taxation of commuters, local income sourcing rules should be uniform throughout a given state. The current patchwork system benefits neither taxpayers nor tax administrators.

References & Appendix: Local Income Tax Rates by County

Click the “Download Data” button above to access the full dataset.

[1] For more discussion of local income tax rates, see Jared Walczak, “Local Income Taxes in 2019,” July 30, 2019,

[2] Advisory Commission on Intergovernmental Relations, Significant Features of Fiscal Federalism Volume 1 (September 1995): 32,

[3] William J. McKenna, “The Income Tax in Pennsylvania,” Pennsylvania History: A Journal of Mid-Atlantic Studies 27:3 (July 1960): 304-305,

[4] Milton C. Taylor, “Local Income Taxes After Twenty-One Years,” National Tax Journal 15:2 (June 1962): 114.

[5] Id.

[6] Further discussion, Jared Walczak, “Local Income Taxes in 2019,” Tax Foundation, July 30, 2019,

[7] Michigan Department of Treasury, “City Tax – Detroit,”

[8] Richard Gabler et al., “The Commuter and the municipal income tax; a background paper,” The Advisory Commission on Intergovernmental Relations (April 1970): 18.

[9] Jared Walczak, “Income Taxes Are More Volatile Than Sales Taxes During An Economic Recession,” Tax Foundation, March 17, 2020,

[10] For further discussion, see Garrett Watson, “The U.S. Tax Burden on Labor,” May 14, 2020,

[11] Bruce Bartlett, “The Case for Eliminating Deductibility of State and Local Taxes,” Tax Notes (September 2, 1985): 1122

[12] Urban Institute, “State and Local Financing Initiative: State and Local Expenditures,”

[13] For further discussion of tax swaps, see Jared Walczak, “Why State-for-local Tax Swaps are Hard to Do,” April 18, 2019,

[14] Jared Walczak, “Property Tax Limitation Regimes: A Primer,” Tax Foundation, April 23, 2018,

[15] Whitney B. Afonso, “The effect of a state income tax on migration: the example of Connecticut,” Journal of Public Policy 38:1 (2018): 117, 122.

[16] Whitney B. Afonso, “The effect of a state income tax on migration: the example of Connecticut,” Journal of Public Policy 38:1 (2018): 135

[17] Niklas Jakobsson, “Attitudes toward municipal income tax rate in Sweden: Do people vote with their feet?” eJournal of Tax Research 11:2 (2013): 164