-600_0.png)

8 Culture Canons for M&A Success

Culture Success Determines Business Success

By Mark Herndon, Chairman Emeritus, M&A Leadership Council

“We’ve done 50 acquisitions globally and STILL don’t know BEANS* about culture!”

This transparent acknowledgement from the Division President of a global Fortune 100 manufacturer was the launch point of a very important development journey. As he elaborated on this lightning bolt, we could resonate with each point he expounded on as, sadly, this is the norm for most acquirers.

“We give culture great lip-service,” he said, “but we have no practical understanding of what we should actually be doing about it at every phase of a deal and throughout integration.” Fortunately, our remit from this leader was to help them design and embed a practical and meaningful series of culture playbook elements at each step of their internal end-to-end M&A process or lifecycle.

Most organizations struggle mightily with versions of this same dilemma.

Frankly, who hasn’t been frustrated and flummoxed by getting culture right in M&A? It’s very challenging to do and we find many common and repeated reasons companies fail at culture in M&A.

Most often, culture is so poorly defined and understood that leaders are not able to translate it into a meaningful business discussion. Multiple past failed attempts at culture in M&A are sometimes stacked up as an impenetrable barrier to future attempts. Other times, it falls victim to assigning the wrong owner, outdated thinking or using a poorly designed change intervention. At its core, however, our view is that most acquirers have not yet hard-wired the right kind of culture actions through their M&A team, process and skillset.

If your organization is intent on continued growth through acquisition, we believe there are eight essential canons that must be understood and applied in order to drive consistent, repeatable success with culture in M&A.

Canon #1: Culture Drives M&A Business Result Outcomes

The business case for “getting good” at culture in M&A is both clear and compelling.

