2024 Personal Income Tax Rates in Europe

Most countries’ personal income taxes have a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

structure, meaning that the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across European countries.

The top statutory personal income tax rate applies to the share of income that falls into the highest tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

. For instance, if a country has five tax brackets, and the top income tax rate of 50 percent has a threshold of €1 million, each additional euro of income over €1 million would be taxed at 50 percent.

Generally, governments can generate revenue more efficiently by leveraging marginal tax rates at the lower end of the income distribution than by using higher top rates. Higher top rates incentivize people over that income threshold to earn less, while leaving the revenue raised from everyone else unchanged. By raising the rate of a lower bracket, however, revenue is raised from taxpayers in higher brackets without incentivizing them to reduce their earnings (only the earning incentives of individuals in that lower bracket are affected).

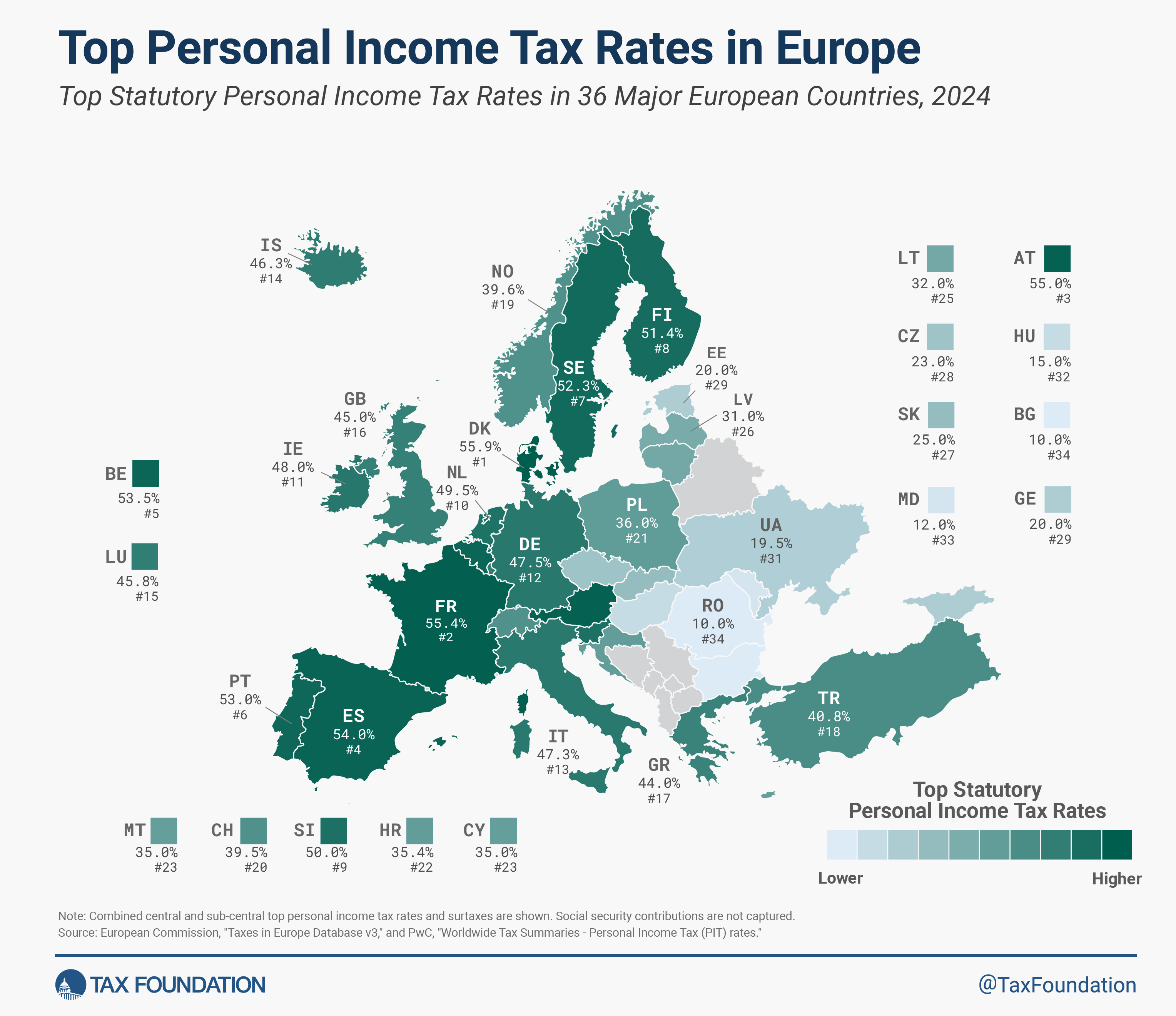

Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.

European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate. Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).

For comparison, the average combined state and federal top income tax rate for the 50 U.S. states and the District of Columbia is 42.32 percent as of January 2024, with rates ranging from 37 percent in states without a state income tax to 50.3 percent in California.

Some countries in Europe are considering changing their top personal income tax rates in the next few years. Austria is planning to eliminate its highest tax bracket in 2026, reducing its top income tax rate from 55 percent to 50 percent. Estonia is set to increase its flat income tax rate from 20 to 22 percent in 2025.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share