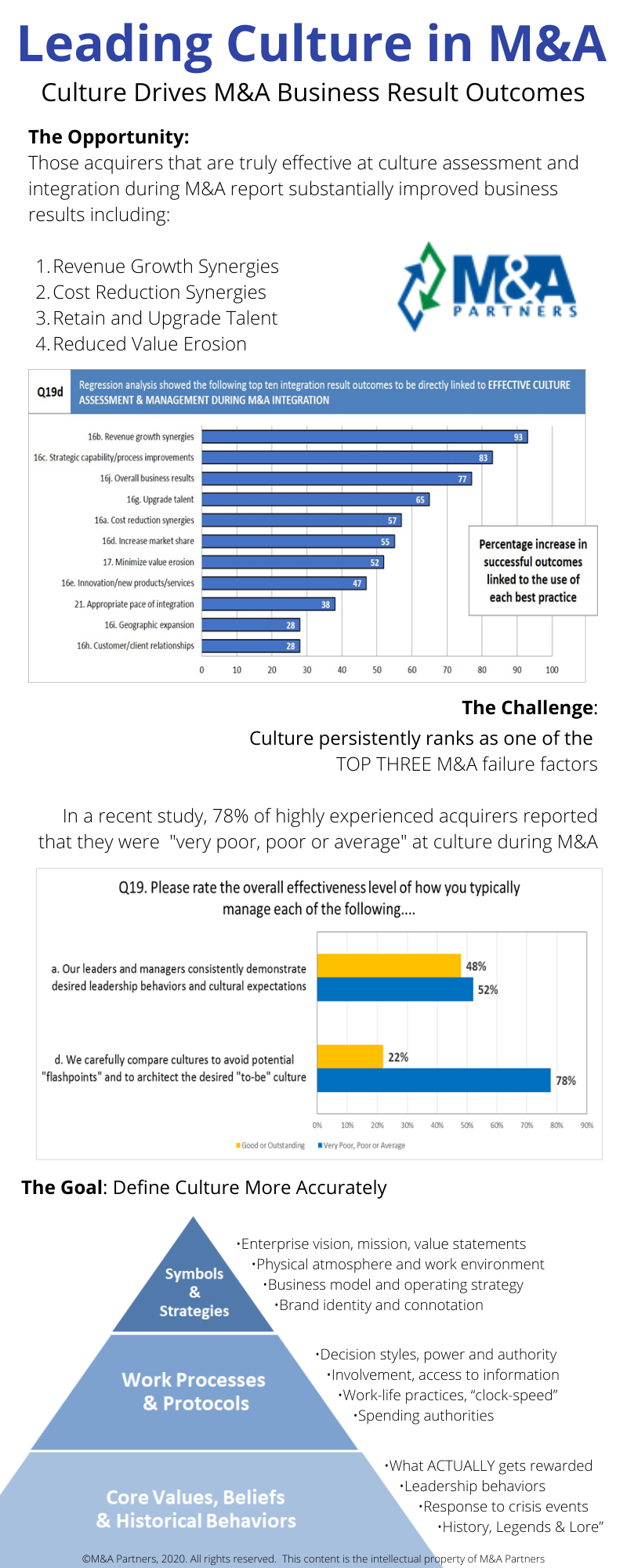

What survey or pundit’s view doesn’t include culture as either a top failure factor or success criteria? Our own research (The State of M&A Integration Effectiveness) including over 150 skilled acquirers demonstrated that those acquirers that were truly effective at culture assessment and integration during M&A reported substantially improved business results including: achievement of cost and revenue synergies; retaining and upgrading talent; and reduced value erosion, a metric we use to determine the impact of negative synergies or unintended consequences of integration. Working with an external statistician, we did regression analysis testing over 40 specific integration best practices to determine the degree of correlation between each specific best practice and specific business result outcomes. The findings? Those organizations that are good or very good at culture assessment and integration during M&A are over 90% more likely to achieve their anticipated revenue synergy targets for the deal than those organizations that are merely poor or average at culture during M&A. Being good at culture in M&A had a similar strong positive correlation on other key business result outcomes including customer relationships, achieving the optimal pace of integration and process improvements, among others.

Yet, in spite of this consistently demonstrated and compelling data, 78% of acquirers in this same study candidly acknowledged they were very poor, poor or average at culture in M&A. (see related charts insert nearby).

Canon #2: Culture Establishes Essential Business Strategic Direction

As we work with executives across the country, I like to ask the question, “What is the purpose of culture.” Invariably, the majority of answers fall short of the true importance of culture strategically to a business. In our view, culture’s strategic purpose can best be summed up as: Culture expresses goals and expectations through values and beliefs; and, Culture guides thinking, actions and behaviors through shared viewpoints and group norms.

Which leads us to an equally important question. “Just HOW would you expect to be successful during integration WITHOUT establishing and managing this type of fundamentally important common footing.

Canon #3: Culture Flashpoints Destroy Deal Value

We define a cultural flashpoint as an emotionally significant or historical practice that has become a valued and accepted cultural attribute, work-life benefit or customer expectation. While some flashpoints can seem innocuous at first, they almost always carry disproportionate risk and negative fallout for limited, and often pyrrhic gains. Most flashpoints are impossible to detect through a due diligence data request and data analysis. Instead, most flashpoints must be observed or thoughtfully discerned through discussions during due diligence and pre-close integration planning. Flashpoints are often caused by things like stark changes in and differences between: spending or decision authorities; decision making styles; work-life perks or benefits such as valued freebies, flex schedules, favorite software tools or applications; and many, many others. If not detected, they tend to go off like a land-mine inflicting damage and disruption at the worst possible times. Worse still is the realization that once your organization stumbles into a culture flashpoint, it taints your leadership credibility and true intentions as an acquirer. That’s a brand connotation that is very difficult, if not impossible, to overcome during the heat of integration. (Note: for more information on Culture Flashpoints, please reference the MAP blog, Caution Ahead – Cultural Flashpoints; or, The Complete Guide to Mergers & Acquisitions: Process Tools to Support M&A Integration at Every Level, Third Edition, Jossey-Bass, 2014)

Canon #4: Define Culture More Accurately

It was none other than organizational culture guru, Dr. Edward Schein, who said that the greatest tendency when discussing culture was to oversimplify it. He was also an early advocate of the idea that culture existed at several levels or in several simultaneous layers. We ascribe to that view as well, and have worked hard over the years to customize and adapt the categories and examples of the layers of culture in the widely recognized “iceberg” diagram to those that are most relevant to acquisitions, culture due diligence and integration (see related Chart inset nearby). In sum, this approach says that just like an iceberg, there are a few important, physical and visible attributes of culture “above the water line,” but other layers and attributes hidden beneath the “water line” that are largely intangible processes, unwritten expectations and the like that must also be carefully assessed and aligned. And, as with icebergs, it is most often those submerged cultural attributes that have sunk many a well-intentioned, but poorly conceived and executed, cultural alignments.

The first level in our model is defined as “Symbols and Strategies” and contains expected attributes such as espoused values, mission, statements and other visible elements that published or communicated to establish general cultural aspirations. In this same category is the impact of brand and brand connotations as determined by physical and work environment, customer experience and employee experience. What is less well understood about the attributes at this level is that the core of the visible, tangible and experiential elements of culture are based on and driven heavily by the organization’s operating strategy and business model. Without including these far reaching aspects in a cultural assessment, you will fall short of your intended outcomes.

The second level in the M&A Partners model is defined as “Work Processes and Protocols.” Attributes found at this level are heavily driven by the organization’s operating model, HR strategy / philosophy and a variety of reward, social, work-life and related policies and practices. In our view, cultural attributes at this level are predominantly where cultural flashpoints come from and where many acquirers blow it. Changes in these processes and practices tend to impact employees personally and emotionally; and therefore, arbitrary, poorly planned or poorly implemented changes in these processes invariably produce charges of culture insensitivity or outright conflict.

The bottom level in the M&A Partners model is defined as Core Values, Beliefs and Historical Behaviors. These form the bedrock foundation for the symbols and strategies; and work processes and protocols in the other levels. In this level, look for leadership behaviors, what ACTUALLY gets rewarded, a company’s response to crisis events and what we like to call “Legends and Lore.”

Canon #5: If Culture Isn’t Important to the CEO, It Won’t Be Important to Anyone

As we work with executives in acquiring organizations, the most common (but wrong) answer to this question is “HR” followed closely by “OD or Change Management.” Stay with me here…there is an essential and mission critical role for outstanding subject experts in culture such as HR, OD or OCM, but unless and until the CEO personally and persuasively demonstrates that culture is important – it ain’t gonna happen. So remember, culture must be led from the top; SME’d by HR / OD or OCM; and owned by everyone.

Canon #6: Master the Distinction Between Organization Culture and National Culture

Here’s how I like to speak to this distinction. Simply defined, organizational culture is the collective actions, beliefs and values of individuals in an organization that create a unique business environment and work practices. Whereas national culture is best viewed as the collective national norms, customs and worldviews inherently created by what country in which we were raised. Of course, this includes a variety of factors including ethnic, societal, historical and geo-political influences that program a general national worldview. Here’s the most important point to remember: national cultures are to be understood, respected and NOT changed. They are what they are, so adapt to them versus the other way around. Fortunately for acquirers, there are many outstanding third-party assessments and educational resources to help global M&A teams quickly learn and be prepared for success. A few of our favorites for future reference include: When Cultures Collide, Leading Across Cultures, Third Edition, by Richard D. Lewis); The Hofstede Institute and the Geert Hofstede 6-D Model of National Culture; and of course, the indispensable field guide, Kiss, Bow or Shake Hands by Terri Morrison.

Canon #7: Focus on the “True North” of Culture

During an integration project we were leading with a global chemical firm in Latin America, the skillful acquiring Executive Sponsor challenged his M&A team with this no-nonsense cultural wisdom, saying: “ Let’s align what we HAVE TO, but get comfortable quickly with differing “NON-ESSENTIALS.” That was his way of saying, stay focused on the True North of culture. That is spot-on, in our view, and the reality is that there are far more cultural non-essentials or preferential differences than HAVE-TO’s. Fleshing that out further, this principle has two components. First, executives must stay relentlessly focused on maximizing business result outcomes by defining and building those few, but essential cultural attributes proven to drive high-performance results. You’ll need to carefully define those in your organization, but I suggest you start with these bedrock elements. 1.) A clear and compelling vision, purpose and strategic direction; 2.) accountability – as defined by having clear roles, structures and performance incentives aligned to key result outcomes and desired behaviors; and 3.) an environment based on trust, growth and challenge.

Canon #8: Lead Culture Across the Entire M&A Lifecycle

As we defined this client’s M&A lifecycle for their industry and typical deal types, we ultimately developed three or four specific and tangible culture actions for each phase of their internal M&A process. Some were important breakthroughs such as conducting a pre-close joint leadership alignment, visioning and strategic planning session; and conducting a post-closing all employee “fast start” working together workshops. On the other hand, others were simply fine-tuning – for example, fleshing out a more effective culture due diligence list and providing a simple tool to help due diligence team understand culture and what to look for or ask about. Others were adopted from one or more internal pilot tests and extended throughout the organization as a documented and standardized part of the revised M&A playbook for culture. It’s awfully easy to “over-academify” culture. So, for each of the 15-20 M&A culture action items throughout the lifecycle, a great deal of effort went into making them practical, repeatable, implementable and “real.” If they passed the smell test of the internal skeptics, the deal team and leaders responsible for using them, they earned a spot in the revised M&A process and playbook, and were placed into a just-in-time briefing for either the due diligence team or integration team, as appropriate.

This canon brings us right back to Mr. “We Don’t Know Beans About Culture.” Honestly, he didn’t say ‘beans.’ The word he used was one letter shorter and much more colorful. You get the point – there was real conviction here, and a compelling need to finally get culture right during M&A. It was time to stamp out the lip-service and do something practical, meaningful and successful with culture instead of talking academically about it. And that is precisely what most acquirers need to do!

______________________________________________________________________________

Learn more about mergers, acquisitions and divestitures at M&A Leadership Council’s virtual or in-person training courses. Network with other M&A professionals while our expert consultant trainers will get you ready for your next transaction (or help an ongoing one) through practical insights, group discussions, case studies, and breakout exercises.

Registration discounts available for Early Bird, Training Alumni, CMAS Candidates and Groups of 3+ from the same company. See event info pages for details.